Musings: Palpable Tension as Market Continues Higher

Someone asked if I had any thoughts this morning. I jokingly said that my only thought on the market lately is "Are we there yet?" This morning's answer was "No, not yet." Here are some of my thoughts...

Day by day, MMI keeps looking up. There also have been many days lately it has not been able to calculate a definitive directional call. There was a FOMO pattern over the last few days with a completion pattern today. A FOMO pattern almost always either ends with or is followed by a pullback on some level. So far, there was a drop after the open. Yet, once again MMI is looking up on the day. I am providing the up daily calls, but am cautioning to pay more attention to support levels. Tension is palpable. I'm seeing it in Facebook posts. People are feeling that "something" is getting close, something big and unpleasant that changes the landscape of their lives. Yet, again, there is no clear definitive spot on any chart I'm looking at that says it necessarily should happen here or there.

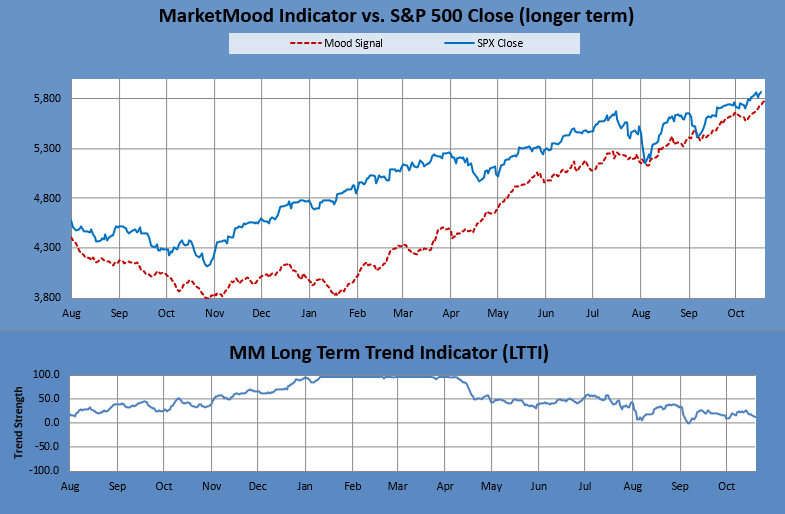

The long term trend chart (below), to me, still says a crash is coming. It doesn't say when. Personally, I don't care that the market keeps going up. I don't care if I miss a few hundred points or even more as this thing finds its top. To me, this is a very stretched rubber band, and it won't be pretty as it all unravels.

The Long Term Trend Indicator (LTTI) seen beneath the long term MMI vs. S&P 500 chart is derived from the divergence between sentiment (the red line) and the market (the blue line). Following historic uber-bullish levels, since August, it has several times gotten down to "Early Bearish" (< 5) and bounced back up to Neutral and then "Bullish." It has not yet broken below that Early Bearish level into solid Bearish territory (< -8). Just like with the market itself, this is a story of support and watching for it to break. It doesn't look to me that it has given up attempting to do so.

We are watching for what may be a generational market top. It makes perfect sense that the market and all that drives it is going to try as hard as it can to keep going for as long as it can. This is like someone drinking coffee or taking stimulants to avoid what might seem like falling into oblivion. It's all coming to a point where life changes from what is familiar to something humanity has never quite experienced before, not on this scale. So, yes, it keeps going up. It has to keep trying.

Those are some of my thoughts.