Eyeing Opportunities In Debt Holdings

Opportunities In The HDI Portfolio

Q2 earnings were very good for the HDI portfolio. We saw some dividend hikes, a lot of earnings beats, and a favorable outlook from our investments. That momentum should continue to support rising prices for our holdings.

The best areas of opportunity in the HDI portfolio are fixed income and other debt holdings. Debt of all kinds had a very tough first half and is only now starting to recover.

Debt prices are impacted by the price of Treasuries and the size of the "spread". The spread is the risk premium debt gets over Treasuries to compensate for credit risk. In other words, if you had the option to lend to the U.S. Government or a corporation, all things being equal, you would lend to the government. You would do that because there is near zero risk of not being paid back on time, while with a corporation, there would be some risk of not being paid back.

So in order to attract lenders, corporate debt has to have a higher coupon than U.S. Treasuries of similar maturity, this is called the spread. So when Treasury rates change, all debt prices move with it. After all, if you could sell your corporate bonds and invest in Treasuries at the same or higher yield, you would.

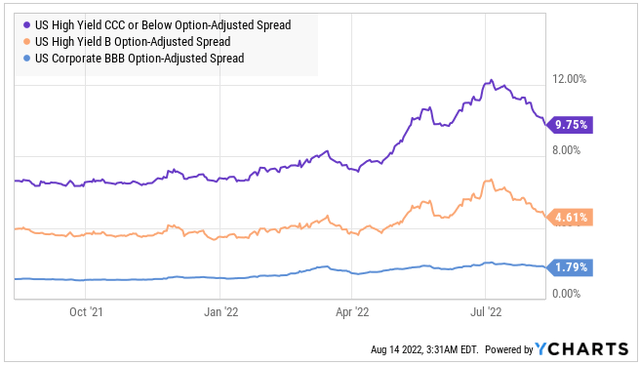

However, we are dealing with the real world, where market prices aren't perfect, and the spread is not constant. Over the summer, we saw corporate debt prices falling from Treasury rates rising, and the spreads increasing as well. In other words, debt prices fell more than is explained by Treasury movements alone.

This has happened numerous times in history, and it is frequently the best time to be buying debt. Like most investments, it is best to buy low, and when spreads are elevated, that is a measure of prices being low.

This has happened numerous times in history, and it is frequently the best time to be buying debt. Like most investments, it is best to buy low, and when spreads are elevated, that is a measure of prices being low.

Over the past month, we've seen prices rally, but debt remains an attractive investment choice. It is the best place to be adding to right now, especially with concerns of a recession in 2023/2024. Owning debt is better than owning equity going into recession.

In the HDI portfolio, we have exposure to several types of debt:

- Bank "leveraged loans": These are floating rate loans that are held by CLOs, banks, and funds. We have exposure through XFLT, OXLC, and ECC. PIMCO has been in the news making several large purchases of bank loans in the past few months. We expect some of those will end up in PTY, PDI, and PDO. These loans sold off as spreads widened, increasing yields. These are very attractive if default rates remain low. As interest rates rise, the cash flow from these loans will improve since they are floating rates.

- High Yield Bonds: Corporate bond spreads widened, creating an attractive buying opportunity. Defaults are expected to remain low relative to historical averages as corporations have generally strong balance sheets. PTY and PDO both have significant exposure to high-yield corporate credit. We are also building a portfolio of individual bonds held by HDI. We will have a new recommendation this week.

- Commercial Mortgages: Commercial mortgages are floating rates and have seen spreads widening. For commercial mortgage REITs, this is a big win. We saw healthy earnings in Q2, and that only reflected a fraction of the rate hikes that have occurred so far. We expect this sector will really take off over the next few quarters. Our exposure includes ARI, ACRE, and BRSP.

- Agency MBS: These are mortgages guaranteed by the agencies Fannie Mae and Freddie Mac. There is no credit risk, as a default results in the investor receiving par from the agencies. The prices of agency MBS tends to correlate strongly with Treasuries. Over the past year, MBS prices have fallen more quickly than Treasuries, and are now trading at higher yields. The mortgage rate to 10-year spread is the highest it has been since 2008, which created a huge surge for agency mREITs that persisted through 2012. We hold NLY and AGNC in our portfolio.

- Non-agency Mortgages: Mortgage rates spike primarily due to the agency MBS market, which is much larger than the non-agency market. However, prices of non-agency mortgages typically follow. With higher yields, newer non-agency mortgages are now getting interesting and could provide an opportunity for mREITs to buy mortgages yielding 5%+ before the next cutting cycle. Right now, our exposure to this sector is primarily through preferred shares. We also have exposure through PIMCO funds, especially PDI, which owns a lot of pre-2009 non-agency mortgages. Right now, the market is too unstable, and dividends are too questionable, but we might consider common exposure to non-agency mREITs in the future if mortgage rates remain high as these higher-yielding mortgages become seasoned and start making up a material portion of their portfolios. We have no interest in 3% mortgages, which is why we don't own common shares in non-agency mortgage REITs. 5%+ is a different story.

Right now, debt investments are both a way to get more defensive and to receive a higher yield.

HDI, described as the 'Must Own' Service for Income Investors and Retirees, offers a “model portfolio" targeting a yield of +9% Learn more here.