No Confirmation Of A Top Just Yet

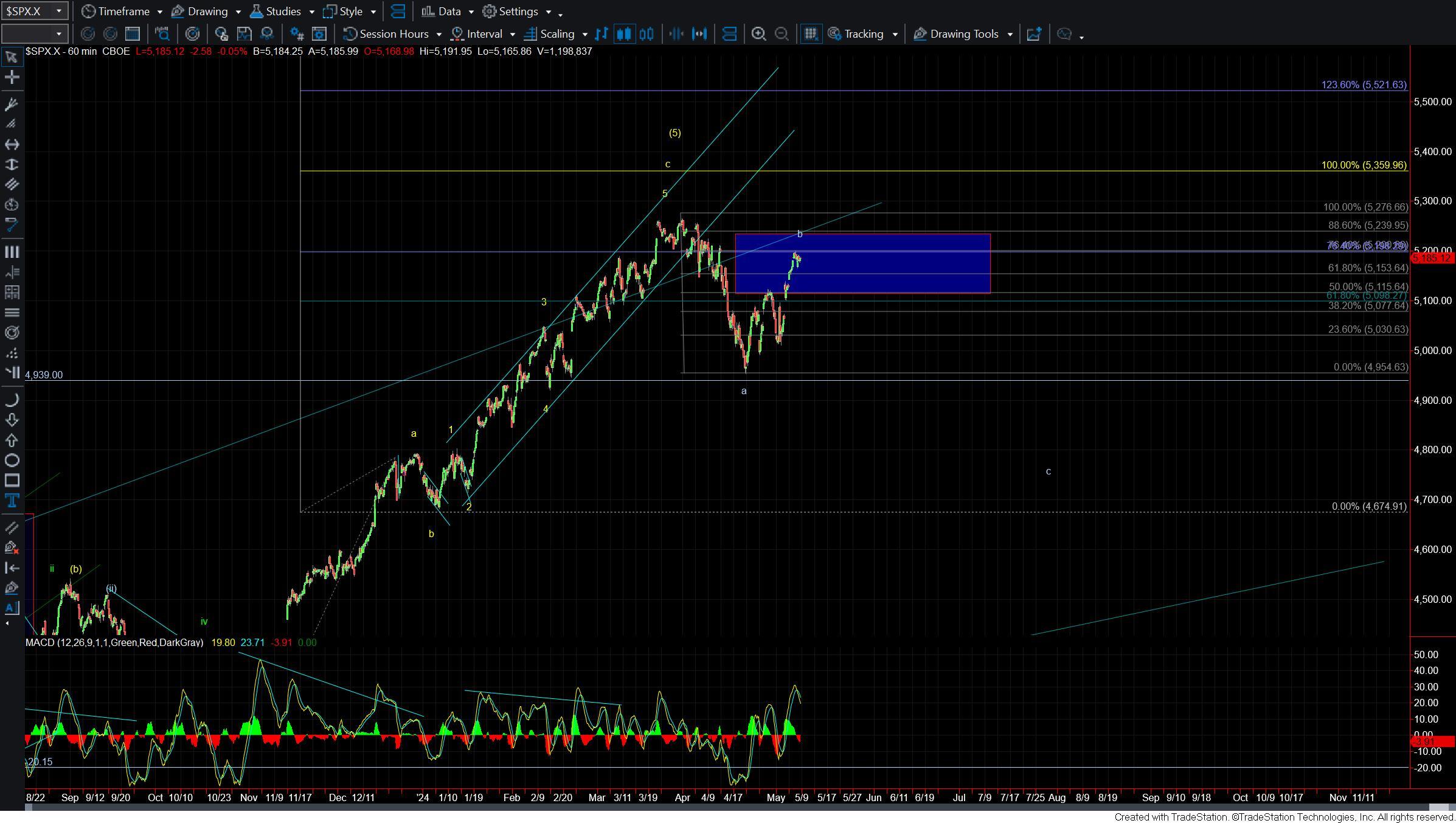

Today the market opened lower but quickly retraced most of those early losses and is trading just about flat at the time of this writing. WIth the move back up off of the lows the entire wave structure to the downside does look corrective in nature. Furthermore, we are still over even the upper most support levels which is still suggesting that we may still need another higher high before any sort of larger degree top is seen.

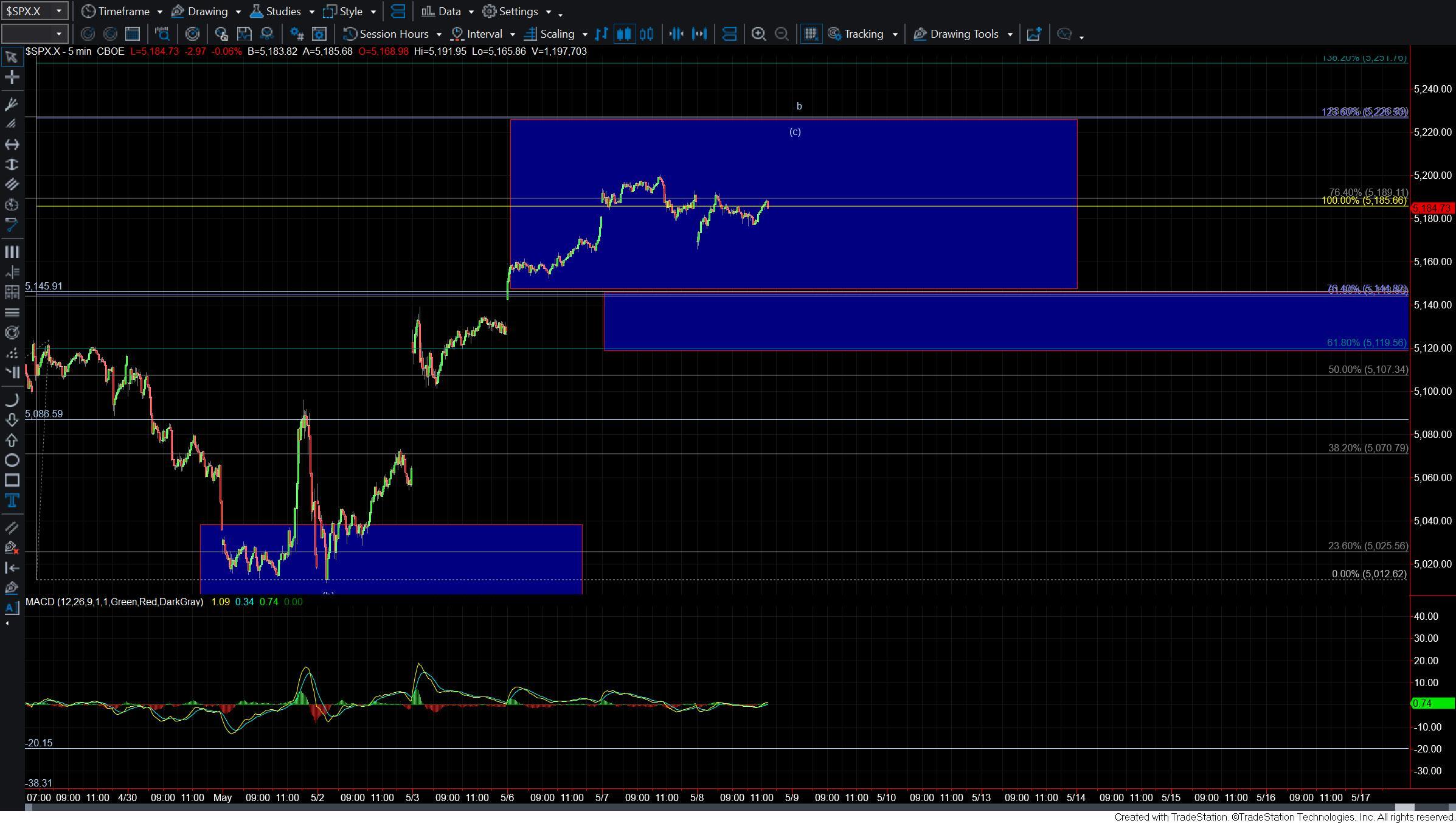

Drilling down to the smaller degree charts I still am watching the 5145-5119 zone below as key upper support that will need to break to give us initial confirmation that we have indeed put in a top. Additionally, because we are looking for a wave c down to begin we will need to see the initial move down off of the highs start with a five-wave move.

As of right now, we are still trading over support and only have three down off of the highs which is making it likely that we still will need to see another higher high before any sort of top is seen. Assuming that we do push higher then the next key overhead resistance comes in at the 5226 level which is both the 123.6 ext of the initial move up off of the lows and the 88.6 retrace of the move down off of the highs. As long as that level holds I still will be looking for a top in the wave b and the start of the next wave c down.

So while we do not have confirmation of a top just yet the pattern is getting quite close to full and the larger degree pattern remains unchanged at this point in time. So while I do think we may see slightly higher levels in the near term bigger picture this is still likely nearing a larger degree top so caution remains warranted in this region.