Two +9% Yields We Are Buying In April

Are you someone who considers themselves a long-term investor? While many of us do, it's important to recognize that the sentiment around a company and the coverage from analysts can sometimes cause us to second-guess our decisions.

It's not just about emotions either. Even the best-run companies can make unfavorable decisions, shift their strategies, or experience changes in leadership that may cause uncertainty. As investors, we must regularly evaluate our holdings and make decisions based on their performance and suitability for our needs.

Warren Buffett, has always stressed the importance of investing in businesses with staying power. His famous quote, "You should invest in a business that even a fool can run, because someday a fool will," highlights the importance of investing in companies with strong fundamentals that can weather any storm.

In this article, we will discuss two picks with over 9% yields that have structural protections to ensure they remain cash cows for the foreseeable future. Without further ado, let's take a closer look at these picks.

Pick #1: ARCC - Yield 10.9%

Ares Capital Coorporation (ARCC) is a Business development company (BDC). BDCs primarily invest in privately owned businesses based in the United States that are not easily accessible to individual investors. These companies often experience rapid growth, making them highly lucrative for investors. By purchasing ARCC, investors can benefit from this growth and enjoy its substantial yield.

ARCC that has been listed on the stock market before the Great Financial Crisis, which was a challenging period for small to medium-sized American enterprises. It has survived the Great Financial Crisis with a minimal dividend reduction, and increased it again soon after the recession. The dividend has been continuously growing since.

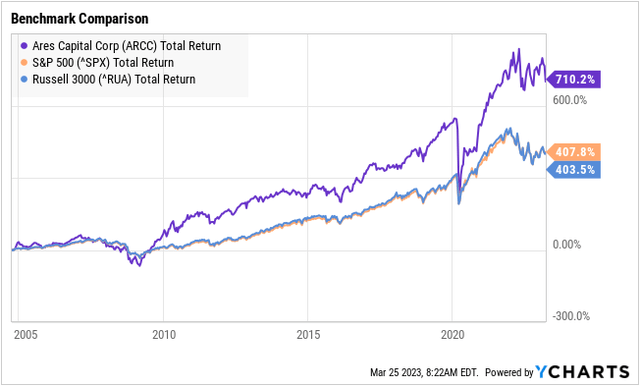

Moreover, ARCC has outperformed both the S&P500 and the Russell 3000 in total return since 2005, its initial year as a public corporation, and currently offers a dividend with a yield in double digits.

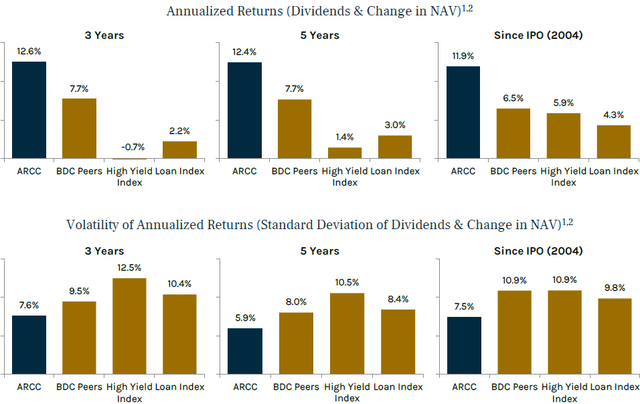

It is worth highlighting that ARCC has surpassed not only the S&P500 but also its BDC counterparts, high-yield bonds, and leveraged loans in terms of performance. This is thanks to a great management team that is conservative and highly skilled.

Pick #2: HQH - Yield 9.4%

In comparison to other high-income countries, the United States allocates a larger amount of funds towards healthcare. The industry's fundamentals remain robust, making it an ideal option for long-term investments.

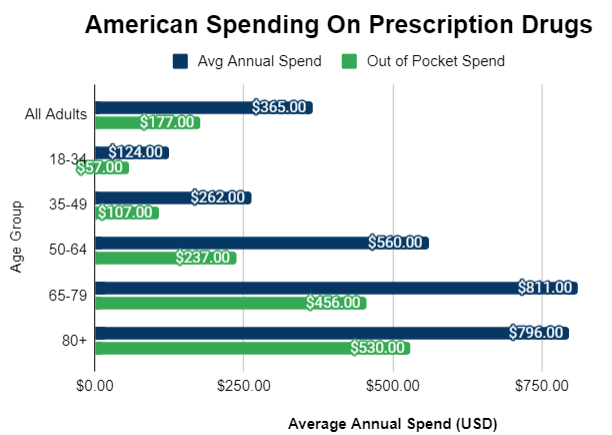

It is important to note that over 131 million individuals in the United States, accounting for 66% of all adults, use prescription drugs. Usage is particularly high among elderly individuals and those with chronic illnesses. However, it is worth noting that over 50% of these expenses are paid out-of-pocket.

The rapid aging of the American population emphasizes the growing importance of the healthcare industry. As more individuals in the US purchase prescription drugs each year, wouldn't you like to receive your share?

Importantly, this particular sector can serve as a defensive measure for investment portfolios during market instability. The demand for medication is relatively unaffected by changes in income, as individuals tend to prioritize their health needs over leisure expenses. This allows companies within the pharmaceutical industry to maintain their profitability during economic downturns. Additionally, t

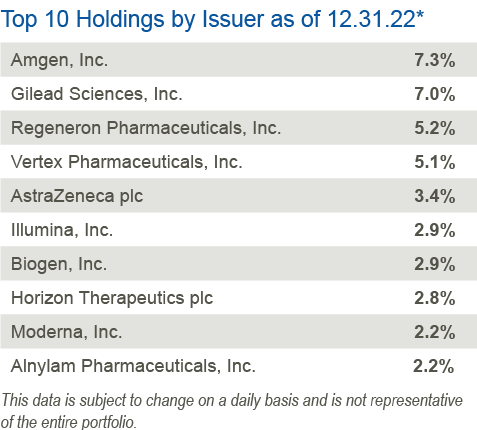

Tekla Healthcare Investors (HQH) HQH, a healthcare-centered CEF, holds a portfolio dominated by top-performing biotech and pharma enterprises, accounting for 77% of its investments.

.

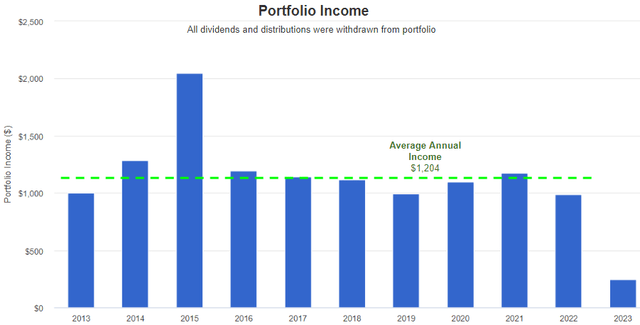

HQH has a strong diversification strategy, with a portfolio of 150 holdings, which positions investors favorably to capitalize on long-term industry trends. Furthermore, HQH's managed distribution policy allows the fund to make quarterly distributions at a rate of 2% of its net assets, although the exact amount may vary depending on market conditions. Despite this, HQH has consistently provided investors with dependable returns.

Looking back at the performance of the last decade, we observe an average yearly income growth of 12%.

HQH trades at a 13.3% discount to NAV, presenting an opportunity to add to your position. Management recently announced a share repurchase program allowing HQH to purchase up to 12% of its outstanding shares up to July 14, 2023.

With the CEF's distributions subject to change, our estimation of a distribution of $0.40 for May contributes to the calculation of a remarkable yield of 9.4%.

The U.S. healthcare industry has consistently had a strong demand regardless of market conditions. Tekla's HQH fund offers investors the opportunity to invest in healthcare with a focus on generating current income. The healthcare industry has good long-term potential and HQH is a sector-focused fund with discounted prices, offering yields up to 9.4%.

Conclusion

Decisions can be influenced by our emotions, causing us to stray from our goals. It's important to evaluate the fundamentals of our portfolio before taking action based on news. Our investment requirements should guide our decision-making to ensure consistency in dividend income, which is the most crucial factor for income investors. Dividend payments are determined by management quarterly or annually and can significantly impact us positively or negatively. As a result, it's necessary to monitor company performance and management priorities regularly, making most securities less appropriate for long-term holding. At 'High Dividend Investing,' we strive to purchase high-dividend stocks for our Model Portfolio, which currently includes 45 stocks for diversification purposes.

This article presents two great candidates for a high recurrent income from among these high-quality dividend payers. They offer yields of up to approximately 9%. Buying into these investments and holding them in the long run can help you refocus on your long-term objectives. They also make a great addition to a retirement portfolio!