Where Fundamentals Meet Technicals: TGT, KWEB, VALE

A number of beaten-down stocks have shown some evidence of forming powerful base levels from which to rally from. This issue of Where Fundamentals Meet Technicals compiles three of such cases.

Target

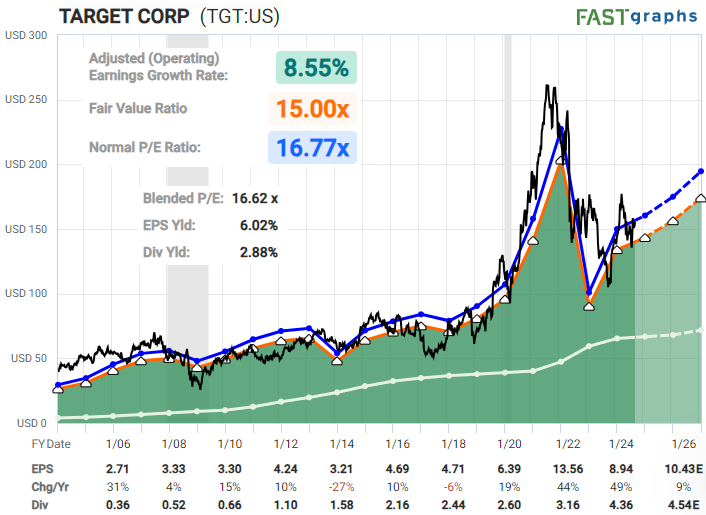

The combined superstore and grocery store concept continues to hold up well in the current market environment, and Target (TGT) might offer the best value in the group at the moment.

The favored stock in the space is Costco (COST), which is trading at over 56x earnings. That’s a higher earnings multiple than Nvidia (NVDA).

Walmart (WMT) meanwhile is trading at a rather rich 34x earnings.

Target (TGT) in comparison is trading at under 17x earnings. It doesn’t have the economy of scale of the other two, but as a major runner-up in the all-in-one store concept, it’s reasonably priced.

Zac has a solid technical setup for it as well:

From a risk management perspective, I really want to see the stock remain above its August 2024 lows of around $133. If it were to break down through that level, I’d be more concerned about a longer-term consolidation.

Chinese Tech

Today, China announced significant stimulus efforts, aimed mainly at consumers and stocks.

One of the themes I’ve written about in many of my recent deep dive reports, is that China’s economy, real estate market, and equity market are likely pretty close to the pain point where central leaders want to stimulate. And they have a lot of levers to pull when they reach that point.

For example in my report from a week and a half ago, I wrote:

This has direct relevance for Chinese equity market performance. Their stocks in aggregate are currently unusually cheap relative to their fundamentals, but are fraught with tail risk that international investors don’t have the appetite for. But even for investors that don’t want to invest in China directly, the state of China’s economy and the performance of their real estate and equity markets have all sorts of butterfly-effect implications for the global economy.

I view China as the #1 variable to watch regarding global macro cycles, even more-so than the U.S. Federal Reserve. Whether the Fed cuts 25 basis points or 50 basis points is somewhat meaningful, but how long China’s leaders consider the cost/benefit analysis of remaining in a malaise of deleveraging versus performing a pivot and stimulating out of it, is likely more important.

[…]

However, timing is important, and so as long as China continues its economic malaise, we shouldn’t expect much strength out of commodities or global growth. And the pain point to watch is the broad Chinese sentiment that shifts the central authority’s cost/benefit analysis in the more bullish direction. If they fail to reach certain growth targets, and if a growing percentage of people don’t feel that their lives are better off than 3-5 years ago, then we would likely see more of a pivot.

With this announcement of Chinese stimulus, stocks and commodities are up sharply. Some of that move may unwind a bit, but I think it increases the odds that the bottom is in for many of these assets. It’s less about this specific stimulus announcement, and more about the pattern that’s starting to build. China’s leaders consider this current area the red zone, and knowing where their red zone is can be quite helpful from a risk/reward standpoint over the next few years.

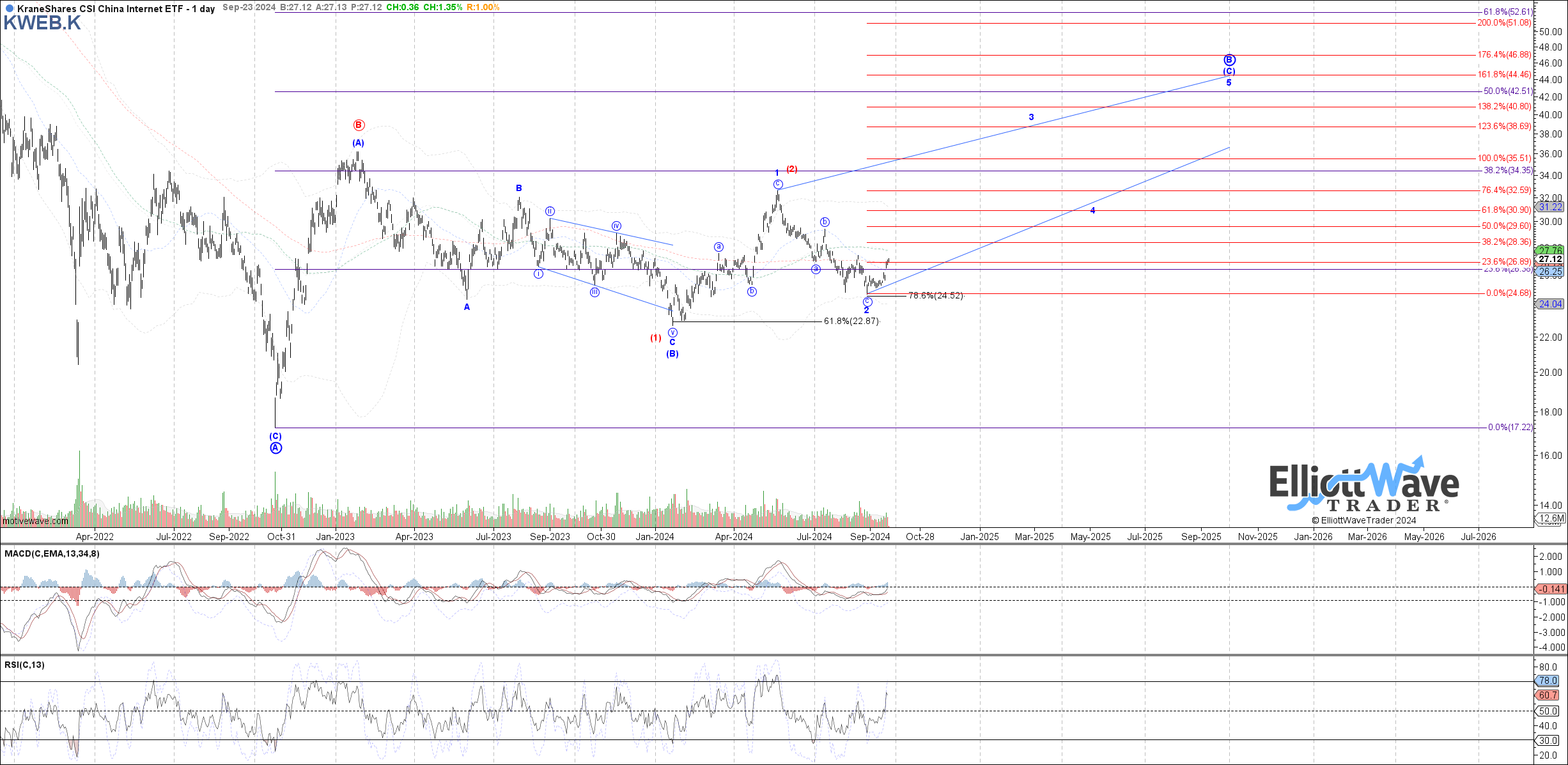

Garrett has a bullish setup in place for the popular KraneShares CSI Chinese Internet ETF (KWEB) as long as the August low holds:

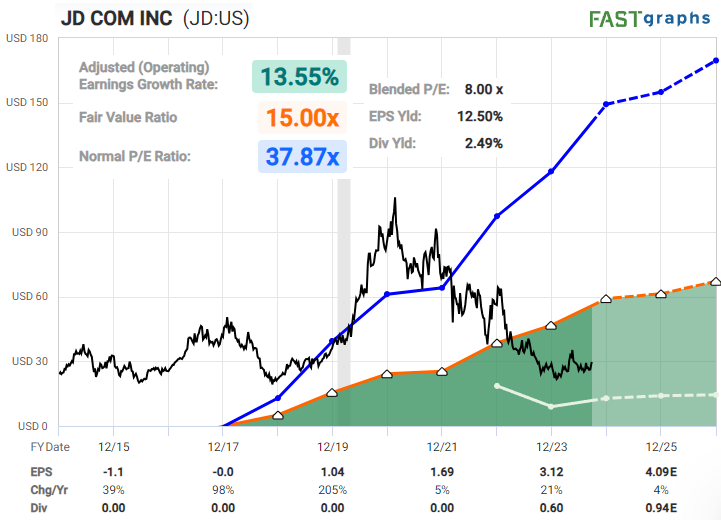

If we look at some of the top five stocks in KWEB, a lot of them are super cheap. JD.com (JD) comes to mind in particular:

While I would exercise caution, I think a solid bull setup is in place for Chinese stocks as long as their August lows hold.

Vale

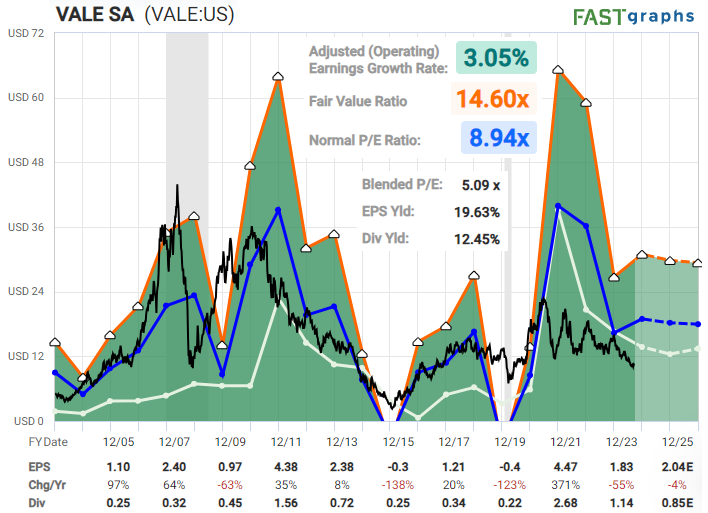

Commodities got a bit of a boost from China’s announced stimulus. While I think the bottom will likely be somewhat of a process, the total return prospects for companies like Vale (VALE) inclusive of dividends are substantial:

Zac has a bullish setup in place technically:

Again, these recent lows in August and September can help us put a bit of a floor in place. If the stock were to break back below those levels, we’d likely want to reconsider the timing of our bullish setups.