Where Fundamentals Meet Technicals: WMT

This issue of Where Fundamentals Meets Technicals takes a look at Walmart, which has received a surge of interest over the past year.

Zac has a rather ominous long-term chart ahead for the stock:

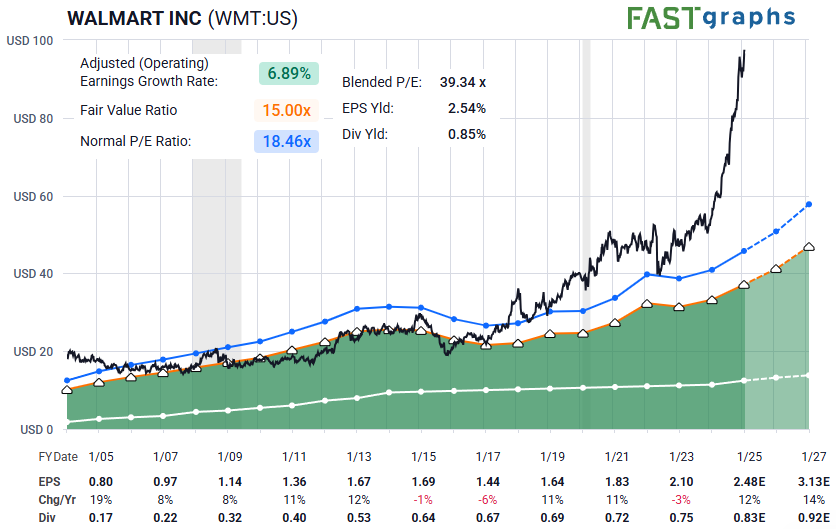

From a fundamentals perspective, the company is trading at almost 40x earnings. That’s normally what we see with a hot tech stock, not a 55-year-old discount retailer. It hasn’t been this expensive in a price/earnings sense since the late 1990s stock bubble, which was followed by a decade of bad returns.

The FAST Graph makes it look like they suddenly cured cancer or something:

To put that into perspective, Walmart is trading at a much higher price/earnings ratio than companies like Alphabet (GOOGL) that have faster earnings growth rates. It’s nearly as high of a price/earnings ratio as Nvidia (NVDA).

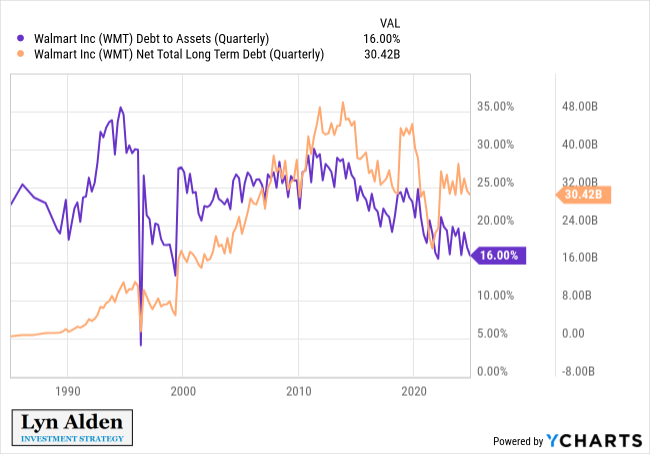

Walmart’s balance sheet is a fortress, much like other top stocks like Alphabet and Nvidia. They have an AA credit rating, and only $30 billion in net debt, which is about 18 months of net income and a small fraction of their $700+ billion market capitalization. Their debt-to-assets ratio is among the lowest it has been in a long time.

Overall, I’m rather bullish on Walmart as a company in terms of ongoing revenue and earnings growth, but quite concerned about their long-term stock price appreciation potential given how expensive the stock has become relative to fundamentals.