Three Solid Picks For Monthly Income In Retirement

Three Solid Picks For Monthly Income In Retirement

Summary

- Income above and beyond your expenses is the symbol of financial health, whether in your working years, or in retirement

- You worked hard through your adult life, don’t let financial pressures affect the quality of your retirement

- Hop aboard the income train for a sustainable retirement powered by dividends, we have three quality picks to get you started.

During our working years, we take up a variety of careers to earn a living. The regular paycheck offsets the bills and other lifestyle expenses, and a little bonus once in a while lets us spring for those luxuries. And if we are diligent enough, a healthy portion gets stashed away for our older self, a retired self who has quit the rat race of climbing up the corporate ladder anymore.

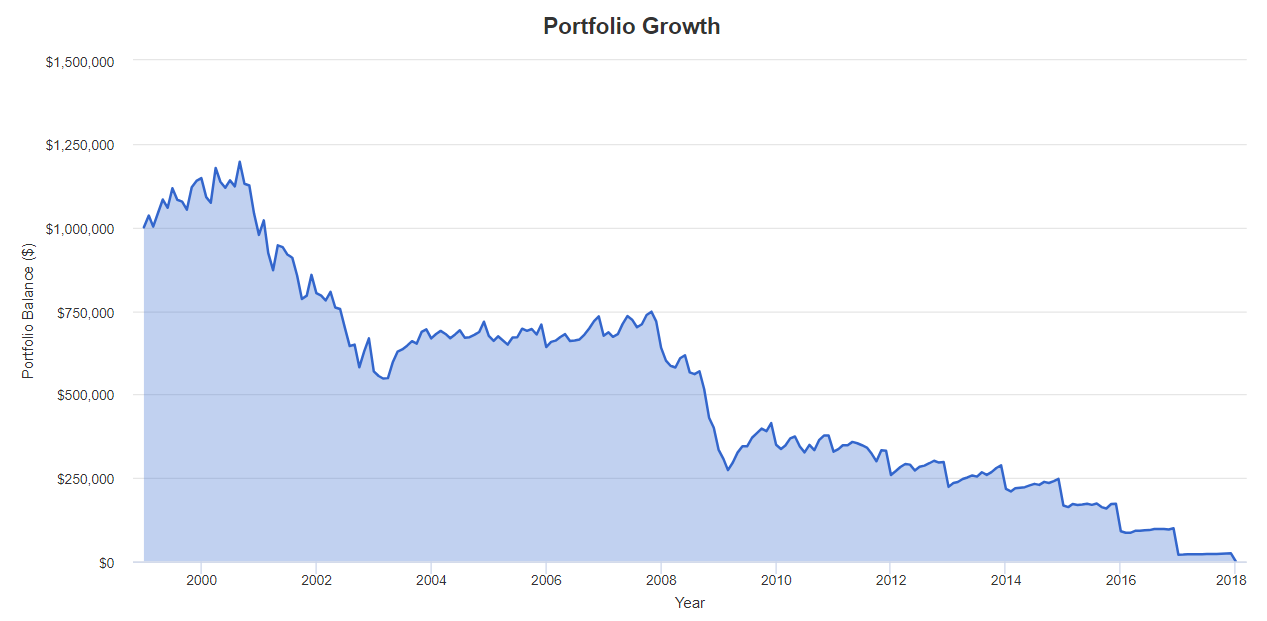

The size of the nest egg you build can vary greatly depending on your lifestyle, family commitments, level of skill, and career track. Whether you save $1 million or $10 million, its sufficiency depends on your lifestyle and commitments. Let us visualize a scenario where you retired at the age of 60 in 1999 with $1 million, invested it all in the S&P 500 index, and sold shares to withdraw an inflation adjusted amount starting at $55,000/year. Source

Portfolio Visualizer

Note: According to the U.S. Bureau of Labor Statistics, a household expense at the age of 65-74 years is $56,435 ($4,702 monthly).

Your portfolio has gone to zero in 18 years! New data from the CDC shows the average life expectancy in America to be approximately 77.5 years. In the above example, your portfolio is cutting it close, and if you were to live longer, or face the need to make higher withdrawals in any given year, you will run out of money in your golden years.

Why $1 million? Why not do the calculation with $2 million, or $3 million …? Valid question, but it is easier said than done for most individuals. This is why I prefer to measure sufficiency through passive income potential, rather than absolute net worth.

At High Dividend Investing, we pride ourselves on the Income Method, where we build a portfolio that keeps producing dividends and interest income. This way, we can live off the income, and keep the cash machine alive for our next of kin.

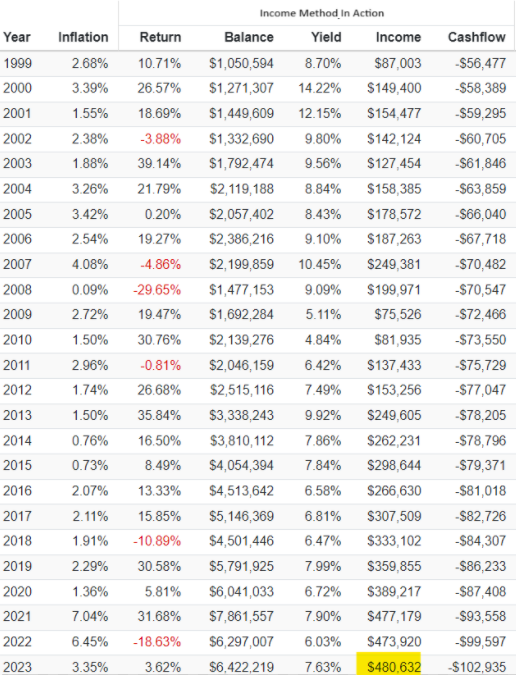

We did a similar simulation with a few of our portfolio holdings (that existed since 1999) such that the starting yield was around ~9%, as we typically target for our portfolio. As seen from the cash flows below, the annually generated portfolio income (through dividends) always adequately exceeded the withdrawals, even during the DOTCOM crash, the Great Financial Crisis, and the COVID-19 market crash. These holdings saw dividend cuts, and massive drawdowns. Yet, their combined potential helped maintain those cash flows. And in this simulation, as of December 2023, your portfolio would be worth over $6.4 million, generating over 400K in annual income!

Portfolio Visualizer

This is the power of income investing. We aim for quality high yields that will provide a lifestyle supporting income stream and leave enough to sustainably reinvest. This helps organic portfolio growth to combat inflation and support urgent income needs without damaging the well-oiled income machine.

Let us now quickly discuss three picks to generate monthly passive income.

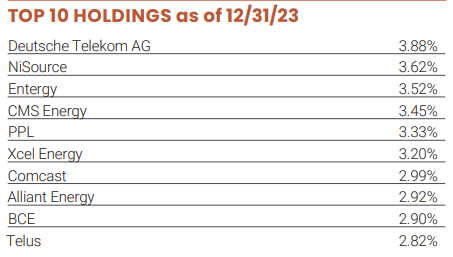

Pick #1: UTG - Yield 8.6%

Reaves Utility Income Fund (UTG) is a Closed-End Fund (‘CEF’) composed of 60 defensive companies in the utility, telecom, and associated infrastructure REITs. UTG was born in 2004 and has paid steadily growing distributions since its inception, through the pressures of the GFC and the COVID-19 market crashes. Source

December Fact Sheet

UTG pays $0.19/share every month, reflecting a healthy 8.6% annualized yield. You can grab this quality CEF at a modest 2% discount to NAV.

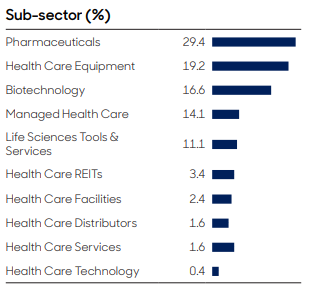

Pick #2: THQ - Yield 11%

Telka Capital Management and all its four CEFs were acquired by global asset manager Abrdn last year, and within months of the transition, management announced a whopping 60% raise to the monthly distributions of Tekla Healthcare Opportunities Fund (THQ). We expect the true potential of Tekla’s quality healthcare funds to be unleashed with the backing of Abrdn, who bring size and scale to the equation.

THQ maintains a healthy exposure to 118 healthcare firms, primarily U.S. based pharmaceutical, healthcare equipment, and biotechnology companies. Source

THQ Fact Sheet

Rising healthcare costs have consistently outpaced inflation in the past two decades, and the rapidly aging U.S. population is going to keep the trend alive. THQ trades at a bargain 10% discount to NAV presenting an excellent opportunity to snag this monthly paying CEF.

Pick #3: RQI - Yield 8.2%

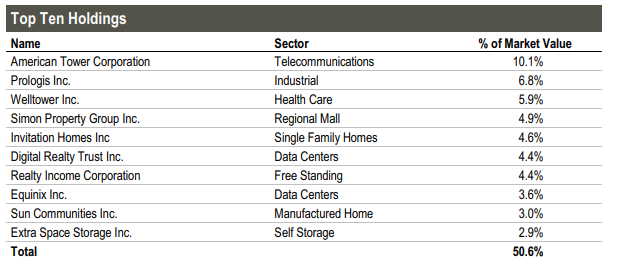

Cohen & Steers Quality Income Realty Fund (RQI) is a CEF with 191 holdings across primarily U.S.-based REIT equity and preferred securities. 50% of RQI’s assets are invested across 10 highest quality REITs in corporate America. Source

RQI Fact Sheet

RQI pays $0.08/month, reflecting an 8.2% annualized yield, and you can grab this CEF at an attractive 6% discount to NAV.

Conclusion

The above three picks provide a combined 9.2% yield. A $100,000 investment across these CEFs will generate ~$766/month. This passive income stream can significantly bolster your retirement finances. At High Dividend Investing, we maintain a portfolio of over 45 such quality dividend payers to enable a retirement of your dreams

Retirement should be about cherishing moments with loved ones and pursuing lifelong dreams, not fretting over financial uncertainties. That's why we advocate for the Income Method, a stress-free approach to financial independence. With this technique in your retirement, you can have your cake and eat it too. This is the beauty of the Income Method, the essence of income investing.