Does G-D Control our Financial Markets?

No truth meets more general acceptance than that the universe is ruled by law. Without law, it is self-evident there would be chaos, and where chaos is, nothing is. Navigation, chemistry, aeronautics, architecture, radio transmission, surgery, music – the gamut, indeed, of art and science – all work, in dealing with things animate and things inanimate, under law because nature herself works in this way. Since the very character of law is order, or constancy, it follows that all that happens will repeat and can be predicted if we know the law.

Natures Law, R. N. Elliott, 1948

In 1228, Leonardo Fibonacci da Pisa published his monumental work entitled Liber Abaci, in which he “rediscovered” what is commonly known today as the Fibonacci sequence of numbers: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc. Within this sequence, each higher number is the sum of the prior two numbers, and the ratio of any two consecutive numbers approximates 1.618 or its inverse, .618. The higher you move through the sequence, the closer you move towards the 1.618/.618 relationship. This .618 number has been referred to as the “Golden Mean” throughout history. We also refer to this number as Phi.

Phi is a number which, as we stated before, exhibits many unusual mathematical properties, and is also the solution to a quadratic equation. These concepts have been understood by Plato, Pythagoras, Bernoulli, Da Vinci and Newton. Historic structures have been built by architects of famous Greek structures, such as the Parthenon, based upon the concept of Phi, and even as far back as the architects of the Great Pyramid of Giza in Egypt, who recorded their knowledge of Phi as the building block for all man nearly 5,000 years ago.

What makes Phi even more unusual is that it can be derived in many ways and is exhibited in relationships throughout the universe, such as proportions within the human body, plants, DNA, the solar system, music, population growth, and the stock market. Phi is the one underlying constant throughout all of nature and governs all the laws within nature. In fact, the greatest minds of history, such as Pathagorus, Plato, and Kepler, all felt that Phi was the key to the secrets of the universe.

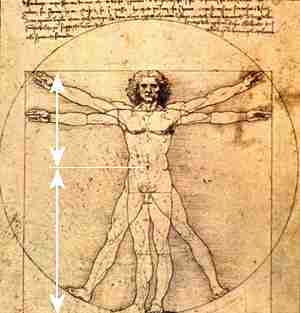

As an example of how Phi is the building block within the human body, in the 1960’s, Drs. E.R. Weibel and D.M. Gomez dissected the architecture of the human lung and discovered a Fibonacci relationship in the formation within the bronchial tree. Others have discovered that the diameter of the bronchial tubes decreases in Fibonacci proportion. Another example is when Eugene Stanley of Boston University, along with researchers from MIT and Harvard discovered that the physiology of neurons in the central nervous system also exhibit Fibonacci relationships. Further examples include the fact that the naval in the human body divides the average adult body into Fibonacci proportions, the neck divides the distance from the naval to the head into a Fibonacci proportion, the heart muscles in the left ventricle are made up of a series of spirals that repeatedly contract to a point that is approximately .618 of the long axes from the aortic valve to the apex, and so on. In fact, Leonardo Da Vinci depicted the general external Fibonacci relationships within the body of man in one of his most popular drawings entitled “Vitruvian Man."

In recent times, we have seen evidence that Phi even governs man’s decision making. Social experiments have been conducted which resulted in price patterns, based upon a mathematical standard, that mirror those found in the stock market. In 1997, the Europhysics Letters published a study conducted by Caldarelli, Marsili and Zhang, in which subjects simulated trading currencies, however, there were no exogenous factors that were involved in potentially affecting the trading pattern. Their specific goal was to observe financial market psychology “in the absence of external factors.”

One of the noted findings was that the trading behavior of the participants were “very similar to that observed in the real economy,“ wherein the price distributions were based on Phi.

In a different study conducted by psychologist Vladimir Lefebvre of the School of Social Sciences at the University of California, Dr. Lefebvre came to the conclusion that “We may suppose that in a human being, there is a special algorithm for working with codes independent of particular objects.” Specifically, when his subjects were asked to sort indistinguishable objects into two piles, their decision making within that process divided the objects into a 62/38 ratio. In other words, these individuals exhibited a Fibonacci tendency in their personal decision making.

Therefore, there is significant evidence that behavior and decision making within a herd and on an individual basis displays mathematically driven distributions based on Phi . This basically means that mass decision making will move forward and move backward based upon mathematical relationships within their movements. This is the same mathematical basis with which nature is governed. The same laws that were set in place for nature also govern man’s decision making en masse, and on an individual basis.

From a technical market based analysis, in addition to the Caldarelli, et. al. study cited above, there are many indications of how Phi governs stock market movements. As an example, until the times of R.N. Elliott, the world applied the Newtonian laws of physics as the analysis tool for the stock markets. Basically, these laws provide that movement in the universe is caused by outside forces. Newton formulated these laws of external causality into his three laws of motion: 1 – a body at rest remains at rest unless acted upon by an external force; 2 – a body in motion remains in motion in a straight line unless acted upon by an external force; and 3 – for every action, there is an equal and opposite reaction.

However, as Einstein stated: “During the second half of the nineteenth century new and revolutionary ideas were introduced into physics; they opened the way to a new philosophical view, differing from the mechanical one.”

Yet, even though physics had moved away from the Newtonian viewpoint, financial market analysis had not. In the late 1930’s, Elliott introduced the idea that the financial markets expand and contract in a series of waves which are governed by Phi. In theory, he proffered that public sentiment and mass psychology is what moves market within 5 waves in a primary trend, and 3 waves in a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply a natural cause of events in the human psyche, and not the operative effect from some form of “news.”

“Many services and financial commentators in newspapers persist in discussing current events as causes of advances and declines. They have available the daily news and market behavior. It is therefore a simple matter to fit one to the other. When news is absent and the market fluctuates, they say its behavior is “technical.”

Every now and then, some important event occurs. If London declines and New York advances, or vice versa, the commentators are befuddled. Mr. Bernard Baruch recently said that prosperity will be with us for several years “regardless of what is done or not done.” Think that over.

In the dark ages, the world was supposed to be flat. We persist in perpetuating similar delusions.” R. N. Elliott, Natures Law, 1946

To really understand Elliott, you would understand that this discovery itself was based in Phi, as 5 and 3 are, in fact, Fibonacci numbers upon which Elliott identified the market movements in his ground breaking discovery.

Even those market technicians that do not prescribe to Elliott Wave analysis recognize how most retracements and extensions within the financial markets adhere almost perfectly to Phi. It is hard to honestly deny that it governs much of the movements within our financial markets.

Conclusion

Ultimately, any honest, dedicated market observer cannot deny the prevalence of Phi within our financial markets. Since Phi is the one underlying constant throughout all of nature and governs all the laws within nature, then that which created nature and instilled the laws within nature must, perforce, govern our financial markets.