Where Fundamentals Meet Technicals: Emerging Markets

This issue of Where Fundamentals Meets Technicals takes a look at emerging markets.

The technical analysts thus far have somewhat divergent views on them, and the fundamentals have a lot of variables to analyze as well, which makes it very difficult.

Avi occasionally posts a weekly chart for the iShares MSCI Emerging Markets ETF (EEM), and it is one of the only indices that he has a positive view on:

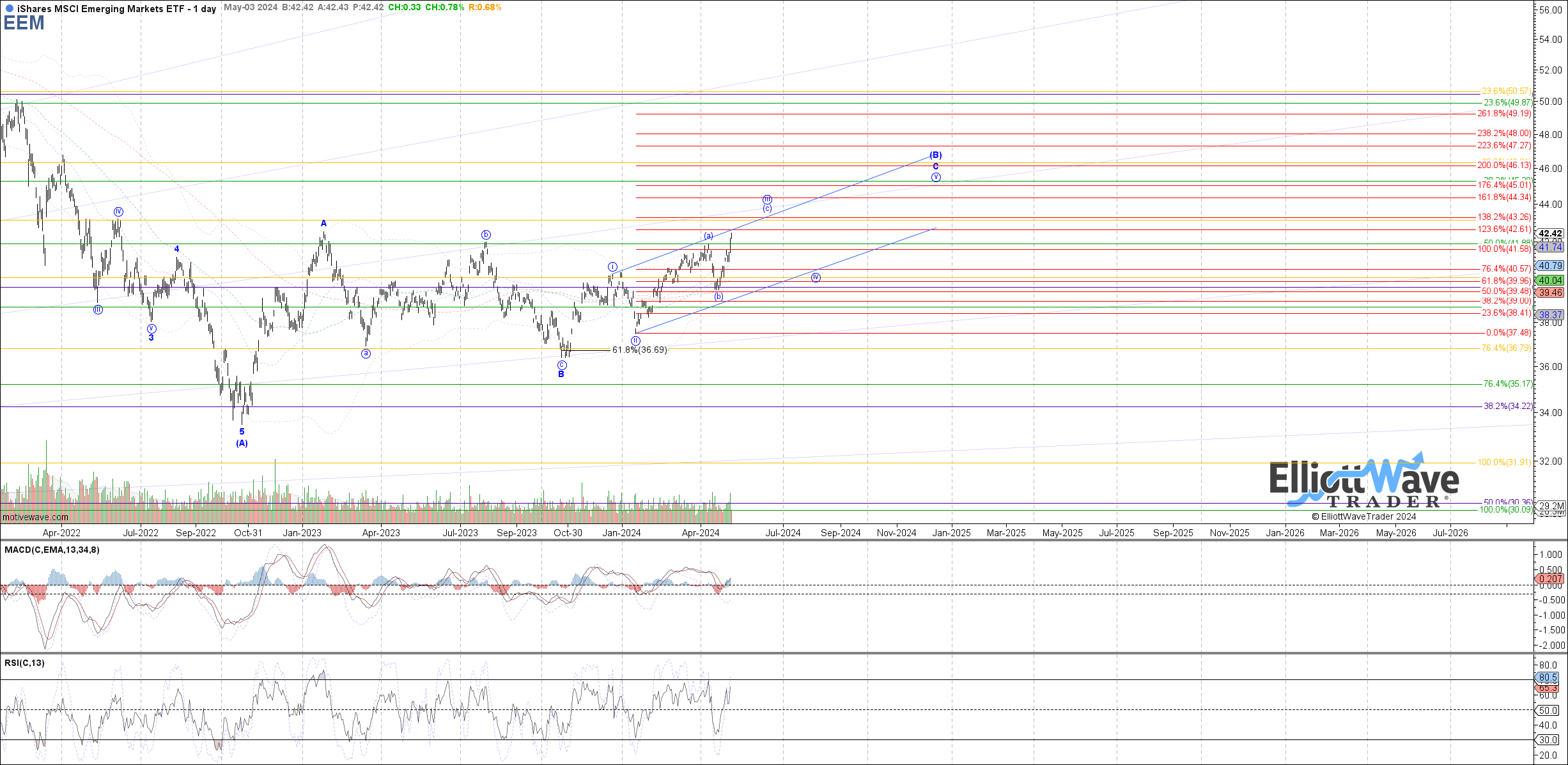

Garrett posted a daily chart of EEM, and sees some favorability for a while longer as well:

Zac has significant concerns around an EEM top here in 2024 followed by further bear market activity:

My base case is that the bottom is in, and my long-term view from a fundamental perspective is bullish. But there are some caveats that could change that view toward more bearish scenarios, which I’ll cover here as well.

The Bullish Case

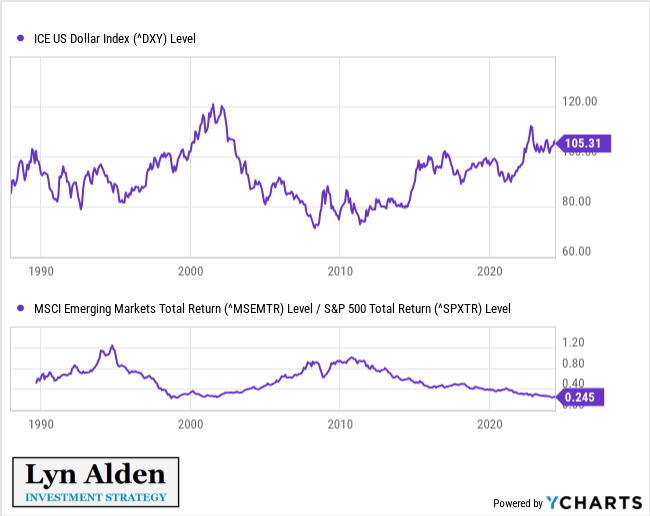

The biggest fundamental correlation with emerging market performance over the past four decades is the dollar index relative to foreign currencies.

This is because emerging markets in general have a lot of dollar-denominated debt. When the dollar index rises, it puts pressure on their debt levels relative to their cash flows and contributes to significant tightness or outright financial crises. When the dollar index weakens, it eases the debt burden of emerging markets relative to their cash flows and generally allows a credit boom to form.

As a result, during structural strong-dollar periods, emerging market stocks tend to underperform U.S. stocks. During structural weak-dollar periods, emerging market stocks tend to outperform U.S. stocks. The following chart shows that correlation, although it goes back longer than just this period shown:

In the current strong dollar period, sentiment on emerging markets is low, and after a long bear market most portfolios have little exposure to emerging market assets. Geopolitical issues are further worsening that.

However, Levi and other technical analysts generally see a weaker dollar in the years ahead:

I also view the dollar top as likely being in from a fundamental perspective, and am more neutral or bearish on the dollar going forward. Global liquidity indicators bottomed in October 2022, have been somewhat rangebound since, and I expect them to probably break out in 2025.

Overall, my base case is to expect stronger emerging market performance over the next several years than they have seen over the past several years. However, it’s worth examining the failure mode for that base case. What could go wrong?

The Bearish Case

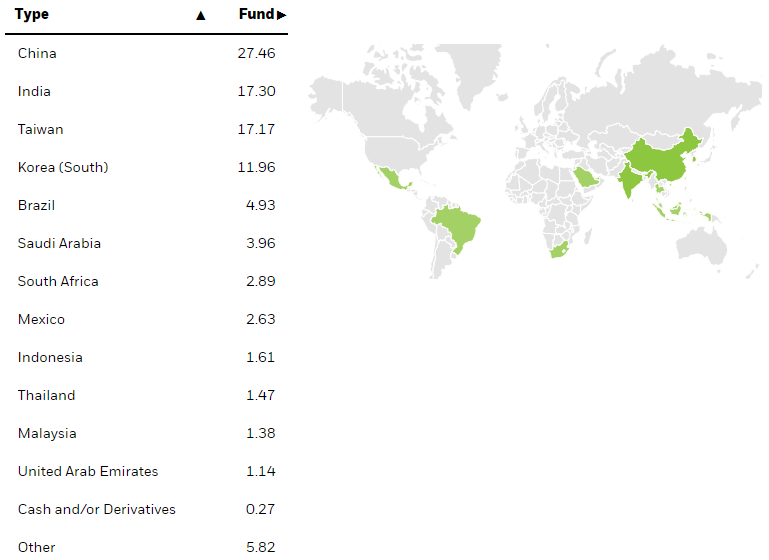

The majority of emerging market exposure is in Asia. Americans could wake up to problematic geopolitical headlines between China and Taiwan at any time this decade, and have their Chinese asset exposure taken from them, like what happened with Russian investments in 2022.

In that scenario, Zac’s bearish scenario would be fully on the table. There are other tail risks that could result in such a scenario as well. So cautious position sizing is important.

Threading the Needle

Latin American equities have rather little weighting in the overall emerging markets index. However, Zac's purple scenario is one of the options for them:

In my recent deep dive reports, I have covered Latin American equities, and I tend to have a bullish view on them in aggregate from current levels.

The attractive aspect about Latin American equities is that they provide fundamental emerging markets exposure, but without the geopolitical risks associated with China and Taiwan. Latin American equities have their own risks of course, mainly including domestic populist politics and spikes in the dollar index, but geopolitical risks are much less.

So, one way of gaining emerging market exposure without having too much China and Taiwan concentration, is to overweight the Latin American segment by owning ILF or various emerging market stocks and ETFs along with broader emerging market exposure. That’s my approach.