The Fed Cut, Now What?

We welcome new subscribers that have recently joined us. The following is the "quick link" to our live google sheet:

HDI Model Portfolio - September 2024

Summary

- The Fed cut rates 50 bps.

- The market indexes rallied, but that rally might not last long.

- Some tickers didn't go the way you might expect.

- A look at HDI investments that benefit the most from rate cuts.

= = = =

Yesterday, the Fed decided to cut the target rate by 50 bps. Last week, was a 50/50 probability, but early in the week 50 bps is what the consensus expected. The market response was initially a "meh", and now today (September 19th) the indexes are rallying. Let's take a closer look at what this means.

What The Fed Controls

When the Fed "cuts" rates, what exactly are they cutting? The rate that the Fed has demonstrated nearly absolute control over is the overnight financing rate. The overnight market is where banks and other institutions borrow money or lend excess money.

A bank doesn't know exactly how many transactions it will have to process on a given day, or whether their deposit balance will be up or down. So each night, banks will process transactions. If the transactions being paid out of the bank exceed the cash balance the bank has, it isn't a big deal. The bank will provide collateral in the overnight market (US Treasuries or agency MBS), and pay a fee to borrow the cash. If the bank has excess cash, it wants to earn interest on that. After all, it has to pay many of its depositors interest. So with extra cash, the bank will lend in the overnight market.

The Federal Reserve is very active in the overnight markets. If there are more lenders than there are borrowers (banks have excess cash), the overnight market will push interest rates down. If the rate starts going below the "target rate", the Fed will step in and borrow, increasing demand for borrowing and increasing interest rates.

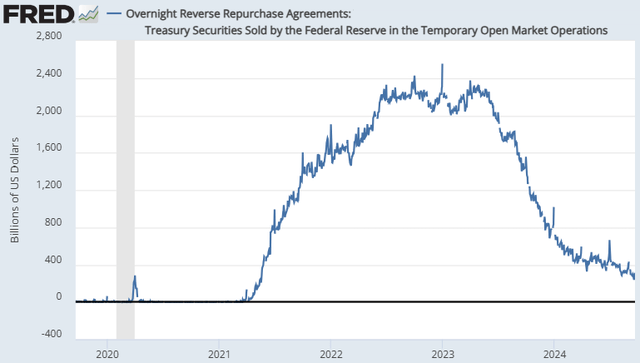

This arrangement is called "reverse repurchase agreements". The Fed is providing its ample reserves of US Treasuries as collateral, "selling" them to banks and buying them back in the future at a higher price. Source

St. Louis Fed

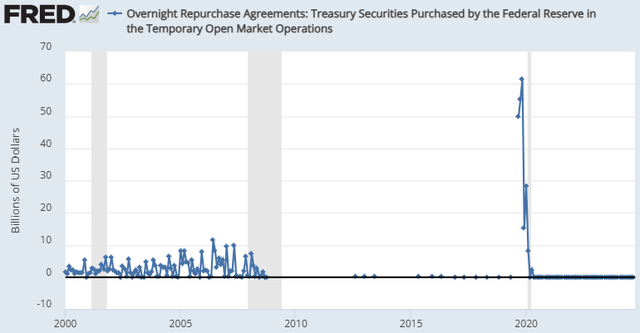

If interest rates start going above the target rate, then the Fed will step in and lend money using repurchase agreements. The banks will provide US Treasuries or agency MBS as collateral, and the Fed will provide them with cash. In other words, the Fed increases the supply of cash, by lending itself. Source

St. Louis Fed

We can see that the Fed hasn't needed to do that nearly as much.

This is why the Federal Reserve's "Target Rate" is always phrased as a "range", it is now 4.75%-5.00%. In modern times, the Fed has become very good at reacting quickly to changes in the overnight markets, but that range gives them wiggle room for natural changes in supply/demand that they can't react to quickly enough.

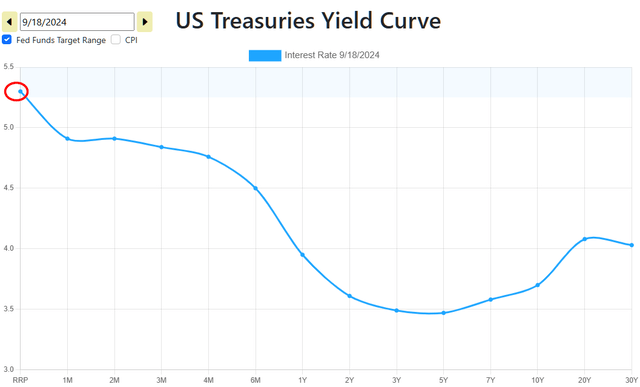

When we look at the entire yield curve, the circled portion is what the Fed controls: Source

US Treasury Yield Curve

The Fed has been artificially holding the overnight rate much higher than it would be naturally. As a result, we can see that the shorter the term, the more influence the Fed's Target Rate has. After all, if you can get 5%+ overnight, then you are not going to be interested in 3.5% over a 30-day period. However, depending on your outlook of long-term rates, if you believe that the 5%+ is going to be short-lived, you might be interested in locking your money up for 5-10 years at 3.5%.

You can see that the Fed's influence rapidly drops from 6 months to 1 year.

"Why Aren't Stocks Responding Like I Think They Should?"

With the Fed cutting 50 bps, the most common question I am receiving is something along the lines of: Stock X should be responding favorably to interest rate cuts, why isn't it up today?!?

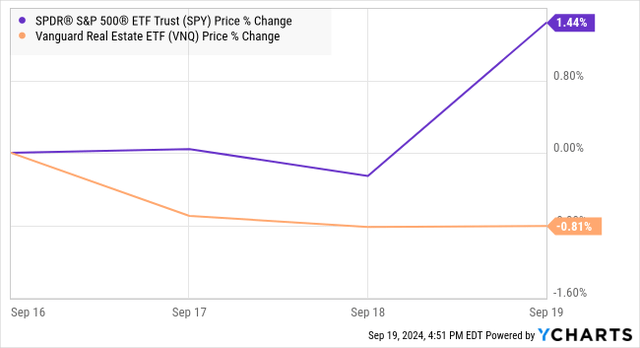

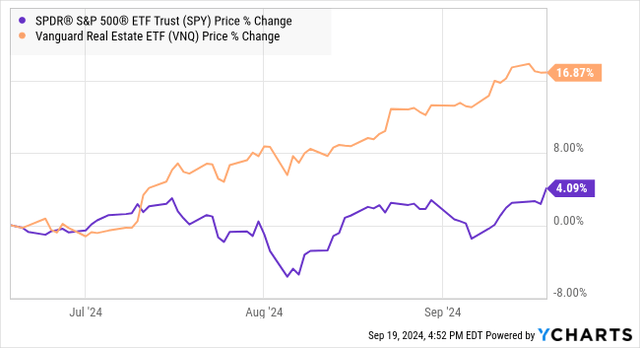

For example, rate cuts are directly positive for REITs, yet REITs are down since the cut, while the S&P 500 is up:

Daily price movements occur for a large number of reasons, and do not always align with what you might think is "supposed" to happen. There are a variety of phrases that stem from this like "Buy the rumor, sell the news". Which in the case of REITs, seems to be what has happened. Vanguard Real Estate ETF (VNQ) is up over 16% in the past three months, while SPY is up about 4%.

Short-Term vs. Long-Term

We have to remember that not everyone in the market follows our strategy. For some investors, holding an investment for 3 months is a "long time".

Put yourself in the shoes of an active trader, who 3 months ago, predicted that the Fed would cut interest rates 50-bps yesterday. That trader decided to invest in securities they determined are interest rate sensitive, and would benefit from lower interest rates. So they were buying things like REITs. Let's say they bought VNQ. Where did that money come from? They aren't dividend investors like us. They don't have the luxury of having 2%-3% of their portfolio value coming as dividends every quarter. They have to get cash from somewhere. Somewhere like selling SPY.

So they sell SPY and buy VNQ. That's their trade. 3 months later, the Fed cuts 50 bps, and they were right. What does a trader do when they are right on a trade? They close it. They take their gain and look for the next trade. In this case, upon the event the trader was betting on happening, they are now looking to sell VNQ, while maybe they are looking to buy S&P or QQQ or something else depending on what they view as coming next. Maybe they believe a "soft-landing" is on the way, in which case the investments in QQQ were the ones that utterly crushed returns following the soft-landing of the 1990s.

The bottom line is that over the past 3 months, they have outperformed the S&P 500 with a 16% gain vs a 4% gain and they probably feel great about that. They aren't worried about whether REITs will benefit from lower rates fundamentally, or how they might perform in the future. Their investment relied solely on one event, that event happened and now they don't have a compelling reason to own REITs. So they take their profits and move on to the next hypothesis.

That is just one example of how some in the market think. You have hundreds, if not thousands of other strategies that investors are employing. Some of them good, many of them terrible, some well thought out, and some have no thought at all. It all aggregates into the supply and demand for each particular stock. Some of that supply/demand will be very individualized, in other words, people buy or sell a particular stock because of particular beliefs about that specific company. A lot of that supply and demand will come from ETFs and funds where investors are primarily focused on the overall sectors – such as the case above of the investor buying VNQ, but selling SPY three months ago, but selling VNQ and buying SPY today. That investor isn't thinking about Realty Income (O), but whenever they sell VNQ, shares of O are sold by VNQ.

Whenever a stock isn't responding the way you think it "should" to news, what is behind it is that many other investors are not investing using the strategy you are employing. They are looking at other things, they have different goals, and they have different investment horizons. If I buy a REIT, I'm planning on holding for several years. When someone else buys it, they might be planning on selling in months or even days.

Thoughts On The HDI Model Portfolio

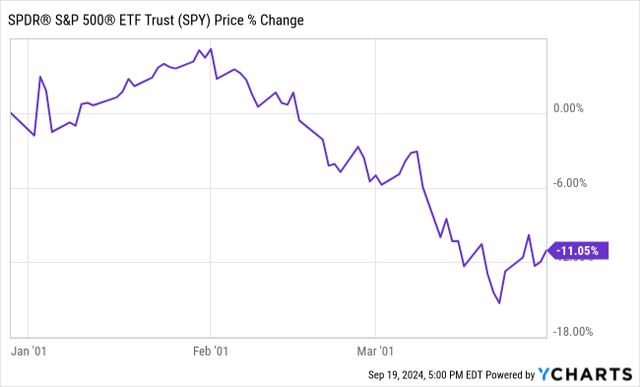

Historically, when the Fed has cut interest rates, the market indexes initially rallied. When the Fed cut 50 bps on January 3rd, 2001, the S&P 500 rallied about 5% that month. Then reality set in:

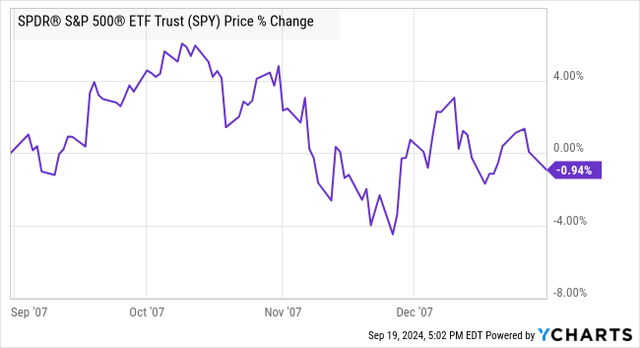

When the Fed cut 50 bps in September 2007, the initial reaction was also an approximately 5% rally over about a month. That marked the high-water market before the GFC set in:

Two events is not a huge sample size, but it's the sample we have in modern times.

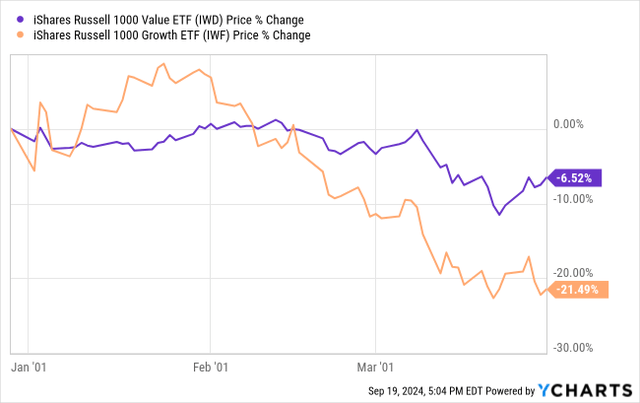

I've said before that I believe the current set-up is most similar to the Dot-Com bust. Here is what happened to Value stocks vs Growth following the Fed's rate cuts in January 2001:

Note that Value didn't enjoy the immediate rally following the cuts. Yet it also held up better when the weakness in the economy became obvious and Growth fell. Value stocks went on to have a much more mild recession than Growth.

In our portfolio, we have some sectors that are going to be more interest-rate sensitive than others. You can likely observe which by looking at the past month, investments that have been up a lot over the past month are likely to benefit more from lower rates long-term, even if there might be some profit taking recently.

The big winners are:

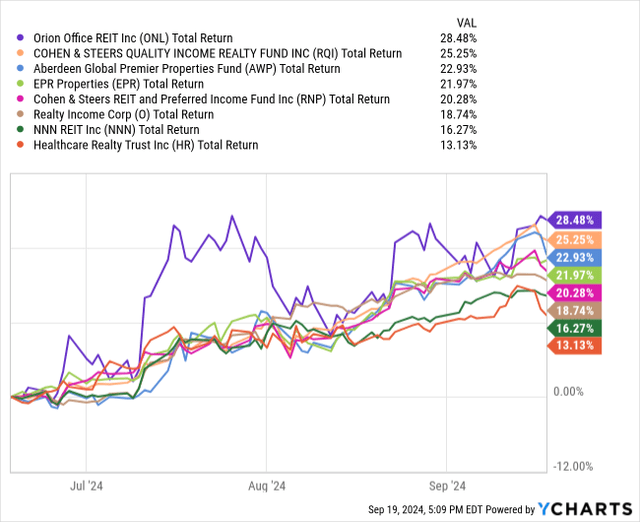

Equity REITs: Equity REITs like O, EPR, ONL, NNN, RNP, RQI, HR, and AWP (MPW will benefit as well, but the MPW specific issues likely overpower the macro environment.). We saw all of these rally the past few months.

Any softness in prices now I would interpret as profit-taking. Equity REITs have been on fire, and have been one of the strongest sectors. We don't believe that recovery is over, it is just taking a breath.

Agency Mortgage REITs:

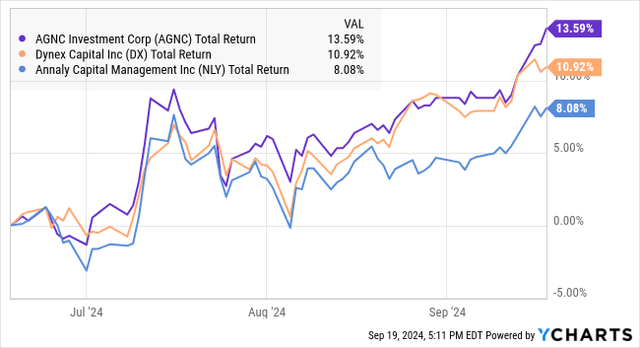

The business strategy of agency mortgages is greatly benefited from a steepening of the interest rate curve. Since the short-end has been held artificially high, that has been a significant drag on the business. In our portfolio, NLY, AGNC, and often-mentioned bonus pick DX, are the go-to options.

This sector has started a rally, but we believe it is in the early stages. There is a ton of room for upside and much of the market seems to have a bias against them due to underperformance over the past several years.

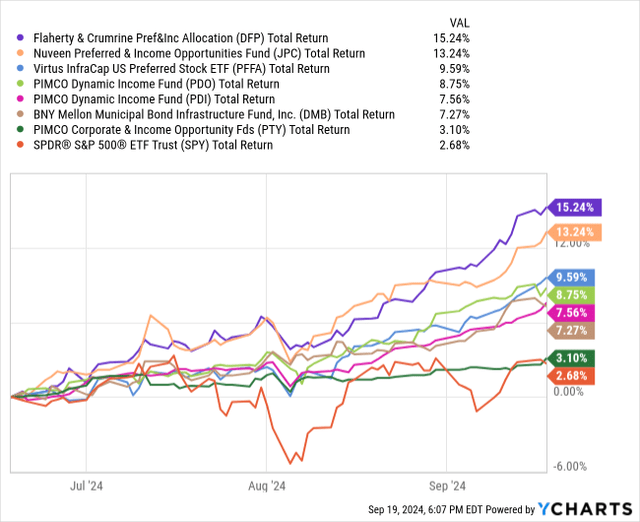

Fixed-income Funds:

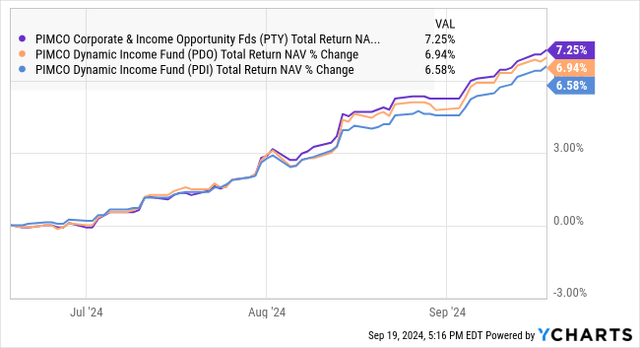

CEFs in general will benefit from a lower target rate because many of them are leveraged, and that leverage is funded using short-term interest rates. Funds that invest in fixed-income assets will benefit even more as fixed-income prices are directly tied to interest rates. The PIMCO family, PFFA, DFP, JPC and DMB have all beaten the S&P 500 in the past 3 months.

Interestingly, PTY has been the underperformer in this group. However, that is due to its premium to NAV has pulled back from about 30% to 23%. The market price has remained fairly flat, while NAV has climbed. On a NAV basis, PTY remains the best-performing PIMCO fund, outperforming its sister funds:

You might say that PTY ran ahead of its peers, and they have been catching up.

Looking forward, there is still a lot of room for upside with these funds. NAVs could have 20-30% more upside, and they are also producing a very nice income.

Fortress Sectors

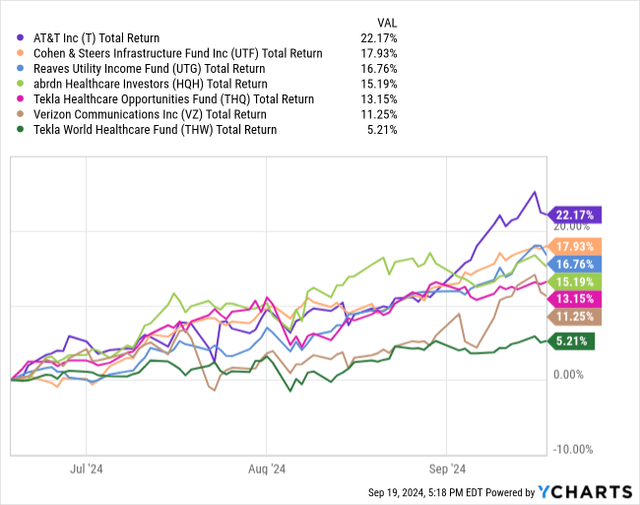

The next class of investments that we have that will benefit from lower rates are what you might call "fortress sectors". Think utilities, infrastructure, and healthcare. While these sectors are not directly interest rate sensitive, they tend to have a business model that has very high barriers of entry, requires substantial capital, and in exchange for that investment, the companies receive a relatively stable and predictable return.

While these companies might benefit fundamentally from lower interest rates, they also appeal more to investors when interest rates are lower. The perception of safety and steady dividends attract investors to these sectors when other income options like bonds get more expensive.

In our portfolio, I would include UTF, UTG, HQH, THQ, THW, T, and VZ in this category:

We've seen them rally with the rumor of rate cuts, and now a bit of profit-taking. However, we still see significant upside opportunities.

Direct Fixed-Income: Bonds & Preferred

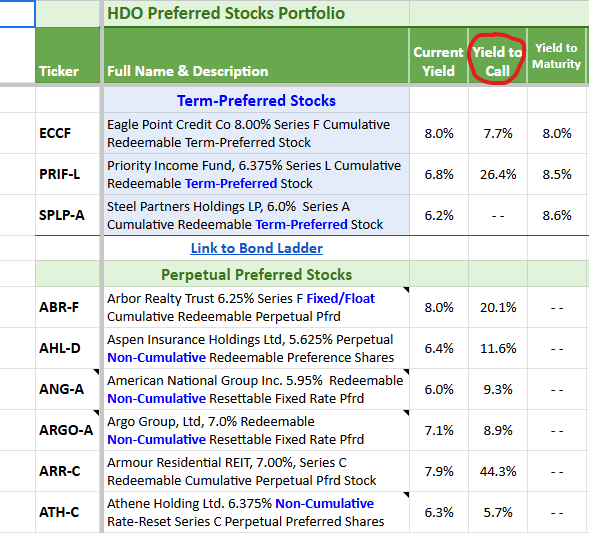

Bonds and preferred shares have generally been climbing in price. While many preferred shares are now trading close to par or even over par, there are many others that are still at a discount. In the coming months, the concept of "call risk" is going to become more important. Call risk is the risk that a company exercises its call option to forcefully redeem the shares at par value.

When shares are trading below par, this is both unlikely, and a positive if the company does call them. However, if a preferred is trading above par, then if it is called recent investors might have a capital loss. Whether it is a good idea to buy above par will be dependent upon when the call date is. If the call date is far into the future, then paying a premium can still be attractive because the dividends you will receive will make up for the capital loss of the premium if it is called as early as possible. You can look in Column E of the Model Portfolio to see the Yield to Call for preferred shares. YTC assumes that the investment is called as soon as allowed, and calculates the effective yield you will receive including any capital gain or loss caused by being called at $25 par. For example, ATH-C currently yields 6.3%, but the YTC is 5.7%. This is because it is trading at a premium to par ($25.13). If ATH-C is called right away, ATH-C investors would only get $25, and so that $0.13 capital loss would offset $0.13 of dividends between now and the call date.

When investing in fixed-income, you want to make sure that the YTC or the YTM (yield-to-maturity) is a return that you will be happy with.

Opportunities in fixed-income are fewer than they were 6 months ago, but they are still plentiful. I suggest reading our "Preferred Stocks & More" articles weekly to keep on top of the best opportunities, as well as checking our list for "trimming". If a preferred's YTC starts getting too low, it will appear on that trim list. That list is our way of communicating that we are still confident in the company's ability to meet its obligations, but the current price is relatively expensive.

What About Everything Else?

Not everything in our portfolio is interest rate sensitive. That is by design, we don't want everything to be interest rate sensitive. As you look above, you'll note that we covered a sizable portion of our portfolio, but we didn't discuss investments like MLPs/energy, CLOs, commodities, BDCs, commercial mortgage REITs, and diversified funds (USA/RVT).

Every company and every person in the entire U.S. is somewhat impacted by changes in interest rates, but for many of these companies interest rates are not the primary determinant of their results or their share price. Interest rates are A thing, but they are not the ONLY thing. I think there is a temptation for investors to lump things into categories of "declining interest rates are good for this sector by bad for that sector". The real world isn't that simple.

For example, BDCs borrow long-term, usually fixed, and lend using short-term variable loans. Rising interest rates have been a boon for the sector and has created a lot of excess cash flow for many BDCs. We've seen a lot of dividend raises and a lot of supplemental dividends from the sector.

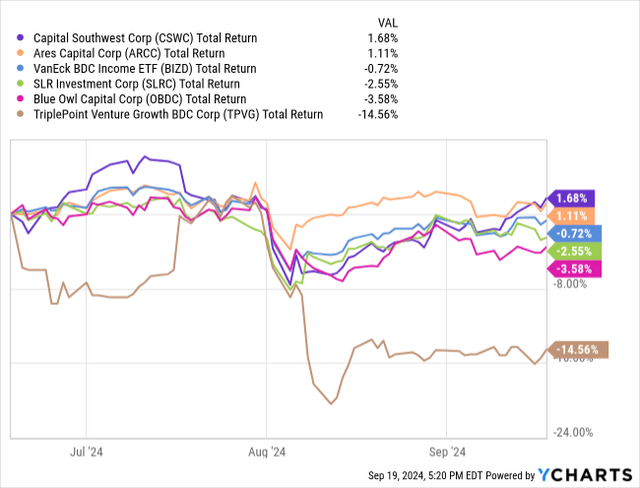

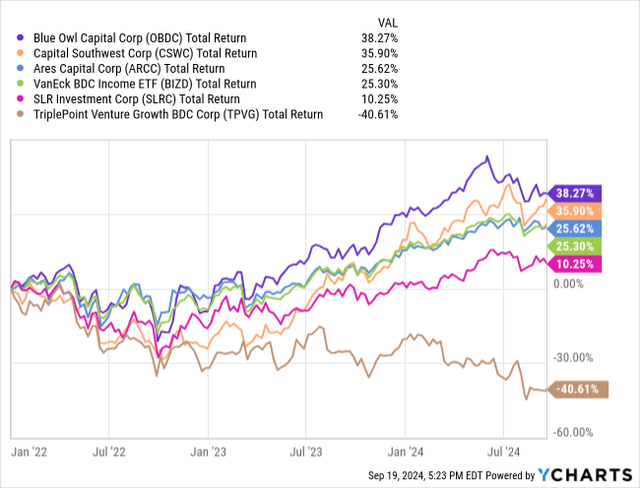

The past 3 months have been anemic for the sector, but aside from TPVG not outright bad.

In general, the rate hiking cycle proved to be a positive period for BDCs.

So with rates coming down, what can we expect? In terms of price, BDCs are not trading at terribly high prices. Most are cheaper than they were in 2021, when interest rates were 0%. I wouldn't expect interest rates being lower to necessarily have a negative impact on prices for BDCs. Ultimately, BDCs are primarily credit risk investments. They do well when borrowers pay their bills. It was credit failures that caused TPVG to underperform its peers.

Going forward, we can expect the supplements to shrink. If rates fall far enough, they might even stop. We should always expect that with any dividend labeled a "supplement" by the company. That is management's way to tell you that they expect the dividend won't be permanent. Yet, we saw in 2021 that BDCs could trade at similar or higher prices in a 0% yield world.

I'm bullish on credit risk. While there have been pockets of defaults, I don't believe that we are heading for a particularly tough credit environment for businesses. On the other hand, with interest rates coming down the supplements are likely to diminish, and there will likely be a gap before we start seeing IPOs and mergers that would lead to BDCs realizing large gains on their equity that would be distributed as "special" dividends.

We aren't selling out of the sector. We expect the pricing to remain relatively rangebound. The upside is slowing down, but barring significant defaults like we saw with TPVG, we believe that prices won't fall dramatically either. The supplements are nice, but the "normal" dividends are nothing to sneeze at and we expect those will continue.

The bottom line, we tightened up the Buy Under prices a little last week, and if BDC prices go over those, we aren't likely to chase them up without confidence that the growth will continue. We are going to be a bit more picky about the price we pay than we were a few years ago when everything was a perfect set-up for BDCs. If we see a rally in the sector, we might opportunistically realize some gains. If we don't, we are very happy collecting 9-10% yields.

Conclusion

Investors approach the market with different strategies. Our strategy is one that focuses on the income. We aren't the only ones in the market to focus on income, but we need to recognize that a large portion of investors don't. As a result, the market often doesn't respond the way our biases might expect.

In my experience, very few investors are willing to be patient. They are judging their portfolio results on a daily, weekly, or monthly basis. When they buy a stock, they aren't looking for something that will outperform over years, they are looking for something that will outperform this month. As a result, they are tied to the news, trying to decipher how the market might respond to rate cuts.

Well, the Fed is going to cut rates, and these companies benefit from rate cuts. So I'll buy them. But wait, everyone in the market knows those companies will benefit from rate cuts, they are going to be overbought because everyone knows they benefit and everyone knows rates will be cut. So I'm going to short those stocks when rates are cut! But wait, everyone knows that everyone knows rates will be cut and will be buying these stocks, so everyone should be selling these stocks and they will be oversold. I'll buy them! But wait, everyone knows, that everyone knows, that everyone knows...

Everyone in the market is trying to be a little bit smarter and one step ahead of everyone else. Is it buy the rumor, sell the news? Or sell the rumor, buy the news? It varies. Everyone is trying to do the opposite of what everyone else is doing, but if everyone does the opposite, suddenly the opposite is what everyone is doing.

It's a hard game to play, and many try. At HDI, with the Income Method, it is a game we don't play. We buy and hold stocks that pay us good income. We buy the stocks that achieve our goals, and let the market worry about chasing the gyrations.