Nightly Crypto Report: In the Opportunity Zone

Long Term View:

Intermediate views are included in Sunday's reports, excluding last Sunday due to my vacation.

Housekeeping:

Tomorrow is our webinar at 11:30 AM Eastern. I will post the code in the room thirty minutes prior.

Micro:

General

Bitcoin is in the zone where it can find a bottom. I expect one more low. However, when fear is high, sometimes the fifth wave in a low is not evident.

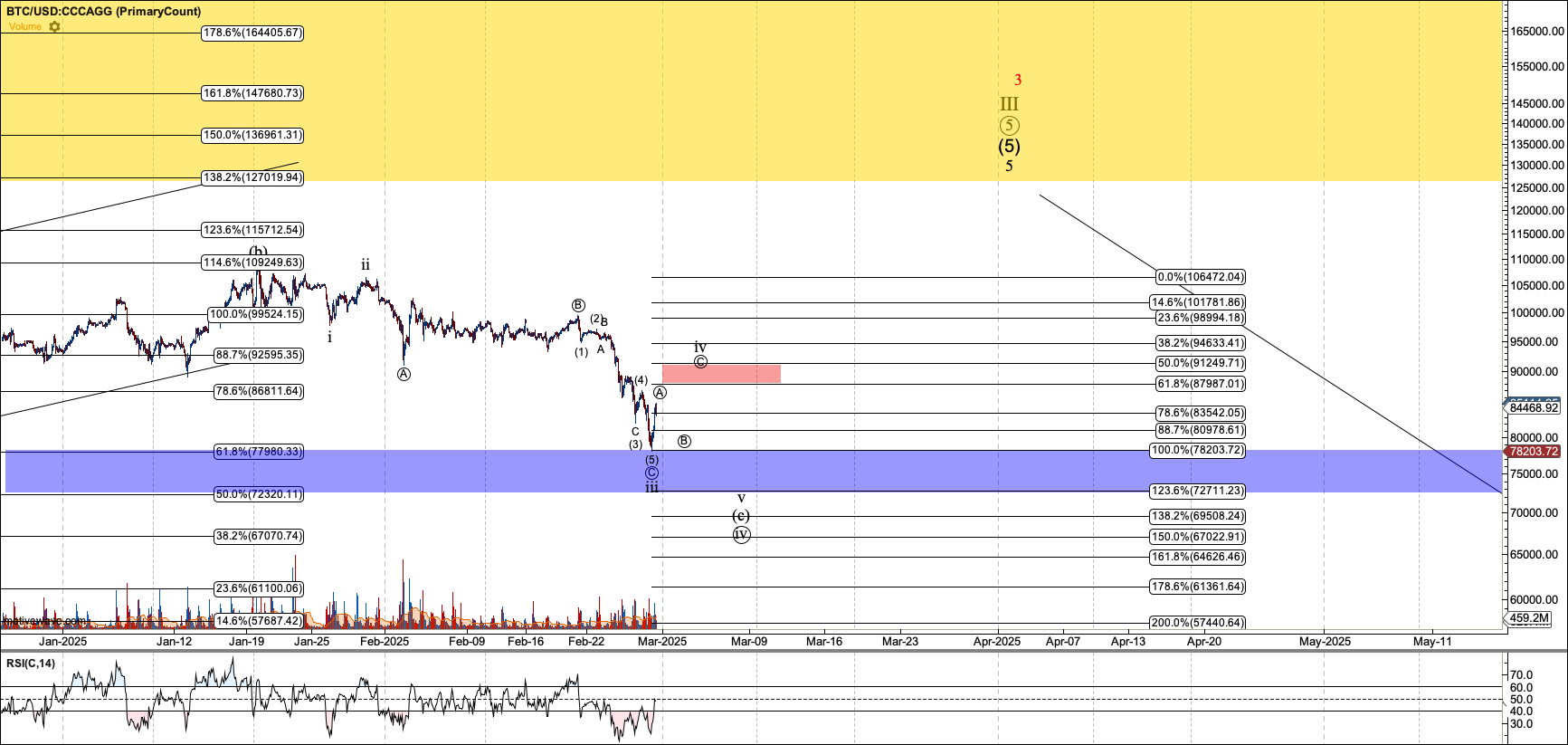

Bitcoin

Bitcoin extended its third but does not yet portend a break of $72K support. Bitcoin has formed fives off of last night's low. I count that five as circle-A of wave-iv. However, if it forms another degree five wave move over resistance at $91,250, the bottom may be in. Either way, this is a zone where I want to be a buyer, so I've started with small tranches in spot and futures. I won't become aggressive until a bottom becomes more evident.

Ethereum

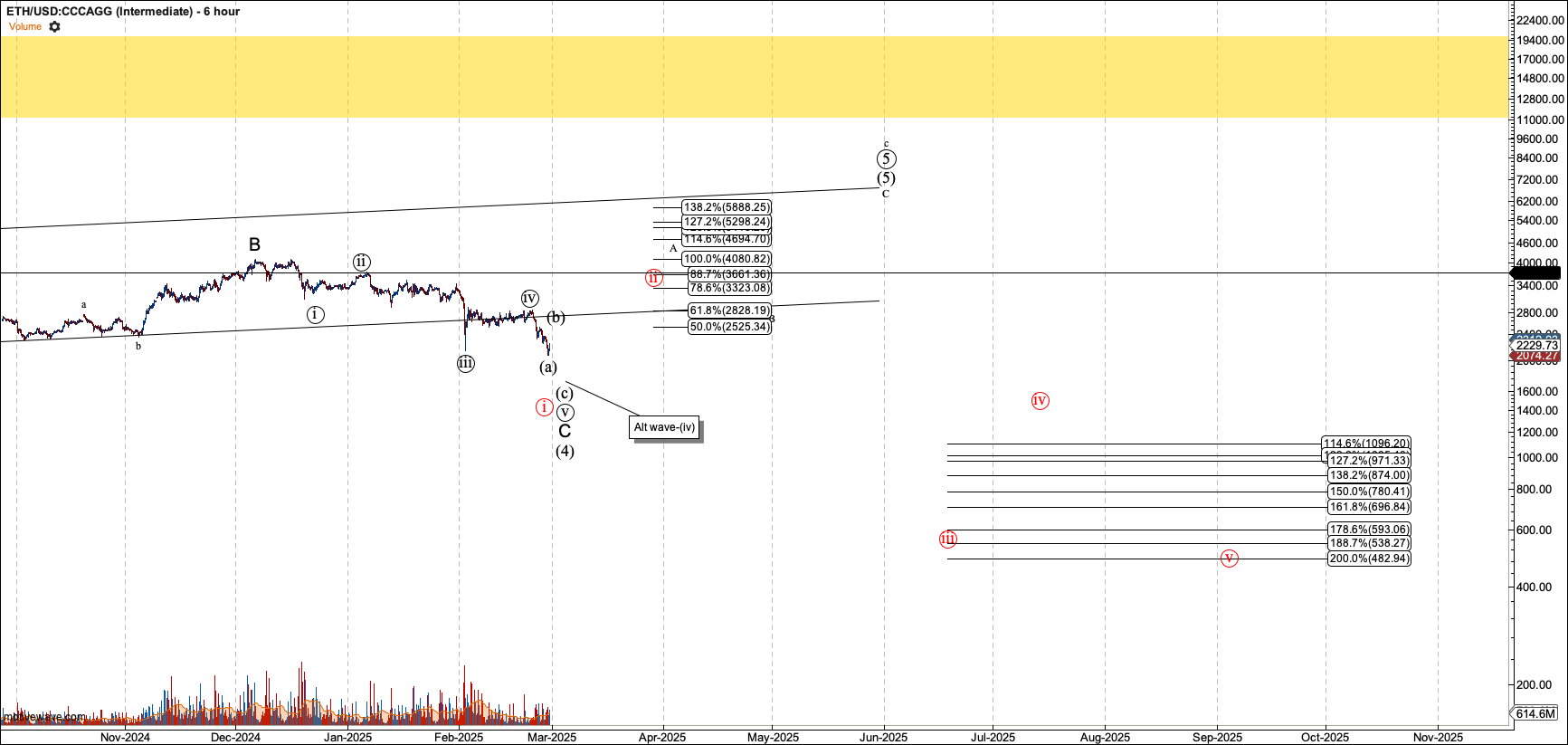

I worked the blue count into the black count as it can resolve in my previously alternate wave-(4). However, note how it will need an impulsive rally over $3300K to make the red count less likely. If it rallies into that level correctively and breaks the low it strikes in this region, we will have the first step in a bear market that should take Ether to $80.

It's quite easy for Ether, as weak as it has been, to present a corrective rally while Bitcoin goes to $125K. I've seen such relationships multiple times over the last 6+ years in this seat.

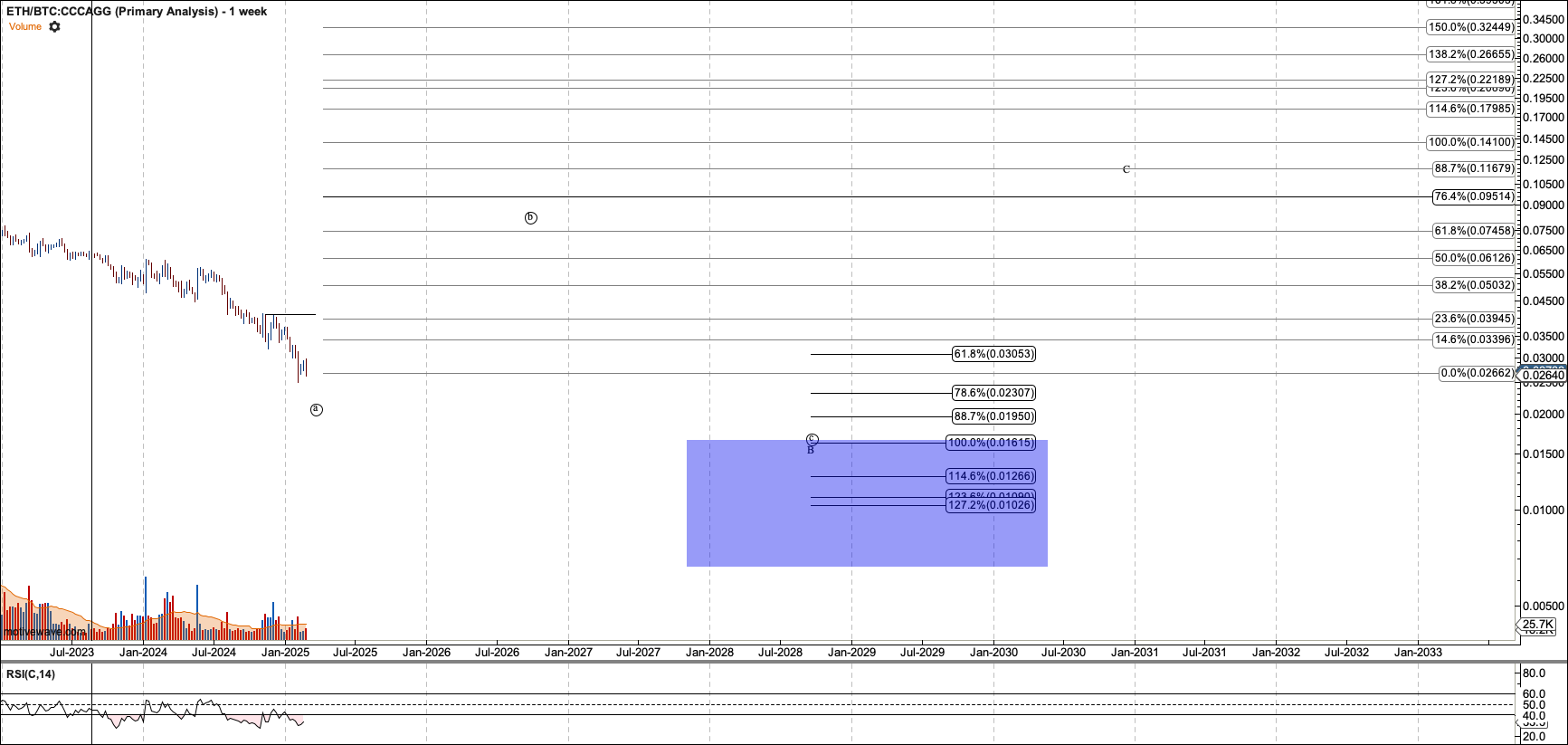

ETHBTC

ETHBTC is close to my first signal line. If it breaks it, and then forms a higher low, I will consider opportunities in Ether more interesting than I do currently. However, breaking that line does not suggest that this pair will see a new ATH.

Spot Conversion

It is not productive for me to produce charts for all the Bitcoin ETFs. The charts lack the history and Bitcoin's price extremities outside regular trading hours needed to create an accurate count. I would need to build calculated charts of each one and manage changes in the conversion rate. That would cut down on coverage of other charts in the service.

Instead, I offer conversion numbers for the Bitcoin ETFs so you can use my Bitcoin chart to manage your positions. Note that these numbers are in the third decimal place. Two shares with the same conversion may vary slightly in price due to a difference in the 5th and great decimal place.

BITO: 0.0003 (rechecked and affirmed on December 26th, 2024)

ARKB: 0.001

FBTC: 0.0009

GBTC: 0.0008

DEFI: 0.0012

EZBC: 0.0006

HODL: 0.0011

IBIT: 0.0006

BRRR: 0.0003

BTCO: 0.001

BTCW: 0.0011