World Markets: Europe/Americas

EUROPE/AMERICAS

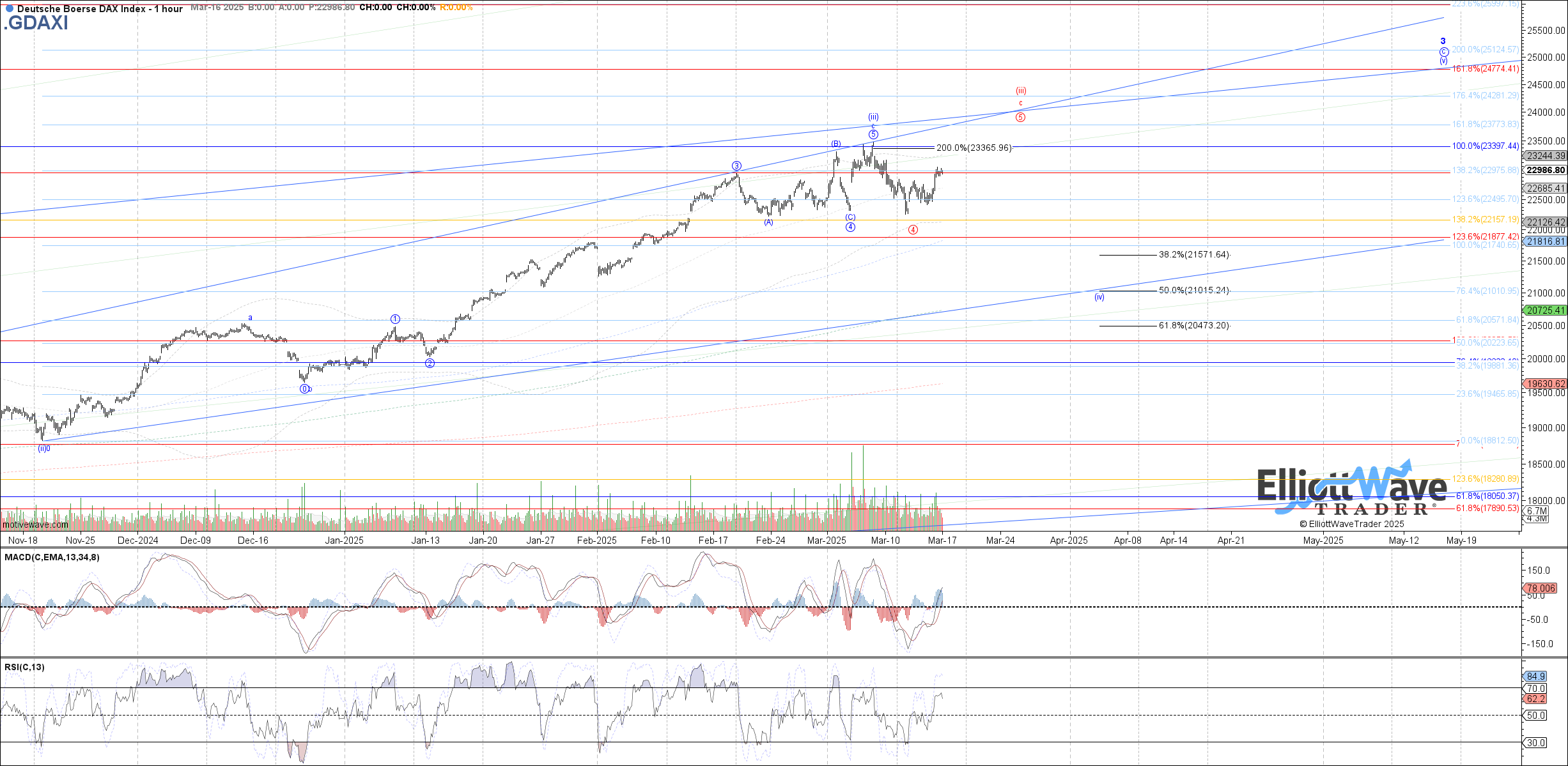

DAX: The DAX started off last week initially lower, briefly undercutting the prior low on the month but then quickly rebounding back above there. Without a sustained break below support, I still cannot view a top struck as wave (iii) of c being confirmed. Unless price breaks back below last week’s low now, another high as red wave 5 of c is a reasonable possibility. Below last week’s low and we can assume that wave (iv) has finally started.

FTSE: The FTSE continued lower last week, breaking below the prior February lows as initial evidence that price has topped as wave c of 3. The next step toward confirming that will be holding a corrective retrace and lower high on this bounce and then turning back down below last week’s low. If a corrective (b)-wave bounce off last week’s low, 8640 – 8745 is standard .382 - .618 retrace as ideal resistance to hold.

STOXX: The STOXX traded lower last week as well, making a new low on the month as initial evidence that wave (iii) of c has topped in blue and price is starting a wave (iv) pullback. Whether this bounce off last week’s low is a 4th wave or a b-wave, holding below 5465 is ideal to keep near-term pressure to the downside. Although not currently my expectation, further extension in wave (iii) is possible here as well.

IBOV: The Bovespa trading strongly higher last week, especially during the latter half of the week. This keeps the blue path on track as price attempting to fill out wave (c) of a, with a breakout above the February high as the next step toward confirming. After which, 134250 remains the ideal minimum target to reach before wave (c) completes.

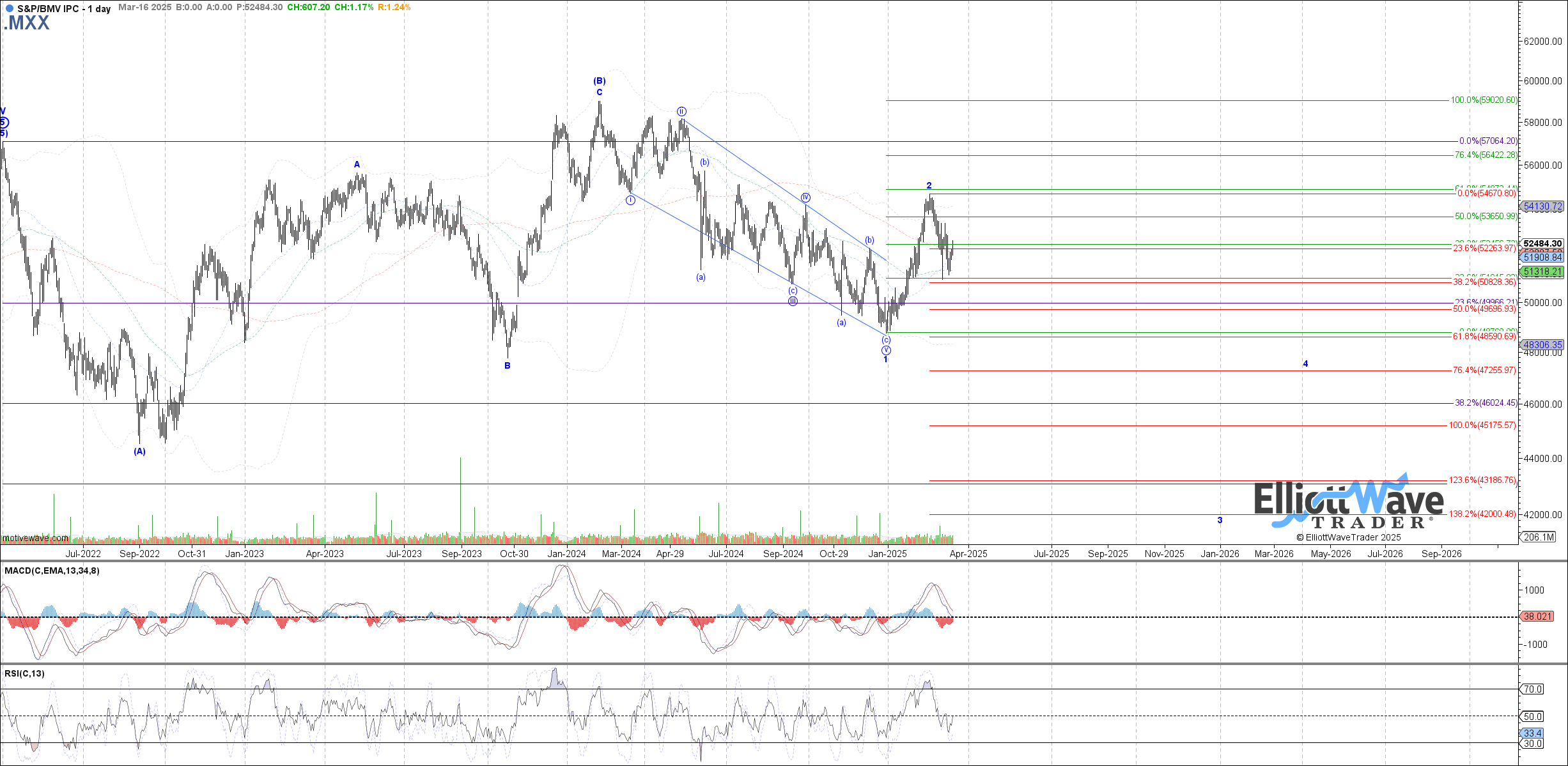

IPC: The IPC started off initially lower last week, but maintained above the prior low on the month and curled back up into Friday’s close. Therefore, price has kept the door open to the potential for a wider flat wave ii shown in blue, which can target the .618 - .786 retrace between 53225 – 53855 before reattempting a local top.