Cameco: Doh! A Vertically Integrated Story

Cameco: Doh! A Vertically Integrated Story

Summary

- The nuclear industry, along with Cameco, is innovating with Gen IV reactors, safer fuels, and advanced manufacturing, making nuclear power safer and more efficient.

- Cameco is a sophisticated, diversified player in the nuclear fuel cycle, well-positioned to ramp up production as uranium demand increases.

- Despite not being a high cash flow company, Cameco's strategic investments and low debt make it a strong long-term asset with huge potential.

- Our analysis shows Cameco has significant growth potential, indicating a possible bullish trend and investment opportunity.

RHJ

Written by: Mark Malinowski and Zac Mannes

Introduction

Uranium is synonymous with nuclear. Be that nuclear waste, nuclear-powered submarines, and even more so, nuclear weapons. I think those associations are part of the reason that most people have a fear and anxiety that automatically triggers when they hear the word nuclear. How could they not? Most American and Canadian adults studied the history associated with nuclear weapons being dropped on Japan. Many others studied ill-planned testing of nuclear power facilities at places like Chernobyl. A good part of the population that were children in the two decades following WWII experienced drills and fear of potential nuclear war as the Cold War swung into action.

We have seen bumbling idiot characters portray nuclear power plant operators for over 30 years on television. So with all that floating around, should it be a surprise there is fear and misunderstanding of what a nuclear power plant is, does or how it is operated? Never mind nuclear waste or upgraded uranium.

X/Twitter: Zac Mannes

So, while Americans have been watching glowing green test tubes bounce on street corners, three eyed fish swimming in cooling ponds, and random barrels of nuclear waste around Springfield, what has the nuclear industry been up to?

Nuclear Industry Innovation

While some of this is relatively “old” news, innovation in this heavily regulated industry takes time, on the scale of 5 years is fast.

Commercial Scale - Gen IV Reactors

Small scale “modular” reactors have been in development for a long time, but now they are getting closer to implementation. Some companies have developed brand-new designs, and others, like Westinghouse (49% owned by Cameco (NYSE:CCJ) (CCO:CA)) have scaled existing designs to create reactors that are sized for small cities, processing plants or remote industrial sites, like mines. A key to these designs are facilities that are inherently fail-safe and will shut down without intervention from an operator. Some of these designs are still in the approval process, while others are ready for their first installation. Kairos Power and Terra Power are in the building phase for demonstration reactors that use different materials like molten salt or lead for cooling instead of water, enabling more complete fuel rod usage, and thereby improving their cost efficiency.

Recycling Used Fuels Rods

Research continues into taking fuel from used fuel rods and separating the small portion of unusable byproducts from the fuel and getting out the 90 plus percent of uranium and other fissionable materials. Now, the technology for this exists, but it would require different reactor technology and a change in the economics of existing uranium fuel costs.

Safer fuels

Safe fuels have higher oxidation resistance and higher temperature stability. Thus, they are much more “accident tolerant” than previous generation fuels, resulting in safe stockpiles and significantly reduced meltdown risk due to run away conditions such as large fires or uncontrolled reactions. Companies like Global Nuclear Fuel, Westinghouse (WAB) and Framatone have all developed their own version of these types of fuels.

Advanced Manufacturing

Using 3D printing technology to rapidly develop, prototype and test different types of facilities and new fuels designs.

Laser Technology Extractionaluable Isotopes of Uranium from Tailings

Cameco has invested in Global Laser Enrichment which has continued to advance existing technology to viably extract more uranium from US government tailings which are currently viewed as waste from the refining/upgrading process.

So with all the training, investment and innovation taking place in the nuclear energy space, there really is little room for pop culture.

Cameco (CCJ/ CCO.CA)

Introduction

The CAnadian Mining and Energy Corporation (CAMECO) is a complex company with a complex history. The company formed from two crown corporations, one provincial, focused on mining development and one federal, focused on uranium mining and refining, in 1988. The initial public offering took place in 2001, listing on the TSX, with the government slowly selling its shares and being fully private in 2001.

Steady growth over the years has come in the form of continued investment in exploration/development of resources and in seeking vertical integration in the world of nuclear power.

Year | Acquisition/ Investment |

1996 | Acquired Power Resources, the largest US producer of uranium |

1998 | Acquired Uranerz Exploration and Mining (Canadian based) |

2001-02 | Invested 100 million CAD into Bruce Nuclear Power Partnership |

2004 | Spins out Centerra Gold Announces development of Uranium mine at Inkai, Kazakhstan |

2006 | Acquires Zircatec Precision Industries - primary business is manufacturing nuclear fuel bundles and other CANDU reactor components |

2008 | Acquired Global Laser Enrichment (24% stake) -Isotope separation technology with SILEX and Hitakchi . Acquired 70% interest in Kintyre uranium exploration in W. Australia |

2012 | Acquires Nukem Energy, uranium fuel broker Acquires the Yeelirrie uranium project in W. Australia |

2014 | Start of ore production at Cigar Lake mine Divestment of interest in Bruce Power at a 350% return on capital |

2021 | Increases investment in Global Laser Enrichment (49% total stake) |

2023 | Acquisition of Westinghouse (49% stake) with Brookfield |

This continued investment in the nuclear space while operating their Tier 1 mining assets with the ability to ramp up additional capacity in Tier 2 assets has continued to help manage costs and quickly grab market share when price and the market show it to be beneficial. However, it can mean a more volatile stock as it moves with the price of uranium.

Cameco Fundamentals

From a purely fundamental perspective, Cameco is not currently a high cash flow company and only pays a small dividend relative to its share price. When one only looks at the price of shares relative to revenue and cash flow, it is easy to call the company overvalued.

If I were to describe Cameco before writing this article, I would have described them as one of the most pure uranium plays and the largest producer of uranium globally. However, after my research, I see them as a very sophisticated, diversified player in the nuclear fuel cycle that is best positioned to turn on more production as demand for uranium and uranium technology continues to ramp up. If that ramp up is delayed, they will continue to idle along, investing where they see opportunities. So buying Cameco is buying assets with huge potential.

From a balance sheet perspective, the company is not sitting on a pile of cash after the Westinghouse investment, where they could acquire other assets without borrowing or issuing shares. Equally, they are not carrying a large debt load, with a current debt of 1.2 billion CAD and a debt to equity ratio of 0.3. The Westinghouse investment will be accretive to cash flow in my opinion and diversify their operations further.

Operations and Production

Mines, Refining/ Upgrading

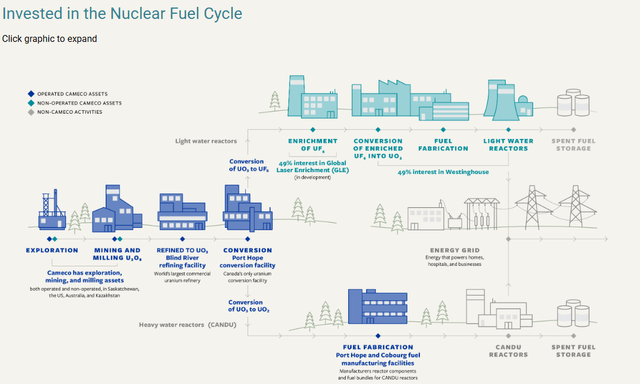

Cameco’s operations are global, including mining, refining/ upgrading, and sales.

Mining operations are concentrated in two specific areas: Kazakhstan (Inkai JV operated by Kazatomprom) and Saskatchewan, Canada (Cigar Lake Mine, McArthur River Mine, Key Lake Mine). While Cameco has interest and has invested money to develop other assets listed in this table, these are non-producing assets at this time, including Australia and United States mining Assets.

Milling and refining operations are focused in Saskatchewan and Ontario, respectively, while sales from their broker arm are located in Switzerland, with whom they have contractual obligations and supply agreements.

Cameco: Operations and Production diagram

Tariffs

There are several things to consider about the threat of tariffs on Canadian exports. Currently, the United States has more demand for uranium than is produced within the United States. There is legislation in place restricting imports of Russian Uranium through 2040. Demand from China, Europe, India and Africa is continuing to grow. Cameco’s brokerage arm sells uranium from Switzerland. Uranium is a relative “drop in the bucket” compared with the cost of nuclear power facilities. So I see next to zero impact on uranium exports if tariffs were imposed on Canadian imports.

Lyn Alden Schwartzer’s Uranium Comments

I have been structurally long uranium since autumn 2020, and continue to hold that view through its ebbs and flows. Uranium price chart attached.

Demand is mostly inflexible, since uranium price is nearly irrelevant relative to the massive cost of building and operating nuclear power facilities, and they need to operate to keep power flowing in their regions. Supply is constrained, and the largest producer, Kazatomprom (OTC:NATKY), has lowered its 2025 production estimates.

Demand structurally exceeds production supply. However, uranium has a large and opaque secondary market from historical stockpiles that fill the gap. As we look out several years, there are multiple countries building nuclear reactors, with Egypt's El Dabaa being one of the largest. Beyond that, small nuclear reactor designs are very promising and are expected to be increasingly adopted in the years ahead.

I'm structurally bullish on uranium, subject to ebbs and flows due to technicals and sentiment.

Technical Analysis of Cameco

Where did we start?

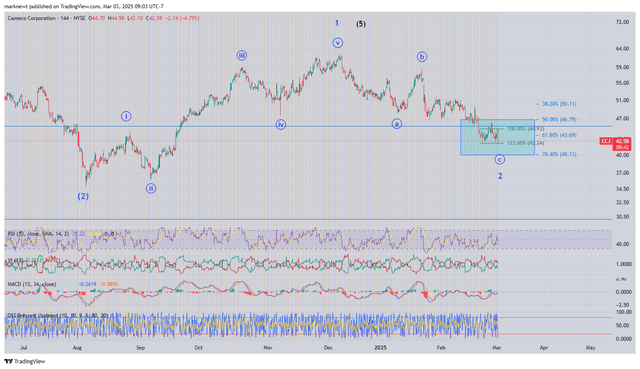

Cameco has been tracked as the uranium company of choice from an Elliott Wave perspective since early 2020. Going back to April of 2020, Zac Mannes posted the following chart, showing signs of a bottom and looking for an impulsive move:

From 6 April 2020 (StockWaves)

Since that time, we have tracked a ~10x move in Cameco.

But that does tell us much about where we are headed. Well, in the most bullish view after Cameco reported quarterly earnings, we are still sitting at important support from an Elliott Wave perspective.

TradingView

Where can we go?

We do not have an active Wave Setup on Cameco at this time, but are looking for the response to support to identify the next opportunity. We do this by looking at the big picture, which can be decades of data, but one thing remains the same. That thing is that the patterns that we see at the smallest time frames are the same patterns we see at the largest of time frames, this is a fractal nature of market pricing. We have given our members the projections and potential we see if price can give us a near term pattern indicating a bottom is in place. This would trigger us to create a Wave Setup.

What is a Wave Setup?

A Wave Setup is when analysts identify clearly defined risk:reward parameters on a chart that has the right proportions and structure aligned with Elliott Wave and Fibonacci Pinball principles.

These Wave Setups provide clear parameters that are updated regularly by analysts to provide targets, support and invalidation pricing levels based on Fibonacci pinball applied onto Elliott Wave patterns. Only the best of the best make it to Wave Setups.

"It’s pronounced ‘Nuc-u-lar’." -H.J.S.