Verizon: Rotation On The Horizon?

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

If you were a bull, 2020 to 2024 were not kind years to the VZ chart. There can be many reasons assigned to the drop, which ended up shaving more than 50% off the stock from its high. Some may claim rotation out of slower growing issues into the hyper-froth that was tech stocks. While it remains to be seen just yet if that prior growth can be achieved once again, we want to focus on VZ at this juncture. Why?

From the low struck in late 2023 at the $30 level, we have one of the higher probability setups that we find in our work. We’ll discuss that structure as well as the parameters going forward for the VZ chart. We also want to share with you this gem. Zac Mannes and Garrett Patten have compiled an extensive list of stocks that are showing favorable setups even in the face of this current broader market decline. That list (click here) can be found in StockWaves and it contains 22 names that have the potential to strike all-time highs even as the majority of other issues decline.

Might this be a massive rotation between sectors and money flows? There really is no way to know. However, what we can zero in on is the structure of price and what it is telling us at the moment. First, let’s just enter a brief discussion regarding emotions. How will this be helpful for our analysis? Note what Avi Gilburt wrote regarding this topic.

Are Your Emotions Being Manipulated?

Avi recently shared this article with the readership:

“Sentiment Speaks: Investors – Not Markets – Are Being Manipulated”

Highly recommended reading for any that wish to better understand how markets truly work. Here is a fascinating comment from that article:

“Markets will often extend well beyond reasonable expectations, with investors buying into a narrative as to why such valuations are justified, even though the buying is being driven by emotion rather than reason.

As Franklin once noted:

"So convenient a thing it is to be a reasonable creature, since it enables one to find or to make a reason for everything one has a mind to do.”

So, at the end of the day, while you may believe you are buying and selling based on your reason, you may want to reconsider that perspective and recognize just how much your decision-making is being driven by emotion. And, when you are able to rise above your emotions, then you move into an elite class of investors that will not be caught looking the wrong way at the major turns in the market.

I will conclude this missive with the wise words of Bernard Baruch, an exceptionally successful American financier and stock market speculator who lived from 1870- 1965:

"All economic movements, by their very nature, are motivated by crowd psychology. Without due recognition of crowd-thinking ... our theories of economics leave much to be desired. ... It has always seemed to me that the periodic madness which afflicts mankind must reflect some deeply rooted trait in human nature - a trait akin to the force that motivates the migration of birds or the rush of lemmings to the sea ... It is a force wholly impalpable ... yet, knowledge of it is necessary to right judgments on passing events.” - Avi Gilburt

Observe And Track But Don't Participate

So, what are we saying then? As an investor, you can benefit from emotions. If you are able to observe what is happening in the marketplace and yet not be overtaken by the emotion of the moment, it will help you remain clear minded and make better decisions. What if you are seemingly caught by surprise, such as what happened over the prior 4 years in VZ stock? It’s plausible to assume that some investors caved and sold out long-held positions, perhaps even near the bottom of the last decline. Well, let’s briefly talk about that.

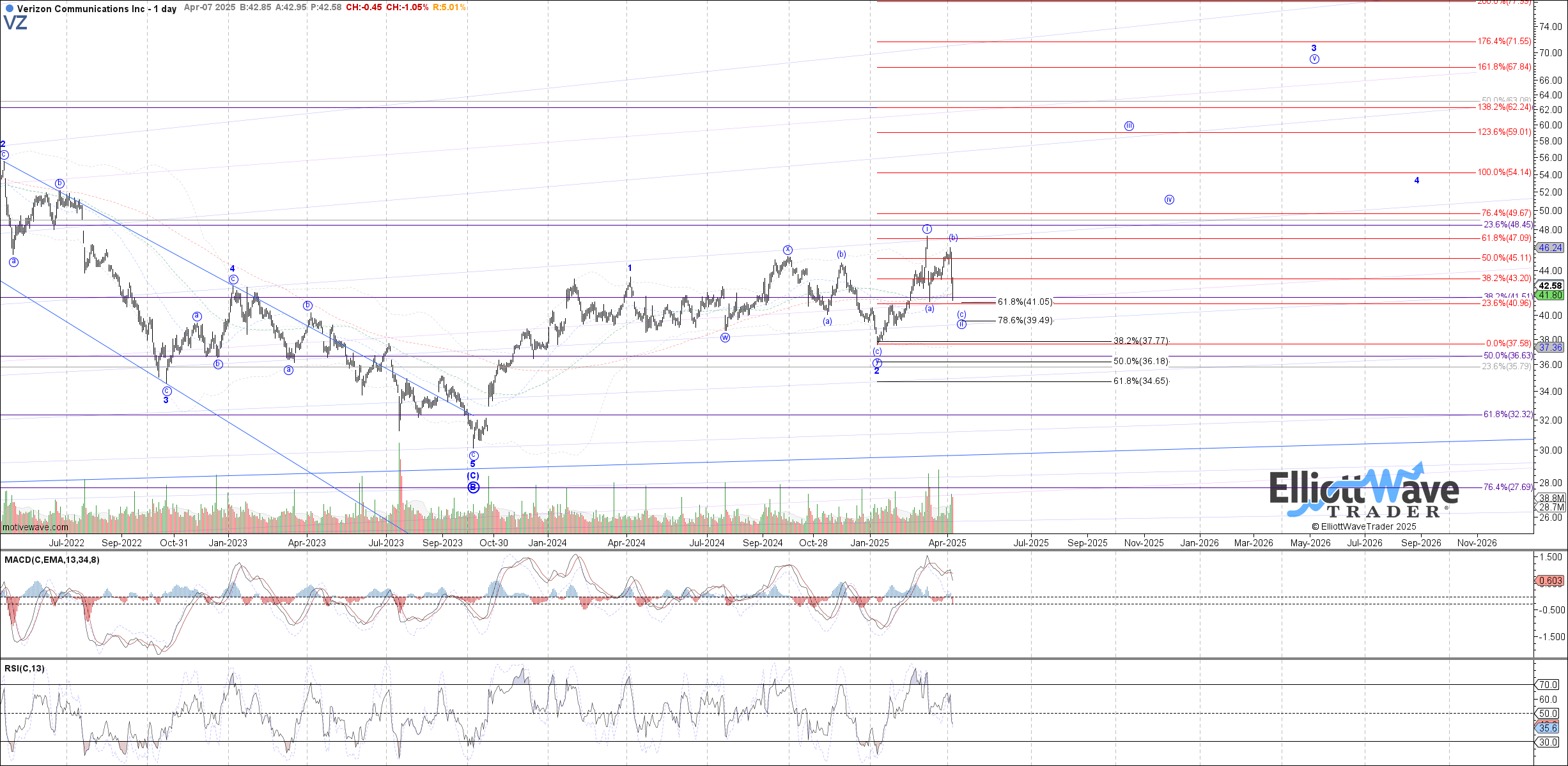

When we are able to identify a clear 5 wave rally followed by a 3 wave decline, it gives us specific parameters to guide a trade. This is what we are seeing in VZ at the moment. The 5 wave rally structure up from a major low is the signal via sentiment telling us that it is more probable a larger rally is to follow. And the risk to reward would be the typical projections overhead versus the low struck at the start of the rally. Here we have this scenario illustrated for us by Zac and Garrett.

Sentiment Illustrated

You can readily see that both of our lead analysts are showing the 5 wave rally structure up from the $30 low. What’s more, it also appears that the next lesser degree wave circle ‘i’ and wave ‘ii’ are nearly complete. This would suggest that the impending rally would reach the 1.236 - 1.382 extension of the wave 1-2 projection at the $58 area. Price may even stretch to the 1.618 extension in wave 3 at $69.

Where might this scenario need adjustment or even be invalidated? If price moves below $37 then the lesser degree wave circle ‘i’ - ‘ii’ is no longer in play. You can see that Zac has his alternate scenario in yellow as a wider wave (2). That more protracted pullback may see the $36 area.

However, the primary scenario seen by both analysts is that price holds in the $40-41 region and begins the larger rally projected on their charts. Keep in mind that the dividend is also approaching a 7% yield at these levels.

Conclusion

You may be skeptical. And that's OK. Even skeptics can become successful beneficiaries of this methodology. I would venture to say that many of our near 9,000 current members were at one time such skeptics. What caused the shift in their opinion? They saw with their own eyes the power and utility of Elliott Wave Theory when correctly practiced. When you see this in real-time, it truly is a sight to behold.

(Disclosure: I/we may initiate long positions over the next 72 hours in VZ stock according to the parameters set forth in this article.)