Sentiment Speaks: Unburden Yourself From What Has Been

Sentiment Speaks: Unburden Yourself From What Has Been

I have always been amazed at the extent to which the public simply believes what it is told without seeking supporting evidence as to the veracity of a commonly held belief or proposition. Instead, most just simply accept fallacies as truth.

In fact, Kahneman, in his book Thinking Fast and Slow, hits upon this subject several times, and I quote:

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguishable from truth.”

He further notes that “evidence is that we are born prepared to make intentional attributions.” In other words, our minds engage in an automatic search for causality. Moreover, we also engage in a deliberate search for confirming evidence of those propositions once we hold them dear. This is known as “positive test strategy.”

He goes on to proclaim that we have a puzzling limitation within our minds:

“our excessive confidence in what we believe we know, and our apparent inability to acknowledge the full extent of our ignorance and uncertainty of the world we live in. We are prone to overestimate how much we understand about the world . . overconfidence is fed by the illusory certainty of hindsight.”

He then explains why most people are unable to escape the fallacious world of beliefs that they create for themselves:

“Contrary to the rules of philosophers of science, who advise testing hypotheses by trying to refute them, people seek data that are likely to be compatible with the beliefs they currently hold. The confirmatory bias [of our minds] favors uncritical acceptance of suggestions and exaggerations of the likelihood of extreme and improbable events . . . [our minds are] not prone to doubt. It suppresses ambiguity and spontaneously constructs stories that are as coherent as possible.”

Francis Bacon was also noted to say:

“The human understanding when it has once adopted an opinion (either being the received opinion or as being agreeable to itself) draws all things else to support and agree with it.”

So, let’s see if we can take a lesson from the Jedi Master Yoda, and try to unlearn what we have learned. In other words, let’s try to unburden ourselves from what has been, and begin to look at the investing world in a more honest and discerning manner.

Now, I will tell you that the inspiration for this missive came from a debate in which I engaged with someone in the comments section to one of my recent articles. The premise for his argument was that the Fed controlled the market and caused the stock market decline we experienced in 2022 due to its raising of interest rates. And, as we all know, this is a ubiquitous perspective amongst market participants.

In fact, I even searched Investopedia regarding its view as to how the Fed and interest rates affect the markets. And, this is what it said:

“When the Federal Reserve changes interest rates, it has a ripple effect throughout the broader economy, affecting both stock and bond markets in different ways. Higher rates discourage spending and can depress company returns and, therefore, stock prices. Changes in interest rates tend to impact the stock market quickly. . .

For bond investors, higher interest rates mean higher rates on new bond issues but a decline in the values of existing bonds. Lower interest rates have the opposite effects. . . “

This is also clearly the general perspective of the investor and analyst community. However, it seems the facts of real life do not necessarily agree.

Elliottwavetrader.net

If you look at the attached chart, we will see some interesting facts. First, take note that the market had already struck a local top almost three months before the Fed rate hike. In other words, the market had already begun a decline phase even before the Fed began raising rates. In fact, we were already 1/3 of the way through that decline phase when the Fed began raising rates. It should initially make you question whether the Fed “caused” a market decline since one had already begun.

Second, note that the Fed began and ended its rate raising campaign from the same level in the market. It began its rate raising campaign in March of 2022 when the SPX was around the 4600SPX region, and its last rate hike was in July of 2023 when, yes, the SPX was around the 4600SPX region. That really does not jive with the common understanding of what Fed rate hikes should have done to the market. The market should have been much lower when the Fed completed its rate raising campaign based upon the common understand of the Fed’s “control” over the market.

Third, take note that the stock market rallied almost 1200 points AFTER the last Fed hike, and until it began lowering rates. Again, this clearly does not jive with the common understanding of what Fed rate hikes should have done to the market. The facts clearly do not match the narrative, and it is not even close.

Now, here is the true kicker. If I challenged anyone to take a clean SPX chart without any dates on the chart and, based only upon the general understanding of how the Fed “controls” the market with their rate movements, label where they believe the Fed began raising rates, when they ended their rate raising campaign, and when they began lowering rates, I can guarantee you not a single person would get this correct.

And, if you think this is an anomaly, well, I would again challenge you to review market history on your own, and you will see that it is not an anomaly.

Now, here is something even more shocking.

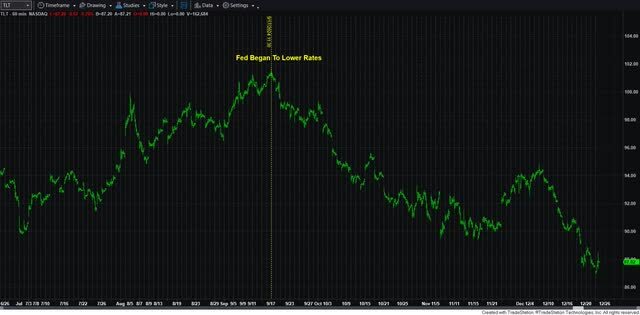

As you can see, the Fed’s lowering rates had the EXACT OPPOSITE affect upon the bond market. So, someone should tell Investopedia.

At this point in time, I sincerely hope that many of you are starting to recognize that the Fed does not control the market as you have been for so long led to believe.

At some point, one must begin to seek out the truth in the market rather than buying into the common fallacies continually propagated by the media, analysts and investors alike. As Daniel Crosby noted in his book The Behavioral Investor:

“trusting in common myths is what makes you human. But learning not to is what will make you a successful investor.”