2 Monthly-Pay Yields of +11% for Today

2 Monthly-Pay Yields of +11% for Today

The month of May brings with it the beginning of spring and the promise of summer. However, for investors, May is also associated with the well-known stock market adage "sell in May and go away." This saying originated from wealthy individuals selling their holdings before going on vacation, but with modern technology, its significance has diminished. Nevertheless, the summer months are known to have lower trading volume, allowing smaller players to have a more pronounced impact on securities' prices. This leads to more volatility in the market. Despite this, there are still excellent sources of income that investors can add to their portfolios and enjoy throughout the summer. In this article, we will explore the effects of the "sell in May and go away" phenomenon and discuss two sources of income that can provide investors with stability and growth during the summer months.

Pick #1: UTG - Yield 8%

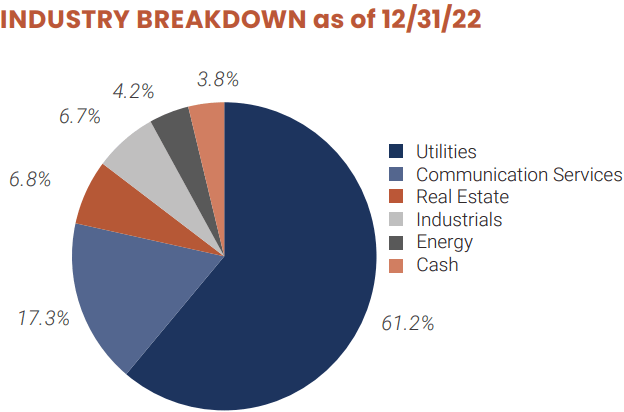

The Reaves Utility Income Fund (UTG) is a type of Closed-End Fund (CEF) that focuses mainly on investing in utilities and communication infrastructure. Source

UTG Fact Card

The Reaves Utility Income Fund (UTG) invests in established businesses in conservative sectors such as utilities and communication infrastructure. These businesses have "inelastic" demand, which means their products are essential and less impacted by economic conditions. Despite challenges of government regulations and inflation resulting in higher prices for consumers, UTG was able to navigate the utilities sector and always emerging as a winter. This CEF has track record of offering generous and growing distributions since 2004, with do distribution reduction whatsoever, even during the multiple recessions that we saw since. This makes UTG it a great investment for income investors and retirees, no matter what economic cycle we are going through.

Pick #2: PFFA – Yield 10.9%

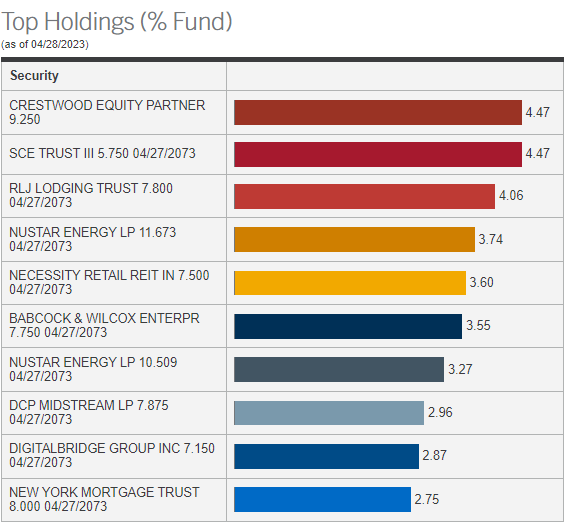

We look for three key factors when choosing actively managed ETF: A focus on current income, diversified exposure to an income-oriented industry or sector, and a reputable management team with a strong track record of shareholder returns. The Virtus InfraCap U.S. Preferred Stock ETF (PFFA) meets all of these criteria. PFFA invests in a portfolio of preferred stocks issued by American companies that are undervalued relative to the sector and to their peers.Source

Virtus.com

PFFA is an actively managed ETF that utilizes modest leverage (20-30%) and careful security selection to construct a portfolio of preferred securities. Its exposure to preferred stocks makes is a lower risk investment. PFFA's strategy involves eliminating preferred securities with low or negative yield-to-call ratios, a strategy that is also employed in our own preferred portfolio. PFFA's investment approach is similar to that of HDI's fixed-income selection style, but with added leverage to boost returns. This strategy is expected to pay off as preferred securities are poised for a strong comeback in the current market conditions. PFFA's reliable monthly income is a major advantage, with shareholders benefiting from the steady monthly distributions and modest capital upside as the Fed continues to scale back. PFFA's monthly payment of $0.165 per share corresponds to an annualized yield of 10.9%.

Conclusion

UTG, and PFFA offer investors a combination of high current yields and growing dividends. Both picks have a strong track record. When it comes to retirement, it's important to have a stress-free portfolio that provides reliable income and allows you to enjoy your hobbies and loved ones. Income investing can provide that kind of security and peace of mind. As the weather gets warmer and summer approaches, take the time to enjoy the outdoors and spend time with those you care about. Your portfolio should work for you, not the other way around. Consider incorporating income investments like UTG, and PFFA to help achieve your financial goals and live a stress-free retirement.

HDI, described as the 'Must Own' Service for Income Investors and Retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.