Quick Silver Update - Market Analysis for Sep 19th, 2024

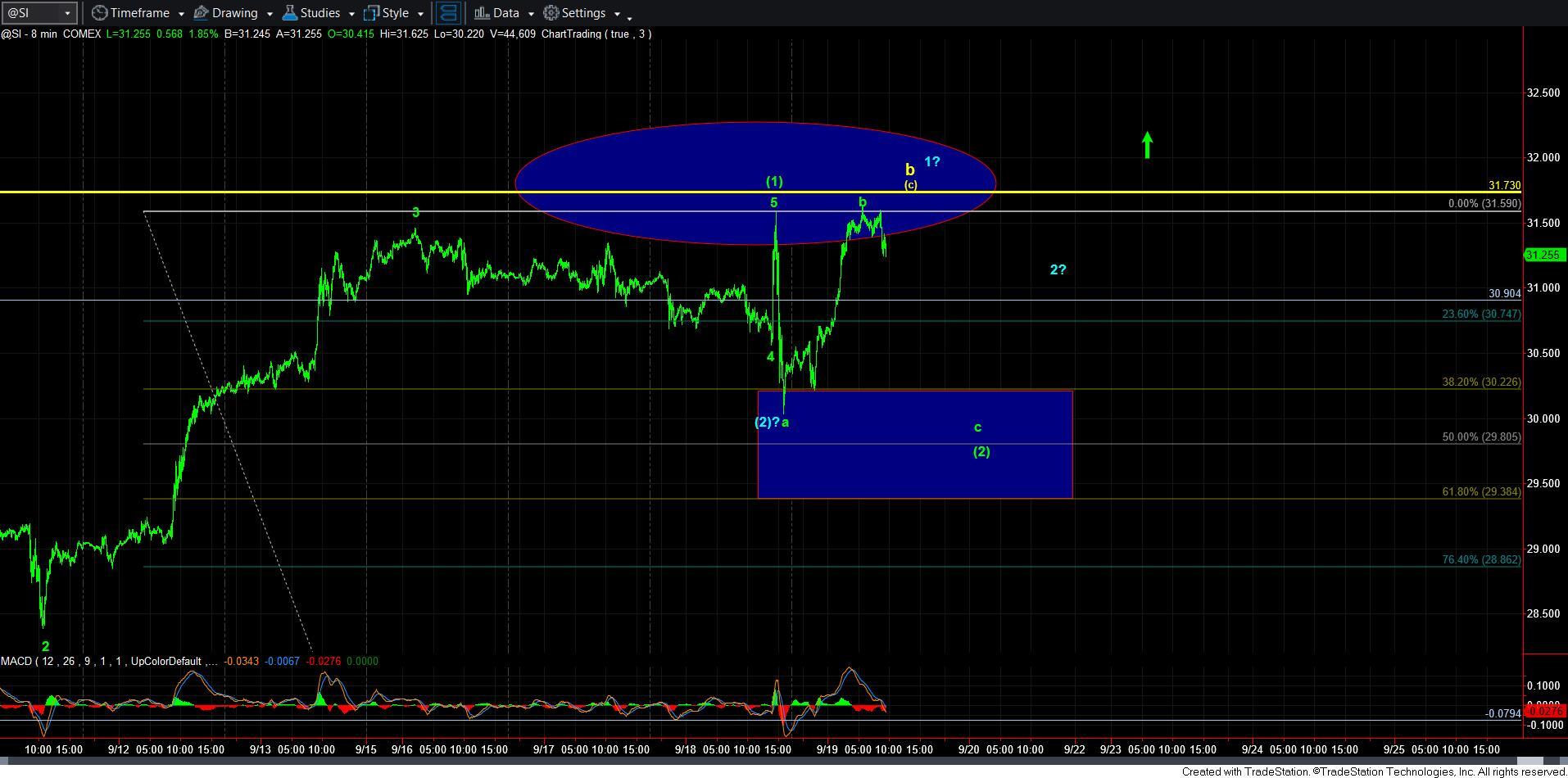

With the decline into yesterday's low and the top of our target/support box for wave 2 being questionable as to whether it was 5 waves down or 3, price has come back up to the scene of the crime, so I wanted to prepare you with the paths I am tracking.

If we continue lower from where we now reside in silver - 31.27, then I have to assume that the high this morning was a b-wave, and we will still see a c-wave to complete wave [2].

Note that I took off the yellow 1-2 because price strike slightly higher than yesterday's high, which would invalidate a 1-2 downside structure.

Now, should we see another higher high, then that would be wave 1 of [2] as my primary count.

The alternative is something someone asked me about yesterday, and that is whether all the sideways and decline action into yesterday's low could have been a bigger 4th wave. My answer was that it was possible but not probable, as it would seem way to large of a structure for that interpretation. But, if we do go higher one more time this morning, and top at exactly 31.73, then I am going to have to at least follow it, and if we see a CLEAR 5 wave decline from it, then I will have no choice but to give it much more credence.

So, a few more squiggles should resolve this region for us, and provide a better answer as to when we can break out in the heart of the 3rd.

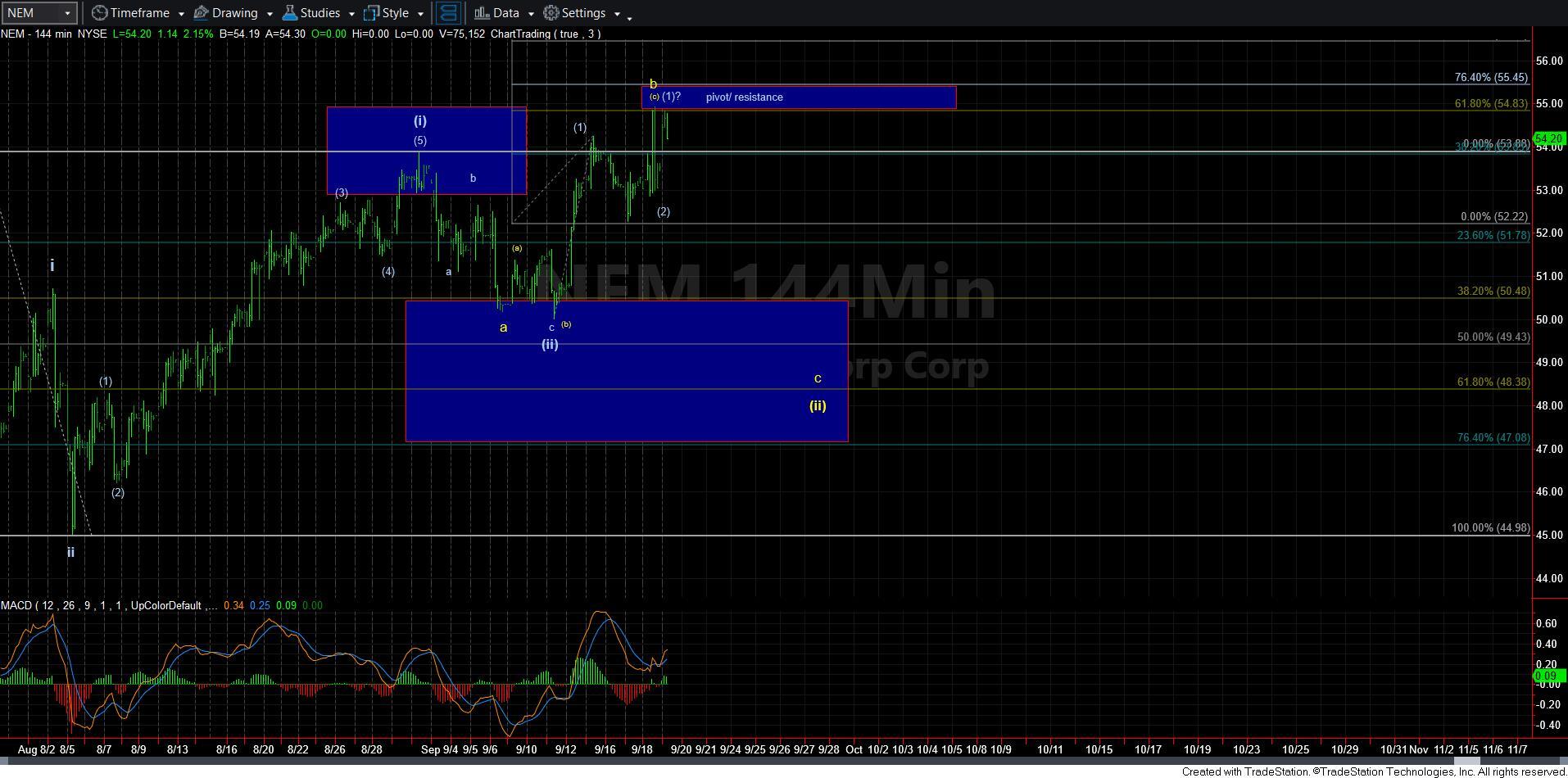

As a side note, NEM is also back to the scene of the crime, and the same general view is seen there..

PLEASE NOTE: Emails were not working this morning so please come into the trading room to see updates posted to this point. It should be working again.