Heads Up: Big Move Day

Wednesday is showing as a "Big Move Day" in equities and gold, but these will often show up as unusual moves across the commodities space as well as forex. These are extra tricky as they are genuine red flags for what could be considered outlier days, but rarely go as expected or calculated in a straightforward manner.

The mood pattern for Wednesday points to a sense of victimization, feeling attacked, or things generally falling apart, which we would expect to show up in the news cycle Wednesday or Thursday. With it being a big U.S. holiday travel day, it's possible that the news will be about travel disruptions and long waits; so this pattern would fit even with nothing especially unusual happening, considering the context.

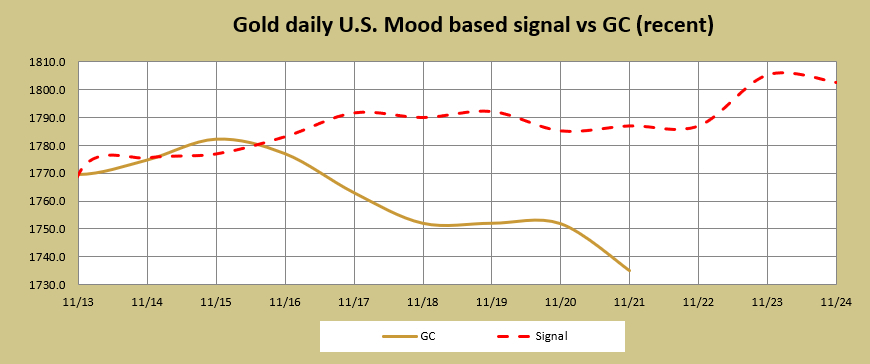

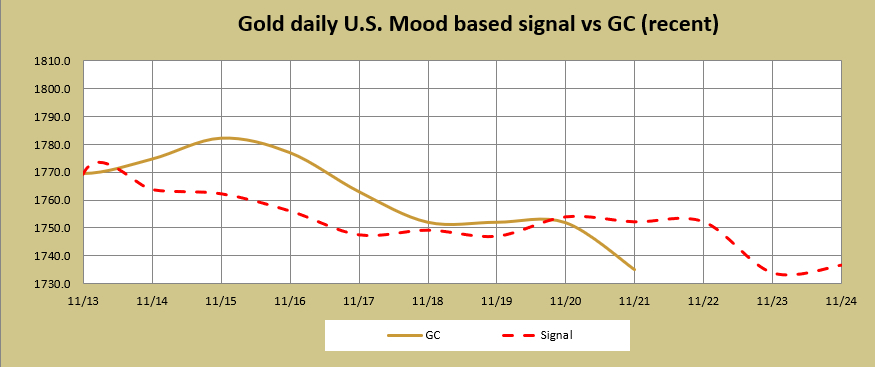

Although a large move down in equities and large move up in gold is depicted in the charts for Wednesday, experience tells us to watch for a potential large move at any time Tuesday-Thursday. Also, be prepared for it to go in the opposite way from what we are looking for (e.g. stops), as you don't want to be caught with the market against you if our current signal orientation is incorrect.

Gold, for example, has been moving opposite to our signals of late, which is why the recommendation has been to use the weekly trigger levels for trading bias. For this week, below 1750 GC Z consider the market as leaning bearish. Above 1756, consider it bullish.

Finally, it's not unusual for these to primarily impact the commodities markets or a particular market and be a big dud in equities. In other words, nothing much happening at all is a possibility to consider.

Latest charts:

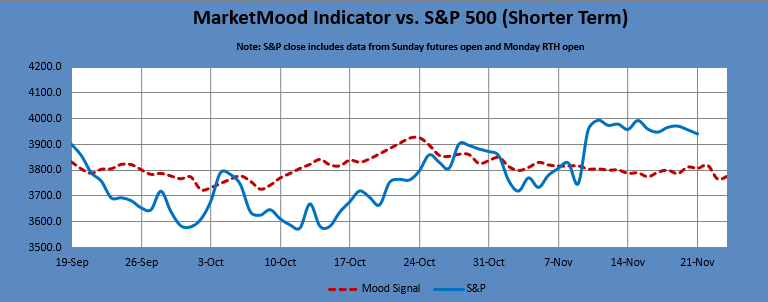

MMI vs. S&P 500

MMI gold vs. Gold (base case)

MMI gold vs. Gold (inverted)