Where Fundamentals Meet Technicals: XOM, AMLP, AXP

This issue of Where Fundamentals Meet Technicals focuses on three value stocks.

The year 2022 was much better for value stocks than growth stocks in aggregate. And then, the year 2023 was weak for most value stocks while many growth stocks surged, especially the big mega-cap tech stocks. Some fundamental and technical indicators are pointing to 2024 being another year for value, although of course that will need monitoring to see if it starts to materialize or not.

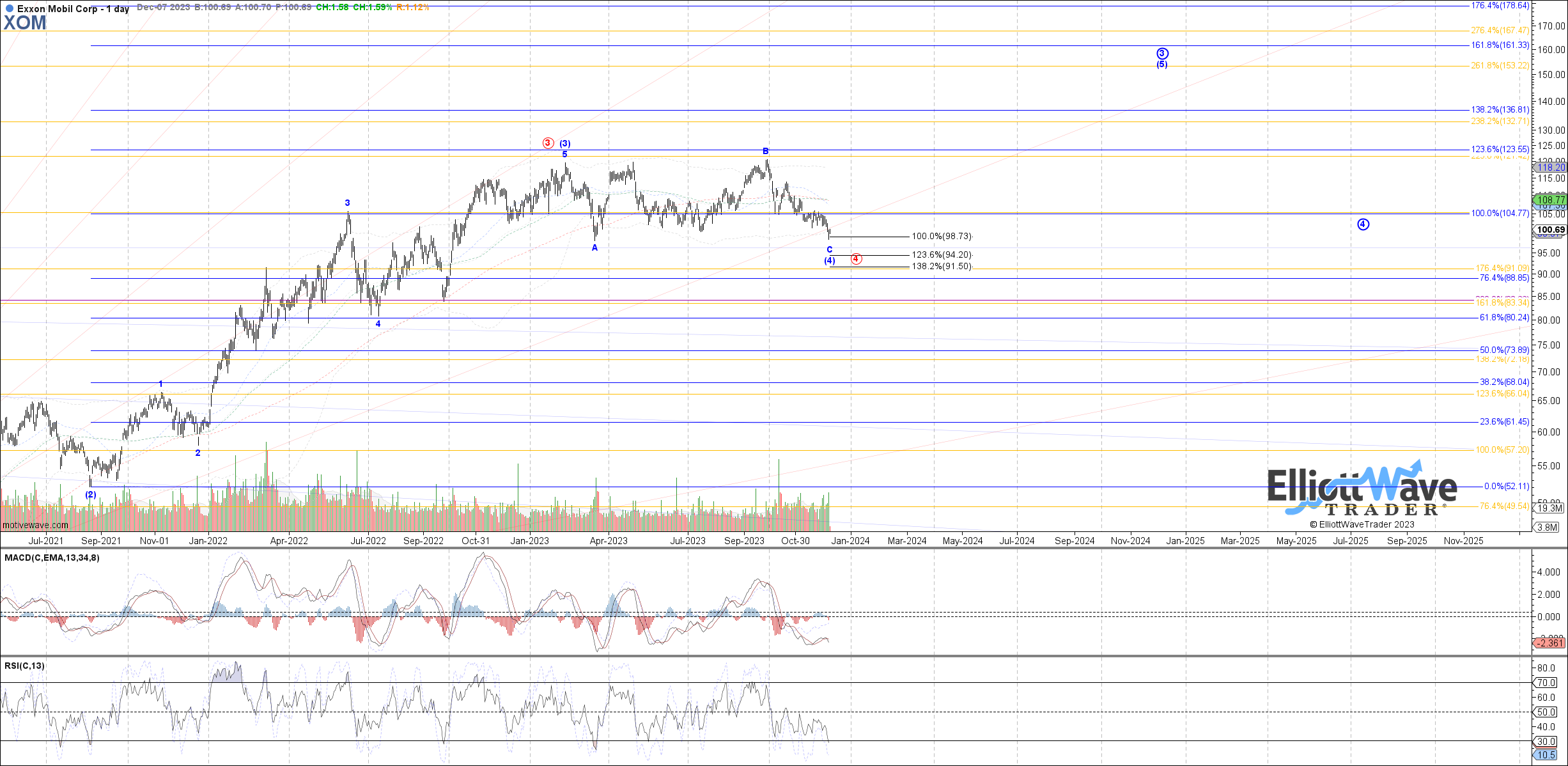

Exxon Mobil

China has very weak domestic consumption at the moment, but relatively strong manufacturing (mainly for exports). The United States is the opposite, with relatively strong domestic consumption fueled by fiscal deficits, but weak manufacturing. Europe currently has the short end of the stick, with weak domestic consumption and weak manufacturing.

All of this has been weighing on the price of oil, along with the global drawdown of oil inventories that has occurred. However, at these levels oil and oil stocks are becoming pretty active fundamentally and technically.

Garrett has a bullish 2024 technical chart for Exxon Mobile (XOM) but wrote, “Need price back above some of the Nov highs as evidence of a bottom”.

For fundamentals, you get a stock with a price/earnings ratio under 11x, with a fortress balance sheet and decades of consecutive annual dividend growth. They’re growing partly from acquisitions, which at this stage in the oil cycle are not that expensive to do.

While XOM might not be a “pound the table buy” yet, it pays to watch to see if it starts materializing a bit of a price recovery to trigger Garrett’s proposed bottom.

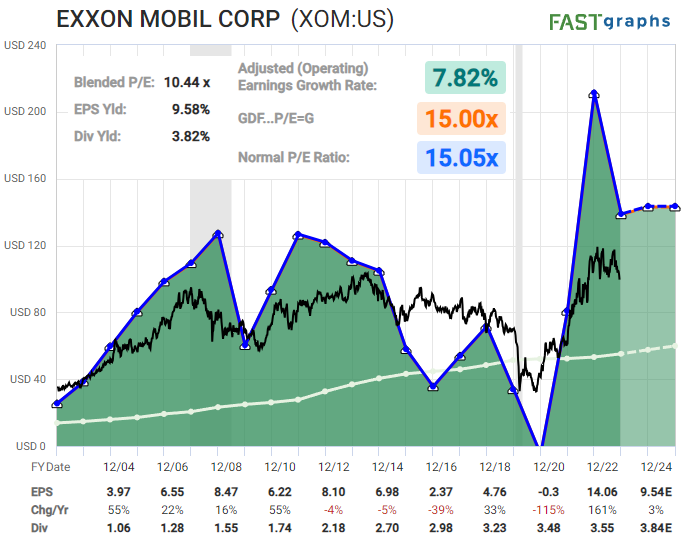

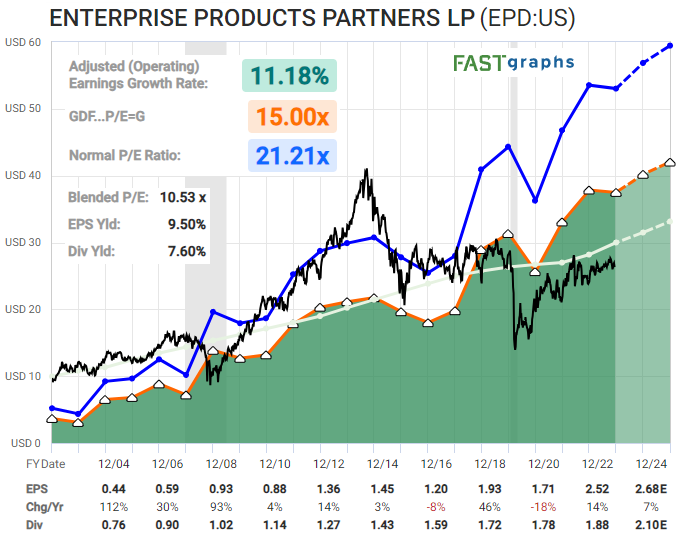

Enterprise Products Partners

Another way to play the energy sector is with energy midstream businesses. They are less sensitive to the price of oil and gas than producers, as long as they aren’t overleveraged and reliant on constantly issuing debt and equity as many of them were a decade ago. Many of them are self-funding now, meaning they can use the part of their income that does not get paid out in distributions to pay for their various moderate growth projects.

Enterprise Products Partners (EPD) offers a high yield that grows mildly over time with 25 years of consecutive annual growth. And they have the highest S&P credit rating within the midstream sector.

Although it’ll be volatile, Garrett’s technicals for the midstream ETF (AMLP) point toward an upward trend in the midstream sector for 2024, and it’ll pay you a high yield while it grinds along that potential path:

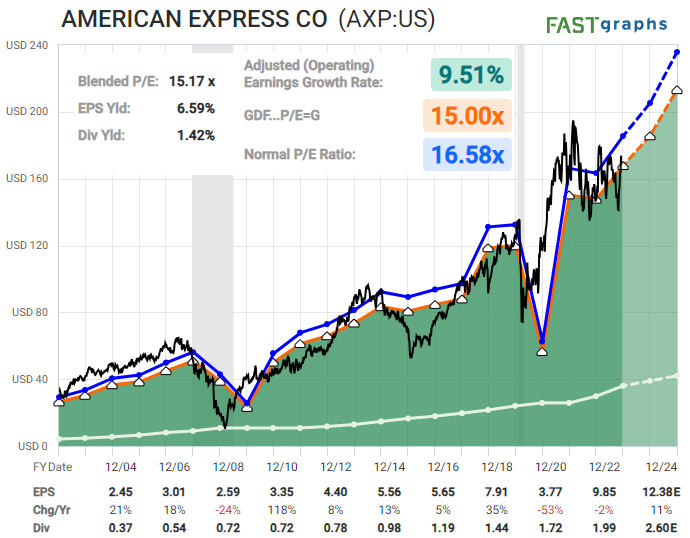

American Express

American Express (AXP) has consolidated for the past couple of years as stimulus has tapered off, but analysts expect stronger earnings in the years ahead.

The U.S. economy is bifurcated along fiscal/monetary lines at the moment. Sectors that are sensitive to interest rates are currently doing poorly, including commercial real estate, many small businesses, and so forth. On the other hand, investment-grade corporations with long-term fixed-rate bonds, and upper-middle class investors with long-term fixed-rate mortgages, are generally doing pretty well. This includes American Express’ primary clientele.

Garrett’s technicals point to a correction in AXP in the near-term, but a solid 2024 overall. Definitely one to watch.