World Markets Weekend: Correction May Not Yet Be Complete

EUROPE/AMERICAS

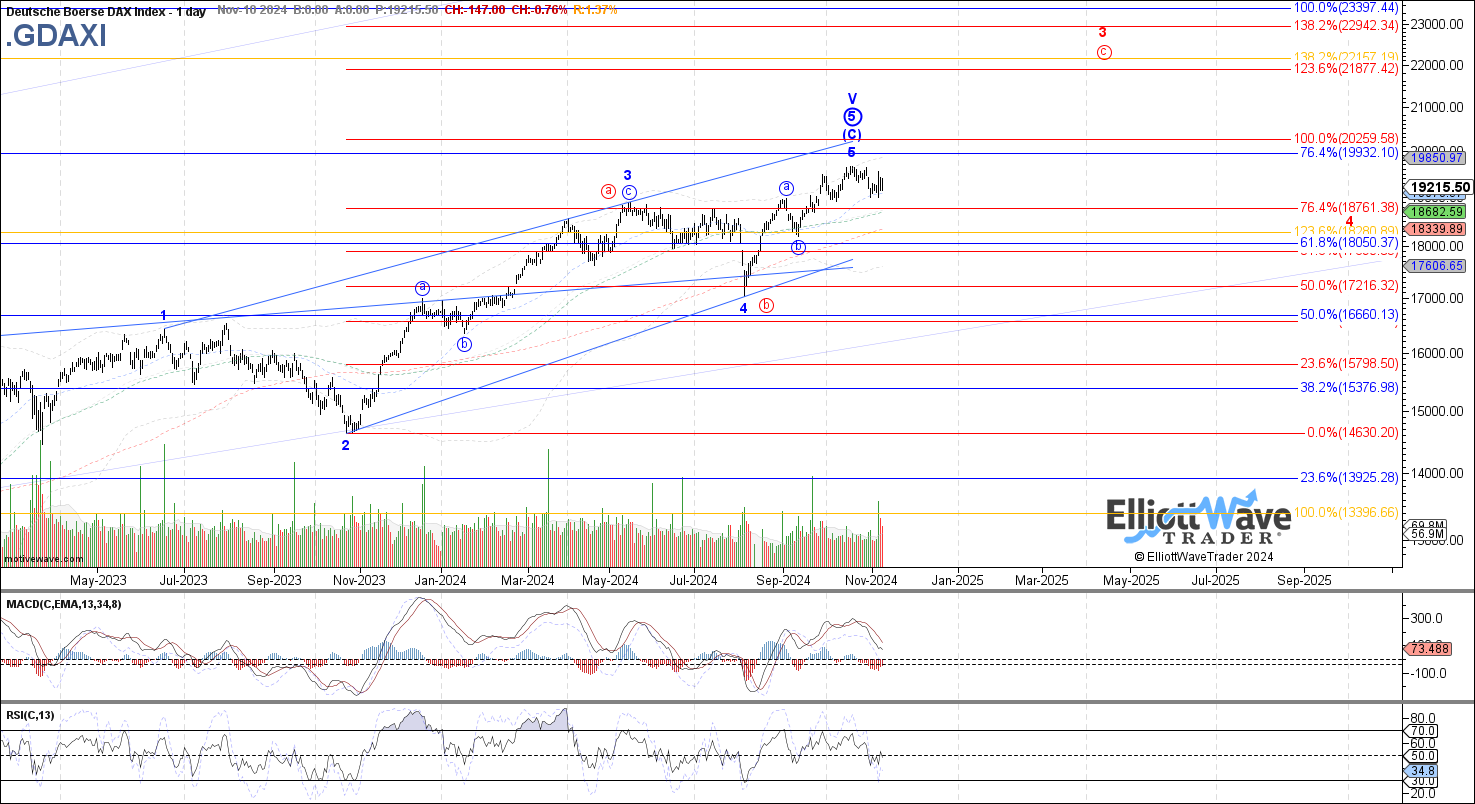

DAX: The DAX traded mostly sideways last week, for now maintaining above the October low but otherwise unable to sustain a rally from there. This price action seems to suggest that the correction off the October high may not have completed yet, in which case 18930 – 18755 is the next retrace support for red wave b of (iii). A break below there would open the door to all of blue wave 5 complete or at least a larger wave a of 5. Price would need to breakout above last week’s high to open the door to being immediately bullish again.

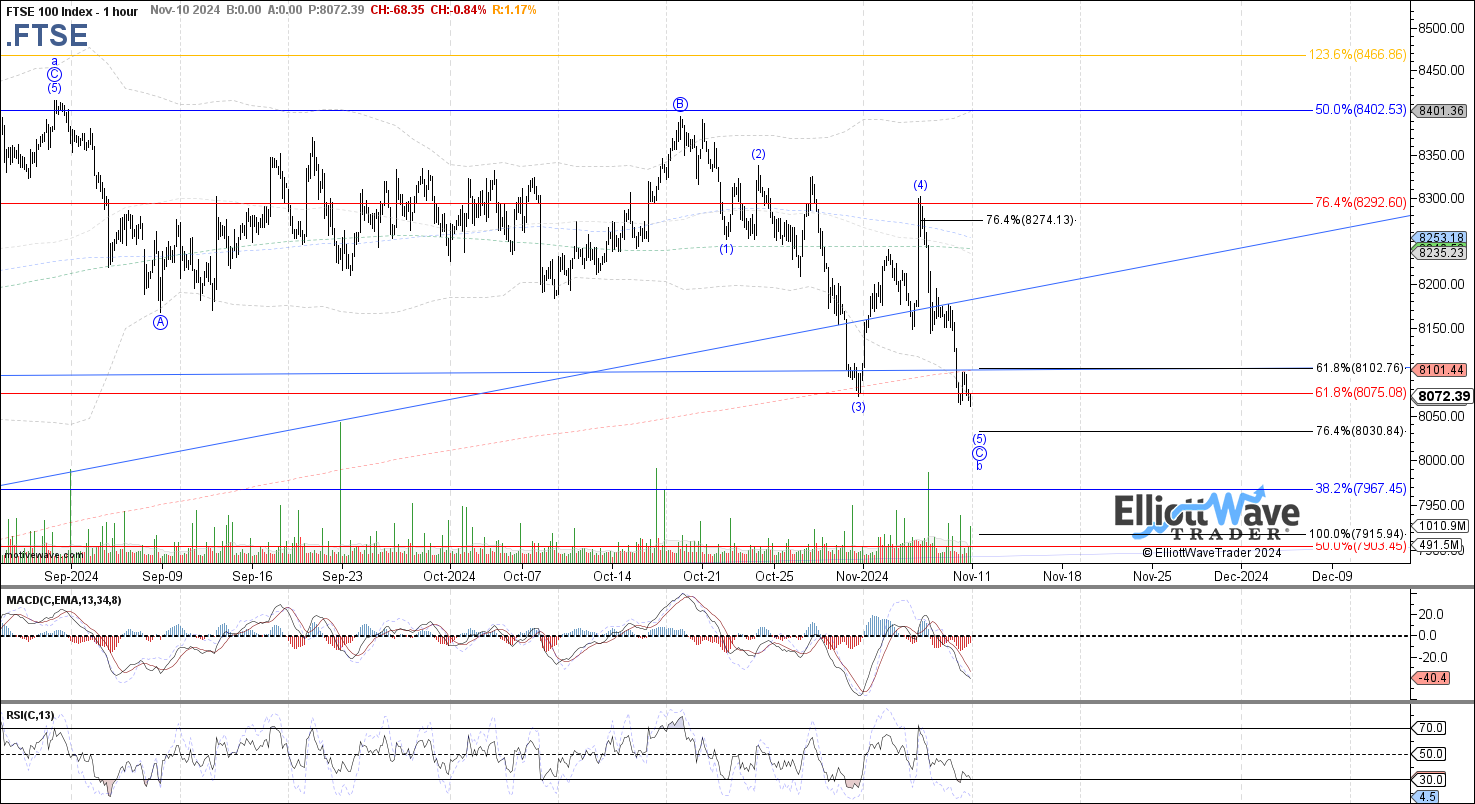

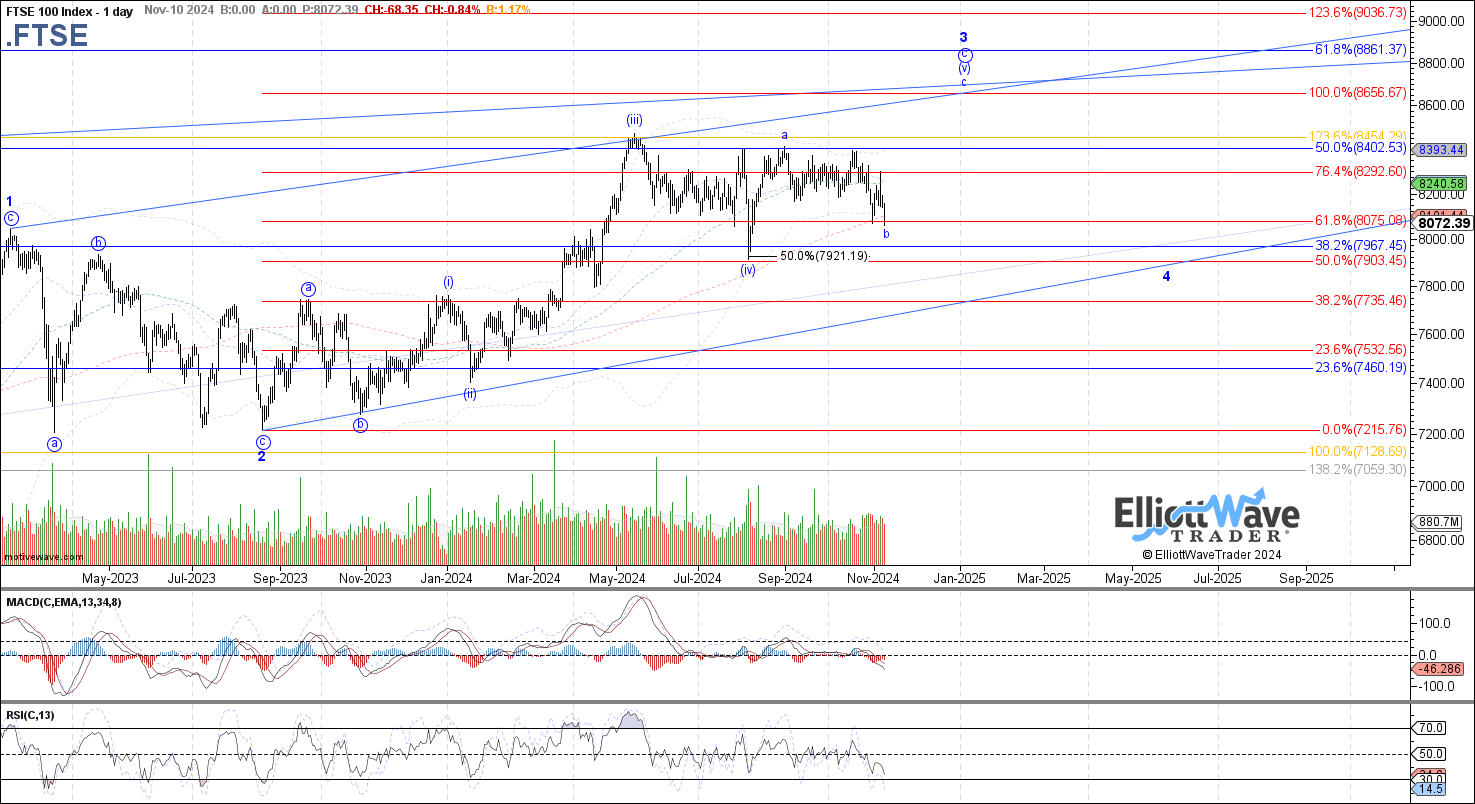

FTSE: The FTSE continued initially higher to start the week, but then rolled back over into Friday’s close and has now made a new low below the prior October low. Therefore, price has at least confirmed that wave b of (v) is not complete yet, but the .764 retrace at 8030 is likely the last chance to hold that count. Below there opens the door to the higher degree wave c of 3 already complete and price correcting in the higher degree wave 4.

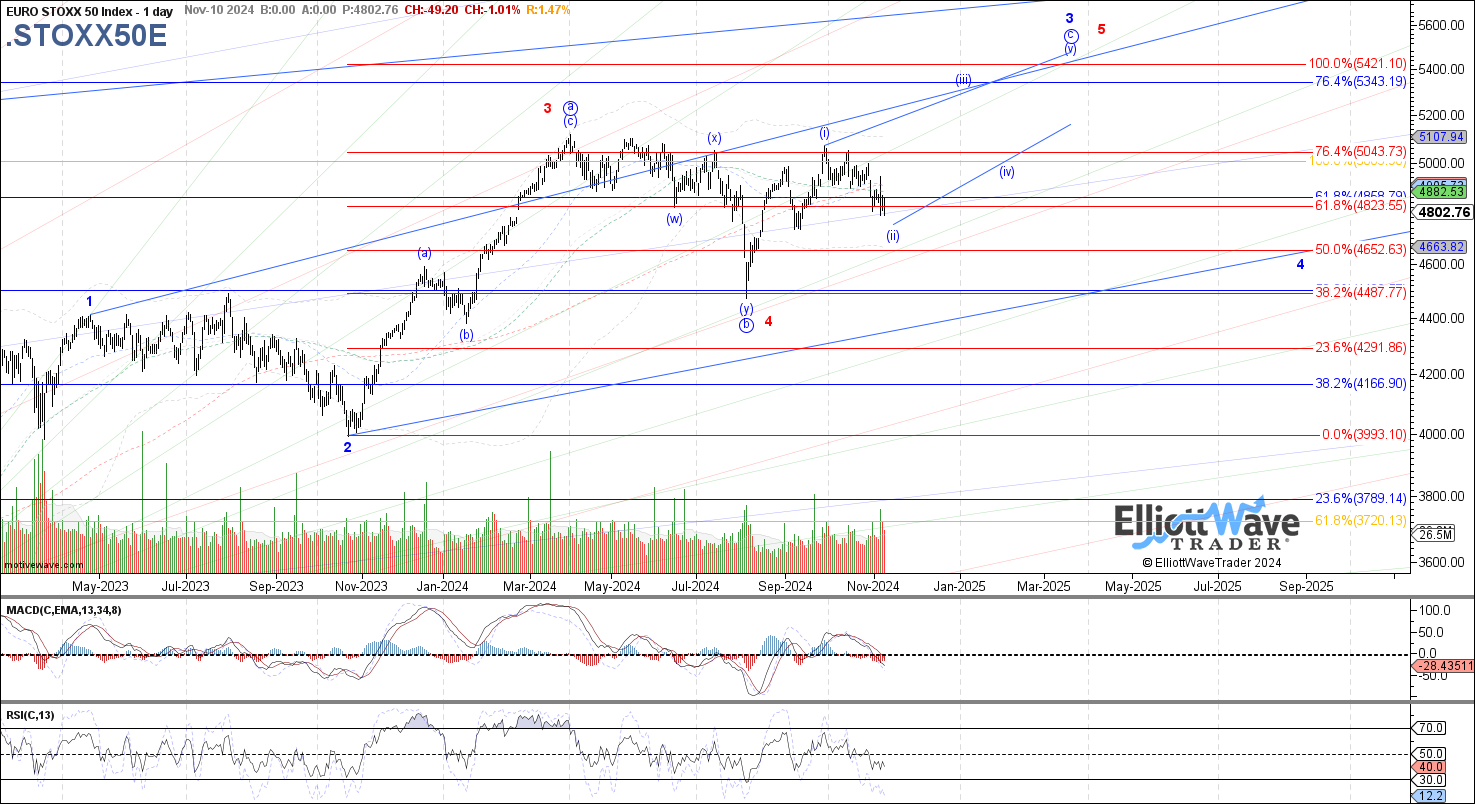

STOXX: The STOXX also started off the week initially higher but then rolled back over during the second half of the week, undercutting the October low. This suggests either a larger (i)-(ii) start to wave c of 3 in the blue count or price still working on wave b of 5 in the red count. In either case, 4765 – 4695 is the next fib support as the .500 - .618 retrace.

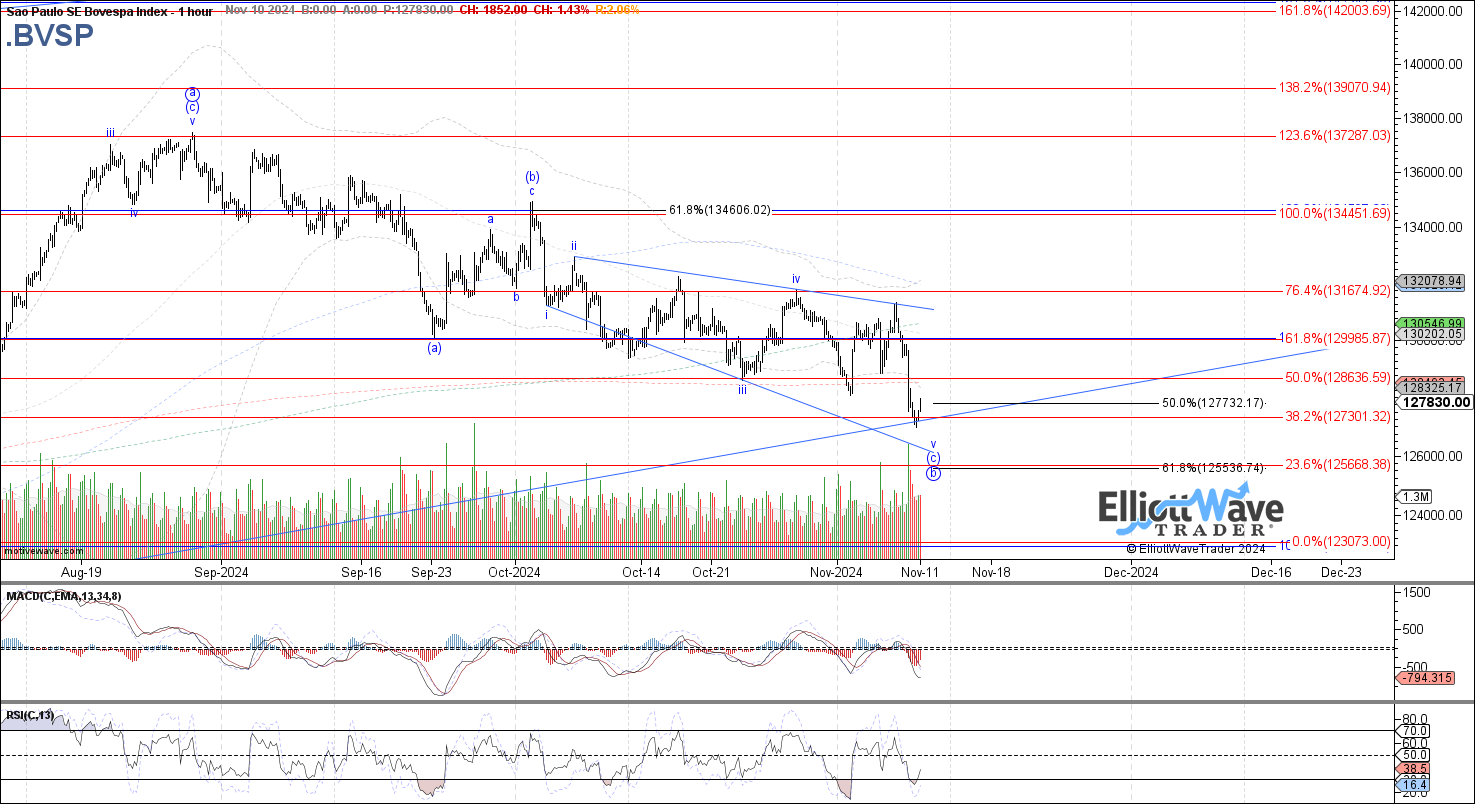

IBOV: The Bovespa started off the week initially higher, looking like price was attempting to start wave c of 5. However, it never managed to clear the previous high made the week prior, and instead ended up rolling back over to another new low on the month by the end of the week. Therefore, this at least confirms that wave b of 5 has not yet completed, with 127730 – 125535 still as the next fib support from which price can reattempt a bottom.

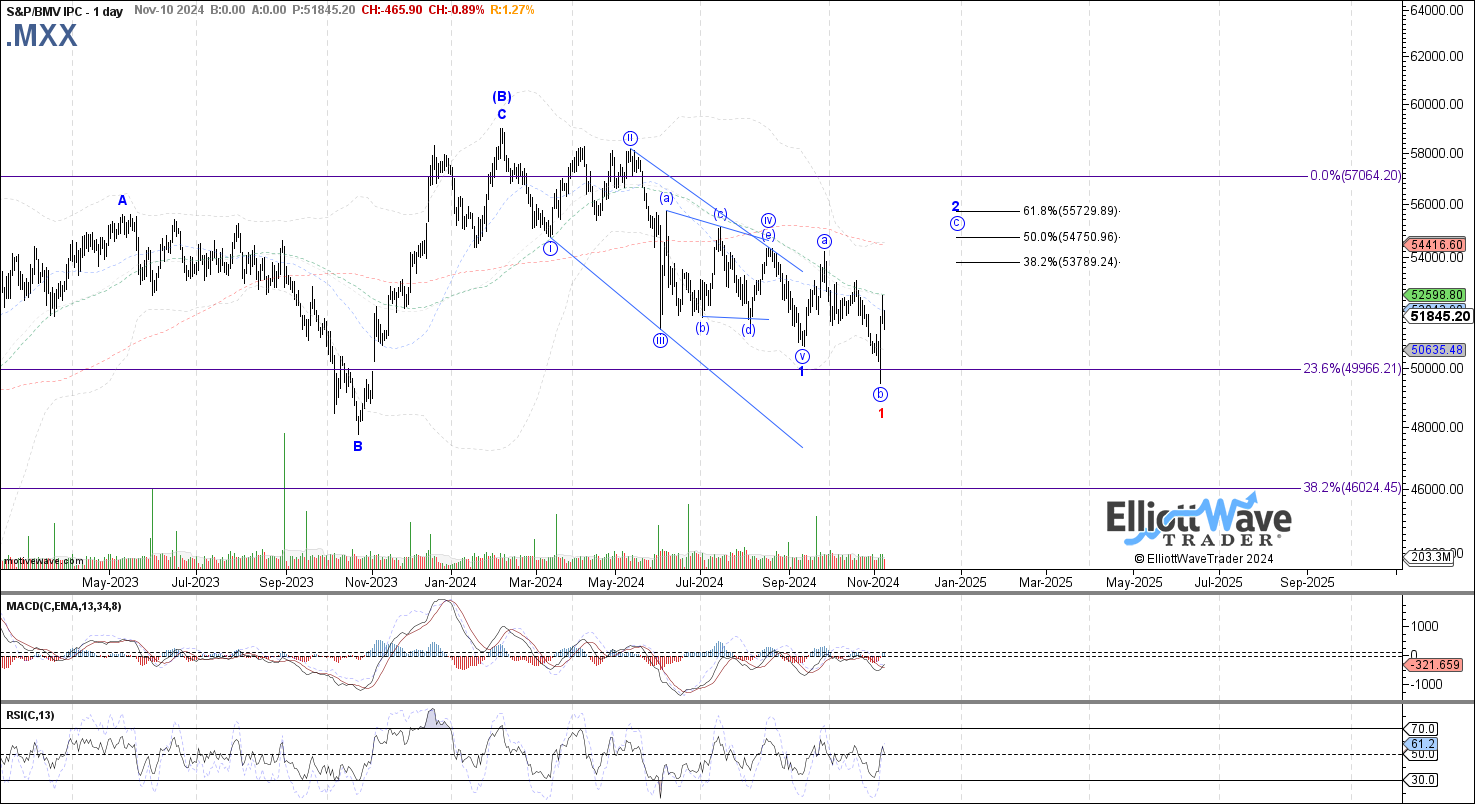

IPC: The IPC continued initially lower to start to week, spiking lower on Wednesday and then reversing sharply higher for the rest of the week. Therefore, although a bit skewed, it is still possible to count last week’s low as wave b of an expanded flat wave 2 shown in blue, otherwise an extension of wave 1 is the next best fit. Either way, there is still room to reach higher as either blue wave c of 2 or a new start to wave 2 in red that can take price closer to a retest of the September high.