MM Weekly Outlook thru 7/26

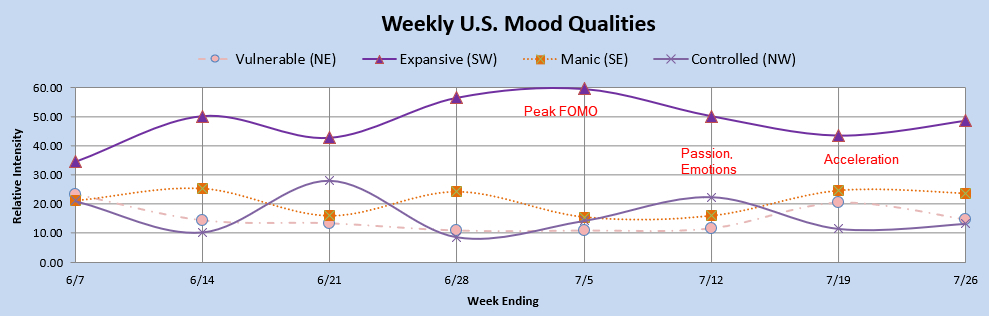

This past week's sentiment pattern reflected FOMO or bullish exhaustion as bulls rush in to buy in anticipation of a continued rally to the moon. We have watched the S&P 500 continue to levitate throughout the week. While there is nothing in the sentiment pattern for the next few weeks that specifically screams "bear market," the sentiment pattern shows a slight dip in enthusiasm ("Expansive" on the chart) and a slight increase in seriousness ("Controlled" on the chart). The overall pattern may show up in increased displays of emotionality and passionate defending of views and beliefs. The sentiment pattern for the following two weeks reflects a continuation or acceleration in the direction of the previous week. That makes this coming week highly significant.

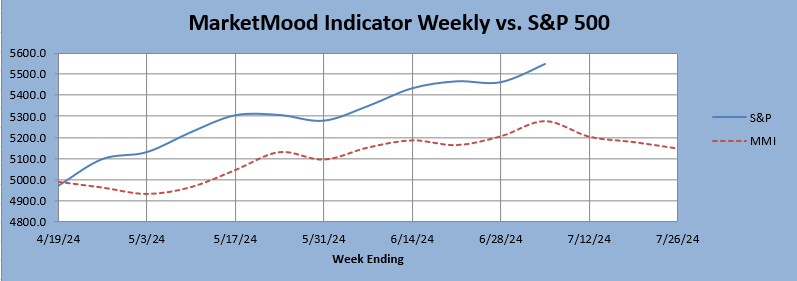

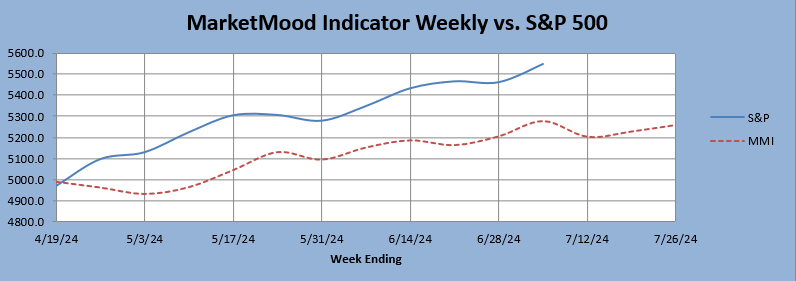

MMI is calculated as down for next week. MMI for the following two weeks depend on how this coming week closes. The two paths are shown in the charts below:

Base case, next week closes down (and Friday closes down), weekly MMI through week ending 7/26 is down:

Alt case, next week closes up (and Friday closes up), weekly MMI through week ending 7/26 is up: