2 Big Fat Dividends To Buy The Dip

2 Big Fat Dividends To Buy The Dip

We often hear or utter axioms in life, which are statements believed to be self-evident as facts. One well-known example is "people never change," as many have lost faith in humans' ability to change their behavior. However, it's not always the case when put into practice. In investing, the age-old axiom of "buy low, sell high" is frequently repeated but often not followed. This results in investors doing the opposite and failing to match the market's performance. The emotional and reactionary decision-making of individual investors can quickly erode their retirement portfolio. Often, poor decisions are made to "preserve capital." That's why at “High Dividend Investing” we fully embrace our unique “Income Method of investing”. Our method is rooted in immediate income investing, fundamental analysis, and contrarian investing. While others sell, we buy. Today, we have identified 2 Income picks with gigantic yields of 10% to buy the dip. We will be adding more to our model portfolio which currently yields +9%. Here are the 2 picks:

Pick #1: CCD - Yield 10.2%

Investors love history, and the media knows this well. But they also know that bad news sells well. When the markets are rocky, I see a lot of charts and analyses showing a lot more downside ahead.

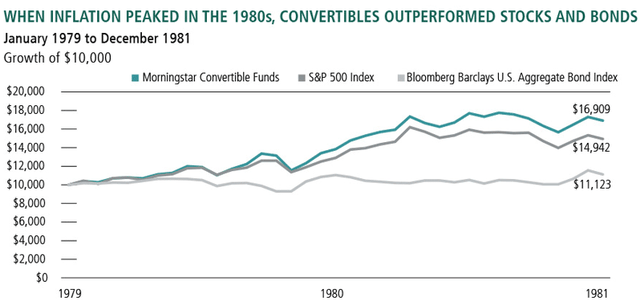

We like history too, but we look to utilize it to further our long-term interests and not guide near-term trading decisions. The hot inflation we face today is comparable to the '80s. But it is notable that when inflation peaked at that time, convertible debentures outperformed both stocks and bonds over the next two years. Source

Lipper Inc and Mellon Analytical Solutions

Convertible bonds are hybrid securities that pay a fixed interest rate and allow investors to exchange the debt for the issuing company's shares if the stock price appreciates. The nice feature of these convertibles relative to the stocks is that investors stand to do well if the companies merely survive, barring debt restructurings. That's a significantly lower bar than for the investors of the common stock.

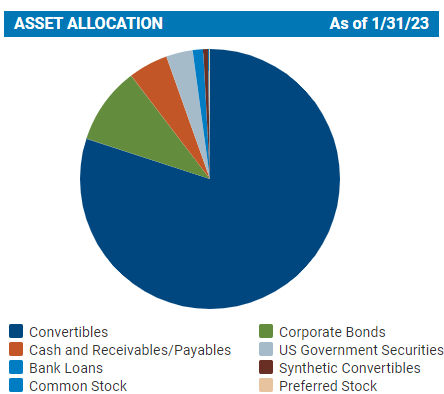

Calamos Dynamic Convertible and Income Fund is a CEF (Closed-End Fund) that actively manages a massive portfolio of convertible securities. With 589 holdings, Calamos fund managers move in and out of positions to realize timely gains, and the proceeds are used to pay big distributions. Source

Calamos Convertible Income Fund

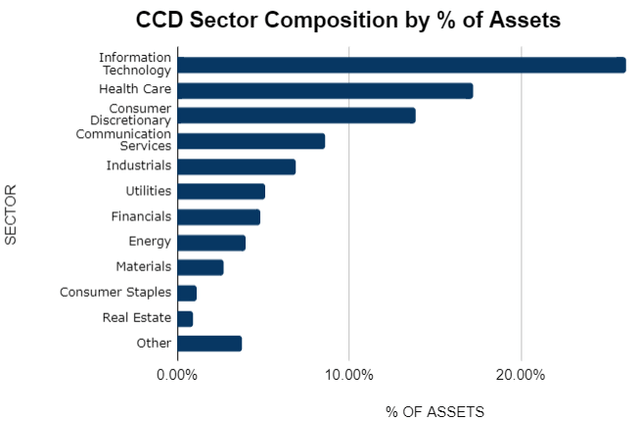

The CEF maintains significant allocations in IT, Healthcare, and Consumer Discretionary sectors and has modest positions in defensive sectors such as industrials, utilities, financials, and energy.

Author's calculations

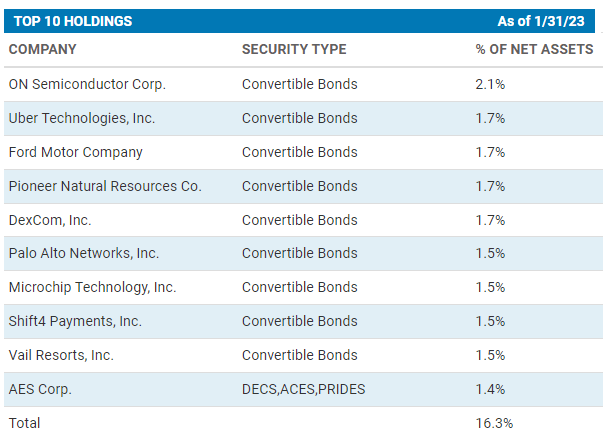

CCDs' top 10 holdings only constitute 16.3% of total assets, and several are highly established and profitable names in their respective fields.

Calamos Convertible Income Fund

CCD distributes $0.195/share every month, calculating to a 10.3% annualized yield. Now let's look at CCD's distribution source in FY 2022 and the four months of FY 2023.

Pick #2: ORCC - Yield 10%

When it comes to a nearly perfect environment for a business to thrive, the current rate market for Business Development Companies (or BDCs) could not be better. Most BDCs issue floating-rate debt and have fixed-rate costs for themselves. This allows them to book rising interest income and see it flow quickly to their bottom line.

For Owl Rock Capital Corp. (ORCC), their management team continues to see great success in executing their plan. ORCC earned $0.49 per share of net investment income, easily covering its normal dividend of $0.33 handily and leading them to issue an additional $0.04 supplemental dividend. Even with paying a $0.37 dividend in Q4, NII covered the dividend by 130%!

The other interesting fact to note in ORCC's quarterly earnings report is their plans to buy back shares when trading at a discount to NAV. Currently, NAV per share is $14.99, up from last quarter. ORCC trades hands for ~$13.70, so there is over a $1 discount baked into their share price.

I'd expect them to continue this process as long as shares trade at a discount.

We fully expect ORCC to continue to grow its portfolio and strongly outperforming.

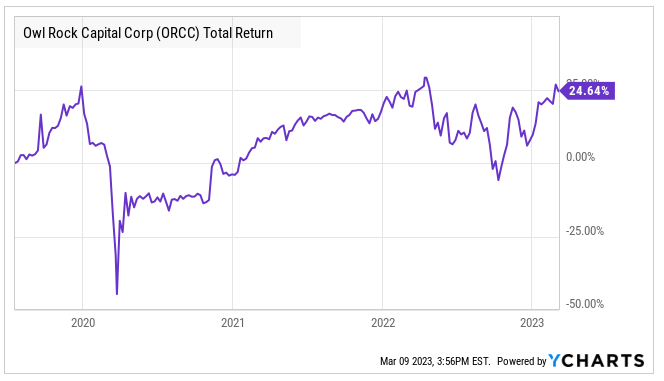

Below is a chart of the performance of ORCC (Total Returns)

At the current price, ORCC highly attractive, offering a fully covered 10% yield. This is a great stock to buy the dip!

Conclusion

Both ORCC and CCD are investment options that may experience fluctuations but can provide significant returns and provoke strong opinions. As income investors, we take advantage of these opportunities by purchasing during the dip while the dividend yield is at 10%!

Our goal at HDI is to collect recurrent dividends and be rewarded for our patience while the market recovers. We use the income to fund our hobbies or passions and grow our retirement portfolio.

HDI, described as the 'Must Own' Service for Income Investors and Retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.