Where Fundamentals Meet Technicals: ITUB

It's been more challenging to find alignments between fundamentals and technicals lately.

Fundamentals on many equities broadly point sideways with a big range of uncertainty due to us being in a headline driven market. Many sentiment/technical indicators point down.

One of the rare bright spots is Itau Unibanco. Garrett has a positive chart on it:

The chart points to a likely possibility of near-term consolidation, which makes sense given how quickly it has moved here in 2025.

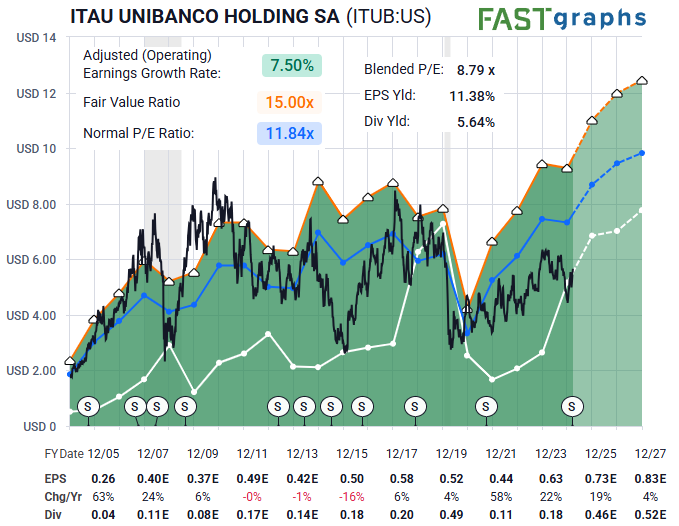

Here's the FAST Graph:

It's important to note that in addition to price action, Itau does pay large dividends, which factor heavily into its total return potential.

One of the biggest issues facing Brazil lately is their loose fiscal policy, which has threatened their currency. It has been a rather out-of-consensus place to invest. However, from a fundamental perspective I view their banking sector as more stable than consensus believes.

A big factor for the investment outcome is the dollar index. Emerging markets have a flywheel relationship with the dollar. Many of them have substantial levels of dollar-denominated debt relative to their cashflows.

When global investors pour money into the United States, it strengthens the dollar, squeezes emerging markets in a fundamental sense as their liabilities strengthen vs their cash flows, which then puts more pressure on them and makes them look even more uninvestable, leading toward more fund flows to the United States which exacerbates the issue. This positive dollar cycle can persist for a while.

When it eventually exhausts itself with extreme sentiment for major policy shifts, the same dynamic can benefit the other side. A weaker dollar actively improves the fundamentals of several emerging markets, which entices more fund flows to them, which weakens the dollar further around the margins, creating a flywheel in the other direction.

It is perhaps too early to say if that flywheel has shifted after so many years of favoring the United States, but in terms of both sentiment and fundamentals, the Brazilian financial sector including Itau is interesting.