Metals, Miners and Agriculture (MMA) at Elliott Wave Trader: Mid-year Review

Metals, Miners and Agriculture (MMA) at Elliott Wave Trader: Mid-year Review

Contributed by Mark Malinowski, produced with Avi Gilburt & Zac Mannes

Introduction

In the Metals, Miners & Agriculture (MMA) service at ElliottWaveTrader, we focus on providing high-quality analysis based on Elliott Wave and Fibonacci Pinball analysis. This analysis showed itself to be particularly prescient in a March 8th public article, Looking for a Spark, in which we wrote:

"Precious metals and precious metals miners are on the cusp of a run. I won’t attempt to predict the future, using a crystal ball. Nor will I ever guarantee that there will be one more low or not. There is no confirmation that the next rally phase, which permabulls have been predicting over the last two years, has already started.

"What I can say is that sentiment appears ripe. Just like a room filled with gas to the right ratio of fuel and air looking for a spark in your favorite action movie, I feel like now is the time."

We recently sat down and reviewed the performance of some of our top Wave Setups in our MMA service. For those less familiar with our work, Wave Setups are defined as highly liquid charts that display clear proportions (the look) and favorable risk reward, posted to members in a format that is called a "Wave Setup." These setups can be days, weeks, months or years in time, and include an entry price range, a stop out price and a target price. While there are a lot of suggestions, guidance and education, we are a self service information provider -- it is up to members to monitor and assess what is the right set up for them to trade and when.

Let’s walk through some of our 2024 Wave Setups and then touch on where we are heading as we look to the second half of 2024.

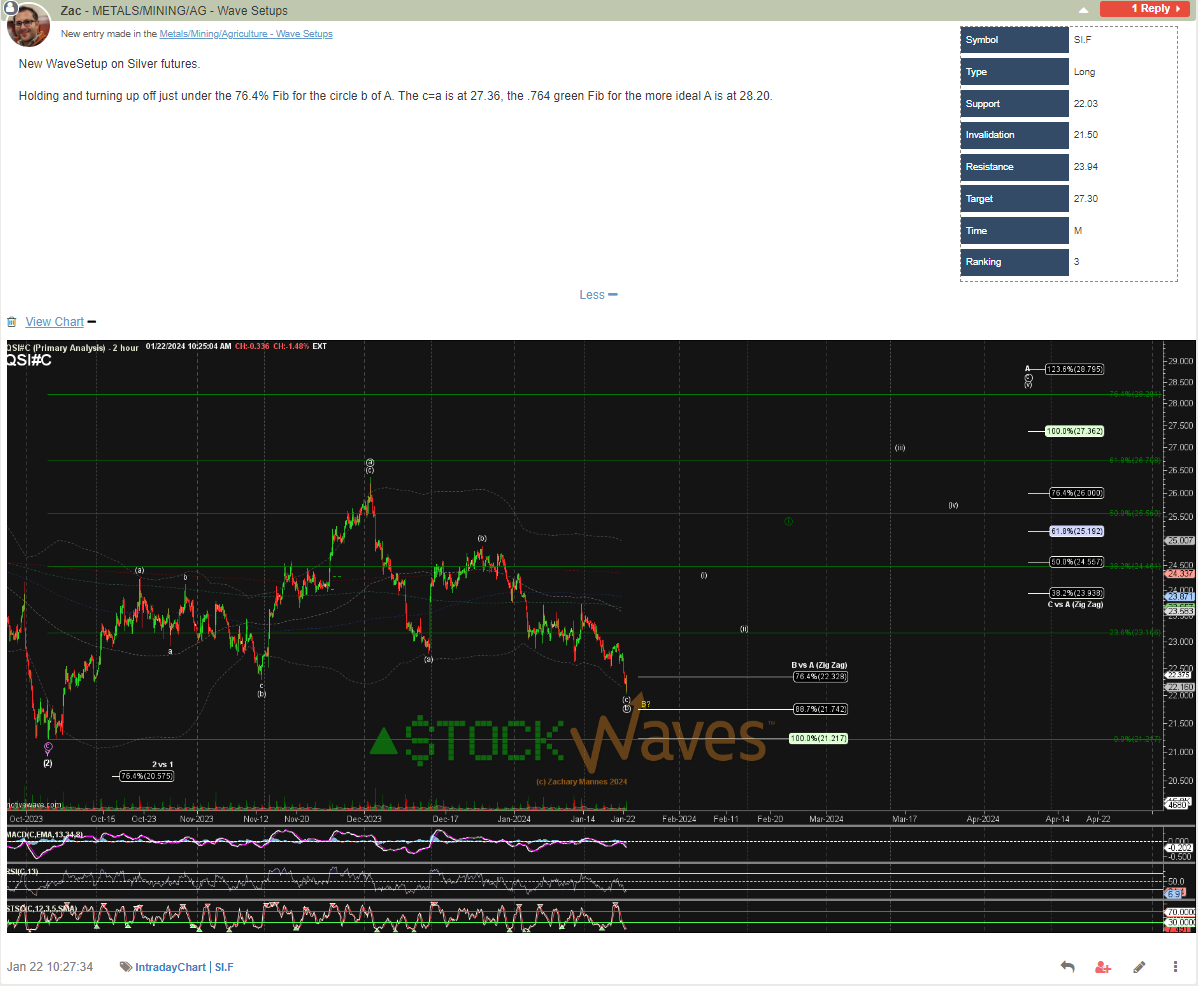

Wave Setup #1: Silver Futures

On January 22, 2024, Zac Mannes posited the following Wave Setup for silver. While this setup was specific to silver futures, many other vehicles were and are covered for members not looking to trade futures.

Daily updates on silver are sent to members, and sometimes hourly updates at key price levels.

While silver did see a nominally lower low, this setup achieved its original target on April 3rd, with a 22% move in silver futures. The setup was extended and some members maximized the 35% move in silver in a 2 month time frame.

More Silver Wave Setups have been posted since this one was closed.

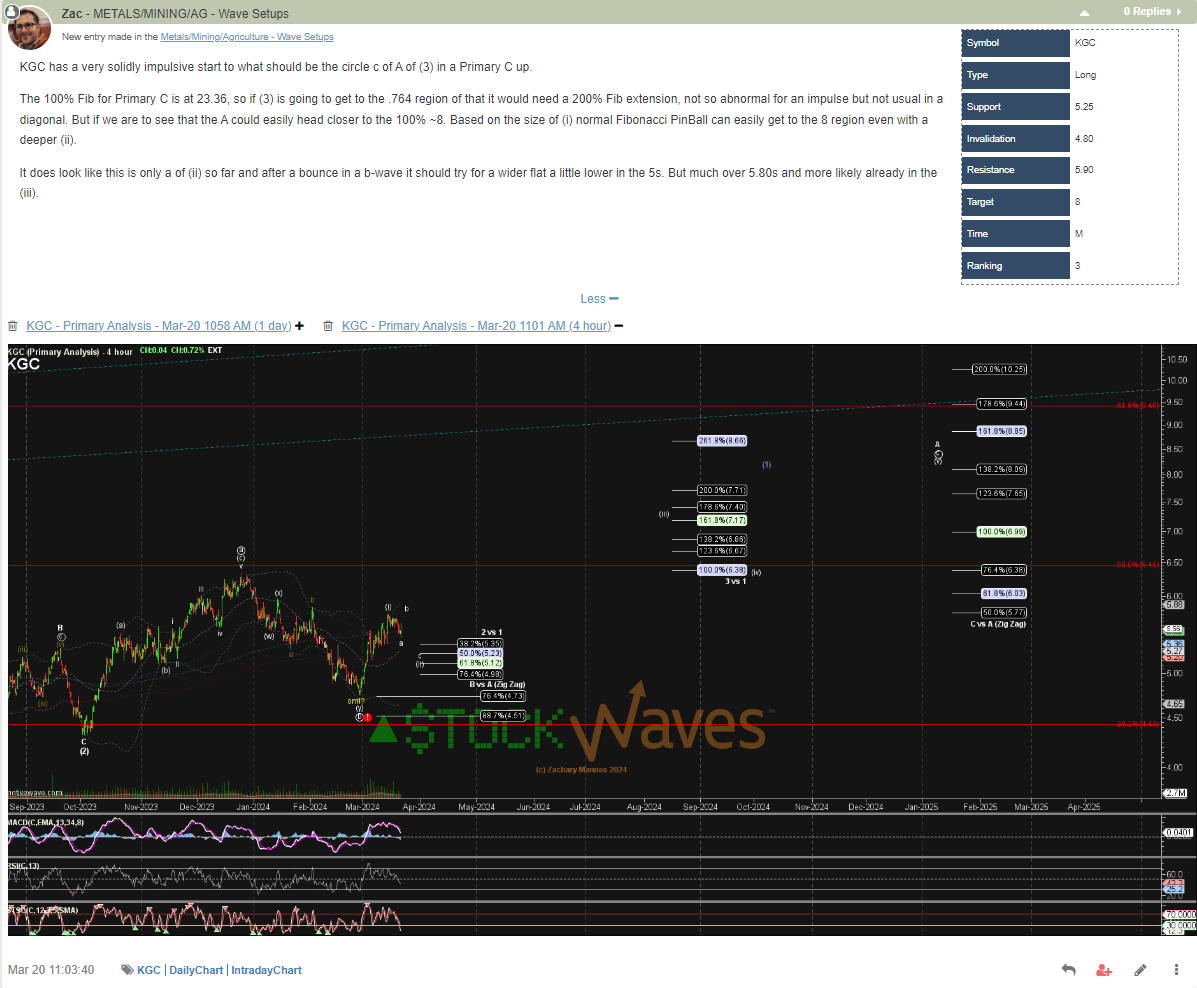

Wave Setup #2: Kinross Gold (KGC/ K.CA)

Kinross Gold (KGC) was a “M” (months) setup and it achieved its original target (8 USD) in late May. As with all things, some flexibility in the target price is required, but a 58% return on shares purchased from the ideal buy zone (5.23 USD) was achieved in a little over 2 months. Stops were slowly ratcheted up with multiple updates to ensure that members knew how and when they should consider protecting their profits.

Those who chose to hold on to a portion of their shares took profits near the recent Wave Setup update, and may have earned an 80% profit from this trade.

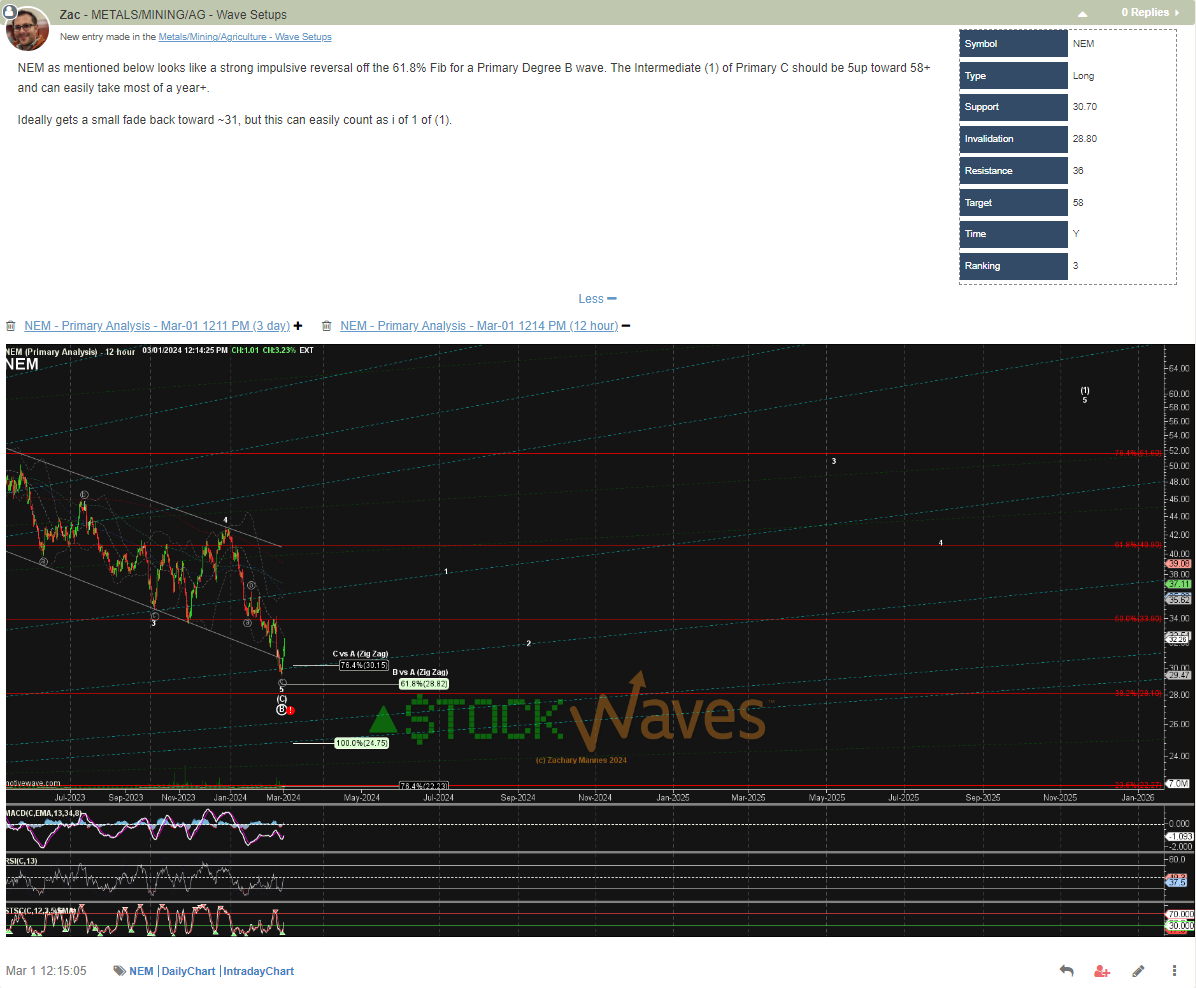

Wave Setup #3: Newmont Corporation (NEM/ NGT.CA)

This “Y” (years) wave setup for Newmont (NEM) was posted on March 1st and highlighted on March 20th in our public article Looking for a Spark. To date it has moved over 45% after pulling back slightly in the last couple of weeks. This has yet to reach its initial target of 58 USD, but we also feel that some near term consolidation would be healthy for this chart in the longer run.

We continue to provide updates to support levels and nearly daily updates to smaller time frame charts (1 hr and less).

For those looking for an update to the first article, Newmont’s fundamental and technical performance was updated in our June article: Newmont: Healthy Pullbacks Are A Good Thing

Wave Setup #4: DRD Gold Ltd. (DRD)

Garrett Patten is a senior analyst at MMA and highlighted this Wave Setup back on March 20th, 2024 for a South African gold recovery specialist that is extracting gold from tailings at a very low cost. While this miner is different, its returns have been a little smaller than some of our other picks, hitting 29% as of publication. What I like about DRD’s chart is that there have been multiple opportunities to add to positions with pullbacks. These have been regularly highlighted in videos, routine updates and Wave Setup Updates over the past 3 plus months.

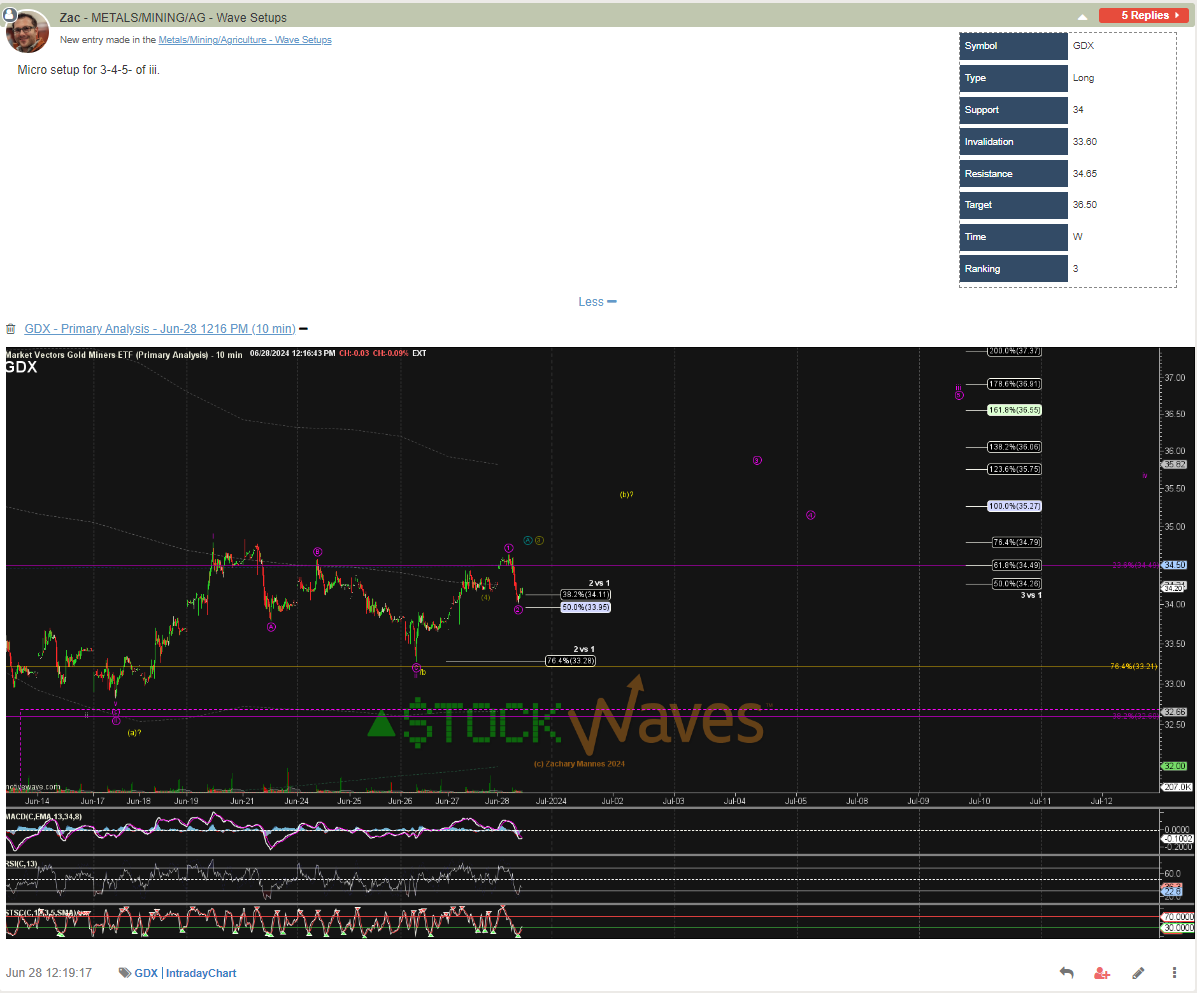

Wave Setup #5: VanEck Vectors Gold Miners ETF (GDX)

This shorter term “W” (weeks) long setup, posted at the end of June by Zac Mannes, shows a more nuanced approach to trading. When this hit a support target, there was an expectation of a bounce and perhaps more. So with tight parameters resulting in an excellent risk:reward opportunity, the analysts gave members a chance to get a great entry that could turn into more than just “a bounce.” The target was hit July 5th and subsequently extended with a new target and price, but if one chose to just close this trade when the target was hit, there was a 7% plus return for a one week trade. While not everyone is looking to trade short term, that is not how I view this setup. When metals and miners sometimes take an unexpected turn higher, entries can be hard to come by, but by using techniques like this, having a position at low risk has certainly paid off as a part of a larger picture strategy.

Conclusion

Many more wave setups have been posted to members of the Metals, Miners and Agriculture service in the past few weeks. While not all of them are big winners and some stopped out, we seek to guide members to protect profits, minimize losses and spread investment across multiple baskets.

The “months and years” Wave Setups are for the most part directed towards the buy and hold investor with some exceptions. The service also provides daily direction queues and price triggers pre-market opening to ensure that members can adjust stops, revise limit buys or create opportunities for themselves based on price. Members can make requests, seek clarification and interact with analysts and senior members of a community that openly shares its collective wisdom.

In other words, Wave Setups are a cornerstone of what we provide to members, but they are only a small piece of what is available to learn, absorb and be a part of in this online community.

Forward Looking View

We continue to have a bullish view of precious metals over the next 6 months to 2 year time window. While not every chart is following the same pattern (or even holding a bullish posture), members can and do seek guidance about many charts that are not wave setups. In addition Zac posts excellent guidance each morning on the sector as a whole in his Morning Updates, these usually include various time-frame views of GC & SI along with GDX & GDXJ. While we study sentiment closely his updates are often a good reminder not to be swept up in what ever the prevailing sentiment is at the moment, to have a plan and stick to ones plan.

With the wave setups we have shared above, one can see that there is a theme with some of the miners looking at a local top. While others have much more closely followed the pullback we have seen in metals over the last few weeks and are providing opportunities to add. Hitting resistance regions in the service will trigger analysts to provide formal updates to charts including updated support and resistance levels to trade against. Several active Wave Setup charts have had “formal” resistance levels hit over the last few weeks. This is typical behavior that analysts associate with a near term local topping. To me, this highlights the prudence of being cautious in the short term and expecting some consolidation, while also highlighting the opportunity for rotation in the precious metals miners.

Focusing on the miners, we are looking for some outperformance with recent bullish wave setups posted to members for Hecla Mining (HL), First Majestic (AG/ AG.CA), and Barrick Gold Corp (GOLD/ ABX.CA). These charts do not have the same path or pattern nor have they confirmed a start to the next leg up, but opportunity is knocking.

GDX percent performance vs HL, AG and GOLD in 2024

We have noted the relative underperformance of some of the precious metal streaming companies, since the start of 2024, like Franco-Nevada (FNV), Royal Gold, and Sandstorm Gold relative to Wheaton Precious Metals (WPM) and other miners. As borrowing costs ease over the next period of time, margin will continue to grow for streaming companies.

We continue to see an outperformance opportunity for silver relative to gold (and we are not bearish gold), based on our analysis of the Gold Futures: Silver Futures ratio chart. We continue to play that one move at a time with wave setups on smaller time frames in the MMA service vs the bigger picture guidance that is provided by Avi Gilburt through the Market Service.

For more specific information on current metals Wave Setups, come check out a free trial of our services at Elliott Wave Trader including monthly interactive videos, weekly analyst videos, bi-weekly metals updates, daily metals charts and any and all Wave Setups for precious miners.