Bitcoin Is In The Buy Zone

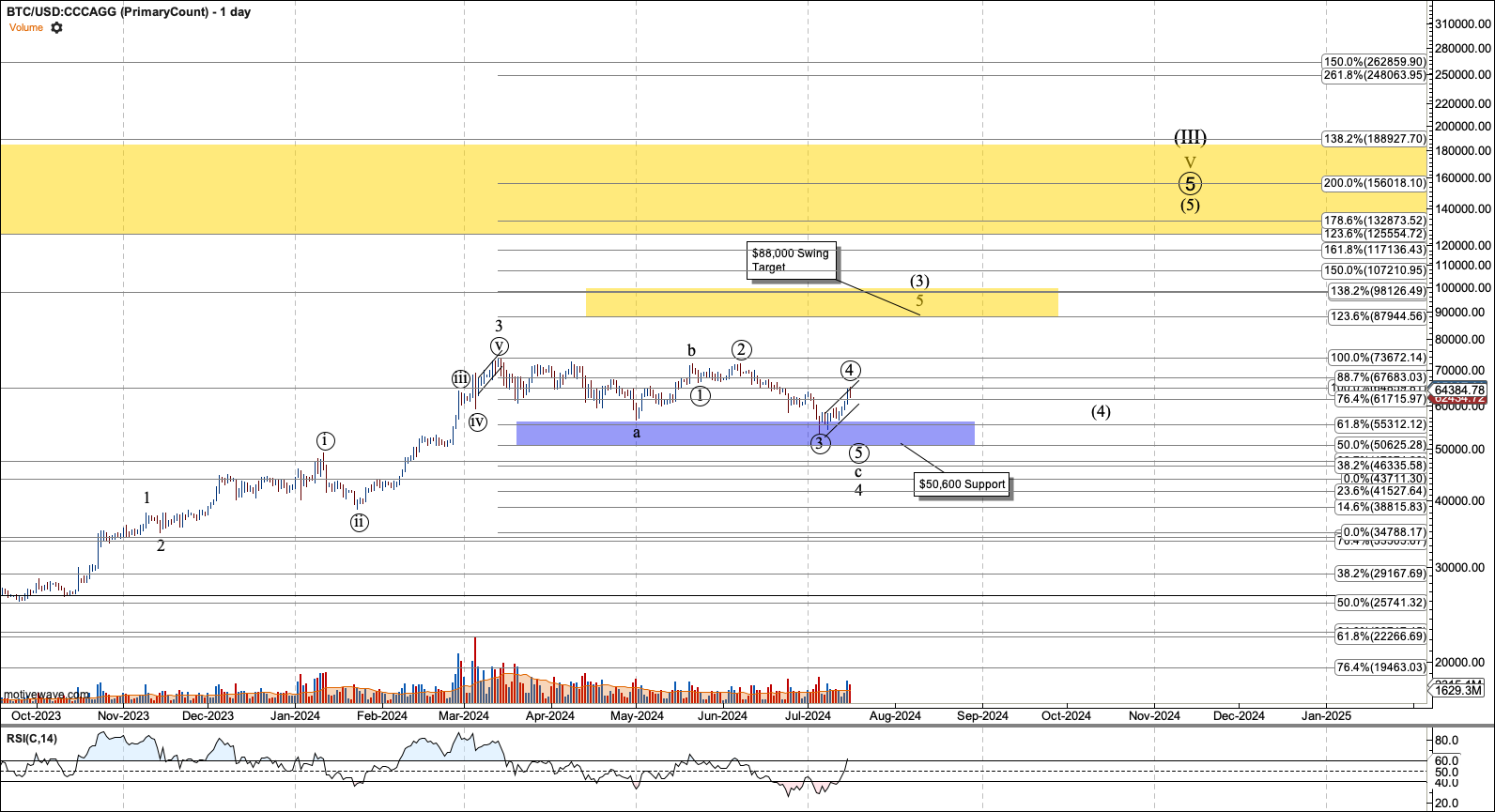

In June, Seeking Alpha’s podcast host Rena Sherbill had me on to discuss the ongoing crypto bull market. In that episode, I discussed the importance of the $50,600 support for Bitcoin. Ideally, it holds. Structurally, it has a good chance of holding. And, although there are no guarantees in trading and investing, we have reached a good point in Bitcoin’s structure to take a low-risk trade.

Frustrating the Bulls

In late March, Bitcoin dropped into a corrective pattern from its all-time high of $73K+. That drop commenced a frustrating four-month slog of sideways action. As is typical during such periods, crypto podcasts flashed titles asking whether this bullish cycle was over. Yet such periods are a key part of bull markets.

And the correction that started in March is still shy of the five-month sideways correction Bitcoin went through from April to September 2023. That correction preceded the vertical move that broke Bitcoin’s all-time high set in 2021. This correction is unlikely to precede the same return on a percentile basis, but as long as it is over $50,600, I expect new all-time highs in the coming months, likely before the year’s end.

Why $50,600?

Why is the level $50,600 so important? That level is the log 50% retrace of wave three that peaked in March at ~$73K. The fourth wave of impulsive rallies holds the 50% retrace of its third wave, and more often holds the 38.6% retrace. The 38.6% retrace in Bitcoin is $55,300 and has already been breached, so $50,600 is the next level to watch.

It is not as though a break of $50,600 commences a bear market, though it might. At the very least it would increase the choppiness of this bull market and open the door to a much longer correction. And for practical and tactical purposes, it would lead me to sell all my more speculative altcoin positions and cut my Bitcoin exposure down. So far, that is not a concern. However, I always consider the most adverse scenarios.

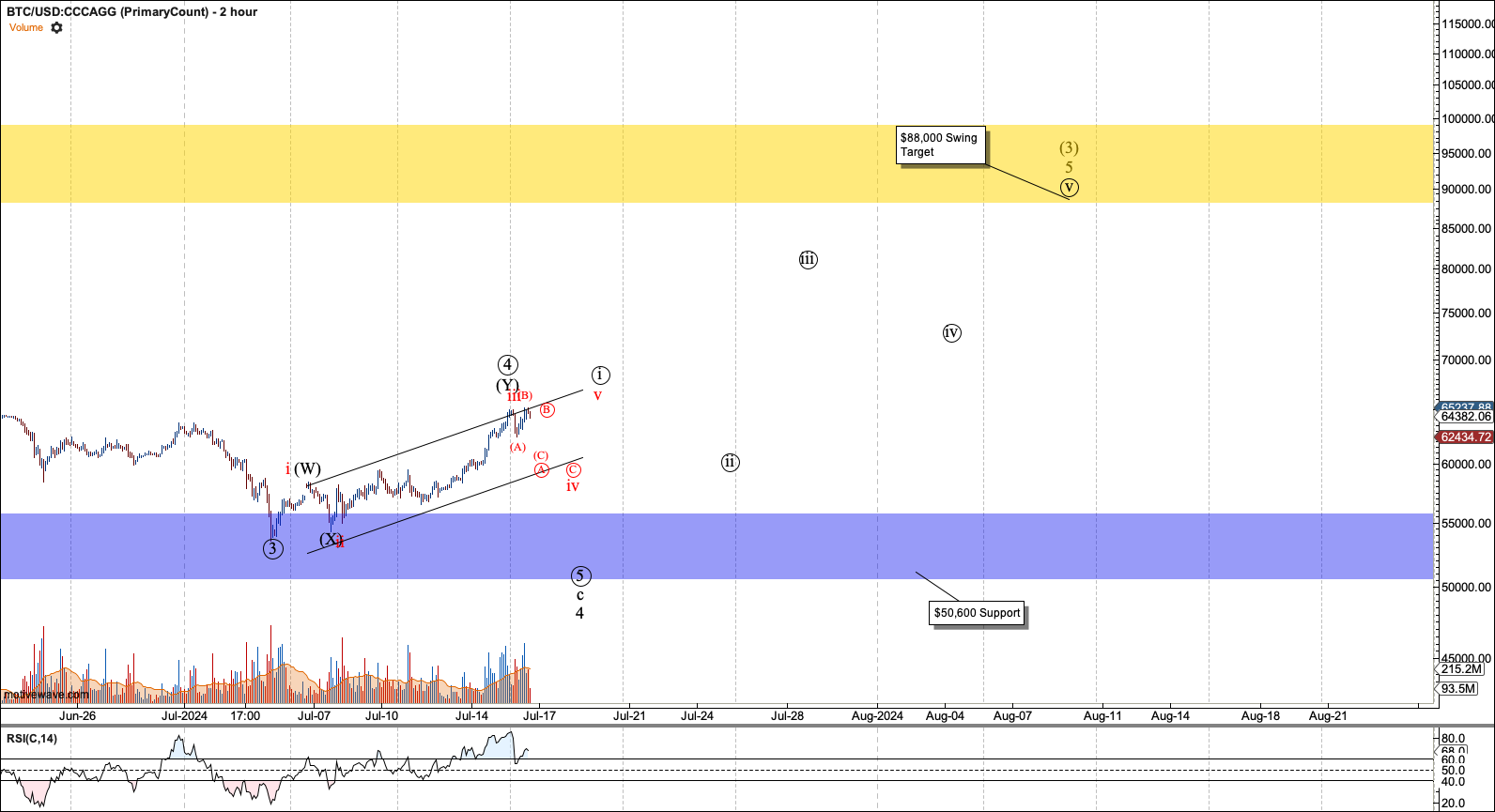

A Surprising Reversal

I intended to publish this article last week, but I was not able to finish it before a planned weekend away demanded my preparation. When I came back on Sunday night, my jaw dropped as I noted Bitcoin made a push through resistance. And at of the time of writing, it has stretched well past a normal wave four, as indicated by my label of black circle-4.

This C wave of this wave-4 was already evident as a diagonal when it was dropping below $60K. That means this wave four is not invalid until it breaks circle-2 $72K. That said, this wave four has breached norms, and I now presume the bottom is in and Bitcoin is headed to my next target of $88K, with the slim possibility of extension to $97K.

However, Elliotticians look for five waves through resistance off a low to confirm that a correction has ended. Resistance was at $62K and so has fallen. However, this move is still three waves in structure. As of writing, the third wave has hit $64,800.

This rally also has a corrective structure indicating that if this reversal is indicative that the bottom is in, it is a diagonal. Ideally, the fourth wave holds the channel as drawn, which is currently in the $60,100 region. This diagonal invalidates with a break below $54K.

Sound Tactics

How do we trade such action as we wait for Bitcoin to confirm a bottom? While we wait for the perfect pattern, the market can get away from us. However, if we trade before confirmation, we can experience a drop to $50,600 (roughly 20%) before stopping out or cutting our position.

First, this is not meant to be construed as personal advice. It is meant to help you consider ways of managing this action.

As I always say with such questions, “It depends on what you start with.” If you still have not participated in this bull market, you might consider what amount of Bitcoin you are comfortable owning whether or not it broke $50,600, and that you would add to if a bear market like that of 2018 and 2022 started. I still have Bitcoin in my possession that I bought in the $3000 region at the 2018 low and then held through the 2022 bull. Those tranches of Bitcoin were not part of my swing portfolio. What has stopped you from holding some Bitcoin long term and slowly accumulating in bear markets?

If you are more interested in developing a swing position, this is not the type of rally to chase, unless you keep the size comfortable for a stop loss at $50,600. However, if Bitcoin forms a clear five waves as shown in red, that could complete black circle-i early. Black circle-ii is a great place to add. The stop for that trade moves up to $53,600. And circle-ii often breaks quite deep, up to a 764% retrace of circle-i. Until circle-i completes, I can’t be specific about levels for circle-ii. However, we may be able to make additional purchases in the $56K–$58K region.

Conclusion

Bitcoin has gone sideways for four months, causing many to wonder if the bull market is over. While no one can predict the future, so far this action is a run-of-the-mill bullish consolidation that provides the launch pad for Bitcoin’s next move higher. While positioning after this correction requires care and patience, we are starting to come into a zone where risk to reward is more advantageous than it has been since the September 2023 bottom.

Lastly, I will remind you that I don’t have a crystal ball. My levels do break at times. However, the proper use of these levels involves not considering them predictive. They are tactical levels from which to measure your risk and resize your position accordingly. Therefore, mark my words. If by chance $50,600 breaks, it will change my view and derisk my own portfolio. That is necessary with such a volatile asset class.