Where Fundamentals Meet Technicals: The Energy Sector

Lately, the beaten-down energy sector has been telling us some interesting things. Nobody seems to want to touch it.

Sovereign funds are divesting from it. Pension funds want out. Investors ESG mandates wish to avoid it. Jim Cramer has referred to it as uninvestable. Valuations are at multi-decade lows. Tesla (TSLA) aims to eat their lunch. And it’s a political hot point with an election coming up.

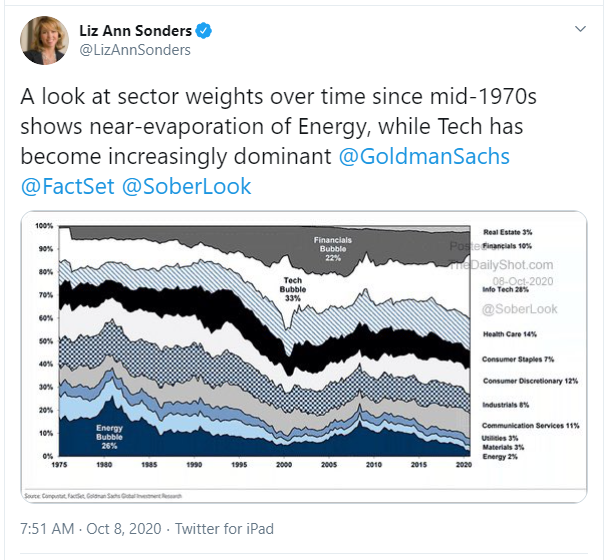

For the U.S. stock market, the energy sector is now at its lowest weight in modern history:

Source: Liz Sonders, Charles Schwab Chief Investment Strategist

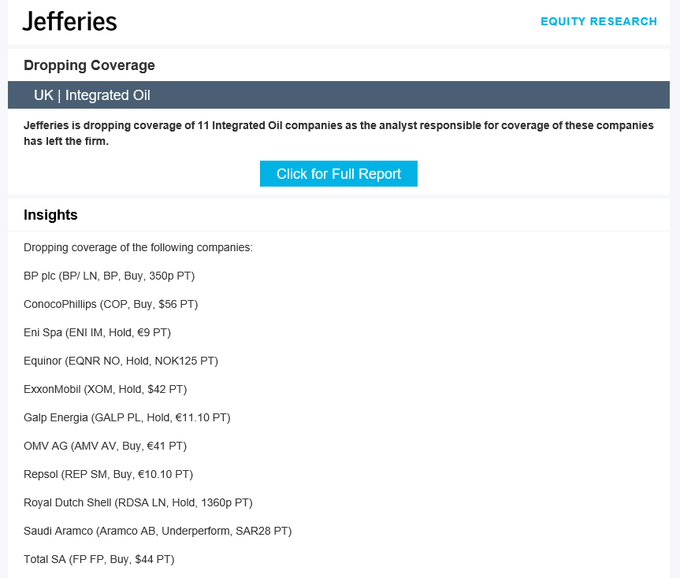

Jefferies apparently finds energy majors no longer worth covering:

Image Source: Jefferies Equity Research, via Tavi Costa of Crescat Capital

The energy sector looks a lot like the tobacco industry from 25-30 years ago. The narrative back then was that tobacco companies were in secular decline, and would therefore provide terrible returns. However, due to how cheap they were, and how they continued to do pretty well fundamentally, the tobacco industry ended up unintuitively beating the market over the next 2-3 decades through to the present day, due to high dividends, share buybacks, and long-term compounding of reinvesting that capital return.

Even as the oil and gas industry is no longer a growth story, with so much capex cuts happening, and a move towards industry consolidation, and an emphasis on cash flows and shareholder returns rather than unprofitable growth, there is plenty of potential in the sector for income investors and value investors (which, I know, are dirty words these days) at these bombed-out levels, if you focus on the top decile companies in terms of quality.

ESG is Good for Oil and Gas

The ESG investing movement is set to result in less investment in oil and gas companies. This, ironically, could benefit the industry over the next decade.

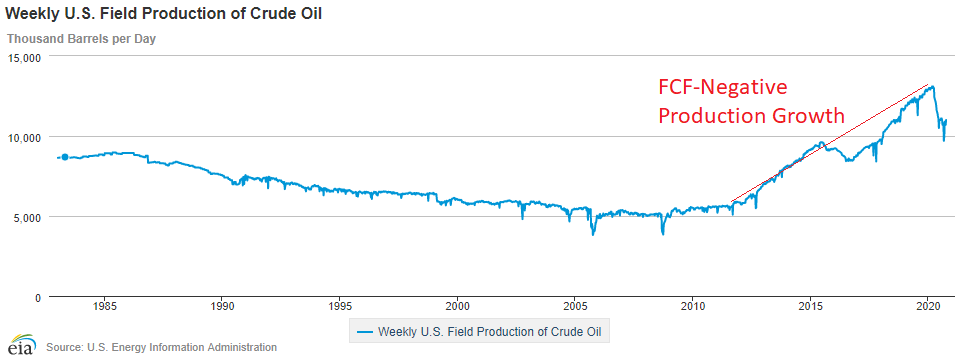

This past decade has been terrible for the global energy sector in large part due to the production growth from unprofitable U.S. shale oil and gas. With interest rates near zero and easy money freely available, investors poured money into financing shale oil and gas projects, and this growth in supply put the global supply/energy balance firmly into oversupplied territory.

Chart Source: EIA

However, the U.S. shale industry has been free cash flow negative most of the time. A handful of the lowest-cost and highest-quality producers have done okay, but the industry as a whole has been an unprofitable mess.

Institutional shale oil and gas investors have basically made an unintentional donation to global prosperity, by repeatedly investing in unprofitable oil and gas shale projects which have kept global energy prices low. Thanks to their relentless willingness to lose money, it has made the rest of us feel like we live in a post-scarcity resource world due to how cheap oil and gas have become. They have lit their capital on fire, and we thank them for their sacrifice.

However, that seems to be changing. With so much institutional money no longer desiring to invest in oil and gas for environmental reasons, and with retail investors having lost money in the poor-performing sector for well over a decade, and with everyone worried about the impact of electric vehicles and renewable energy on the sector, there’s not exactly a ton of capital interested in financing oil and gas projects anymore.

So, with the industry in oversupply, companies are slashing capital expenditures, emphasizing free cash flow and capital returns, and preparing for a low-growth future.

The Electric Age

One of the narratives right now is that electric vehicles will take over very quickly. Unfortunately, most of our electrical grid energy is produced from burning coal and gas, so the second narrative is that solar and wind production will quickly displace those energy sources, for a full renewable future.

And that’s true to some extent; even though it’s a tiny share of existing production, renewable energy is a rather large share of new energy production, especially in developed markets.

My background is in electrical engineering; I love renewable energy technologies and the benefits they bring. However, the renewable energy conversion process will likely take a while, especially in developing markets. There are still a lot of hurdles to overcome.

For centuries, the world has moved continually to more and more energy-dense sources (from wood, to coal, to oil, to nuclear) and now it’s trying to make a shift for the first time to a less energy dense source (solar and wind) for environmental reasons. Improving technology makes it more and more competitive over time, but it’s inherently hard.

The market already priced a lot of optimism in, though. Tesla’s market capitalization is already far larger than the entire North American midstream energy sector, meaning it’s much larger than all of the transportation and storage of oil and gas across the entire continent for domestic use and for global export, despite the fact that Tesla produces a small fraction of the revenue that the midstream sector does. In other words, the market is already pricing in a rapid replacement of existing energy sources for renewable energy sources and cars that run on them.

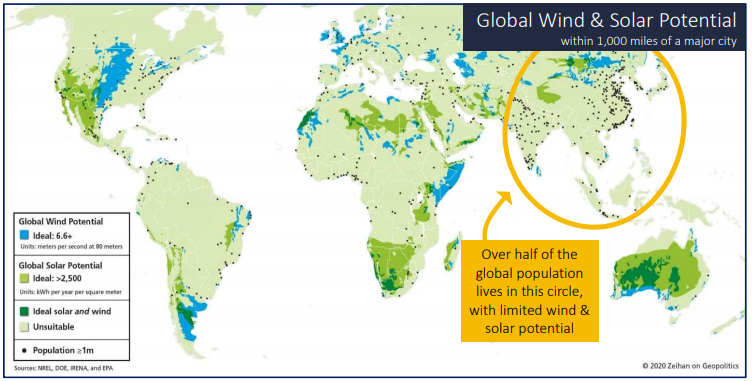

We tend to emphasize Europe and North America when discussing renewable energy, but a very large chunk of the world’s population lives in Asia, and they don’t have great geography for solar or wind energy production relative to the size of their population:

Chart Source: Zeihan on Geopolitics

So, they rely heavily on energy imports. In fact, many countries in Asia are still building new coal plants, let alone still growing their oil and gas imports. They still have plenty of capacity to build renewable energy and will do so, but even when they grow their wind and solar capacity by 10x, it’ll still just be a chunk of their energy needs.

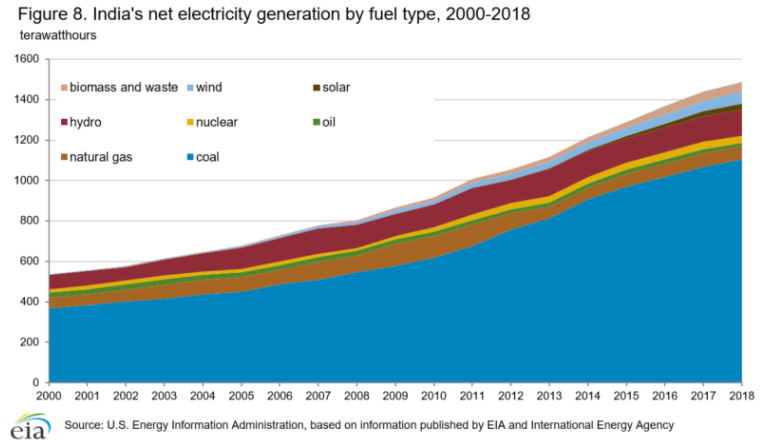

We’re having a public conversation about whether oil and gas have a future over the next 20 years, when their dirtier predecessor, coal, is still humming along in Asia with new plants being built. Here is India’s electrical grid production, for example:

Chart Source: EIA

That being said, oil and gas demand is likely to be somewhat weak going forward, as the world’s population growth slows, and as we build as much solar and wind capacity as we can in places where it is economical to do so, with electric vehicles indeed taking market share over time.

So, for those that want to dive down in the trenches and invest in oil and gas, it’s important to buy companies at low valuations, and that can sustain themselves even in a long consolidation period for the oil and gas industry with low commodity prices.

Emphasizing Quality

If oil and gas have a recovery bull market at some point due to a post-pandemic demand rebound combined with industry capex cuts that curtailed new supply, some of the worst companies can have the biggest percent gains, as they recover from being borderline insolvent to reasonably okay.

However, for optimal risk-adjusted returns over a full investing cycle, the highest-quality producers and transporters are generally better. With strong balance sheets, low production costs, and/or good transportation infrastructure, they have the capability to survive the bear markets as weaker companies die out, and can even make some cheap acquisitions when the sector gets bombed out like that, so that they are around to enjoy the recovery.

Therefore, I tend to emphasize risk-adjusted returns, and thus the highest-quality companies. And I like to diversify into the midstream sector rather than just exploration and production.

So, for example, I like Enterprise Products Partners (EPD) in the natural gas liquids transport space, Lukoil (LUKOY) in the oil production space, and if I have to go with a shale oil and gas producer, it would be EOG Resources (EOG). Despite the risks, I’m pretty bullish on all three of them with a multi-year view, and I further diversify away from single-producer exposure with ETFs, such as the iShares Global Energy ETF (IXC) which I’m bullish on down here as well.

I’ve been lukewarm on energy for the past couple years, neither avoiding it nor overweighting it. However, down here, I like a slight overweight energy sector position, but with an emphasis on quality.

I could be wrong of course, but I like the asymmetry of potential outcomes from down here, within the context of a diversified portfolio. My emphasis is on companies that can make money and pay dividends with oil below $40, companies with low debt, and companies that emphasize transport, especially for non-vehicle energy.

I also like to diversify jurisdiction risk by owning major producers from different regions, so for example if the United States seeks to reduce oil and gas production for political/environmental reasons, I like owning some foreign producers in addition to my U.S. midstream picks.

Enterprise Products Partners

Enterprise Products Partners is one of the largest and best-managed midstream companies. Rather than focusing on oil, they emphasize transporting natural gas liquids, as well as petrochemicals, natural gas, and yes, some crude oil. A significant chunk of their future transport volume is expected to be exported to Asia through their export infrastructure, as they continue to import more energy. A lot of what EPD transports is used for the production of chemicals, additives, plastics, cooking fuel, and grid energy, rather than vehicle energy.

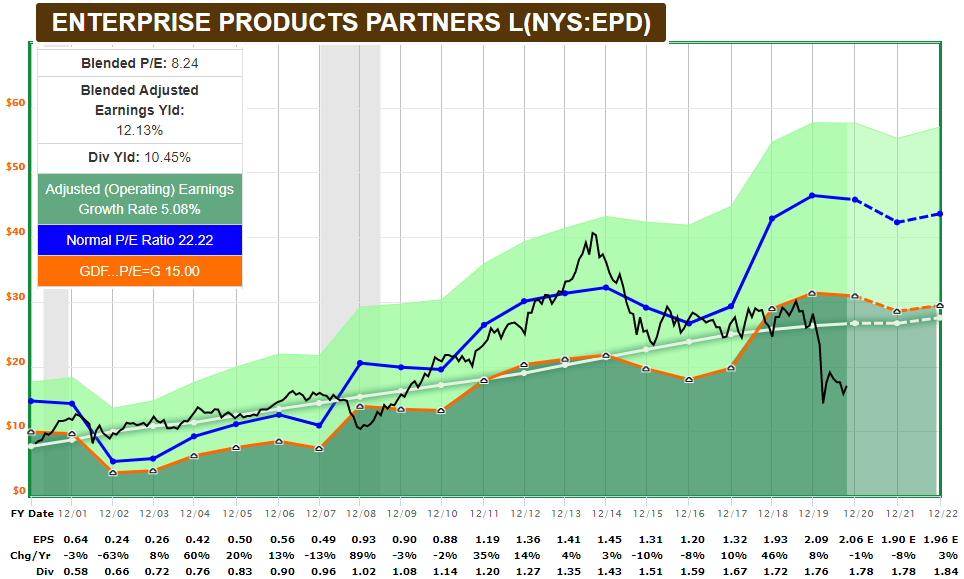

They have 21 years of consecutive annual distribution growth, and currently have 1.6x distribution coverage, which is higher most industry peers and higher than their historical average. They have among the least leverage and highest credit ratings in the midstream sector, and insiders own a third of the partnership.

I used to be moderately bullish on EPD, which admittedly hasn’t worked out well in the past, but given the recent price decline to extraordinarily low valuation levels, I’m more bullish now. The fundamentals have performed roughly as expected, but the valuation has become a bargain.

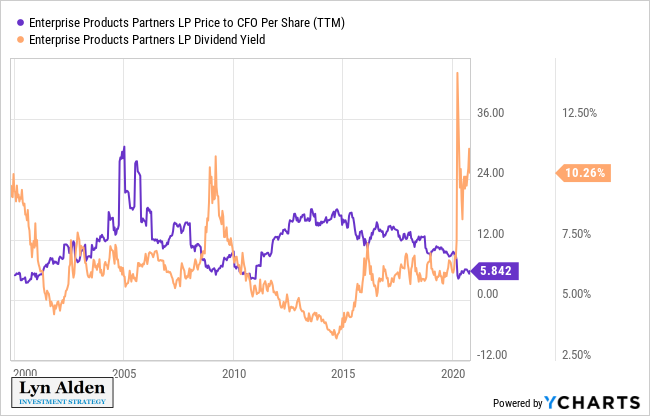

Here’s EPD price to cash flow ratio (below 6x) and distribution yield (over 10%):

Zac Mannes’ technical work sees EPD potentially having bottomed, but still having the prospect for a final low in the $14’s, before potentially moving up to the $20’s or $30’s:

A break over $18 would heighten the probability that the low is in, otherwise it could easily meander down here for a while and go lower first.

I personally have no idea where it will bottom or where it will go in the next year, but at current valuations, I like it for a 3-5 year hold or more. The upside appears to outweigh the downside. I’m bullish at current prices.

In light of the current environment, they are cutting capex spending to return more capital to unitholders, and they are priced in such a way that even if their network volumes never increase, they should be able to support their distribution and provide decent returns over time through capital return.

EOG Resources

EOG Resources is historically one of the shale producers with the lowest-cost production profile.

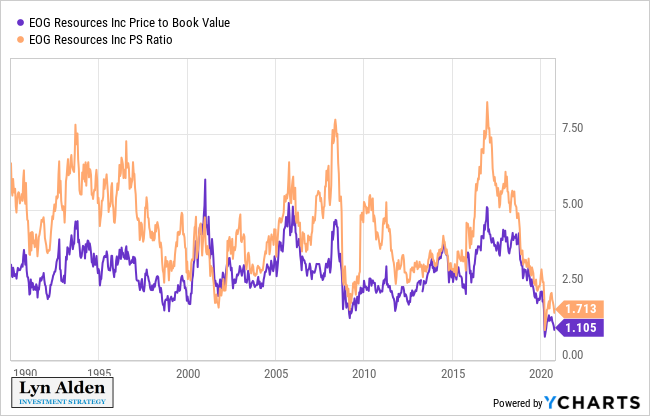

Their price/sales and price/book are at multi-decade lows, as investors rationally question what their assets are still worth in this environment:

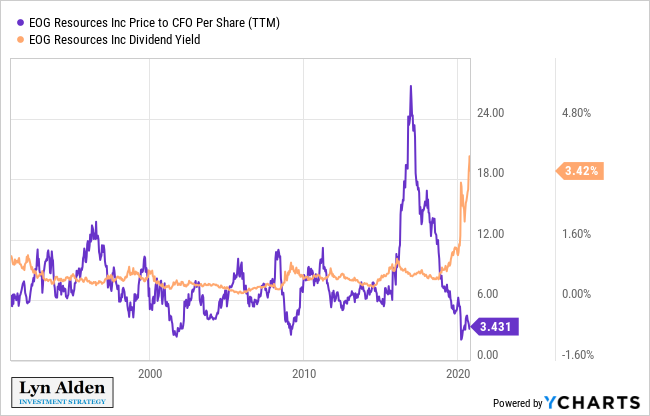

Their price to operating cash flow ratio is at historic lows, and their dividend yield, while not very high, is at its highest yield in history, and is reasonably well-supported even in a low oil price environment:

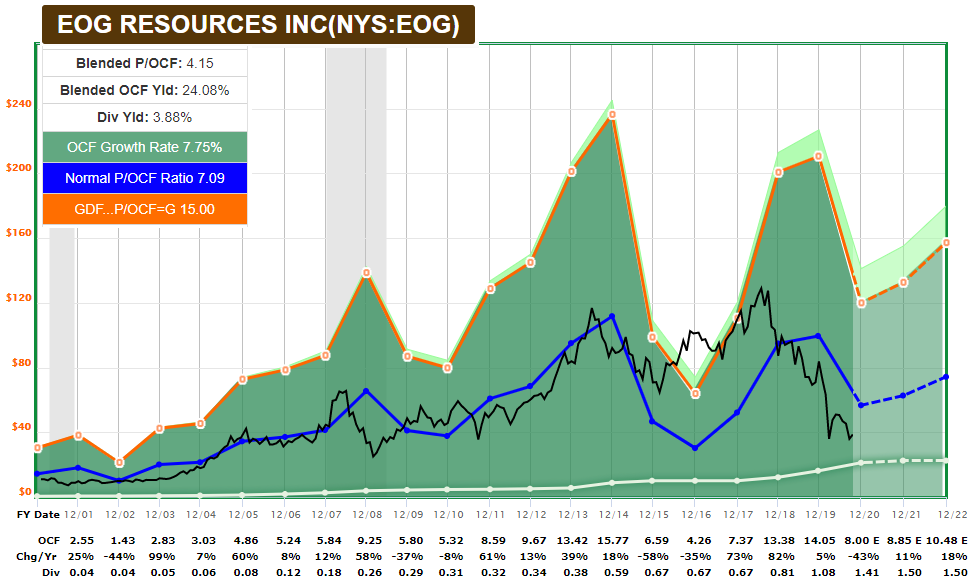

Here’s their F.A.S.T. graph:

EOG, due to their use of technology, strong investment-grade balance sheet, and disciplined capital allocation track record, has the capacity to grind through a long period of weak energy prices and outlast most of its North American competitors.

Zac sees a potential technical bottom in place, although a price into the $40’s would help confirm it:

Whether this recent low was the bottom or not, I’m interested in it with a multi-year view at these levels, as a small position.

A big tail risk for them, however, would be if a new administration bans or limits production on federal lands. Small position sizing can manage that risk within the context of a portfolio, and such an outcome would benefit global energy producers as it limits the production of U.S. companies.

Lukoil

As I described, I personally wouldn’t want all of my energy exposure in the United States. Potential political pressure on the shale industry, for example, could take some U.S. supply off the market. It's not my base case, but it's a potential outcome. So, I like to own some of the highest-quality foreign producers as well.

It surprises a lot of people, but Lukoil of Russia is the best-performing major oil company in terms of total returns. Over the past 20 years, 10 years, 5 years, 3 years, and 1 year, they have outperformed Exxon Mobil (XOM), Chevron (CVX), Total (TOT), and Shell (RDS.B) by a sizable margin.

Some people don’t like the Russian jurisdiction for good reasons, but Lukoil is exceptionally well-run and is not a state-owned enterprise. Lukoil also happens to have among the lowest debt levels and lowest valuations in the oil major space, as well as some of the lowest production costs and longest reserve life.

Would I invest heavily in Russian companies? No. Would I invest some? Sure.

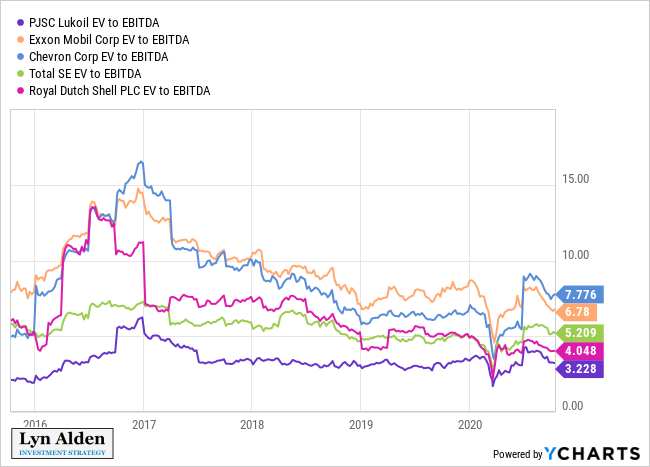

Here’s the EV/EBITDA ratio of some oil majors, with Lukoil remaining the cheapest despite their long-term outperformance:

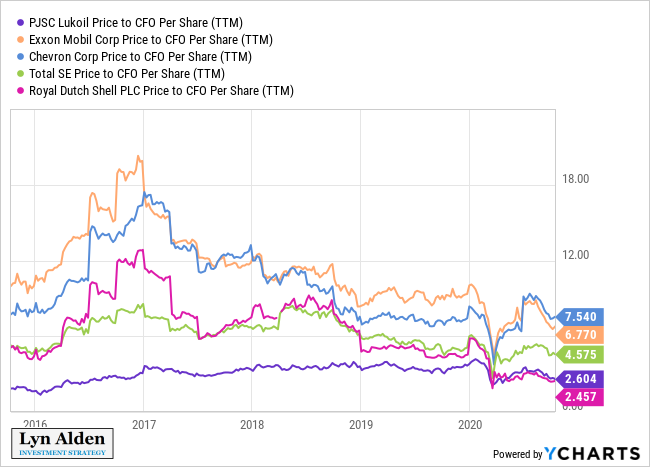

Here’s their price to operating cash flow ratios:

Down here, I think the potential upside outweighs the potential downside for the sector, when position sizing is managed well, when jurisdictional diversification is applied to reduce political tail risks, and when an investor emphasizes the top decile of quality in the sector.