Market Outlook March 7- 2021

Summary

- The markets continue to show signs of resiliency. Investors have been buying every pullback.

- The reasons behind this strong bull market, and why it is set to continue.

- We explain the 2 main risks that could derail this bull market and make the case why these risks are very low.

- Underneath the surface, there is a big rotation from growth stocks to "value stocks".

- Our "model portfolio" targets a yield of +9% mostly composed of "value stocks". I am confident that our performance will beat the large market indices by a strong margin over the next 2 years at least.

Market Outlook March 7- 2021

These past two weeks, market volatility has picked up significantly. Note that the media has blown out-of-proportion the fact that long-term interest rates have been rising which could derail the bull market. As always, negative headlines sell much better than good news, and the media knows this very well. This may have resulted in some panic among some investors; however, the reason behind the price volatility is quite normal. As explained previously, the market has had a huge run in the past few months, and now it is time for some consolidation. In fact, such consolidation is quite healthy for equities as it helps them build a strong base to resume their way higher. I have been encouraging our members to embrace such volatility and to take advantage by buying the dips.

The bottom line is that the equity markets continued to show signs of resiliency with every pullback being countered by investors buying the dip. Note that the selling has been shallow and short-lived. As stated in previous market updates, the world is swimming in liquidity, and there is virtually no better place to put this excess money to work other than the stock markets. Many folks today remain at home, with few new business opportunities or ventures that are worth investing in, the best place to generate returns is through the stock markets. This is one big reason why stocks are seeing large money inflows and supporting higher prices.

Interestingly, higher long-term Treasury yields don’t necessarily equate to lower stock prices. In fact, investors should be embracing the relatively small increase in longer-term interest rates, because it is an indication that the U.S. economy is on the right track for a strong recovery. A recovery in the economy would result in higher stock prices. In fact, I would be worried if longer-term interest rates were not going up which would mean that the economy is set to stall again.

You see, the market is a forward-looking mechanism and moves based on future expectations. We have to keep in mind that the rise in interest rates is still small and we are today still well below the norms, with long-term rates remaining near their all-time lows despite the recent increases. I remain confident that our fundamentally superior high dividend stocks will keep their recent stellar outperformance.

Keep Focused on the Big Picture

For us investors, we need to keep focused on the large perspective. Today, the markets remain in a very strong uptrend, and there is no reason to fight this bull market or fight the Fed for that matter. The reasons for this continued surge in stocks can be attributed to several factors that we have previously discussed:

- Consumer savings are around their highest levels in years. Cash is plentiful and there is no better place to invest other than equities.

- The world is awash in liquidity, and more liquidity is set to further flood the markets through new stimulus packages and planned infrastructure spending.

- Rising long-term Treasury rates mean that investors are dumping these treasuries and raising cash. This cash is going to find a home somewhere, and it will most likely end up in the equity markets. Therefore I view that rising interest rates for long-term treasuries is actually bullish for stocks.

- There remains a "Bubble of Cash" sitting on the sidelines invested in CDs, Money Markets, cash, and low-yielding Treasuries. Much of this cash is bound to find its way to equities, and thus supporting this ongoing bull market.

- The Fed Fund rates and short-term interest rates remain near zero, which gives consumers more buying power and cheap borrowing rates for most businesses. Lower interest rates for longer has been re-iterated several times by Fed Chair Powel – most recently last Thursday stating that the economy is far from employment and inflation goals; he gives no sign that the central bank would seek to stem the rise in Treasury yields.

Remember that the last time that the Fed raised interest rates was in late 2016, and it was mostly acknowledged by Fed Officials as a big mistake. Although these rate hikes were small, they had a huge negative impact on the economy, derailing economic growth and quickly dampening inflation. The Fed clearly does not wish to make the same mistake again, and this is their logic behind letting the economy run hot before making any decision to hike short-term rates. The Fed's previous inflation target was set at 2%, an indication of healthy economic growth. However, it has been extremely frustrating for the Fed to reach this inflation level and to maintain it. So now, the Fed will let inflation run above the 2% previous target before taking any decision to put a brake on growth through hiking rates and reducing liquidity from the system.

A Big Rotation Continues Underneath The Surface

The NYSE advance/decline line, which is an indicator of the breadth of the markets, has set a new high recently. There has been no broad-based selling pressure despite the market volatility. The reason is that there is a continuous rotation of money under the surface. The rotation from expensive large-cap stocks into value stocks continues with the Nasdaq index (including the high-flying stocks) strongly underperforming the rest of the indices. This rotation started at the end of the summer last year, and continues to develop in 2021 as seen over the past two months.

Investors are now focused on "value stocks", which are companies viewed as cheap when we compare their prices with metrics such as earnings, sales, and book value. These value stocks have been suffering from underperformance for more than a decade versus growth stocks, and they have a lot to catch up on. It is not a surprise that "value stocks" are back in focus. Historically, value stocks tend to outperform growth stocks when longer-term interest rates start to rise. The reason behind this is that smaller and medium cap companies benefit the most from an improving economy, rather than growth stocks. Furthermore, all the stimulus by the Government is targeting those smaller companies which are the backbone of the U.S. economy. Also rising long-term interest rates would hurt growth stocks more than smaller companies because much of these large-cap stocks have been borrowing based on low-interest rates in order to support their prices through stock buy-back and expanding their businesses. Clearly, the momentum of their growth will be impacted.

Note that when "value stocks" start outperforming "growth stocks" this trend has historically lasted for many years. I expect this trend to continue for the next 3 years at least. This is great news for the HDO portfolio which is mostly comprised of high dividend value stocks trading at attractive valuations.

The Risks of Chasing High Flying Stocks: The Case of Zoom

Here, I would like to take the opportunity to highlight one of the high-flying tech stocks that have reached exorbitant valuations. Zoom Video Communications, Inc. (ZM) does not need much introduction, as they have a product that is well known among most investors. The stock had been seeing strong momentum as investors and speculators were piling money over money to take advantage of the "latest technology of the year".

Zoom recently reported their earnings. While earnings on the surface look great, here investors have to dig into the details. The guidance looks a bit ambiguous because of the strong focus on the quarterly growth highlighted instead of the yearly guidance. However, let us look at what ZM is really saying with its guidance:

Q4 saw $882 million in revenue and non-GAAP EPS was $1.22/share for the quarter. So annualizing those results, that is a run-rate of $3.528 billion in revenue and $4.88 in non-GAAP EPS.

In other words, from the Q4 base, ZM is expecting revenue to grow by only 6.8% and it expects to work harder for that revenue, actually experiencing a 25% decline in non-GAAP EPS from their current run-rate.

Today Zoom is trading at a high Price/Earnings ratio of 150 times! What valuation do you put on an interesting tech company that is growing revenues at 5-10%/year? Certainly not a forward P/E ratio of 150+ times. These are insane, euphoric valuations that make no sense whatsoever. We saw these types of extremely high valuations during the "dot-com" bubble, and those stocks that were trading at such expensive valuations saw their shares crash by 70%, 80%, and even more.

ZM is clearly a strong sell at these valuations and given the poor growth going forward. For those who like trading, in fact, ZM is a great short candidate. This is why at HDO we do not chase such speculative stocks, and we would rather build our portfolio slowly but surely with high dividends and reasonable capital appreciation without gambling on high-flying stocks that can ruin investors as the bubble bursts.

Two Main Risks that Could Derail the Bull Market

Here, I would like to highlight two main risks that could derail the current bull market and explain why we should not be worried about these risks. These two main risks are:

- Significantly higher inflation.

- A premature or unexpected move by the U.S. Fed to raise short-term interest rates or reduce quantitative easing.

Risk #1: Inflation Risk

There are several reasons why inflation has been so stubborn, and frustrating Fed officials. Although the world is flooded with liquidity (one main factor for higher inflation), there are many counter-inflationary factors at play today. This would include technological advances that have increased employment efficiencies, and higher than normal unemployment rates.

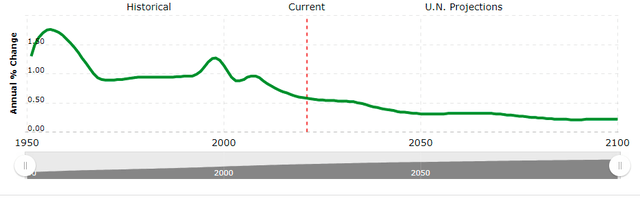

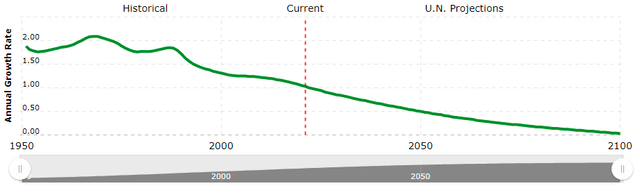

Importantly, demographics is another big factor dampening inflation. Today, the U.S. and most developed countries are seeing an aging population, and in many cases a declining population in places such as Japan, Italy, Spain, Portugal, Lithuania, Estonia, Romania, Bulgaria, Greece among others. As more folks decide to retire, their spending budgets tend to reduce. As investors, (and HDO members), we need to keep in mind that the biggest driver for economic growth is a growing population. As the population grows, with many younger people joining the workforce, and their demand for housing, consumer goods, clothing, transportation, travel, and entertainment tends to put stimulate the economy and put upward pressure on inflation. This is why past recessions were relatively short-lived when population growth in developed nations was high. However today, we are in a totally different environment. Let us take the United States for example. Back in 1950, the U.S population was growing at a rate above 1.5%. Today this rate is barely at 0.5% as we can see in the chart below:

This trend is not only impacting U.S. population but also the global population growth is seeing steep declines.

This is also the reason why in previous recessions, it was relatively easy for the Fed to fight off recessions and get back to economic growth relatively fast. However, nowadays, the global economy is much more fragile than it used to be 20 or 30 years ago due to the demographic factors discussed above.

This is also the reason why in previous recessions, it was relatively easy for the Fed to fight off recessions and get back to economic growth relatively fast. However, nowadays, the global economy is much more fragile than it used to be 20 or 30 years ago due to the demographic factors discussed above.

Risk #2: The Fed making a premature or unexpected move to slow down the economy

As stated above, many Fed officials have acknowledged that raising interest rates too soon in 2016 was a very big mistake. The Fed is clearly aware of the risks of acting too soon to put a curb on economic growth. Based on this, any wrong move by the Fed could result in a long and painful recession that will be very difficult to overcome. This is a situation that the U.S. Fed and European Commission are trying to avoid at all costs. I personally do not see any change in the Fed policy anytime soon or at least over the next two years.

Bottom line

The health of the global economy and where it is heading is perhaps the biggest driver for equities. I always like to remind our members that keeping a close eye on the forces at play that could impact the economy is probably more than 50% of the due diligence required to be a successful investor. A rising tide will lift all boats, and the opposite is also true.

Here at HDO, our main objective is to keep collecting high yields no matter how the global economy is playing out. But we need to adjust from time to time our portfolio's direction based on changing economic conditions in order to maximize the returns for our members. For example:

- During periods of slower economic growth, we will overweight fixed income, preferred stocks, utilities, and other high-yielding stocks and sectors such as utilities and telecom among others. Basically, we focus on those sectors that are basic necessities and/or those with demand that is relatively inelastic no matter how the economy is doing.

- On the other hand, when the economic outlook is strong, we like to overweight those sectors that are economically sensitive to bank on those stocks that are set to strongly benefit from the situation. Picking the right stocks can be tricky because several other factors come to play such as the state of interest rates, inflation expectations, the sector outlook, barriers to entry, the competitive environment, the sustainability of the dividends among others.

Today, some of the best sectors to be invested in include Property REITs, mortgage REITs, the financial sector (BDC companies), CLOs, and Energy. The healthcare sector is another good one that has lagged the general markets despite strong tailwinds and fast growth, and presents a great entry point. We are planning over the next 30 days to have small re-allocations to our portfolio which would consist of reducing our exposure to defensive stocks, and allocating more to economically sensitive stocks and sectors.

Best Course of Action

There is no need to fight this bull market. I am personally staying the course and not worrying about the current market volatility. As with every year, we are likely to see the occasional market correction, but I expect any correction to be relatively shallow and short-lived. Furthermore, we could very well see over the next few weeks some more market consolidation, and I would consider every pullback as a buying opportunity.

For us income investors, our main objective is to collect a high level of income in good and bad times. Our model portfolio targeting +9% mostly invested in value stocks is our best strategy for sustainable high returns. Today, recessionary risks are extremely low, and bear market risks are mostly off the table for the next two years at least. The best course of action, as far as our model portfolio is concerned, is to remain invested in this market and to navigate the market volatility without stress.

Again, we remain in a strong uptrend supporting this secular bull market. The next target for the S&P 500 is at the 4000 level, likely to be reached relatively soon. The following target would be the 4300 level later on during the year. I remain very confident that the next two years are going to be very rewarding for investors, and looking forward to solid returns for our portfolio in terms of both income and capital gains. Our high-yield portfolio is mainly composed of "value dividend stocks" which are set to strongly outperform the S&P 500 index, so I expect that our returns will be stellar.

As always, I am continuously following the factors at play (both economic and market forces) and will make sure to keep our members up-to-date in case of any change of outlook.