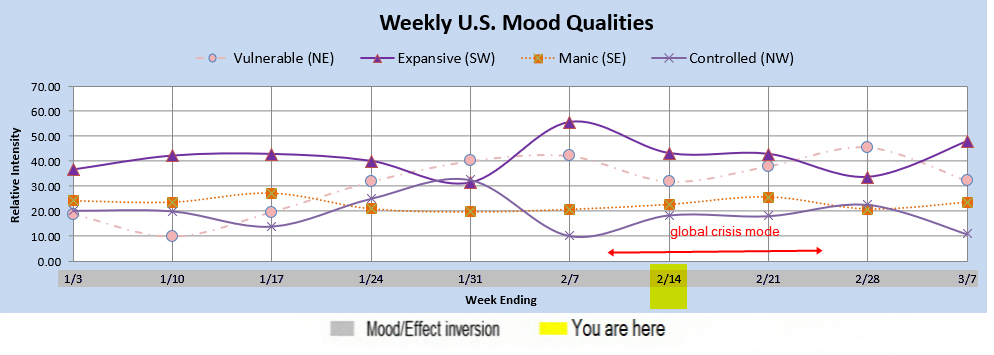

MM Weekly Outlook: Crisis Mode In Progress

People have been asking, "Where is this global crisis mode?" It's in progress, as stated. The sentiment pattern that usually points to systemic crisis or disaster is one that reflects unexpected change on a large scale and the response to that. Most often the market is very unhappy with large unexpected changes such as this. The sweeping changes that the Trump administration is imposing fits this description. The markets are mostly ignoring it, at least so far, but that pattern is playing out nevertheless. Also, there are often many miscellaneous turbulent and disruptive events that accompany this pattern. There have been a number of small plane events. There have been a number of disruptive weather events. There was a 7.6 earthquake off the Cayman Islands causing a tsunami warning for a brief period. The pattern is still playing out. Perhaps the market will continue to ignore it. This would be highly unusual, but it's an unusual market trying its best to avoid facing the reality of the beginning of a very, very long bear market. The market always does this at a major top. It fights giving in to the bear. This top is especially important and it's fighting like crazy to avoid the inevitable. It will happen when it does. Until the turn down becomes apparent, the bulls will keep on trying.

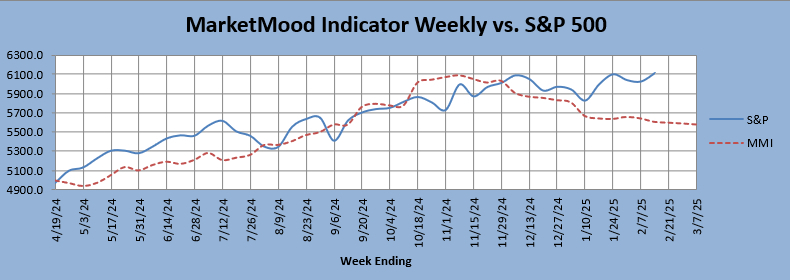

The weekly chart continues to show a highly overbought market per sentiment. It would still really prefer to be much closer to 5700 or lower than it is now.