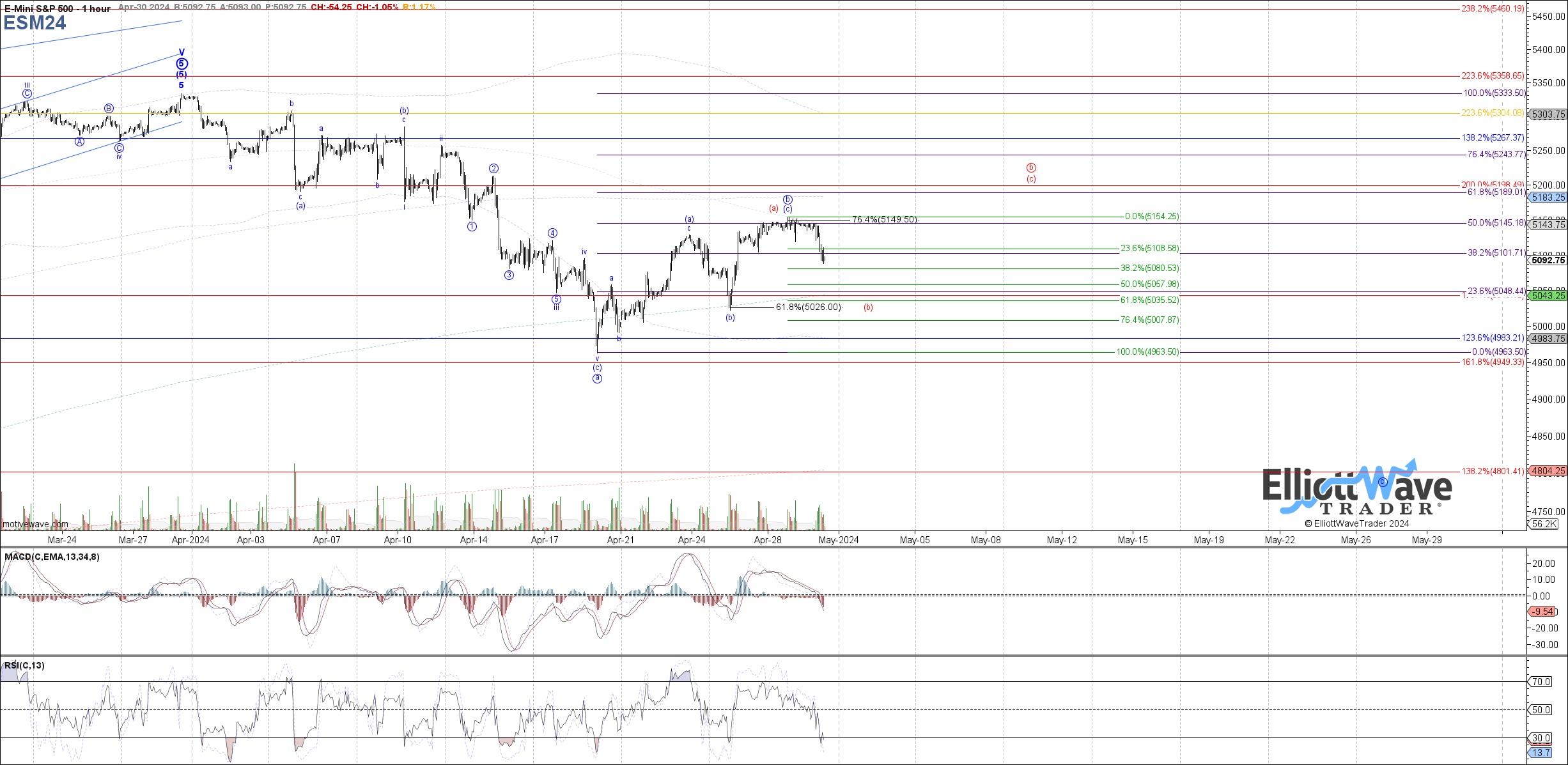

Has the b-wave finished?

The market rolled over today, failing to hold the retrace support cited for wave iv of (c) and then making a sustained break below the 5105 signal support. Therefore, as discussed the door is now open to all of the circle b-wave being complete, and price turning down in the start to circle wave c which will eventually make its way back down below the April low. If price fills out a clear 5 waves down from Monday's high, then odds will increase even further that the circle c-wave has started.

Otherwise, the only bullish alternative to consider at the moment is that instead off all of circle wave b completing into Monday's high, it was a larger (a)-wave shown in red. In that case, price would be working on filling out wave (b) of b, but even under that expectation the red wave (b) of b likely has more downside to go before completing. The .618 retrace at 5035 has decent odds of being reached before red wave (b) of b completes, and price turns back up in red wave (c) of b. The decline also needs to look clearly corrective in order to expect the wider flat b-wave in red, otherwise the blue count has the current advantage.