Nightly Crypto Reports, July 15th, 2024

Leaning Higher

Long Term:

Intermediate views are included.

Housekeeping:

I am on vacation from July 20-23 so there will be no webinar on the 20th. However, I will initiate a special webinar, or offline video if action demands it.

Micro:

General

Note that I am starting to lean toward the bottom being in. However, 'leaning', 'primary view', and 'alternate view', are all useless words for forming a strategy. The question is whether the risk to reward is in one's favor. With the way I bought in small in the recent lows, I can wait for five waves, and a wave two before I position more aggressively. My leaning can be wrong, and the market has proved nothing yet.

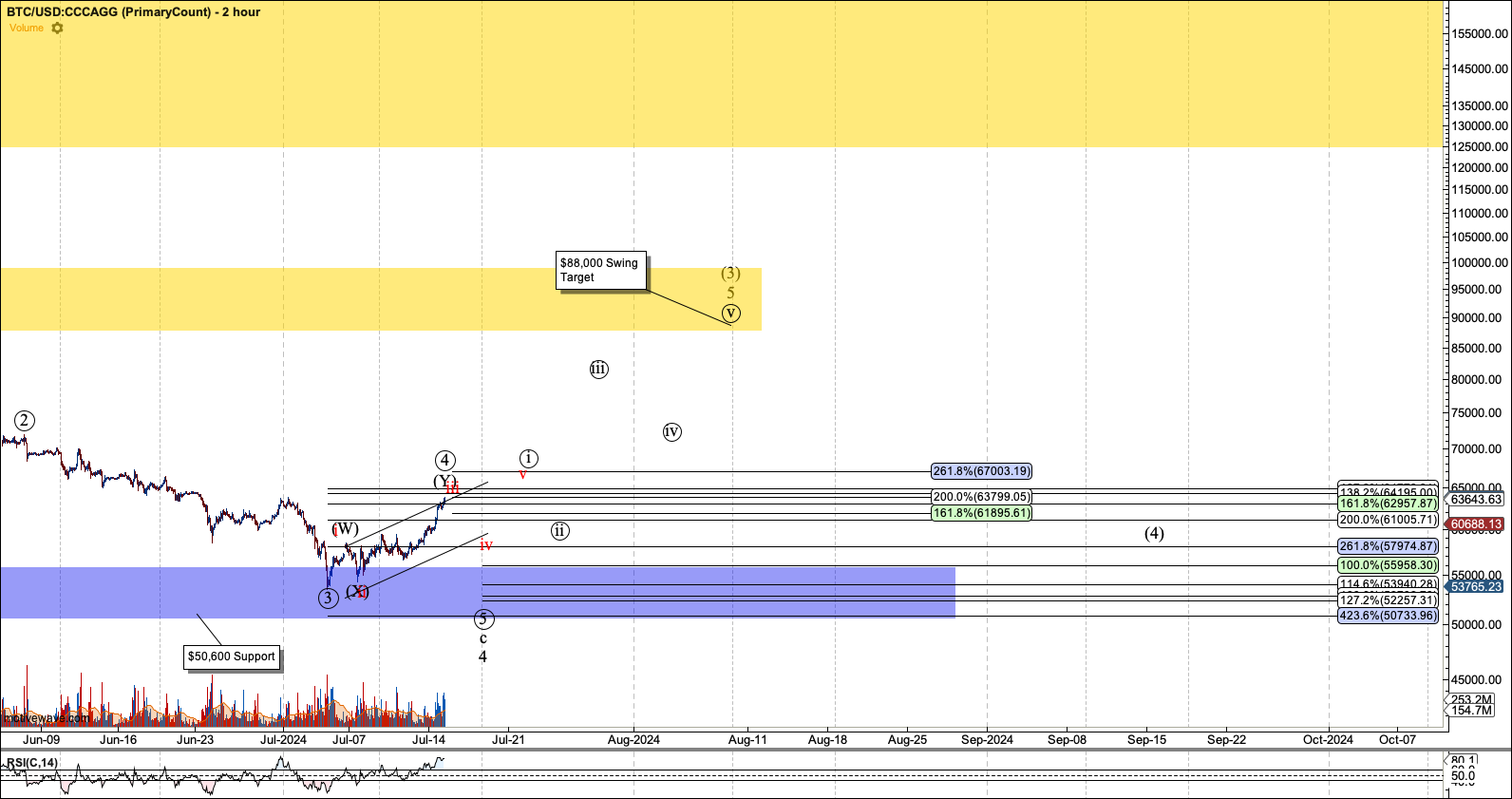

Bitcoin

Bitcoin stretched upward today making the black fourth wave even less plausible. However, until the red count fills in all five waves, I cannot say we have a reliable low in place. Currently, the lower channel, where the fourth ideally holds is at $59,500.

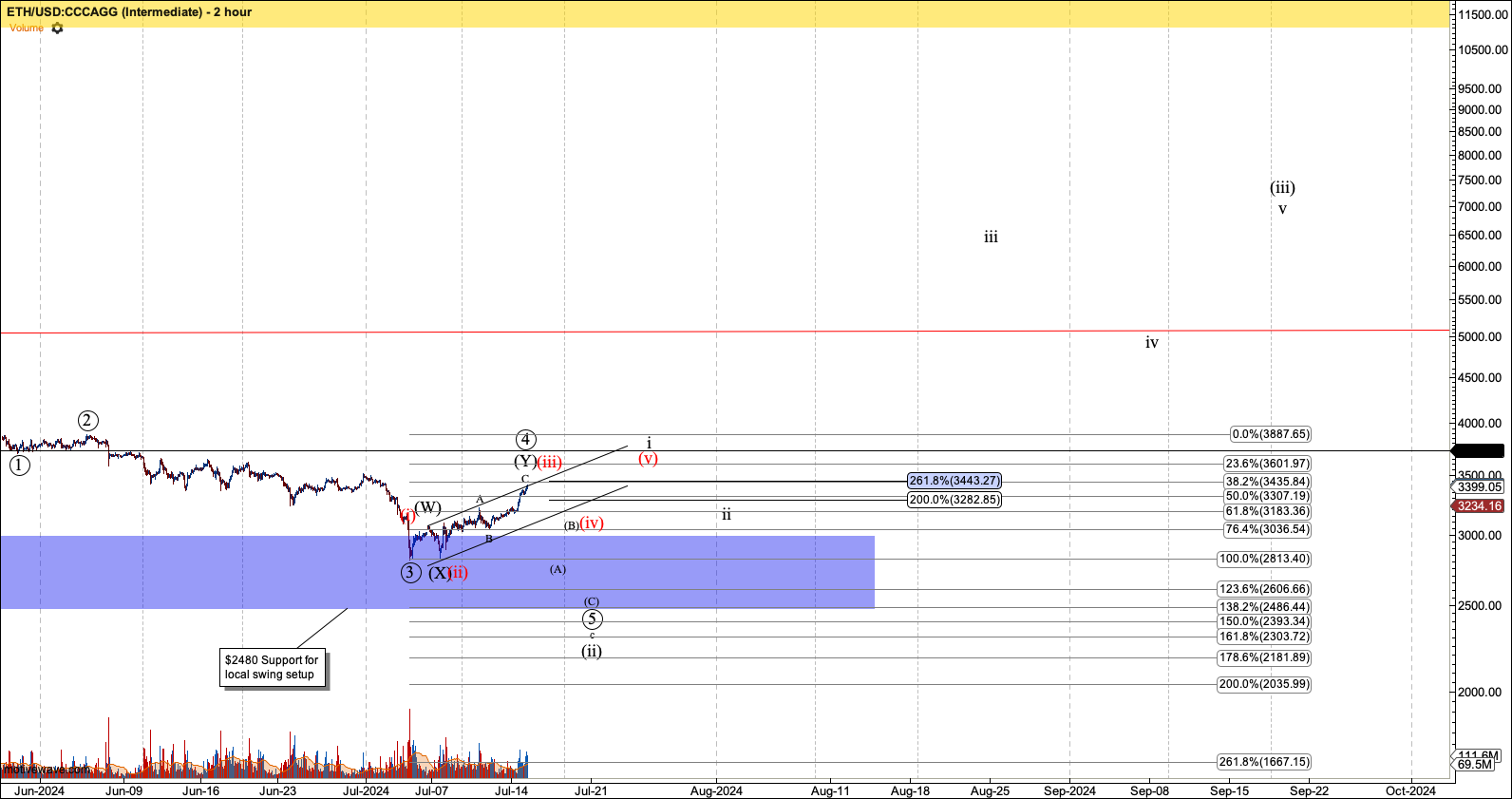

Ethereum

As unreliable as the red 1-2 setup is in Ether, even for a diagonal, it continues to to stretch the black fourth past the point of being probable. However, we still need to see five waves in red to indicate the lows are in. The lower channel is in the $3165 region where red-(iv) should hold.

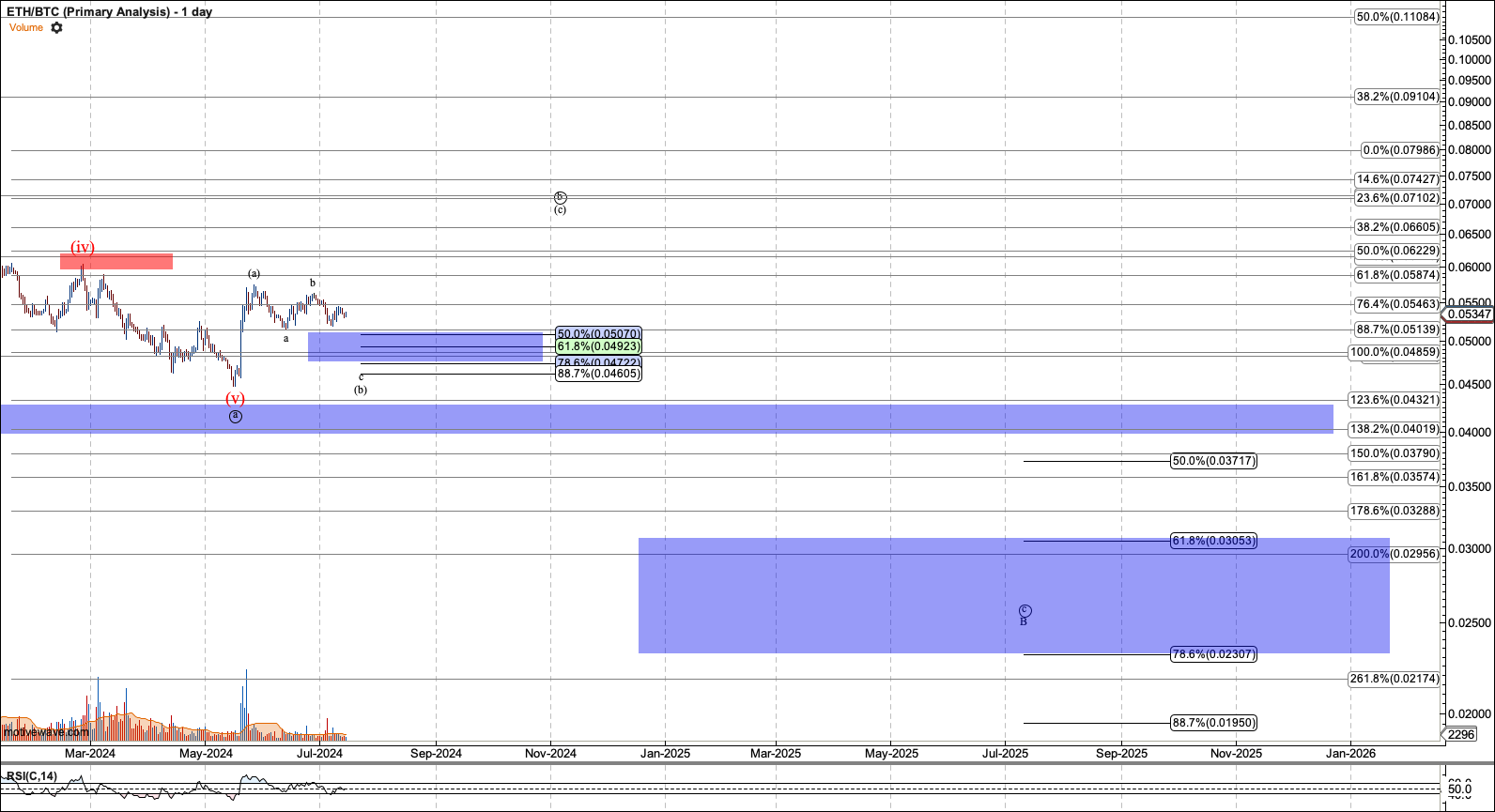

ETHBTC

ETHBTC is dipping toward micro support at 0.047. The question is whether it reverses, giving Ether its last leg of positive performance versus Bitcoin during this bullish cycle.

Spot Conversion

As an experiment, I have changed this section to the conversion numbers for the Bitcoin ETFs so you can use my Bitcoin chart to manage your positions. Note these numbers are to the third decimal place. Two shares with the same conversion may vary slightly in price due to a difference in the 5th and great decimal place.

BITO: 0.0004 (rechecked and affirmed on July 3, 2024)

ARKB: 0.001

GBTC: 0.0009

DEFI: 0.0012

EZBC: 0.0006

HODL: 0.0011

IBIT: 0.0006

BRRR: 0.0003

BTCO: 0.001

BTCW: 0.0011

FBTC: 0.0009

BITB: 0.0005