Sentiment Speaks: It’s The Roaring 20’s Again – Begin To Prepare For The Same Ending

This article will be published on Seeking Alpha tomorrow. While you know my thoughts on this perspective already, keep in mind this is a public article:

I have read many articles over the years, and it seems that the manner in which the market has acted has caused many to confidently view market declines over the last 12 years as short-term opportunities to make long-term investments in a generally rising market. What I find most interesting about this commonly held perspective is that it presumes a linear expectation for a continuation in a long-term rising market.

Now, most of you that read my analysis know that I have been a staunch bull, especially after we struck my long-term pullback target in the 2200SPX region last year. In fact, my ideal target for this bull market which began in 2009 is in the 6000SPX region.

But, what if we are approaching a point in history where that very long-term bull market finally ends?

In this article, I am going to be using a point of reference that goes back 100 years in history. And, since there really is no one left from that generation that is still alive, it is quite clear that we do not have a personal frame of reference from which we can relate to the “Roaring Twenties” of the 1920’s. So, can we be doomed to repeat it?

Very few people reading this article even know to what we are referring when we bring up the “Roaring Twenties,” and even less understand the implications.

So, let’s learn a little history.

In 1918, the Spanish Flu was spreading around the globe and affected 20-40% of the world’s population. In fact, it claimed the lives of over 50 million people globally. The US alone lost approximately 675,000 lives to the Spanish Flu. As it abated, the US then moved into the “Roaring Twenties.”

The “Roaring Twenties” refers to the decade of the 1920’s, which was a period of tremendous economic prosperity. During this period, we saw tremendous technological advancements, including the use of automobiles, telephones, moving pictures, radio, aviation and electronic appliances.

It was also a time where the United States experienced a stock market boom. In fact, the stock market quadrupled from 1920 until 1929.

As we were approaching 1929, many were quite certain that the United States entered a “new paradigm” of economic prosperity. Allow me to present to you what our financial leaders back in the 1920s said about our markets. For those that know their stock market history, you would know that those “in the know” were absolutely certain about the impossibility of a market crash right before the market crashed and led us into the Great Depression. Let me show you a few examples:

"We will not have any more crashes in our time."

This was said by John Maynard Keynes in 1927, two years before the stock market crash which led to the Great Depression.

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as they have predicted. I expect to see the stock market a good deal higher within a few months."

This was said on October 17, 1929, a few weeks before the Great Crash, by Dr. Irving Fisher, Professor of Economics at Yale University. Dr. Fisher was one of the leading US economists of his time.

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

- E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"There will be no interruption of our permanent prosperity."

- Myron E. Forbes, President, Pierce Arrow Motor Car Co., January 12, 1928

And, these are just a few of the popular quotes of their day. And, by the way, has anyone heard of the Pierce Arrow Motor Car Company? You have not? Well, that is because they went bankrupt during the Great Depression. But, I digress.

As we know today, this did not end well for those that became intoxicated by their financial fortunes of the 1920’s, as the stock market crash of 1929 ushered in the Great Depression. While the stock market struck its bottom within two years of the onset of the 1929 market crash, the Great Depression lasted almost a full decade.

Is anyone seeing any eerie similarities to our times today?

We are now approaching a year and a half after the onset of the Covid pandemic. And, we have also seen one of the strongest rallies in stock market history, with the stock market almost doubling within a year’s time, with much higher likely to be seen. During the market period 90 years ago, the US went through the Spanish Flu, and the market soared four-fold since. These are just two obvious similarities. But, keep in mind, these correlations are clearly not dispositive of my future expectations in and of themselves.

Moreover, since we began rallying off the March 2009 lows, and the conclusion of our last financial debacle, many have become quite confident in our government’s ability, along with the Fed, to guide our financial future and prevent any prolonged financial pain. In fact, if you ask the average investor, they will tell you that the chances of another Great Depression are extremely unlikely.

These are just some of the types of comments we all so often see:

“Stonks only go up! If the FED is destroying price discovery and has guaranteed to backstop every crash, stonks only go up baby!”

“The Market will NEVER fall in a serious way with Democrats in charge...the Government and the Federal Reserve just won't allow it.”

“I simply do not understand how writers on SA don’t comprehend this. The SPX is simply a matter of national security now. Pensions, sovereign wealth funds, everyone is too invested that any pullback will be a matter of national security. In the event of a pullback, the Federal Reserve and The Treasury will issue add’l stimulus to individuals in the form of transfer payments, and then supplement any drop in corporate earnings via transfer payments to corporations under the guise of ‘Economic Stability Grants’.”

“Endless QE, dollar debasement and hyperinflation are all supportive of stock markets, real estate and other bubbly assets.”

And, remember, we are still not even close to my ideal targets for the market yet. In fact, I am going to expect many comments to this current article to agree with my perspective. Yet, when we reach the top of the market, most will likely disagree with my perspective, and refuse to believe this can ever occur. That is simply the way markets work.

In fact, many former bears will likely be giving up, with some even turning bullish, before this long term top is finally struck. As an example, one of the foremost market bears, Harry Dent, has recently noted that if we do not top by 2022, then he will retire. If we can take him at his word, he will probably give up and retire, with the market then topping not long after he actually gives up.

Furthermore, almost 90 years after the 1929 market crash, Janet Yellen, our former Fed Chairman and current Secretary of the Treasury, pronounced that the banking system is "very much stronger" due to Fed supervision and higher capital levels. She then followed that up with what I believe will be a history-making statement, akin to those quoted above from generations past. Yellen also predicted that because of the measures the Fed has taken, another financial crisis is now unlikely "in our lifetime."

Most investors have been trained quite well over the last decade to expect a V-shaped recovery in the stock market no matter what it does. Our stock market during the last decade has trained investors in a Pavlovian manner to assume we will always be higher a year from now.

In fact, I believe the financial environment within which we have all lived from 2009 forward has only reinforced the belief that the Fed has everything under control. Every market drop has been met with a strong V-shaped recovery rally thereafter. It has reinforced investor’s belief that “the market always comes back.”

But, what if the next market dip does not lead to a comeback? What if the next market drop ushers in a period of financial devastation on par or even potentially greater than the Great Depression? There are not many who view this potential as realistic, especially since, as I noted at the start of this article, there is no one alive with any personal experience as to what that can mean.

Well, I am sorry to be the purveyor of bad tidings, but that is indeed my expectation. After this current rally fades in the coming year or two, I fear we run the risk of a Great-Depression-type event.

I am sure many of you are reading this and thinking I am absolutely out of my mind. I mean, one of the biggest bulls in the market right now, with targets of 6000SPX, is expecting a Great Depression? So, please allow me to explain.

For those that do not know me well, and are new to my analysis, I am what is known as an “Elliottician.” This means that I utilize a form of market analysis based upon the Elliott Wave.

Back in the 1930’s, an accountant named Ralph Nelson Elliott identified behavioral patterns within the stock market which represented the larger collective behavioral patterns of society en masse. And, in 1940, Elliott publicly tied the movements of human behavior to the natural law represented through Fibonacci mathematics.

Elliott understood that financial markets provide us with a representation of the overall mood or psychology of the masses. And, he also understood that markets are fractal in nature. That means they are variably self-similar at different degrees of trend.

Most specifically, Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend. Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of “news.”

This mass form of progression and regression seems to be hard wired deep within the psyche of all living creatures, and that is what we have come to know today as the “herding principle,” which gives this theory its ultimate power.

And, over the last 30 years, many social experiments have been conducted throughout the world which have provided scientific support to Elliott’s theories presented almost a century ago.

For, example, in a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, present a nice summation for market mechanics:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

As Elliott stated:

“The causes of these cyclical changes seem clearly to have their origin in the immutable natural law that governs all things, including the various moods of human behavior. Causes, therefore, tend to become relatively unimportant in the long-term progress of the cycle. This fundamental law cannot be subverted or set aside by statutes or restrictions. Current news and political developments are of only incidental importance, soon forgotten; their presumed influence on market trends is not as weighty as is commonly believed.” R.N. Elliott - October 1, 1940

So, this all now begs the question as to where we reside within that Elliott Wave structure.

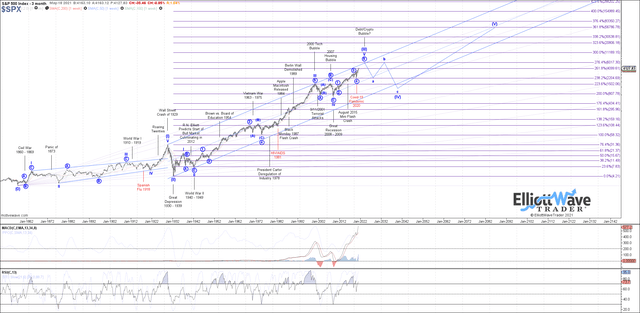

If you look at our analysis of the long-term Elliott Wave structure (the chart above was provided by Garrett Patten of Elliottwavetrader), which includes the years prior to the Great Depression, and if you compare some of the points I noted above regarding the time period prior to the Great Depression to our current times, you would see many eerily similar points.

In fact, many in the market are now quite certain that the Fed has conquered the business cycle, and is in full control of our markets, quite similar to the period just prior to the Great Depression. Many people even claim that we no longer have free markets, as the Fed simply manipulates our markets. Moreover, Janet Yellen placed the cherry on top of this perfect storm concoction with her assurance that we will not see another financial crisis such as the one experienced in 2008 in our lifetime.

You see, the markets have now trained us quite well to assume that the only reason we keep going higher and higher is because of the Fed. And, investors mistakenly believe that we will always be able to “safely” buy big drops, since it will certainly come back thereafter due to the Fed having our backs. Isn’t that what most articles you read confidently claim?

Now, if you look closely at the chart above, you will notice that our analysis suggests that the market can still rally up to the 6000SPX region in the coming years. However, once that rally completes its final Elliott Wave structure, we will likely be topping out in a multi-decade rally which began in the 1930’s. Yes, that means we are now completing a 100-year long structure.

In fact, back in 1941, with world War II raging around him, Ralph Nelson Elliott penned the following market prognostication:

“[1941] should mark the final correction of the 13 year pattern of defeatism. This termination will also mark the beginning of a new Supercylce. . ., comparable in many respects with the long [advance] from 1857 to 1929. [This] Supercycle is not expected to culminate until about 2012.”

For those of you that do not understand this quote, Elliott was predicting the start of a 70-year bull market in the face of World War II raging around him. Quite an amazing prediction, even if he was off by a decade. Still, if we do top out in the coming several years, he would be approximately 88% accurate in his prognostication. I have personally never seen a market prognostication in my lifetime that has been anywhere near as amazing as Elliott’s back in 1941. And, again, consider the time in which he made this prediction, and how silly it must have sounded at the time.

In standing upon the shoulders of giants, I am potentially seeing the culmination of this very long-term bull market, and the emergence of a major bear market, the likes of which has not been seen in modern times.

You see, the crash which was seen in 1929 was a wave [II] bear market, whereas we are now moving towards the completion of that 100-year wave [III] bull market. And, once wave [III] completes, it will usher in a wave [IV] bear market.

Now, in Elliott Wave analysis, there is something called the theory of alternation. It suggests that if the 2nd wave was a sharp and fast correction, then the 4th wave of the same degree will likely be a long and drawn-out event. Since the wave [II] which ushered in the Great Depression was a relatively short spike down, then I can reasonably assume that wave [IV] can be a long and drawn-out event.

So, when taking all these factors into consideration, I think it is reasonable to expect that, once we complete wave [III] in the coming several years, we will usher in a long and drawn-out bear market in wave [IV], which is the same wave degree as the wave [II} which ushered in the Great Depression. Maybe we need to expect the Greater Depression based upon these expectations.

Therefore, if one is going to take the position that this next bear market will be a major buying opportunity then you may be holding onto losing positions for over a decade. Of course, there will be bear market rallies along the way, but there is a strong probability that the highs struck within the next few years may not be seen again for many years to come.

Now, I want to go back again to a point I made when I began this article. When it comes down to it, I am neither a perma-bull nor a perma-bear. Rather, I simply want to be on the correct side of the market at all times. Therefore, I am simply perma-profit. To that end, I am not providing my analysis with any form of colored glasses or bias. I am simply explaining to you what I objectively see. And, when you sit back and attempt to understand what I am trying to convey, it should be quite sobering.

Again, I have never been one who is going to continually warn you of an imminent bear market, as many other authors or analysts seem to do for their various reasons. You all know those of which I speak. And, just as a broken clock, they will eventually be right. Rather, I am one who is only interested in being on the correct side of the market trend, with no bias for direction other than what the market presents to me. In fact, many have called me a perma-bull these last few years, thinking I was off my rocker when I called for a rally from the 2200SPX region to 4000+, with an ideal target in the 6000SPX region around the 2023 timeframe.

As just one example, another contributor posted this to me about my prognostication as we were bottoming in March of 2020, and it is a typical type of comment I received at the time:

"Coming from someone who still thinks the bull market of January is alive enough to carry us to 4,000, that's highly unmeaningful... Here is the 2200 exactly that you said the S&P would bottom at before taking the trip back up to 4,000... What do you want to bet the ECONOMY is going to pull it down a lot further and that 4,000 is a lot further away than your charts ever said... . . . my own resolution is that this market has a lot further to fall because it is now following the economy, which it long divorced itself from; whereas Avi doesn't believe the economy ever means anything to stocks and has told me so several times last year... So, you have that common sense view, or you can believe Avi's chart magic will get you through all of that and is right about a big bounce off of 2200 all the way back up to 4,000."

After saying all this, I will note that I can always be wrong. But, I must warn you that this analysis with which I am providing this prognostication has been scarily accurate for many years now. Moreover, my “alterative” perspective is that the market will ONLY return to the 1800-2200SPX region from the 6000SPX region. That is an estimated 70% decline. And, as you can see from my zoomed in chart below, that is the alternative wave [2] in dark green, and represents my “good” scenario.

However, if we are to see the full fury of what these charts suggest, it would seem we have strong potential to return to the 1000SPX region, which would be over an 80% decline, and can take us over a decade to complete. The reason I am expecting it to take longer than a decade is because the 4th wave of one lesser degree occurred from 2000-2009. Therefore, a reasonable expectation would be for this 4th wave of one higher degree to take longer than the 2000-2009 bear market.

This will now bring me full circle to our discussion at the start of the article. The market is potentially approaching the perfect storm. Market participants have become certain that the Fed stands behind the market, and that any decline will be immediately followed by a Fed-driven rally taking us back to new all-time highs again. Investors have been trained in a Pavlovian manner over the last decade to expect this as an almost certainty. In fact, there is almost a “can’t-lose” mentality imbued within the current investor psyche, which has spawned the quite popular acronym “BTFD” (if there are still some of you that don’t know what this represents, feel free to look it up on Google).

So, does one really believe we will forever remain in an environment that provides us with short-term opportunities to make long-term investments in a generally rising market? Or, has the market simply trained us to believe that this type of environment will continue in a linear fashion unabated for decades to come?

I, for one, do not see the market as a linear environment. That is one of the most valuable lessons that Elliott Wave analysis has taught me. Moreover, one of the most powerful aspects of Elliott Wave analysis is that it provides us with market context, which I have not similarly found in any other type of analysis methodology. This current market context is providing us with a 100+ year perspective.

George Santayana once noted that “those who do not learn from history are doomed to repeat it.” I strongly urge us all to take the lessons learned from the similarities seen between the time frame prior to the Great Depression and our current market structure. And, as we head towards my higher targets over the coming year or two, I will certainly be taking action based upon how the market presents itself at that time.

Again, I can always be wrong, and truly wish I am, since the ramifications of my being correct could have a devastating impact upon most Americans as we look towards the last half of this decade and beyond. And, if the market continues to prove this thesis correct over the coming two years, then we will need to appropriately prepare as we approach the completion to this bull market.

Lastly, I want to note that I am generally a very positive individual. In fact, those that know my own personal story know that the only way I am where I am today, and not lying in some gutter somewhere having given up on life, is due to my positive attitude. (I have linked a post from Elliottwavetrader which includes my personal story here, for those interested). So, it does pain me to write such an article. Therefore, please recognize the context within which I am presenting this article, as it is certainly not coming from the pen of a perma-bear or one who is always negative, so please take it with the seriousness with which it is meant. We are still a bit early to prepare, but you must at least begin to consider the potential.