Where’s Bitcoin Going In 2024?

Where’s Bitcoin going in 2024?

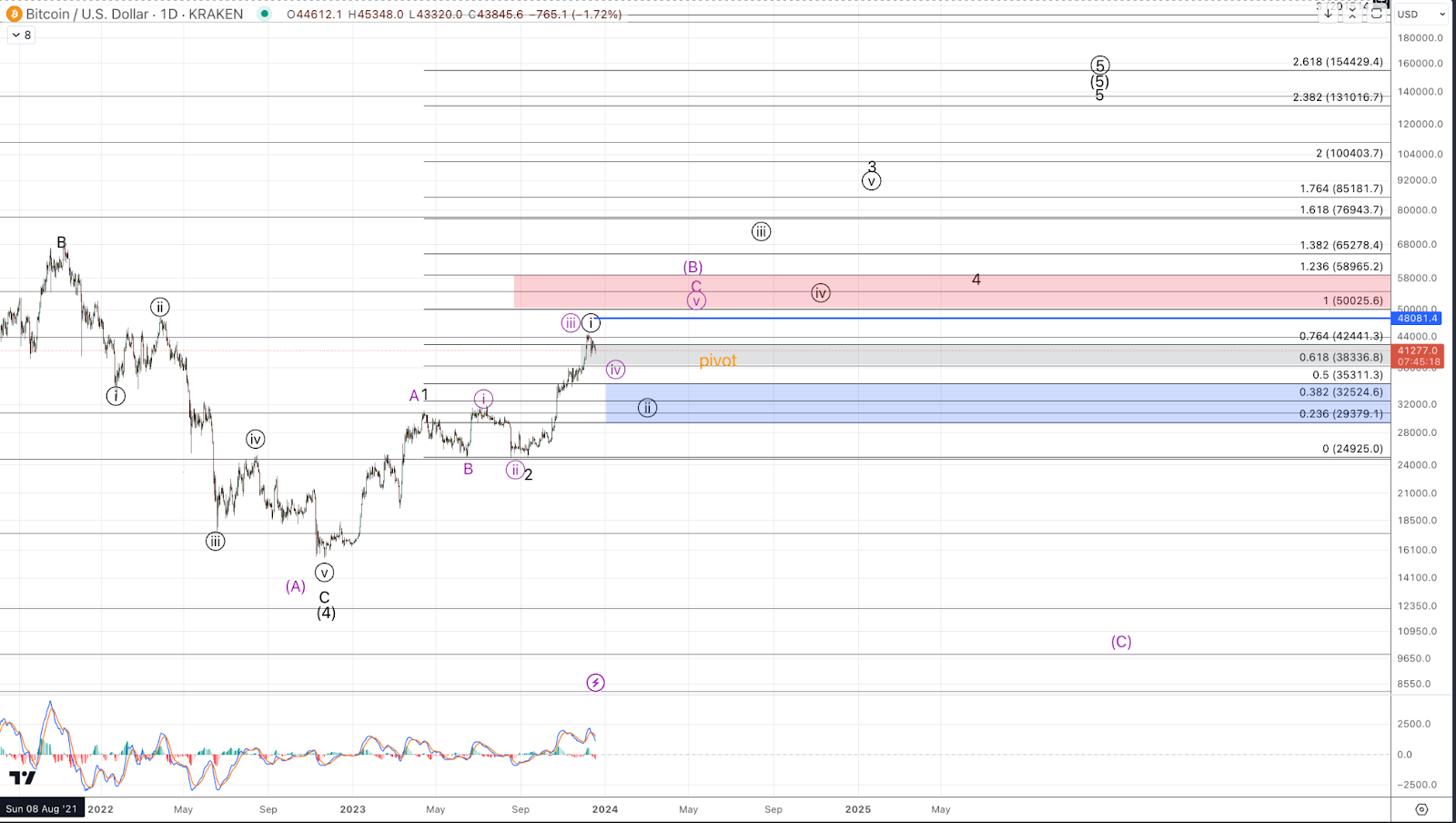

In a word, higher. Our tentative expectations for 2024 are quite bullish. That may surprise readers newer to our Crypto Waves analysis after BTC has gained 145% YTD (as of writing this article) and as much as up 189% from its 2022 low at the recent peak in early December. The current sentiment in the short run may be a bit overheated, which could provide 20-30% pullback, but our overall expectations are to see much higher prices in 2024–with a note of caution for the bullish case, on which I’ll elaborate in this article.

Our bigger perspective has been bullish up from the 2022 low, and though last year’s drop took us off the immediate “Moonpath” from 2021, the impulsive bounce from $15.5k has re-affirmed the cautiously bullish tone that we’ve maintained.

Though the crypto space continues to wade through an unfriendly regulatory situation with several “after-the-fact” actions from SEC on the heels of missing Terra/LUNA, Celsius, Voyager, and of course FTX, BTC has been undeterred this year in its strong ascent higher.

The second half of 2023’s News items “du jour” regards the prospect of approval for a Blackrock Bitcoin ETF. As our approach is primarily technical, our analysis avoids making forecasts that are contingent upon regulatory approval. This is a fancy way of saying that for anything beyond the very short term, my outlook is unconcerned with the outcome of Blackrock’s bid to get their spot-Bitcoin ETF approved by the SEC. Failing to get approval may shake out some newer buyers, but on the other hand, approval could be very bullish for providing a conduit for a bunch of new capital to flow into Bitcoin. In this sense, I suspect approval makes a nice narrative for Bitcoin going higher but the chart shows us this as the more likely outcome without needing to predict the SEC’s actions.

Bitcoin is very “pure” in this sense for Elliott Wave analysis, as it does not have any clear consensus of fundamental valuations models like equities do and is much more clearly fluctuating on sentiment.

Lyn Alden has written several articles–and a recent book called Broken Money–that make a strong fundamental argument for Bitcoin being structurally undervalued. This analysis, which as well is similarly uncensored with shorter term price fluctuations, dovetails with our perspective of seeing much higher prices in the coming years.

Let’s take a look at the current technical stance to understand where we see potential advantageous opportunities to add exposure and what kind of price action may change our stance to be more bearish for the 2024 outlook.

From the early August update we noted that “we tentatively considered the uptrend intact from the 2018 low, and while the November 2022 low briefly broke beneath ideal support, that its strong rebound and continuation higher in 2023 constitutes an overall successful test of support.” That idea, “a successful test of [longer term] support” seems even more true with Bitcoin’s resounding breakout above its May 2022 - July 2023 resistance region in the $31k-$32.5k zone. Though this rally up from the September completion to the flat correction has extended a bit past the ideal extension zone for a wave i of 3, this is both A) somewhat characteristic for Bitcoin’s movement within Elliott Wave counts, and B) favorable for providing confluence with larger degree targets for the wave (5). Typically within an impulsive pattern, like the one that Bitcoin has formed from the 2022 low, expectations are for price to reach the 2.0 extension of waves 1-2 and in this case, that occurs right around $100k which we’ve discussed as a minimal target for this rally from the 2018 low for years now. However, $140k is a more ideal target, and in order to reach that level, Bitcoin will need some extensions beyond the standard targets. As such, a bigger wave i of 3 is not something that in and of itself should be of any concern yet.

What’s desirable from the current stance for the bullish case, is for price to maintain without any breaks below technical support. Based on the bullish count presented in black labels on the accompanying chart, Bitcoin is starting wave ii of 3 within this 1-2, i-ii setup. Without going into great detail about all of the different types of setups, I’ll say briefly that 1-2, i-ii setups offer the best expected value entries in that they have a higher likelihood of followthrough in the direction of the trend and they offer very outsized risk-to-reward skew opportunities.

Fibonacci support is in the $29.4k-$35.3k region. Bitcoin has had extraordinarily strong price action since the September 2023 low with short and shallow pullbacks. I have no guidance on whether the current pullback from the December high will be similarly “disappointing” to buyers who are “squeezing” for a deal. However, I will say that I see corrective pullbacks as favorable buying opportunities with perhaps the $31k-$33k region as the most favorable area as a retest of the breakout threshold.

Within the current setup, a break below $29k would be the first area of concern of a prospective failure to follow through (to the upside) and a sustained break below $26.5k will favor a break below the September low. Should such price action occur in the coming weeks, it would be very concerning about a prospective retest of the 2022 lows with a possible breakdown to $10k.

However, assuming support holds, the bigger test is the $50k-$59k region. Assuming BTC ascends to $50k+ in the coming months, in order to maintain a more confident bullish outlook about a rally to $100k+ it's necessary for price to keep from making any sustained breaks below $38k on any subsequent pullbacks. If Bitcoin were to fail from $50k and then break below $38k, it warrants concern about my alternative “bearish” thesis (shown in purple) which addresses the lower probability potential for a retest of 2022 (or lower) without reaching the upside targets: $100k+.

All of the above two paragraph’s bearish conjecture aside, our expectations are for prospective tests of the noted $29.4k-$35.3k region to be successful and to send Bitcoin to much higher levels. Ideally, wave iii of 3 would target around the former all-time high at which point we would like to see a “floor” around the $50k region, which should support subsequent bounces to prices upwards of $100k.