MM Weekly Outlook: Extreme Caution Advised

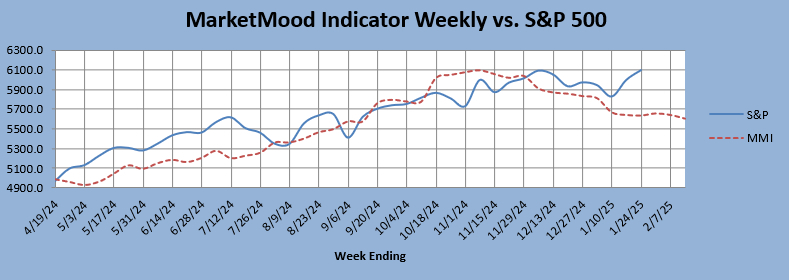

There has been a watch for a couple of weeks for an initial move lower in conjunction with a weekly "Sharp Drop Alert" through January 27 (1st chart below). This alert is generated when the market is highly overbought per sentiment and the sentiment line on the chart is relatively flat. This usually points to an Elliott wave "c" wave likely to occur during that timeframe. It was cautioned not to just jump on this as it can happen anytime within this period (or not at all). Instead, especially when this is a several week long period, it's suggested to be on alert for a break of support or some other hint that a decline may be underway prior to taking action.

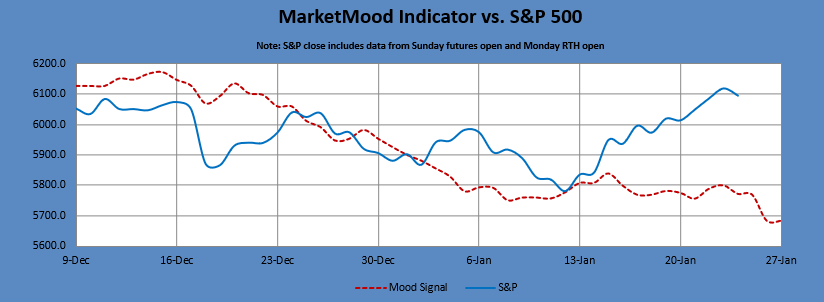

The market is currently down for the day, but has not yet decisively signaled a trend change or even an initial 5 waves down. That may or may not happen before the day is over. Zooming in on the daily scale charts, there are reasons for concern or at least caution for those that are in the bullish camp.

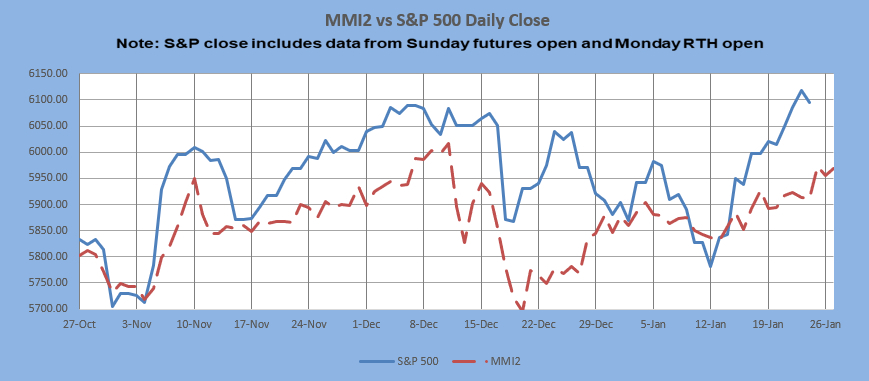

The sentiment pattern for the weekend is a combination of a sense of deteriorating circumstances and a completion or ending. Preliminary sentiment for Monday reflects an ambiguous "beginning of something new," with no specifics available at the moment on the associated qualities of this. The daily MMI vs. S&P 500 charts (below) reflect an extremely overbought market per sentiment. The first of these two charts makes one wonder if something might be wrong with the algorithm. It certainly seems a bit extreme in its implications.

There's no telling what actually will happen. Please don't bet the farm on any of this. However, all things considered, there is a clear signal that complacency is not a great idea right now. What else it means for you depends on your timeframe of investing and risk tolerance.