Market Analysis for Oct 11th, 2022

Overnight topped at ES 3630s around Asia open, then proceeded with a breakdown setup below 3600 targetting 3570 (monthly low). Sellers ran with the trend until 3584 produced a micro double bottom. As of writing, market bounced back into 3625 (yesterday’s closing price). Now, hovering around the 1hr 20EMA trend before RTH dictates the next move.

Going into RTH open, the parameters for range vs. trend day remains the same as yesterday’s report.

3570 is the must hold level as support as that’s the ongoing October monthly lows. Again, below 3570 opens up much lower downside targets at 3550/3500/3450/3400/3380…etc.

If sellers take out 3584 followed by 3570 quickly after RTH open, then price action can deviate from our rangebound expectations and turn today into a trend day down setup.

If buyers keep defending this monthly range low support and stay above 3630, then likely proceed with rangebound backtest into 3650/3665/3680 resistances.

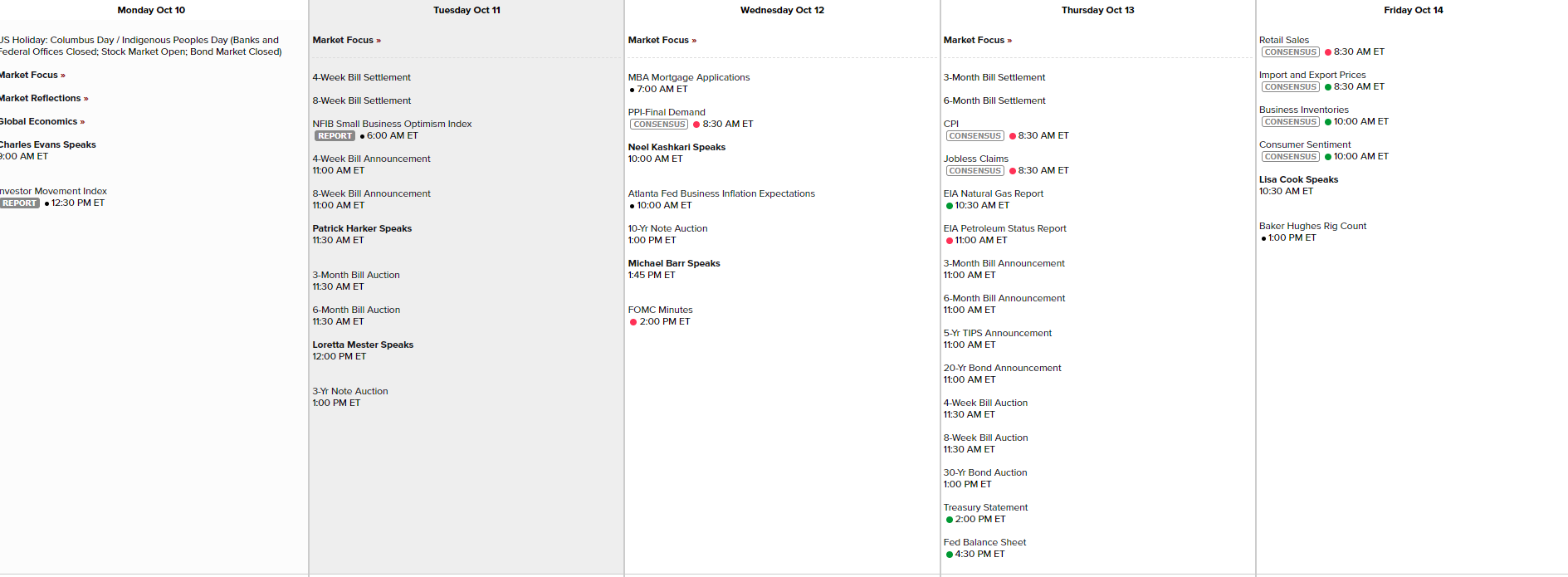

Important note: on the daily context, market is likely waiting the timing catalyst reports of PPI, CPI, retail sales later this week. We need to be more patient on trade locations as price action has kept trapping us into failed breakout/continuation setups since late last week.

See screenshot below for timing catalysts ahead.