Market Filling Out The Pattern

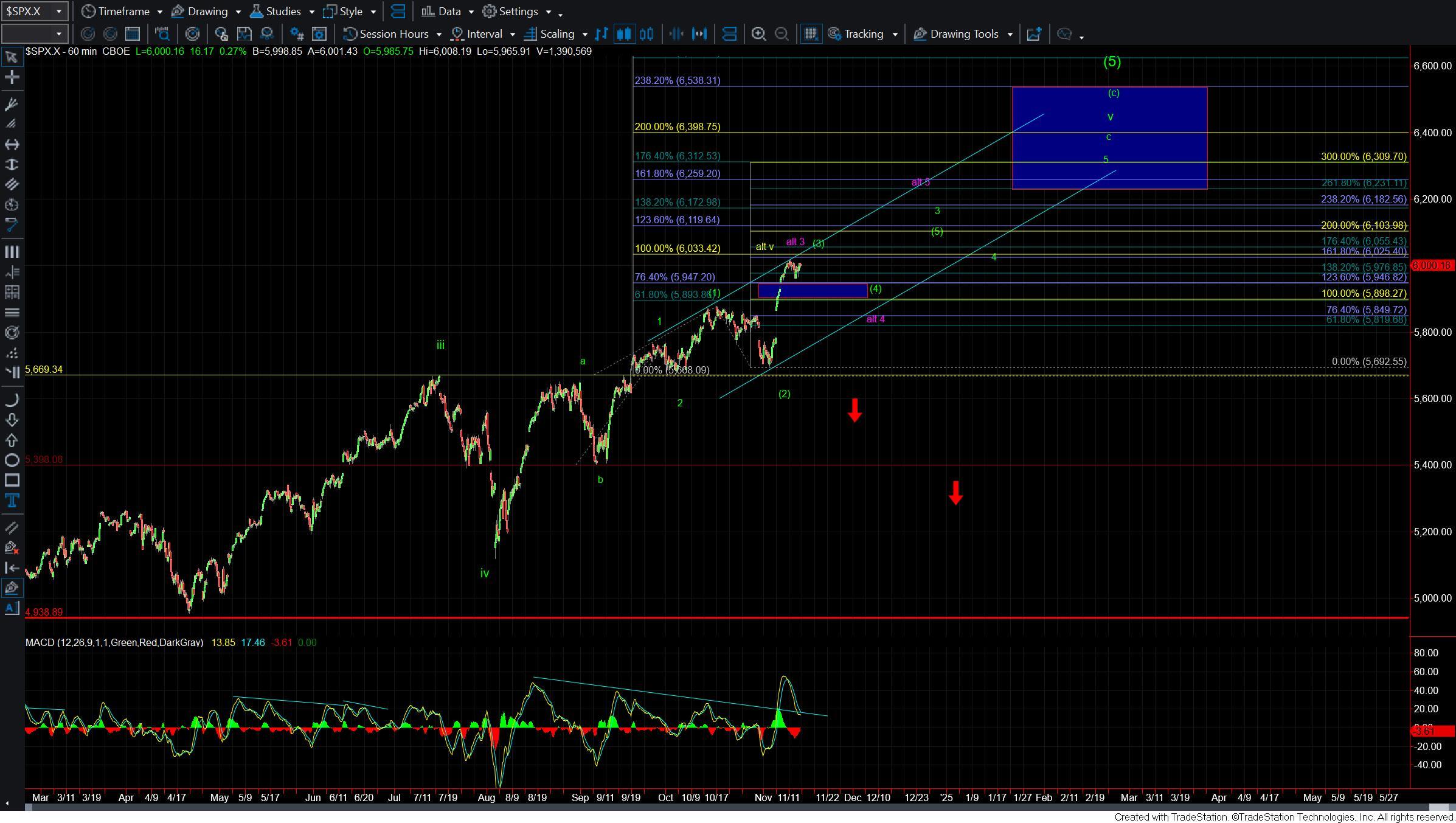

We have seen the market consolidate over the past several days after the sharp spike up post-election. With that being said we are still following a fairly clean fib pinball pattern and are trading over support for the potential smaller degree fourth wave. So with that, the pattern and analysis is fairly straightforward at the moment and as long as we remain over-support the near-term pressure will remain up.

Today we saw the market open slightly lower only to push higher into the afternoon session. We are still currently holding the previous high that was struck on Monday and only have three waves up off of that low so far. This is suggestive that we still have a bit more consolidation to do before a bottom is seen in the wave (4). Ideal support for that wave (4) comes in at the 5949-5898 zone. As long as that zone holds then the impulsive green count is still very much in play and we are likely heading higher in the wave (5) of 3 targeting the 6103-6259 zone overhead.

If we begin to break under that 5989 level then it opens the door for this to have put in a more significant top but we still would need to see a break under the larger degree pivot at the 5667 level down below.

Again as of right now, the pattern remains fairly straightforward and as long as we are holding over our fin pinball support zone the pattern is still looking incomplete to the upside. So while our bigger picture perspective remains unchanged this market still looks to have a bit of unfinished business to the upside before a large degree top is indeed struck.