Spotlight On AGNC: Yield 9.6%

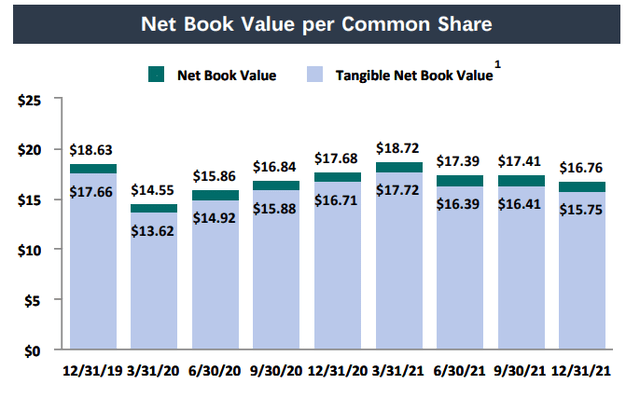

AGNC Investment Corp (AGNC) reported earnings and the market continues to hyperventilate over book value, which was down about 4% from the prior quarter. While the market is running for the hills in a panic, we get to collect our income. Today, let's take a look at why book value is down and then discuss why it doesn't matter a hill of beans unless you are trading in and out.

AGNC is operating at a leverage level of 7.5x equity. This means that for every dollar of book value, AGNC has $7.50 of assets. A 1% move in asset prices will result in a 7.5% shift in book value before accounting for hedging. That means book value is going to be rather volatile. over the past 8-quarters, book value frequently shifted 6-9% each quarter. A 4% move, isn't unusual. It is also something that is fairly routinely made up in a quarter.

AGNC Book Value By Quarter (AGNC Q4 Investor Presentation)

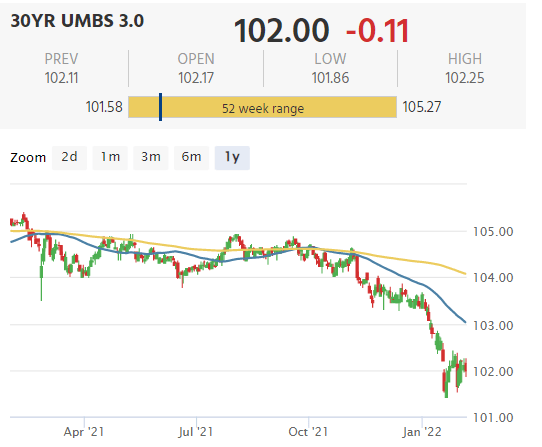

Ultimately, the reason for book value going down is in the prices of their largest asset: agency MBS.

Mortgage News Daily

MBS prices are down about 3% from 52-week highs. A sharp move in the agency MBS world. Remember, these mortgages are guaranteed by the agencies Fannie Mae or Freddie Mac, so there is minimal credit risk. They tend to correlate most strongly with US Treasuries, so we can see prices were actually quite stable but started heading down in late Q4 as the Fed was seen as more "hawkish".

Since the mortgages are guaranteed, no matter what happens AGNC is getting $100 when the mortgage is refinanced, paid off, or defaults. The premium reduces the effective yield that AGNC will receive, just like when you buy a preferred share or bond above par.

For cash flow, this is a good thing. Why? Because AGNC wants to be a net buyer of MBS. Historically, they have operated at leverage levels of 8.5x-9.5x, so they have a lot of capital waiting to be deployed. Lower prices means higher yields! When you are a buyer, you always want prices to be lower.

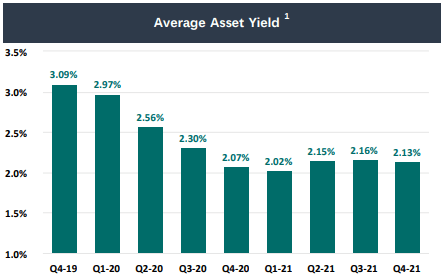

As a reminder, here is how AGNC's earnings work. Take average asset yield:

AGNC Q4 Investor Presentation

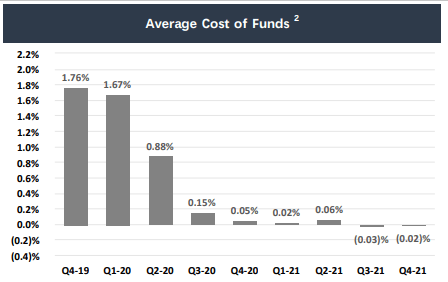

Subtract the cost of funds:

AGNC Q4 Investor Presentation

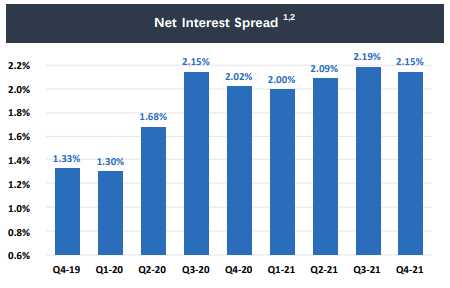

And you get your "net interest spread":

AGNC Q4 Investor Presentation

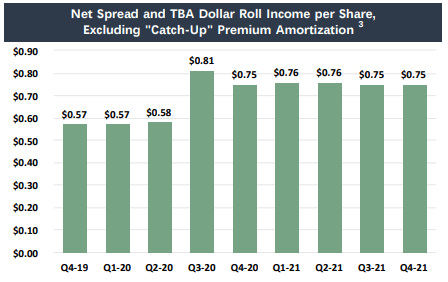

Multiply this number times their assets, and you have their gross profits. Higher is better. The end results in in their income per share.

AGNC Q4 Investor Presentation

Note that AGNC is consistently producing $0.75/quarter, 30% higher than they were making pre-COVID! Also covering their dividend by 208%! Yet their share price is lower than when they made less and were only covering their dividend by 119%. To us, that is just insane.

The yield is over 9.6% and it is extraordinarily well-covered. Earning could be cut in half, and it would still cover the dividend even without leveraging back up to historical levels! This means that AGNC's dividend today will be secure even if conditions deteriorate significantly. That isn't something that could be said the last time the Fed started a rate hiking cycle.

Why hasn't management leveraged up? Because they believe that as the Federal Reserve moves out of MBS, spreads will get wider allowing them to invest at even better prices. AGNC thinks that they can get a better price later. However, the tenor of the earnings call was very different as they suggested that leveraging up might occur "in the next two quarters". A much more definite timeframe than we've seen them discuss before.

The bottom line, the market is completely ignoring the cash flow. While some investors might do quite well jumping in and out trying to chase book value, that just isn't our style. We can collect a very high dividend income that is well-covered by earnings today and will remain covered even in a very bearish scenario. We're happy to sit back and collect our dividends while we wait for the market to realize the cash-flow machine that is agency MBS right now.