European Markets Trade Higher

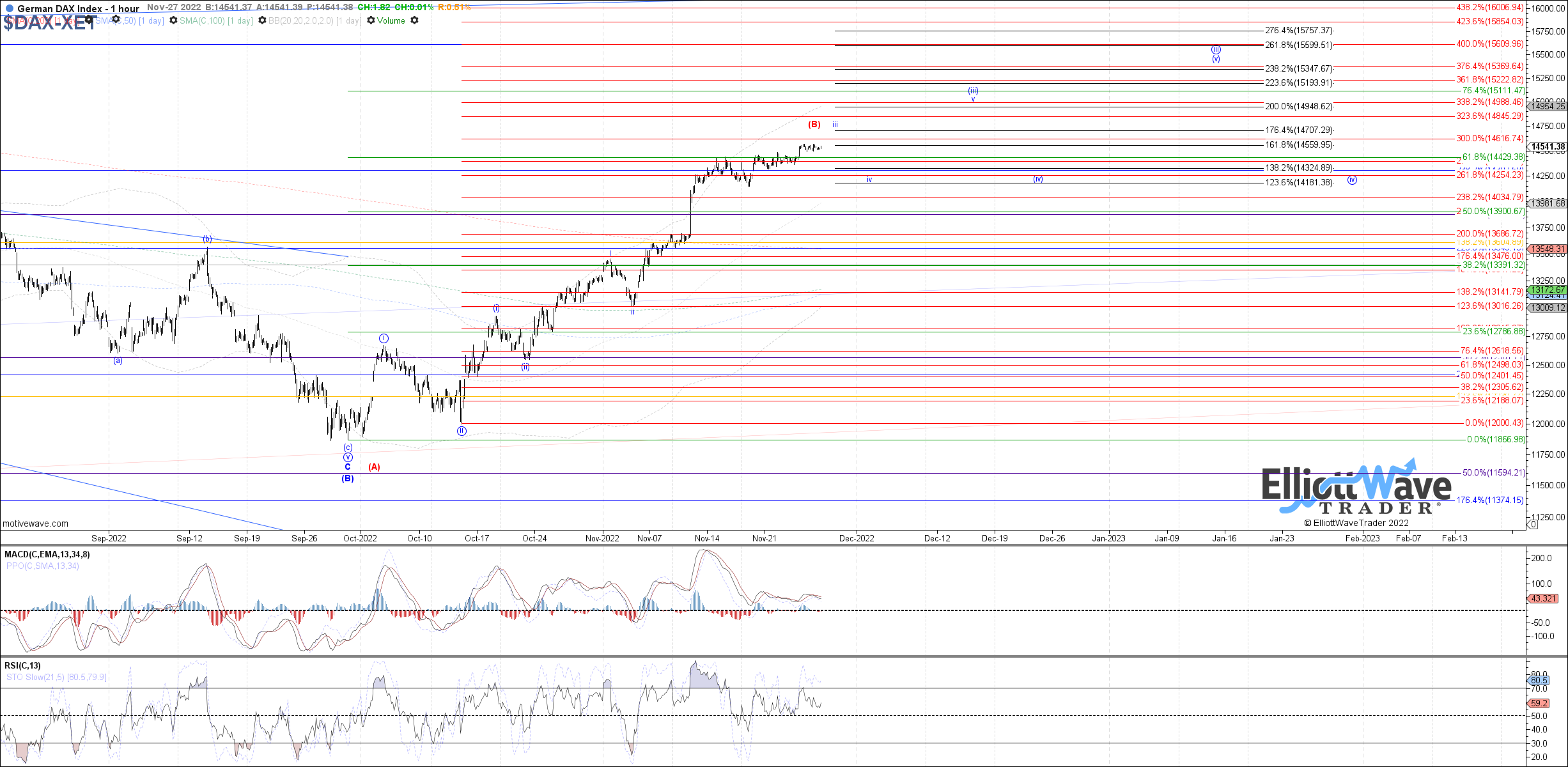

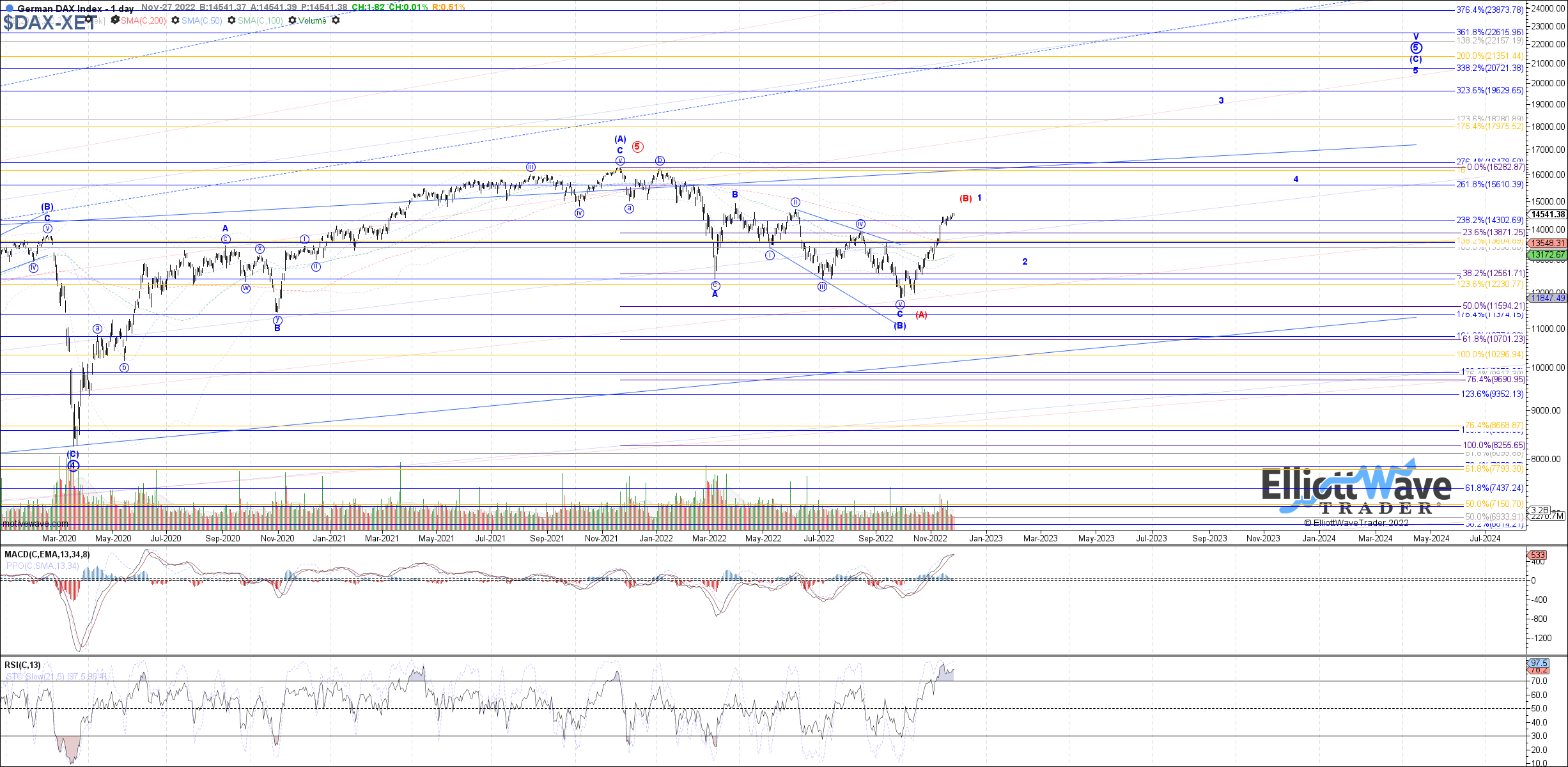

DAX: The DAX Performance Index traded higher last week, making another new high on the month. Therefore, odds of a more nested impulse off the September low have increased, with price still finishing up the heart of a 3rd wave. If that is the case, then 14705 is the next fib resistance above for any further immediate extension. Otherwise, a break below 14315 is needed as the minimum indication of a local top in place and at least the start to some degree 4th wave consolidation in the blue count.

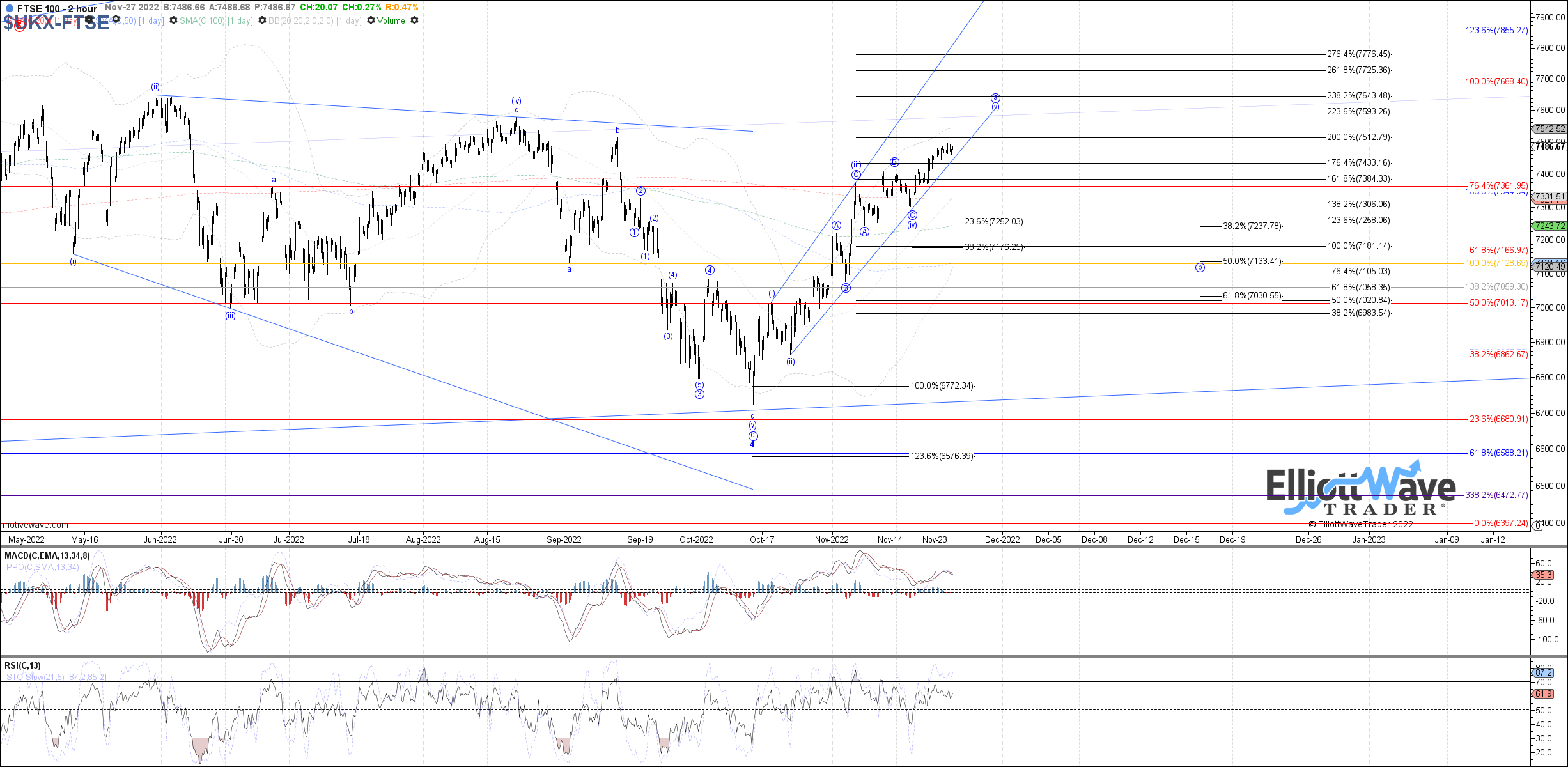

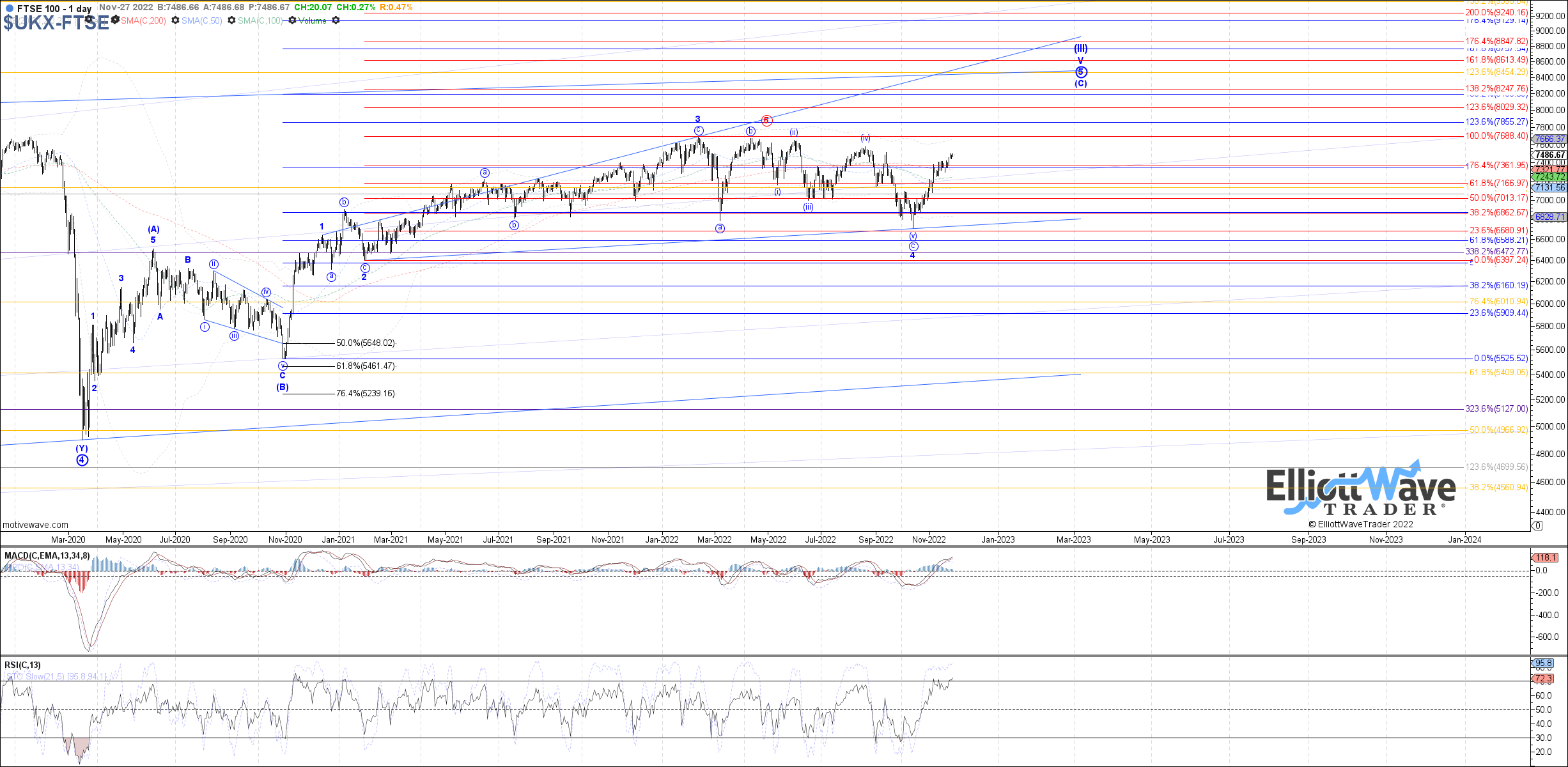

FTSE: The FTSE 100 also traded higher last week, making another new high on the month and therefore confirming wave (v) of a filling out. Under that assumption, 7515 is the minimum fib target expected to be reached before wave (v) of a completes, but with room up to 7595 – 7645 possible in the case of an extension. Otherwise, a break below 7400 is needed as the minimum indication of a local top in place.

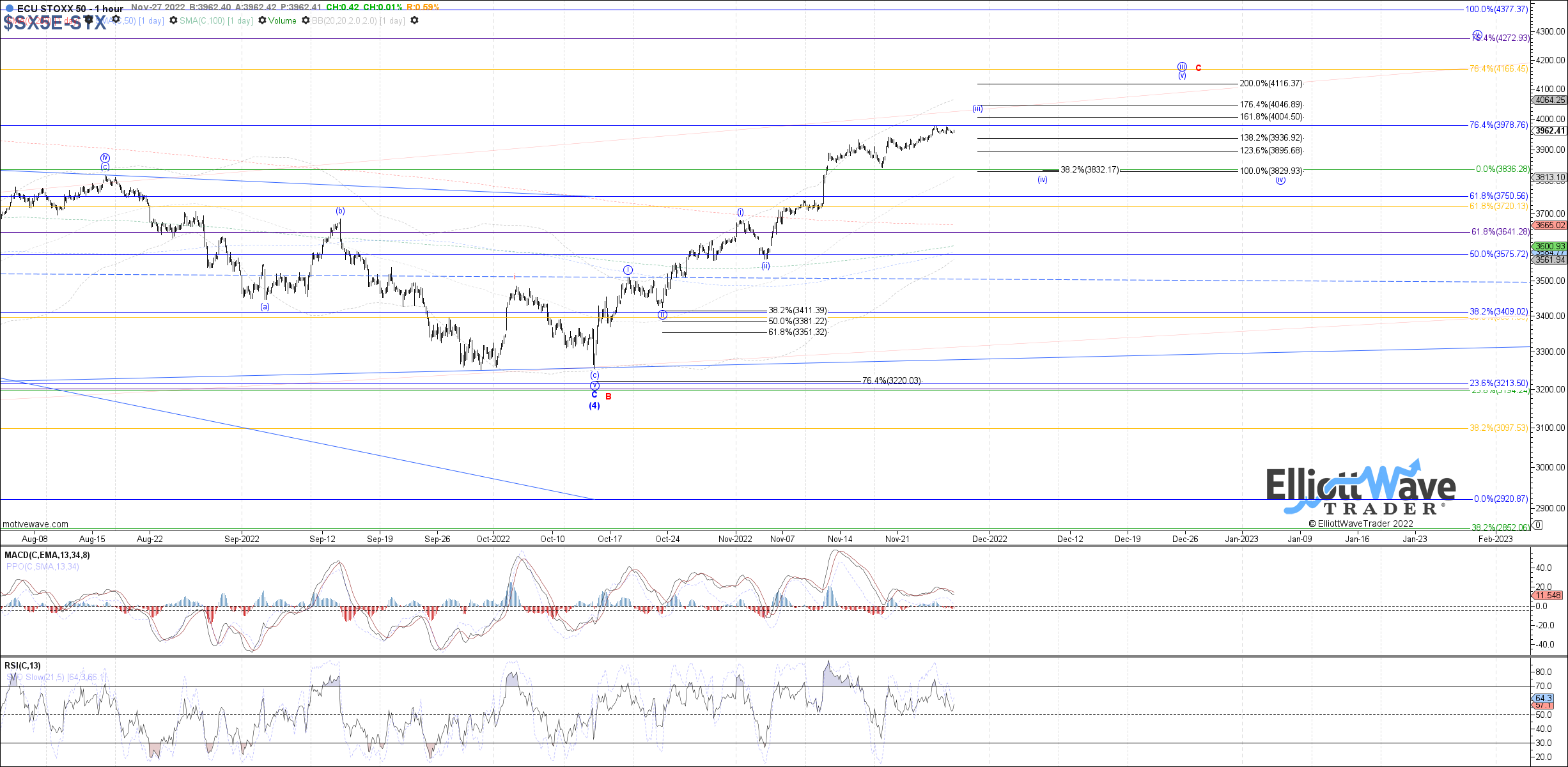

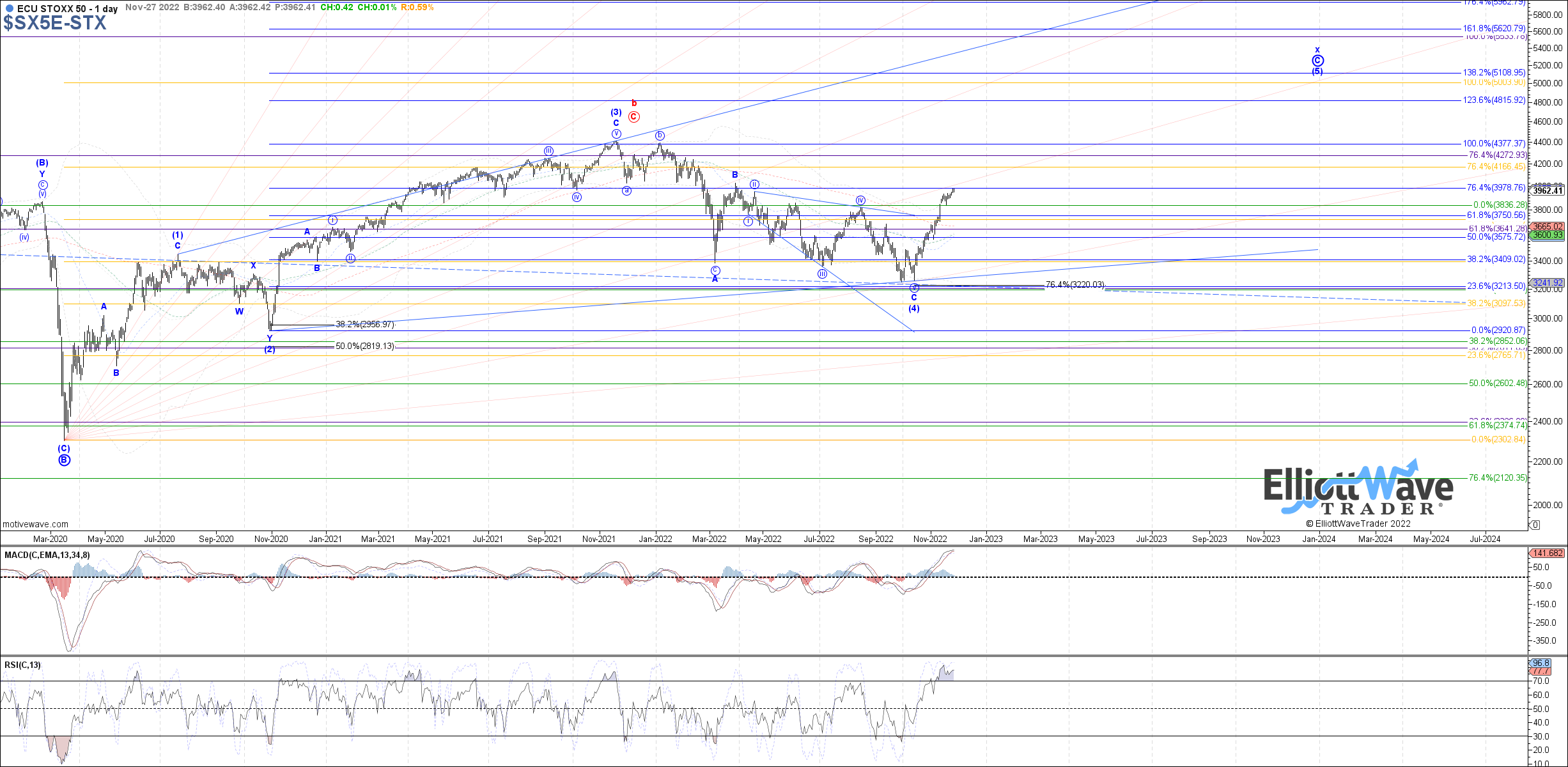

STOXX: The Euro STOXX 50 Index stretched higher last week like the DAX, increasing odds of a more nested impulse off the October low. Like the DAX, price should be finished up the heart of a 3rd wave in that case, with 4005 as the next fib resistance above for any further immediate extension higher. Otherwise, a break below 3900 is needed as the minimum indication of a local top in place and at least the start to a 4th wave consolidation.