Cautiously Bullish - Market Analysis for Jan 3rd, 2021

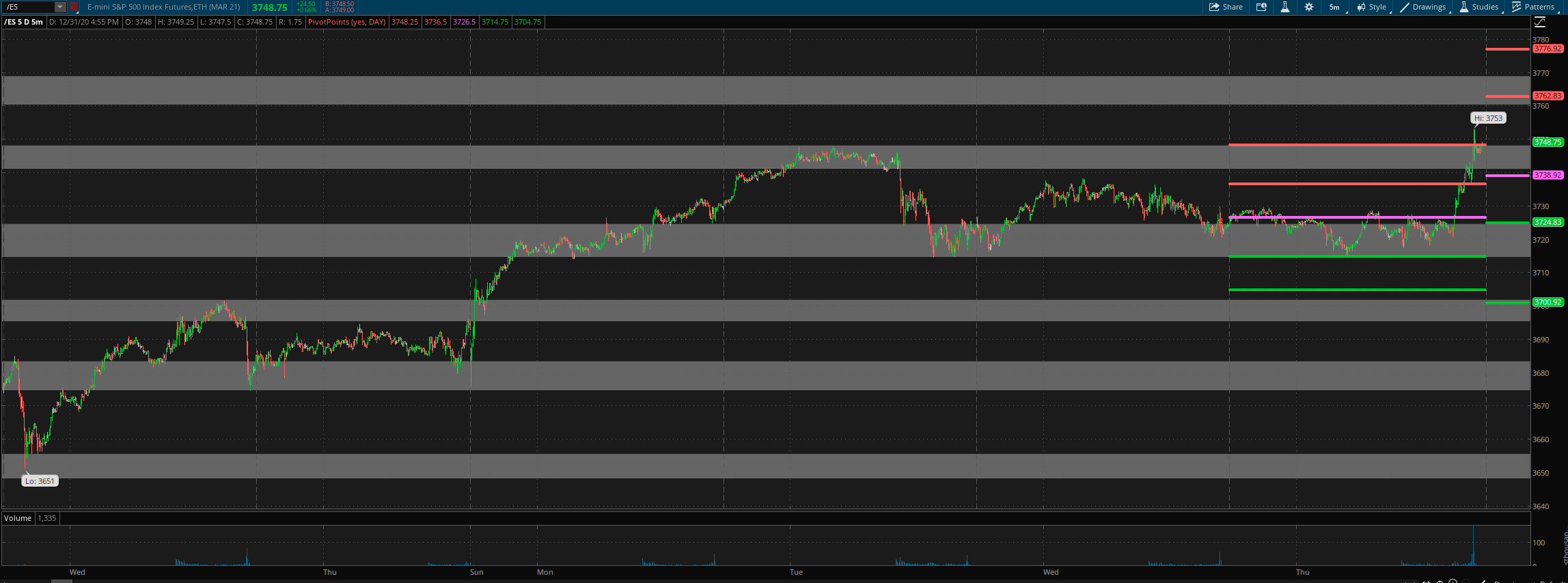

In last weekend's report, I wrote: "I still think we may be able to tag the 3750/75 area before the reset," and indeed the Emini S&P 500 (ES) tagged 3750 late in the week.

What's next? Options data is bullish. Internals are holding a mildly bullish posture, but the short term micro1 indicator continues on the sell side. Price action is short-term bullish, medium-term bullish and long-term bullish. The Odds indicator continues to hold long and the Composite indicator went back to a buy signal. So we now hold longs via the primary and complimentary trades.

We tagged the 3750 area we have been looking for. And there is likely more upside ahead into the 3775/3800 area. Internals continue to be on the weaker side, so my read is to stay cautiously bullish but do not over extend on the long side. We are not likely to have any Odds sell signals for the next couple of weeks but there are some possibilities after the first half of January. For now, though, we stay long via the Primary and Complimentary trades.

Grey zone resistance is at 3761-69 and then near the 3800 area. Support is at 3748-41, 3725-15, 3701-3695, 3683-73, 3656-47, 3635-23 and then at 3596-87.

For Monday, daily pivot is at 3739. Resistance R1 is at 3763 and R2 at 3777. Support S1 is at 3725 and S2 at 3701.

All the best to your trading week ahead..