The Fed Is Playing Jenga With The Economy

The Fed Is Playing Jenga With The Economy

Oil Prices Rising, What That Means For Inflation

A combination of geopolitical factors have caused oil prices to rebound strongly in the past 3-4 months. What does this mean for inflation and the economy?

Oil has a direct and indirect impact on inflation.

The direct impact is obvious, oil prices contribute to the cost of gasoline. For consumers, the price of gasoline is a big deal. When people complain about inflation, more often than not, the current price of gasoline is brought up as an example. This is in part because it is a commonly recurring expense and also likely because gas prices are plastered across large signs around the country. The high visibility of gas prices on a daily basis makes changes more noticeable than other products.

Indirectly, petroleum and petroleum by-products are key ingredients for a very large number of products and packaging. You would be hard-pressed to find any product that doesn't use oil or byproducts somewhere in its manufacturing process.

Yet the impact of oil on inflation measures like CPI is actually very weak. The correlation on CPI is only 0.27 (0 being not correlated at all and 1.00 being perfectly correlated) according to the St. Louis Fed. If you want to know whether or not inflation is high, oil prices alone are not a particularly helpful data point. The reason is that high oil prices put disinflationary pressure on other products.

Discretionary Spending

How does raising interest rates reduce inflation? Higher rates slow inflation by increasing the costs of everything, resulting in consumers having less money and, therefore, lower demand.

What happens when oil prices rise?

The costs for producers go up, encouraging them to raise prices, reduce other costs (like labor), or reduce production. Higher oil prices reduce profits; plus, consumers have less disposable income. While consumers might be able to reduce their gas use slightly, it typically is not an expense viewed as optional.

Folks will gripe about gas prices all day, but they aren't likely to stop driving. Unlike the government, consumers have a budget, and any deficit they are running will have to be addressed sooner rather than later. Any increase in expenses will result in less discretionary income, and that means they stop buying something else.

It isn't a coincidence that the past three recessions were preceded by a spike in oil prices. In a way, high oil prices serve a very similar function as a Fed rate hike by reducing demand for other products.

For inflation metrics, higher oil prices will increase prices for some categories while simultaneously decreasing demand and encouraging lower prices in other categories. Hence, the weak correlation.

Slowing Economy

The oil price spike was easily absorbed in 2022, and that was likely due to how strong the economy was booming through 2021 – wages were growing, consumers had excess cash, and companies were struggling to keep up with the demand.

Today, we are in a very different environment – wage growth is slowing, consumers are turning to debt, and most companies have caught up with demand. There is no longer a significant cushion to absorb higher costs in consumer or corporate budgets. If oil prices continue to spike and reach prior highs, it could become the catalyst that sparks a recession.

The Tale Of Two Markets

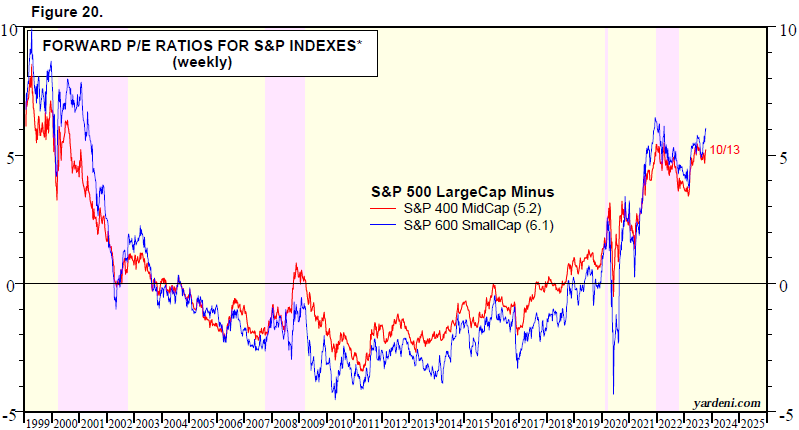

The stock market continues to be bifurcated, with large-cap and mega-cap stocks continuing to trade at very high P/E levels, while small and mid-cap companies trade at low P/E levels. The difference between large-cap valuations and small/mid-cap valuations is the largest it has been since before the Dot-com bust. Here is a look at the average large-cap P/E ratio, compared to the average mid and small-cap P/E ratios: Source

Yardeni Research

Twenty years ago, it didn't end well for those who overpaid, and I don't believe this time is different. For most of the past 20 years, small to mid-cap stocks carried a higher valuation than large-cap stocks.

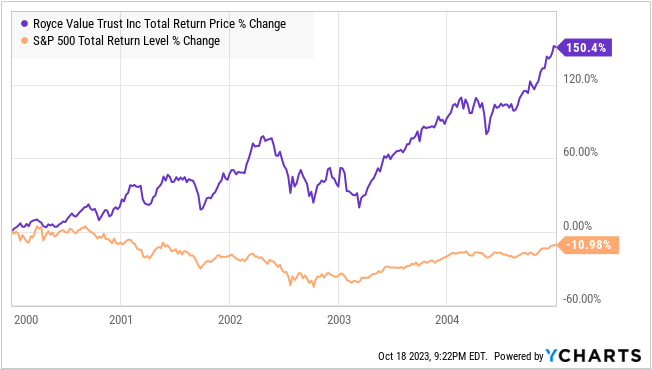

Small-cap stocks held up extremely well during the dot-com bust. For example, here is Royce Value Trust (RVT), a CEF (Closed-End Fund) in our portfolio that focuses on small-cap Value stocks from the start of the recession compared to the S&P 500:

It makes sense that large-cap stocks are becoming popular. Over the past two years, we've seen some of the more speculative Growth stocks collapse. Investors are looking for safety, and they conflate large with safety. Most of the people who were investing in startup electric car companies, bitcoin miners, and other innovative companies aren't likely to pile their money into telecom, utility, real estate, oil, or other companies that are typically "value" stocks. They are much more likely to try to make their portfolio "safer" by moving into the larger, more established companies in the sectors they already are fond of, such as Tesla (TSLA), Nvidia (NVDA), Amazon (AMZN), etc.

There remains a large segment of investors who first started managing their investments in 2020. Many of them might have seen great success with meme stocks, crypto, and the most speculative tech companies that surged into 2021. After seeing triple-digit returns in many stocks, the idea of collecting "only" a 10% dividend doesn't fit their expectations. More experienced investors know that the conditions of 2020/2021 were highly unusual, and the massive returns for someone who just started investing in April 2020 are not a realistic expectation for future averages.

Sometimes, the worst thing that can happen for a new investor is to have a lot of success on their first trades. It can create unrealistic expectations and lead to poor investment decisions in the future. In 2020/2021, it was clear that a very large portion of the market was not considering valuations when making a purchase. Now that the wind was knocked out of the sails of many speculative investments, these investors are moving to "safer" investments but are still failing to consider valuations.

Many Opportunities For Income

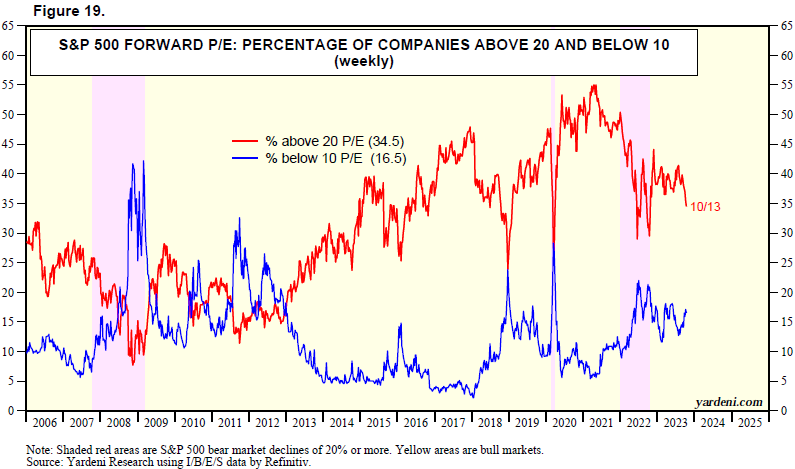

With investment money running to large caps, the number of companies trading at low valuations is relatively high. 17% of the market is trading at a P/E ratio below 10x, which is three times higher than what we saw in 2021.

At the same time, 34.5% of the market is trading above 20x P/E. In the current market, it is the middle that has become compressed.

As income investors, we target investments that are trading around 10x P/E. The higher the percentage of stocks that are trading below 10x, the more options we have when deciding where to invest.

Conclusion

Recessions aren't necessarily "caused" by one thing. The Dot-Com bust wasn't caused by only dot-com companies. The Great Financial Crisis wasn't caused by mortgages alone. The economy isn't that simplistic. There are always numerous factors at play, and a recession usually builds up over time. Then something happens that adds just a little bit too much strain, and it collapses.

It's like a game of Jenga – every piece removed makes the structure slightly weaker until one piece causes the whole structure to collapse. It isn't the "fault" of that last piece. If the last piece had been the first piece removed, the structure probably wouldn't have collapsed. It is the accumulation of all the pieces removed over time.

In the game of Jenga, we place the "blame" on the last player to remove a piece. In the economic history books, we also love to place the blame on the last piece, even though every recession is caused by numerous weak points.

We are starting to see conditions that indicate a recession might be near. What has been unclear is what the catalyst will be. The economy is getting precarious, valuations of large-cap companies are excessive, the burden of Fed rate hikes is starting to be felt throughout the economy, and now the price of oil is heading back up. A lot of pieces have been removed, and the structure hasn't collapsed yet, but it is definitely wavering.

At HDI, we will continue to protect ourselves by focusing on companies that are producing large amounts of cash flow and are trading at valuations that are well below average. As was the case for RVT during the Dot-Com bust, sometimes the investments that were the cheapest before a recession barely feel the impact of a recession at all. A large basket of quality dividend payers will continue to pay out reliable income through economic pressures.

We will stay focused on building up our income so when a recession happens, we will find ourselves well-positioned to take care of our personal budget and have surplus to take advantage of discounted equities in the financial markets. That is the beauty of income investing, and the essence of our Income Method.