Frustrating Some, But Still Bullish

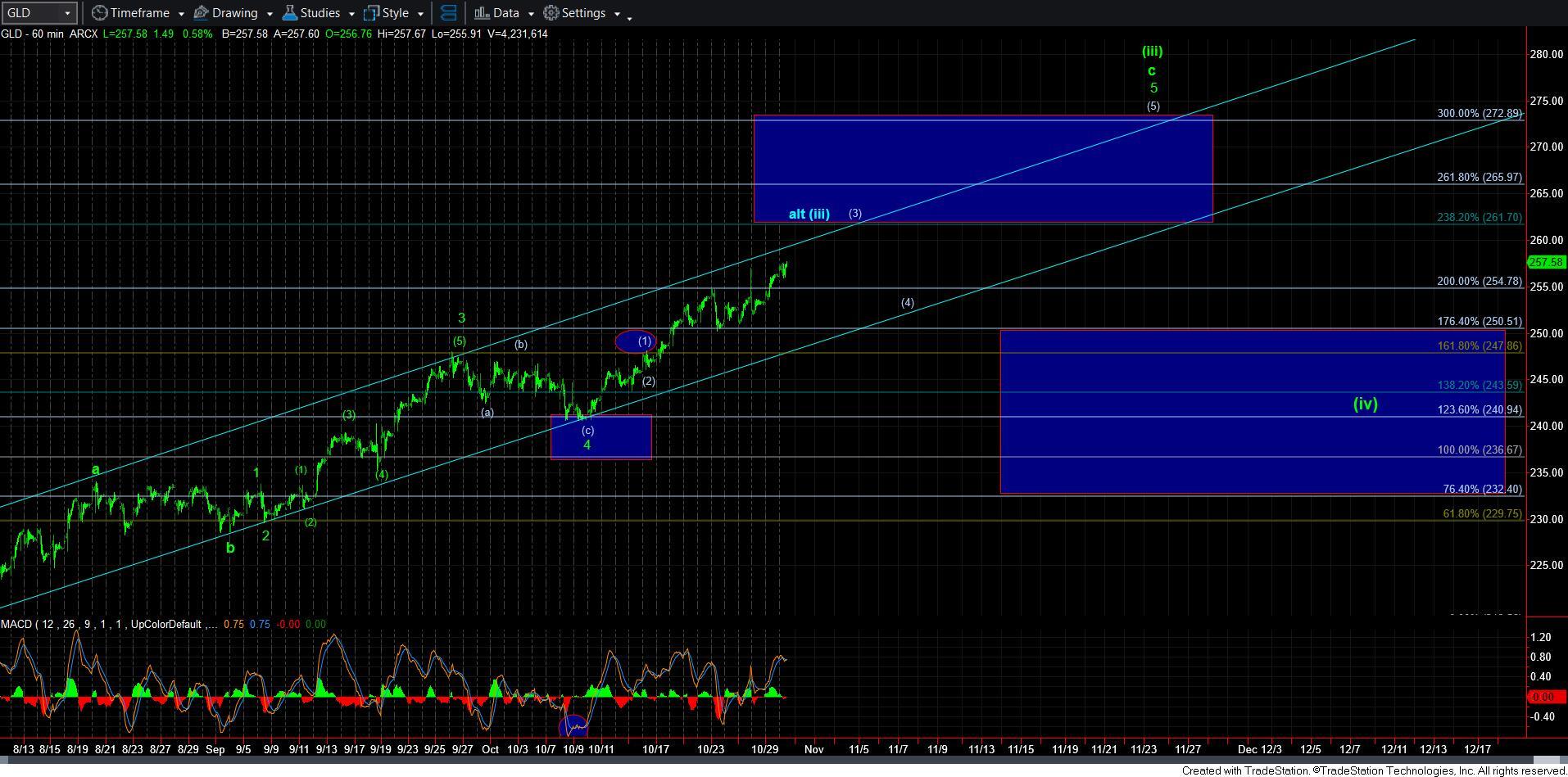

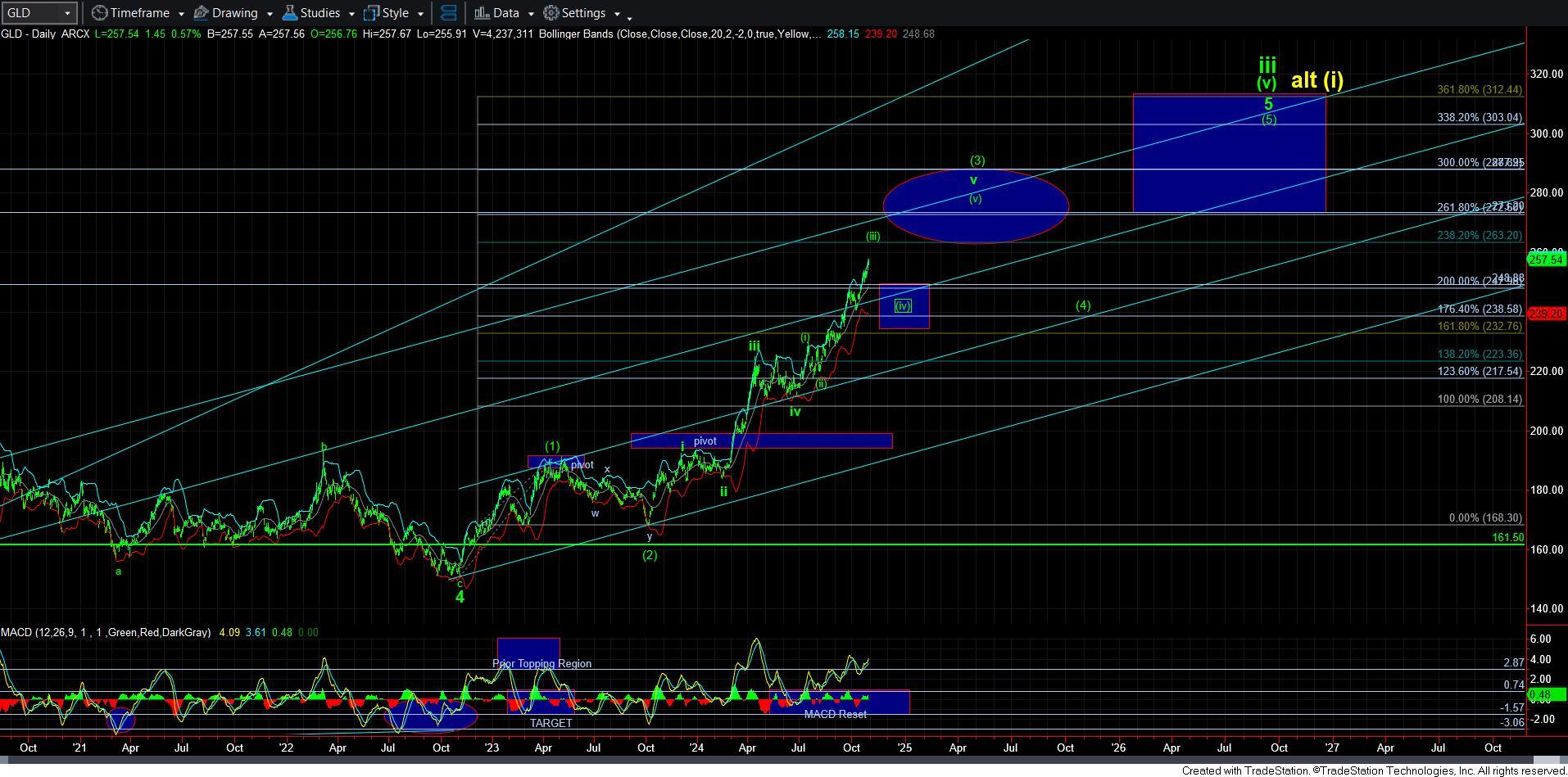

There really is not much more for me to say about gold. It has really been following through in 2024 even better than I had expected a year ago. And, as we speak, I think we are attempting to complete wave [3] of [iii], as shown on the attached 60-minute chart. And, as you can see, I am still expecting another [4][5] before wave [iii] is complete. But, should we see a sustained break of 250, then I will have to consider the alternative count presented in blue, wherein wave [iii] completes sooner than I currently expect. For now, that is only my alternative.

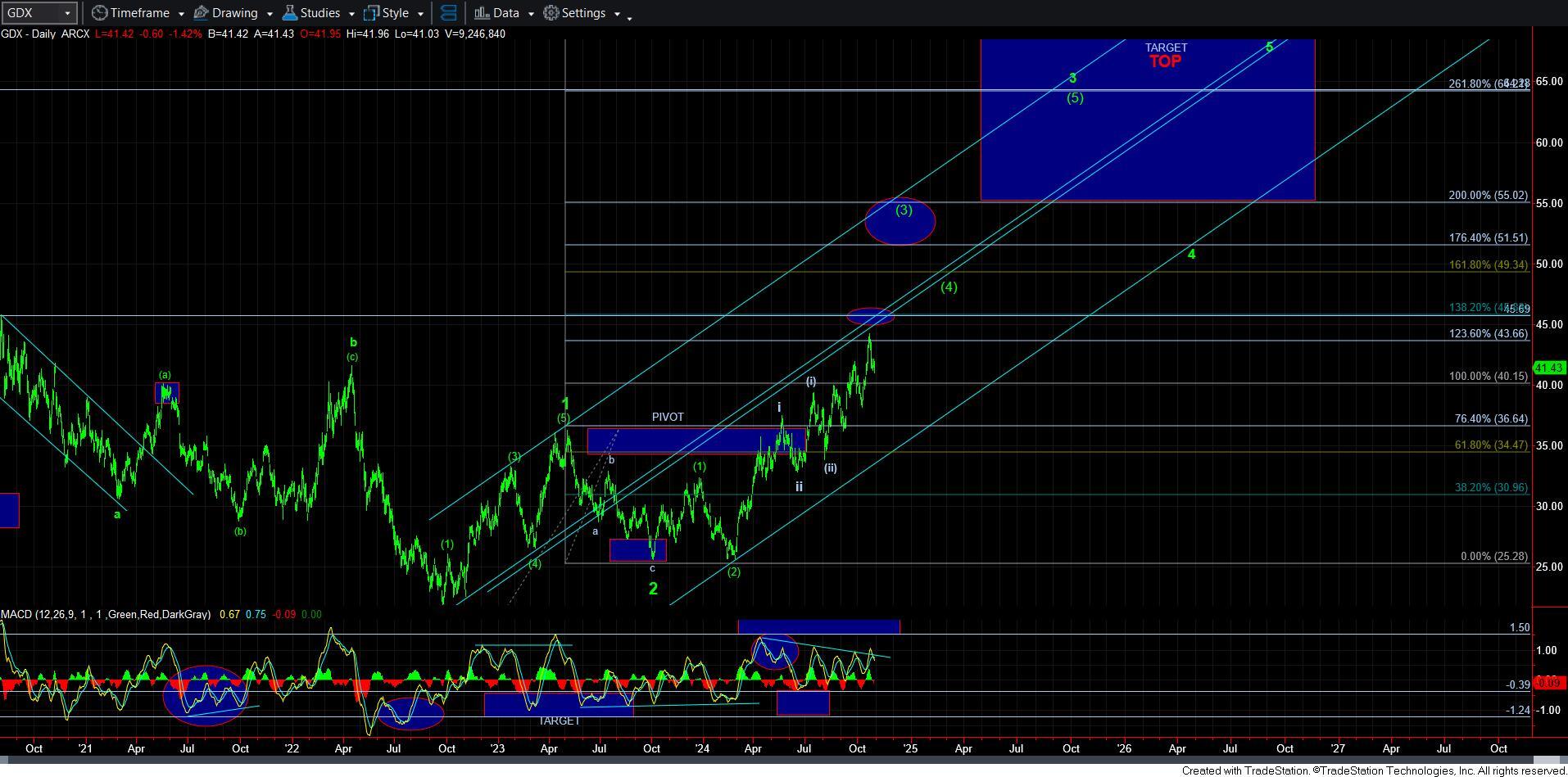

GDX has certainly pulled back from the resistance I was noting by the ellipse overhead on the daily GDX chart. In fact, it would seem the MACD on the daily chart suggests that we saw a failed break out.

I believe the micro structure suggests this pullback could be completing very soon, and then I will be tracking the bounce off that low to determine if it is impulsive or not. For now, my preference remains that we still break out into the accelerated upper trend channel for wave [3]. But, depending upon how the market reacts over the coming several weeks, I may have to adjust that expectation, and view the current rally as remaining within the lower trend channel as we work our way up to 50+.

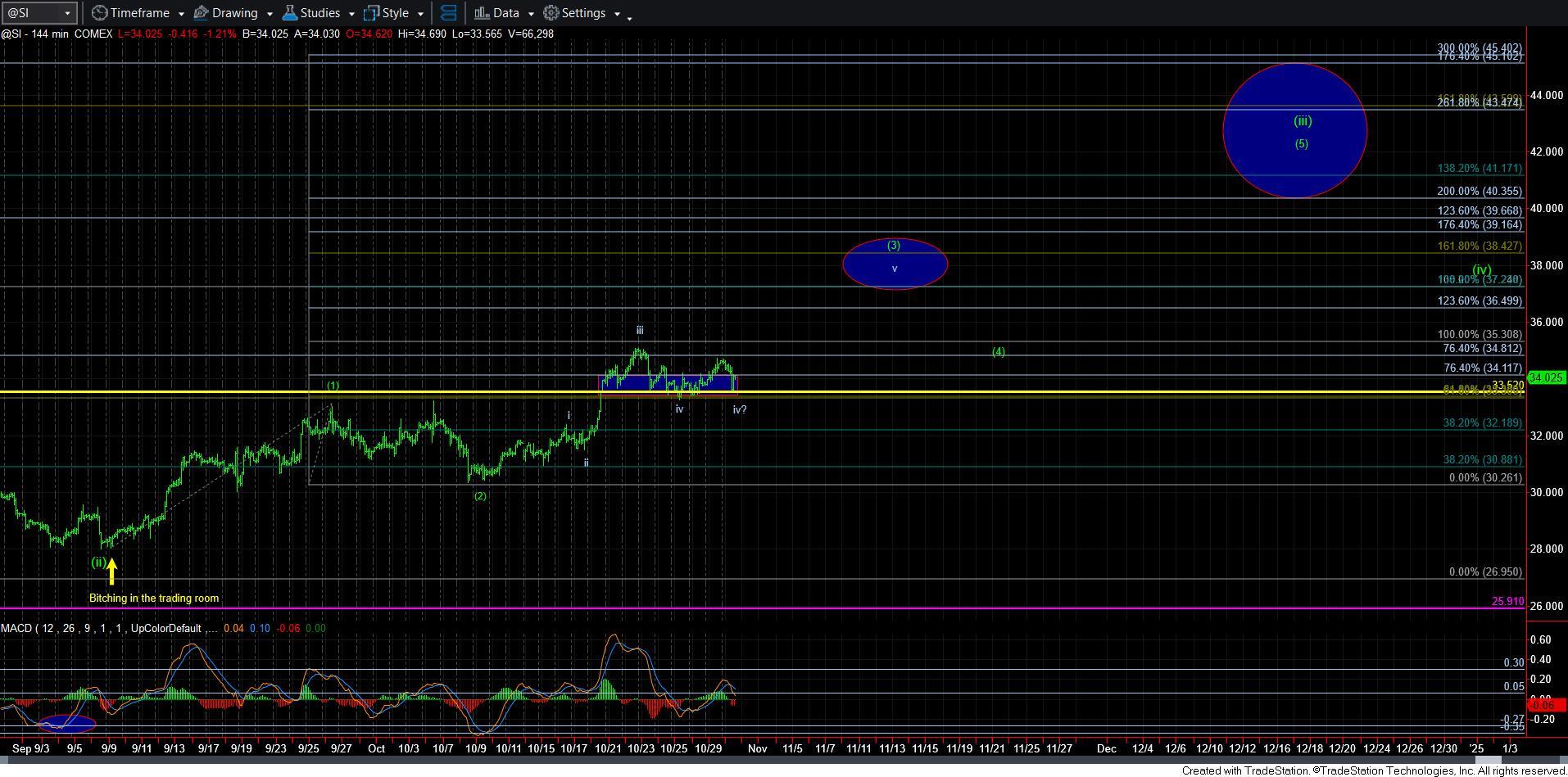

Silver continues to provide us with strong bursts, followed by a sideways consolidations. But, we really should be approaching a point in time where this no longer occurs and we see a massive burst in price, similar to what was seen in 2010. There remains strong potential for that still.

For now, I am still viewing this as a wave iv in silver, especially as long as we remain over the 33 region. Because of the overlap, there are several ways to count the micro action on the 8-minute chart. This could be a 4th wave in a leading diagonal for wave [i] of v of [3], which means we rally back up to the prior highs, and see another pullback in wave [ii]. That is my preferred path for now. The alternative include this already being wave [ii], which means we will see a break out through 35 sooner rather than later. And, the other alternative is that this is still within a wave iv flat pattern.

In summary, the bigger picture still remains bullish across the charts. But, I am going to really need to see silver and GDX begin to outperform gold over the coming weeks and months, so that remains my expectation. Should I see signs that would suggest otherwise, I will certainly inform you of such. For now, I am seeking the next smaller degree set up for GDX and silver to suggest the next bigger move higher is about to take shape.