Where Fundamentals Meet Technicals: OXY and XOM

This issue of Where Fundamentals Meet Technicals re-iterates my bullish view on energy names.

As I sit here typing this piece in Cairo, I can unfortunately report that Egypt faces daily rolling power outages, which are caused primarily by natural gas shortages. The grid operators spare my neighborhood from them, but most neighborhoods throughout Egypt are facing recurring scheduled power outages as the limited power generators can only power so many of them at once.

Egypt produces lots of gas domestically and also imports gas from Israel, but the total amount is increasingly insufficient for Egypt in the summer months when air conditioning demand is at its highest. They are turning to LNG imports, but there is limited capacity for that in the near term.

This anecdote is one of many, since it’s a common occurrence throughout the developing world. But it underscores how important energy is. There is vast demand for energy throughout emerging markets, and in the long run I expect that their total usage will go up considerably.

In particular, when the dollar index puts in more of a local top, and the Fed begins a rate-cutting cycle, it should alleviate the USD-denominated debt burdens of a number of emerging and frontier markets, and lighten up their liquidity situation enough to active more energy demand.

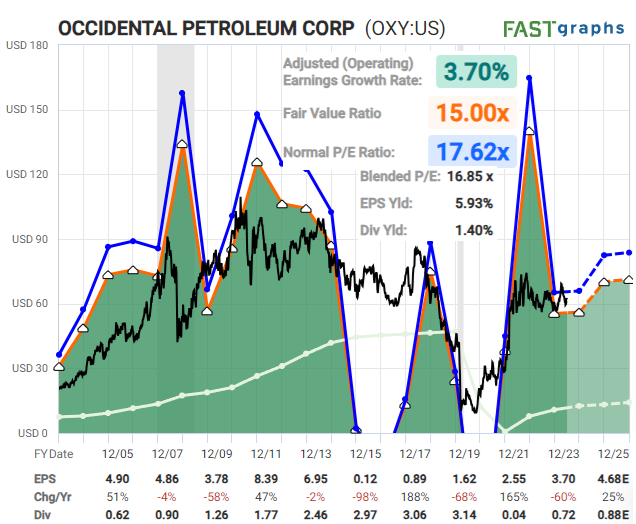

Occidental Petroleum

Occidental Petroleum (OXY) has been a Buffett darling for a while; Berkshire (BRK.B) just keeps eating it up and now owns over a quarter of the company. It’s a potential acquisition target in the long run.

Zac recently wrote about the stock (and sector):

“It is not like I ENJOY making things diagonals... (well maybe a bissel)

But we are in a larger diagonal for most of the energy names off 2020 lows so this (5) is an ABC. And thus inside the subwaves of the it is not at all abnormal for some of those moves to be diagonals themselves.

The move off the low could be i-ii of (i) of circle here on OXY but it is a bit large for that give the expected size for (i)... it is too small to reliably be a nest (i)-(ii)-i-ii of an impulse for circle c also.

But an a-b and micro 1-2 of c in blue for (i) of an ED would fit very well based on expected circle c-wave Fib PinBall.”

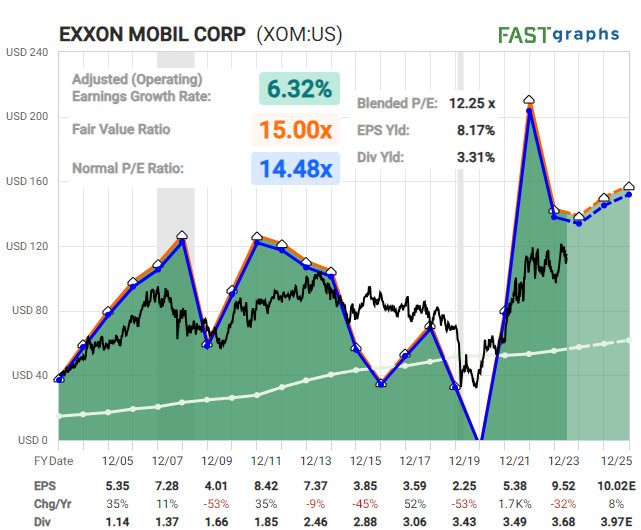

Exxon Mobil

Exxon Mobil (XOM) and other large integrated energy majors have been my preferred way to play the energy sector. They are inexpensive, they are very profitable at current oil prices, and they have strong balance sheets.

I view the 2014-2020 period as a major bottom for the oil market. Zero interest rates and the subsequent willingness of investors to fund unprofitable companies helped accelerate the shale revolution, and all of that new oil disrupted global supply/demand balances for oil. But now companies need to be more profitable and self-financing, and the global supply/demand situation for oil incorporates this new shale oil.

Going forward, I expect oil to be flat-to-up, and I expect to see a lot of profitability from the oil sector. In other words, I think there’s a pretty strong floor under oil companies. With their ability to spin off reliable dividends from free cash flows and fortress balance sheets, at these valuations I view them to be like volatile bonds with built-in inflation protection and an option for much higher potential.

Zac sees a potential move from $115 to $165 over the next year. I don’t have any firm view on that, but the way I see the risk/reward situation is that I think the bear case is rather stagnant and rangebound, and the bull case includes some rather large price appreciations of this scale.