Metals May Be Done Sooner Rather Than Later

While my initial expectation was to see a b-wave rally in the metals complex before this correction completed, the fact that we continued to the downside today has opened the door to this correction potentially completing this week.

First, the issues I was having with a potential 5-wave rally at the end of last week has now clearly been settled, as it seems to have been corrective, which is evidenced by this continued move lower.

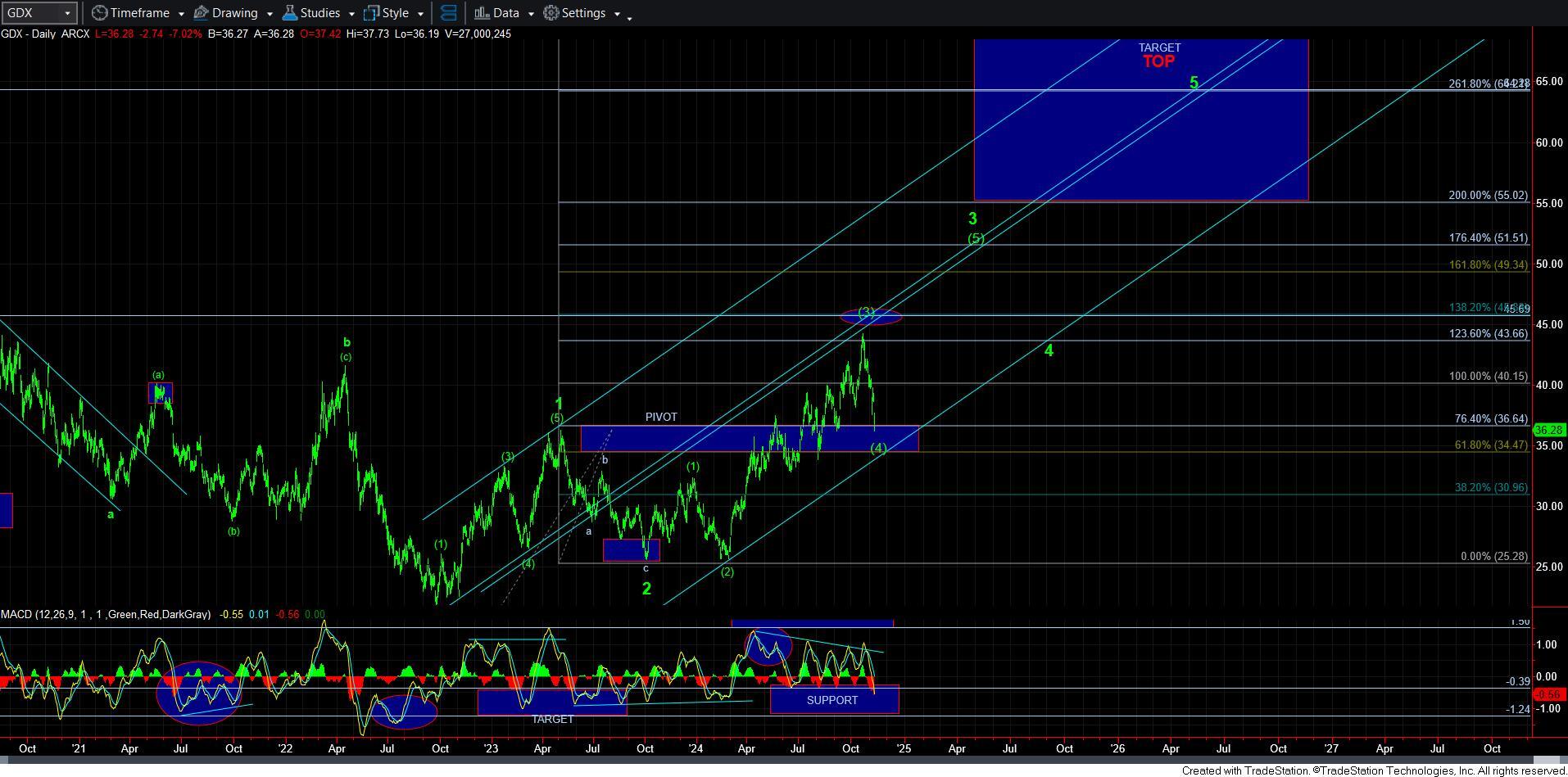

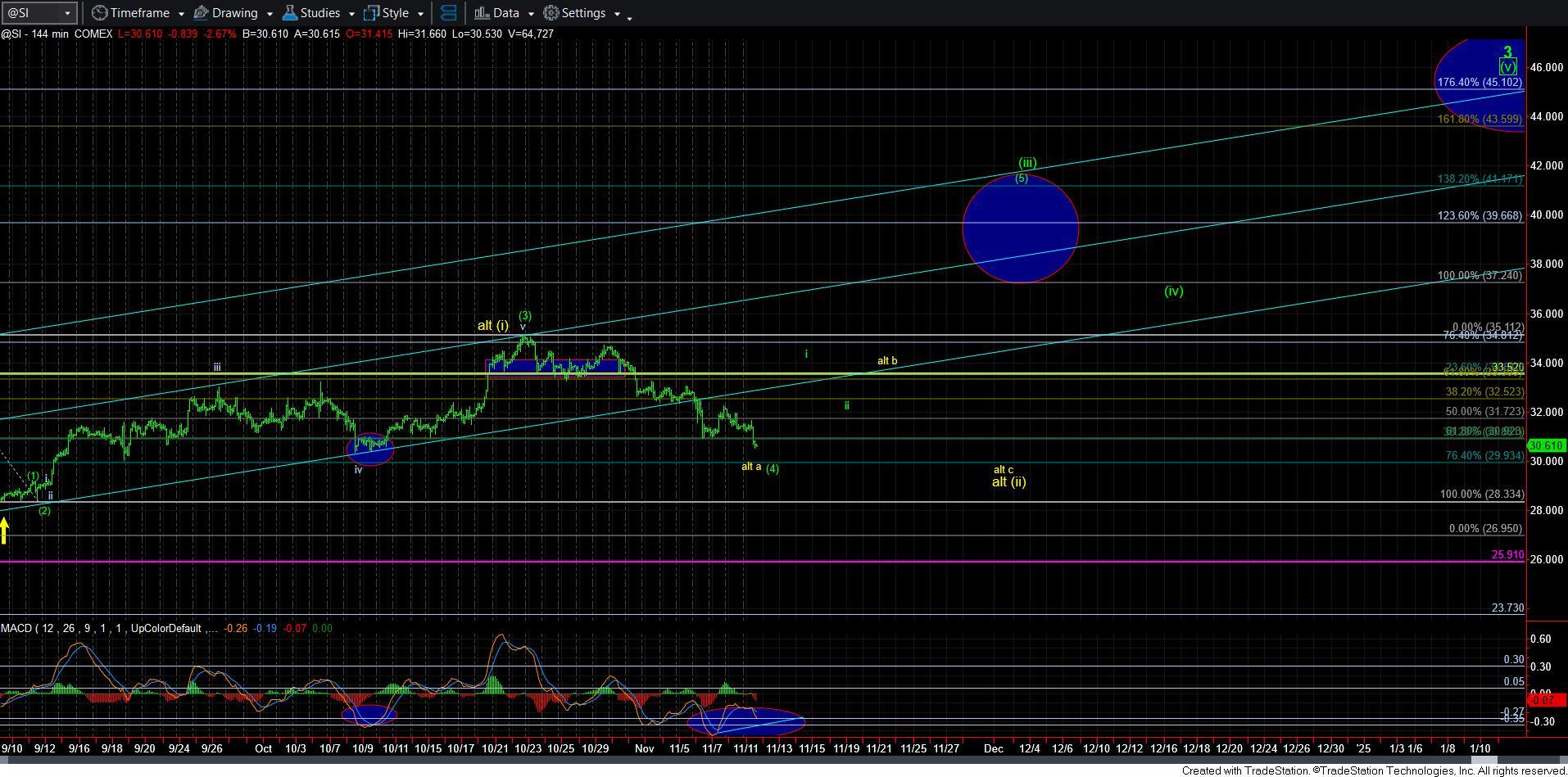

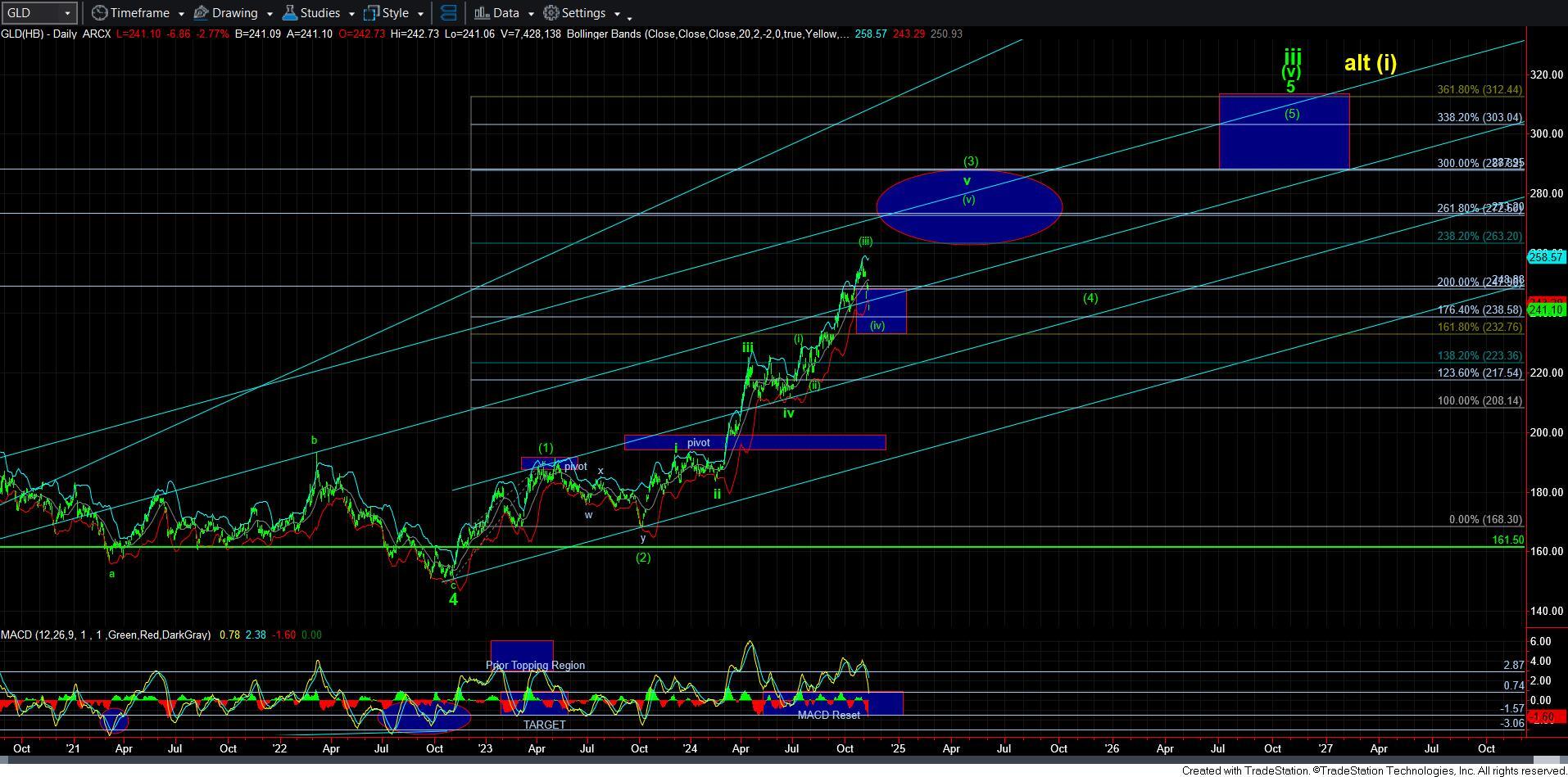

Second, the MACD on silver is now presenting a very nice positive divergence, whereas the MACD on the daily GLD and GDX charts are now reaching the support region and have clearly reset.

However, when I zoom into the smaller degree structures, it would seem we may still have to endure a 4-5 within this c-wave of the decline over the coming days before a bottom is struck.

Now, I clearly was not expecting this wave degree pullback to have begun this soon. Nor did I expect it to potentially reach its minimum destination so quickly as well. So, I do apologize for that. However, should the market provide us with an initial clear 5-wave rally later this week, we may be preparing for the next major rally phase sooner than I had initially expected as well.

However, should the next rally be clearly corrective in nature, then I would assume we will see a larger b-wave rally, taking us back towards the prior highs, which will then set up that additional c-wave down later this month. So, again, the key will be how the next rally takes shape.

Lastly, I want to again reiterate that there are no indications that this metals bull market move has run its course yet. I am still expecting another rally into 2025, followed by what may be a multi-month correction, and followed by what will likely be a parabolic concluding 5th wave. To that end, we have to continue to recognize that silver has still underperformed. Therefore, now is not the time to get frustrated with your long term silver holdings. Now it is the time to recognize that silver is that much closer to the expected parabolic move I expect in silver, as it usually catches up to gold towards the end of the metals cycle.

In summary, I would expect that this segment of the move down may still see another 4-5 before this c-wave completes. The nature of the next rally is going to be the key for the coming weeks. Should it be clearly impulsive, then we begin to prepare for the next phase of the metals bull market. Should it be corrective then we will have to prepare for another c-wave down in the coming weeks.