Pullback Is Required - Market Analysis for Feb 9th, 2022

I'm doing this supplemental mood analysis to show why a pullback almost has to happen here. For the last few days I've been wondering about the possibility that a flip I dismissed over the weekend shouldn't have been dismissed. For the moment, it doesn't matter as a pullback should be next in either orientation.

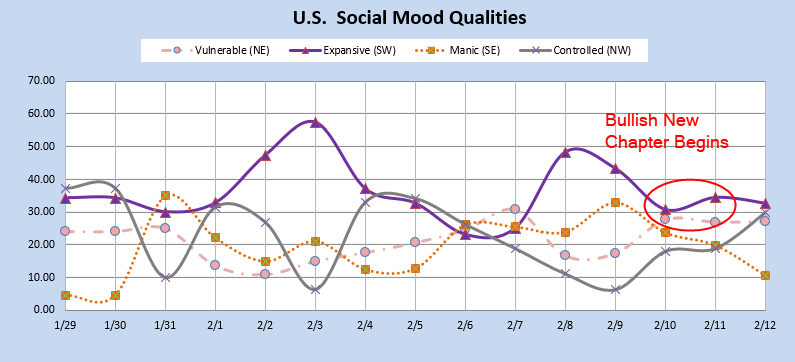

The chart below highlights the mood pattern for the next couple of days in the normal orientation which is my base case. This is a "green shoots" pattern or alternatively, new bullish chapter or next bullish EW pattern. After the rally in the past two days, the only way to have a new bullish chapter, is to have a pullback. If this is the correct orientation, and a next bullish wave is about to start, there *must* be a pullback first. You can't have a new up wave if the old up wave is still happening.

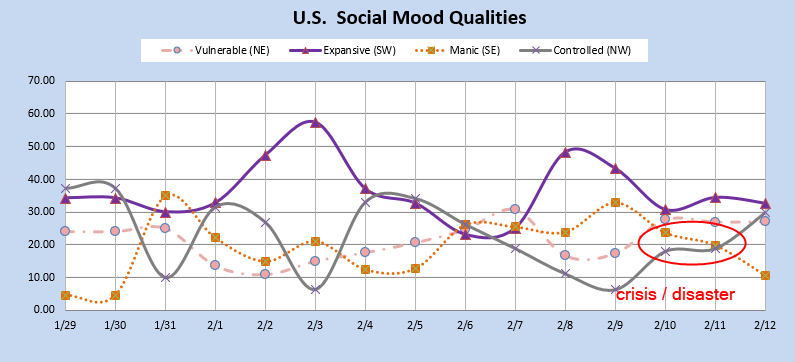

This second chart highlights the mood pattern for the next couple of days in the inverted orientation which is the alt case. This is a "crisis/disaster" pattern. If there is a notable crisis or a very sharp selloff without a new bullish EW beginning tomorrow and Friday, then this would point to the inverted mode.

In either case, a pullback should be next. Either we get a pullback followed by a next leg up or we get a much more dramatic pullback to finish the week. The least likely thing to happen, and something I would have no way to account for, would be a continued upward climb.