World Markets Weekend: Eye on Asian Markets

ASIA/PACIFIC

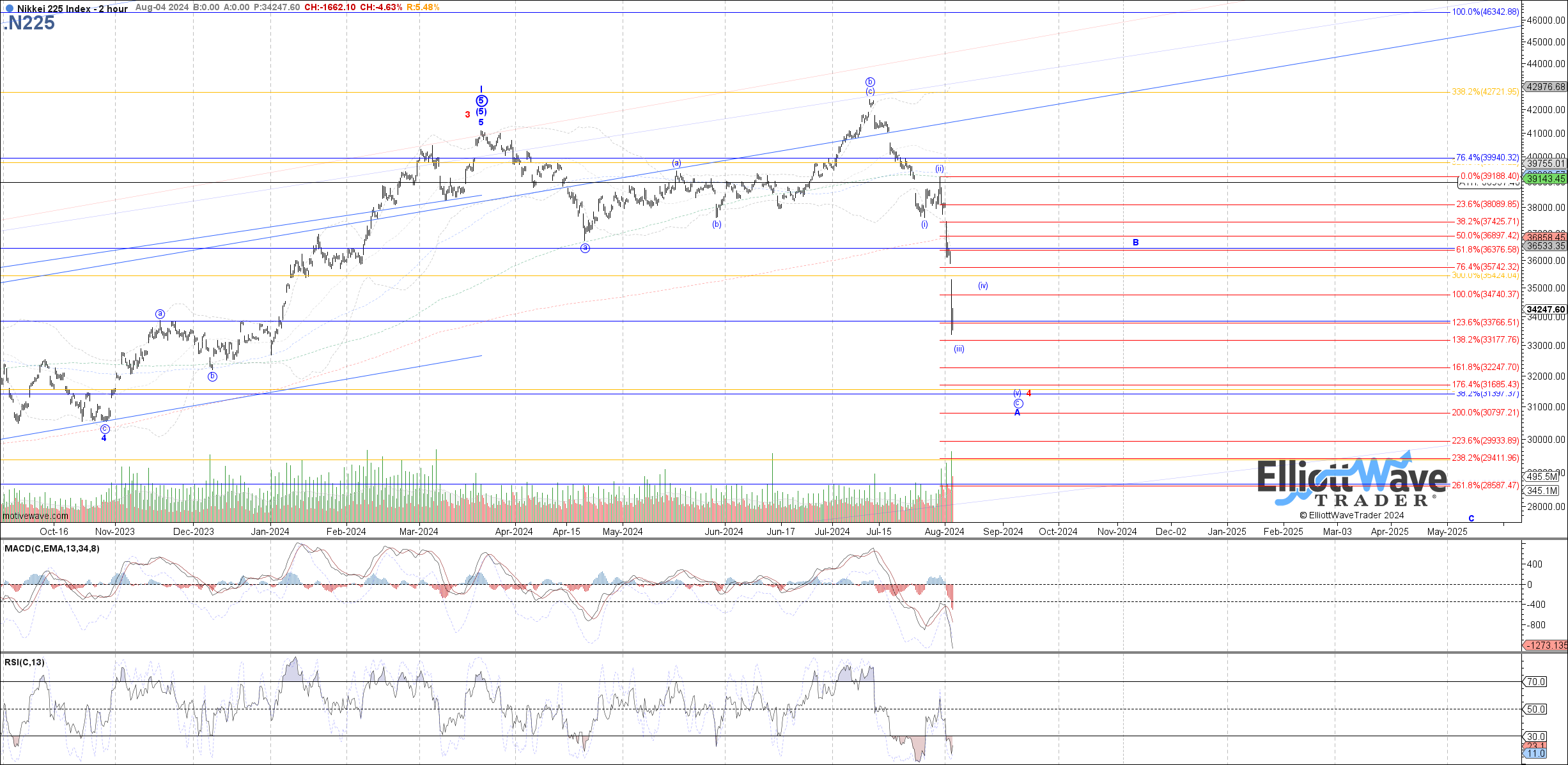

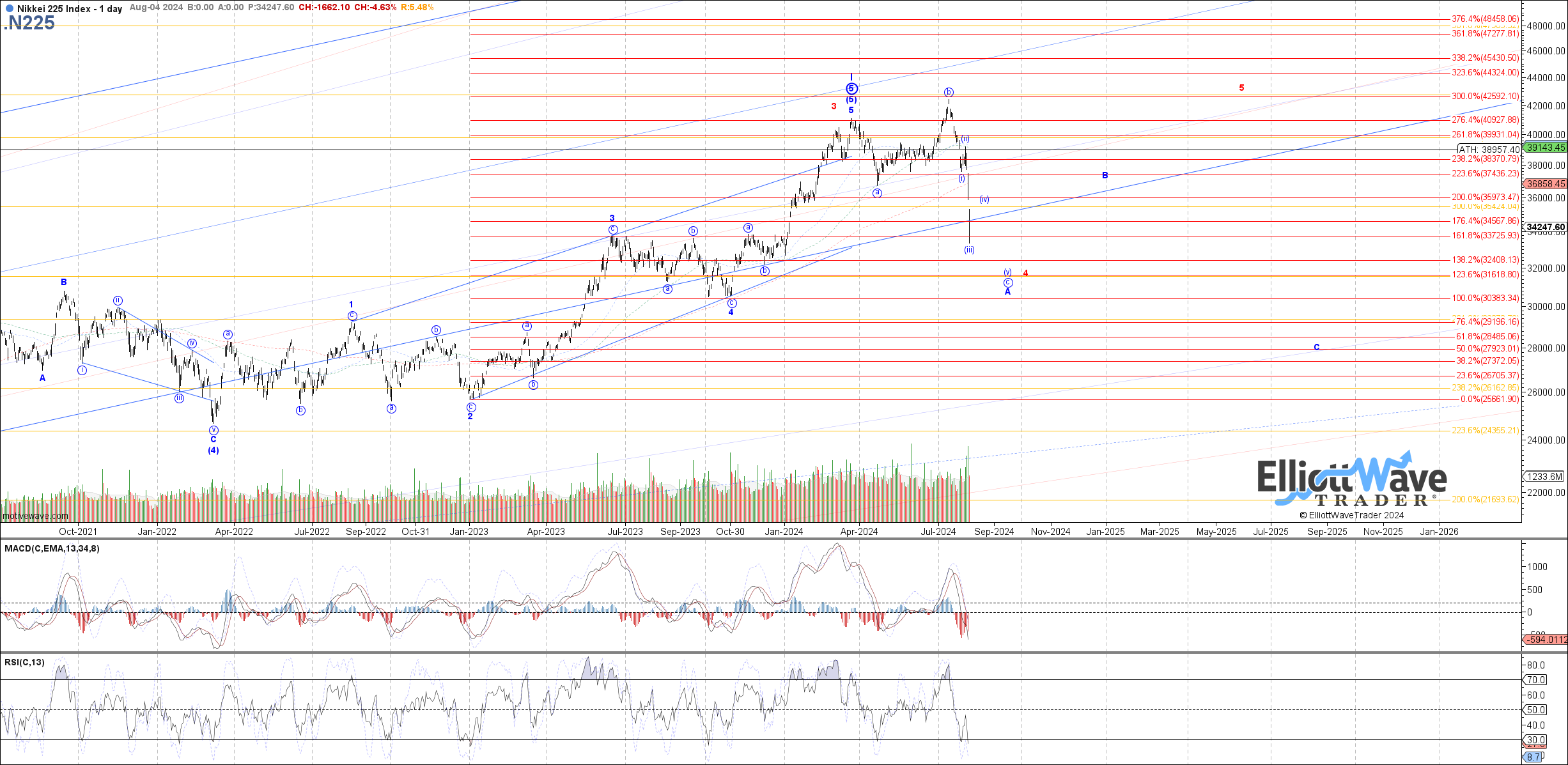

N225: The Nikkei started off last week initially briefly higher but then quickly rolled over sharply for the rest of the week and has since start off this week with another large gap to the downside. While I still think the price action counts best as an expanded flat off the March high, it looks like price is still working on wave (iii) of c rather than already in wave (v). Therefore, another (iv)-(v) can be seen before a more sustainable bottom is attempted, with 35740 as main overhead resistance for a wave (iv) bounce, and 31685 as a potential target for wave (v) of c if that resistance holds.

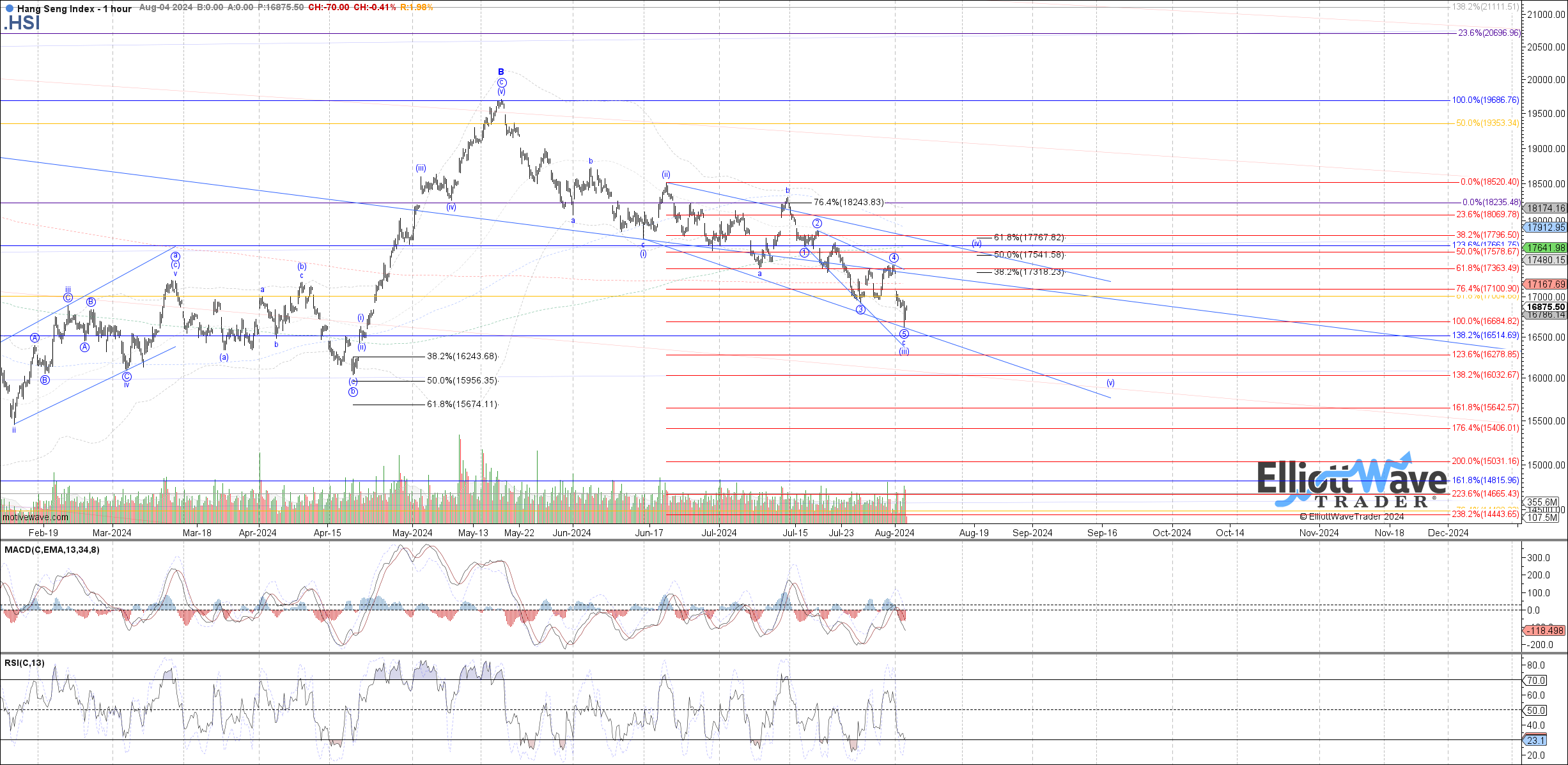

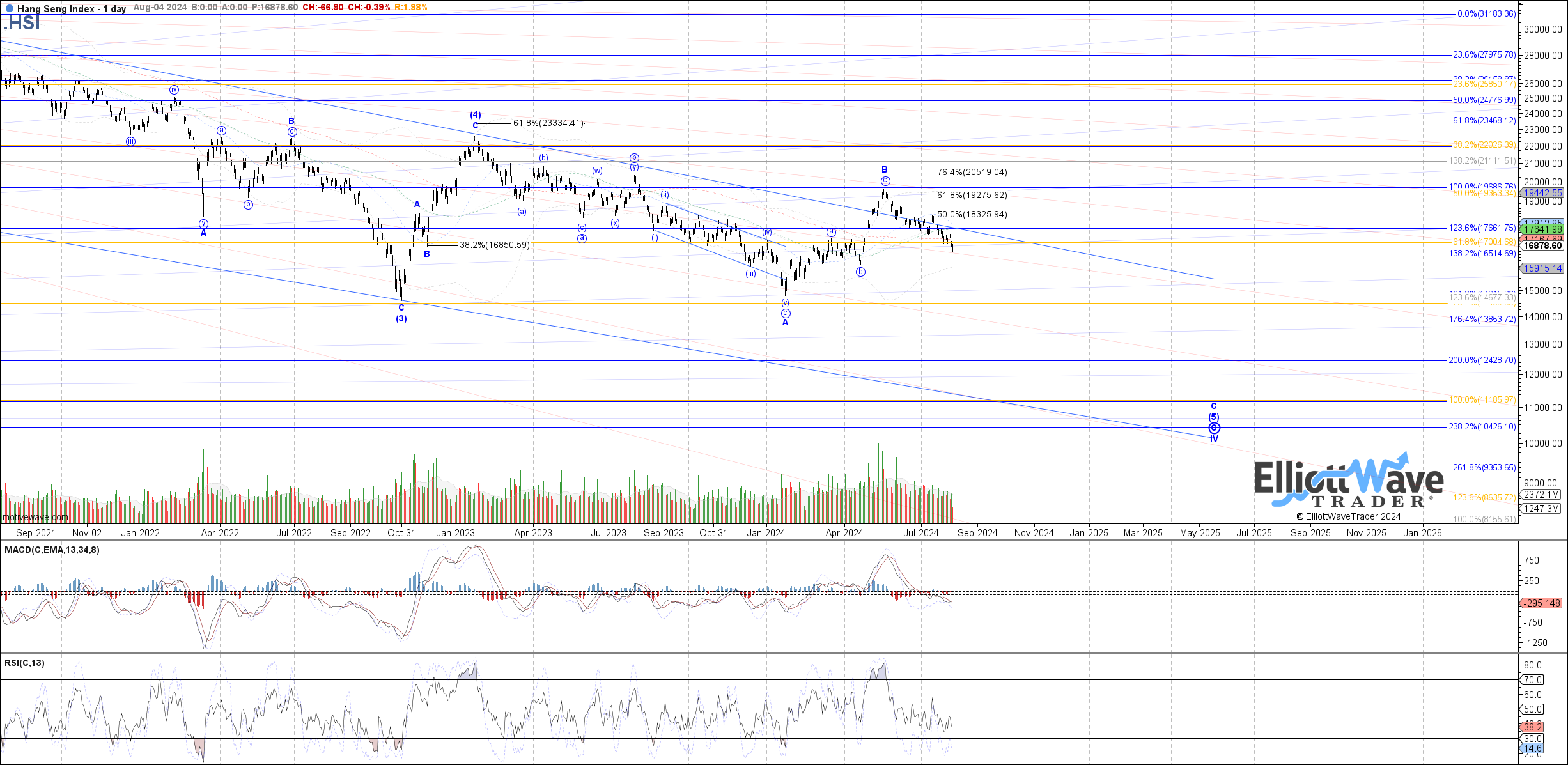

HSI: The Hang Seng also started off last week initially with a bounce, which turned out to just be a wider flat for wave 4 of c as suggested and price has since made a new low as wave 5 of c to reach the 16685 fib target cited as the minimum expectation for wave c of (iii). Therefore, price has the opportunity to attempt a wave (iv) bounce from here, with a break above the gap resistance at 17070 as evidence of a local bottom. From there, 17320 – 17770 is the overhead target range for wave (iv).

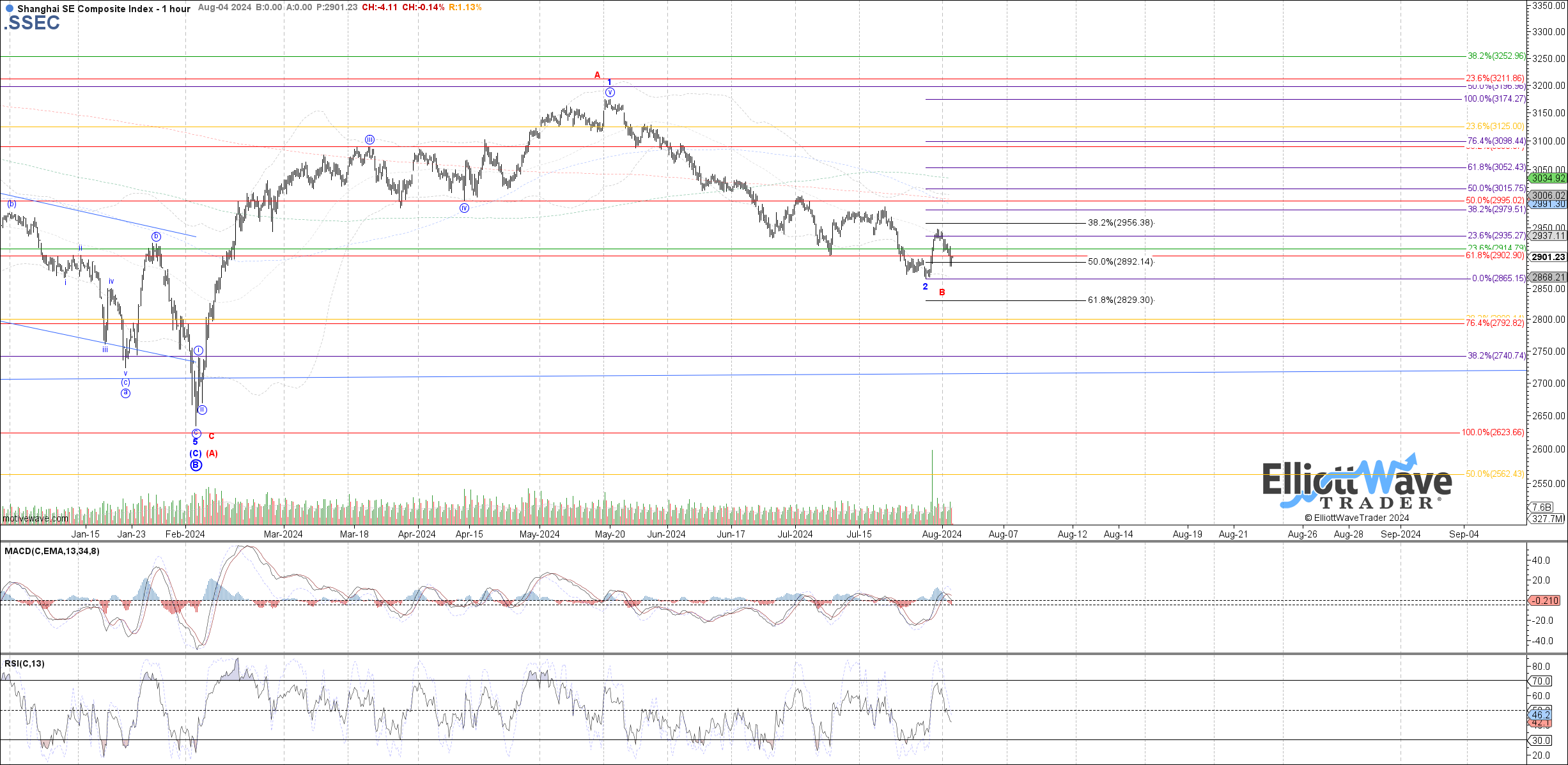

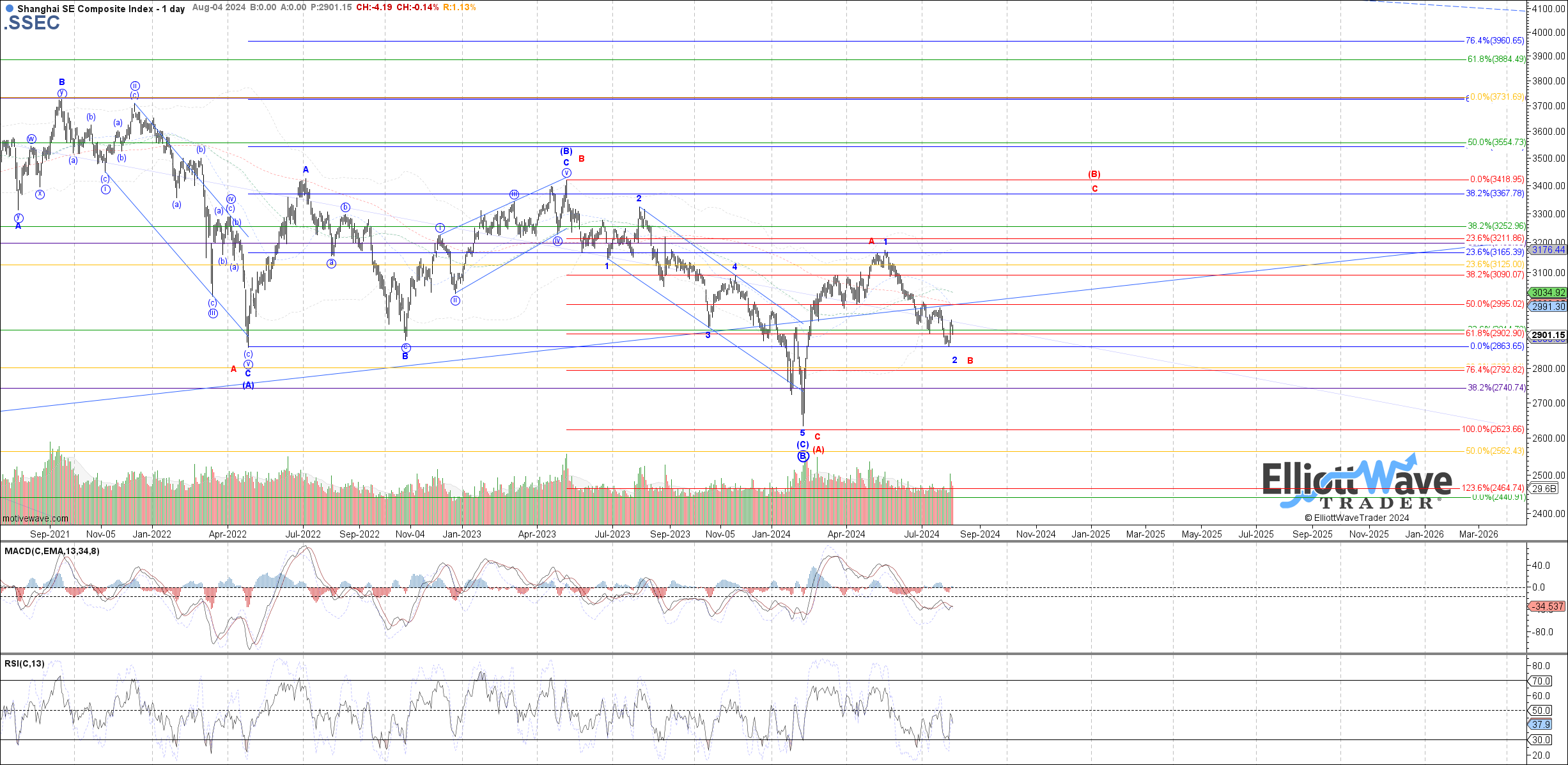

SSEC: The Shanghai Composite started with a bounce last week as well, but price has not yet cleared the prior July highs noted as what is needed for evidence of a bottom. Still, price is exhibiting some relative strength here with it still holding above the July low despite selling pressure across other markets. However, without confirmation of a bottom yet, further downside cannot be ruled out with 2830 still as the next fib support below.

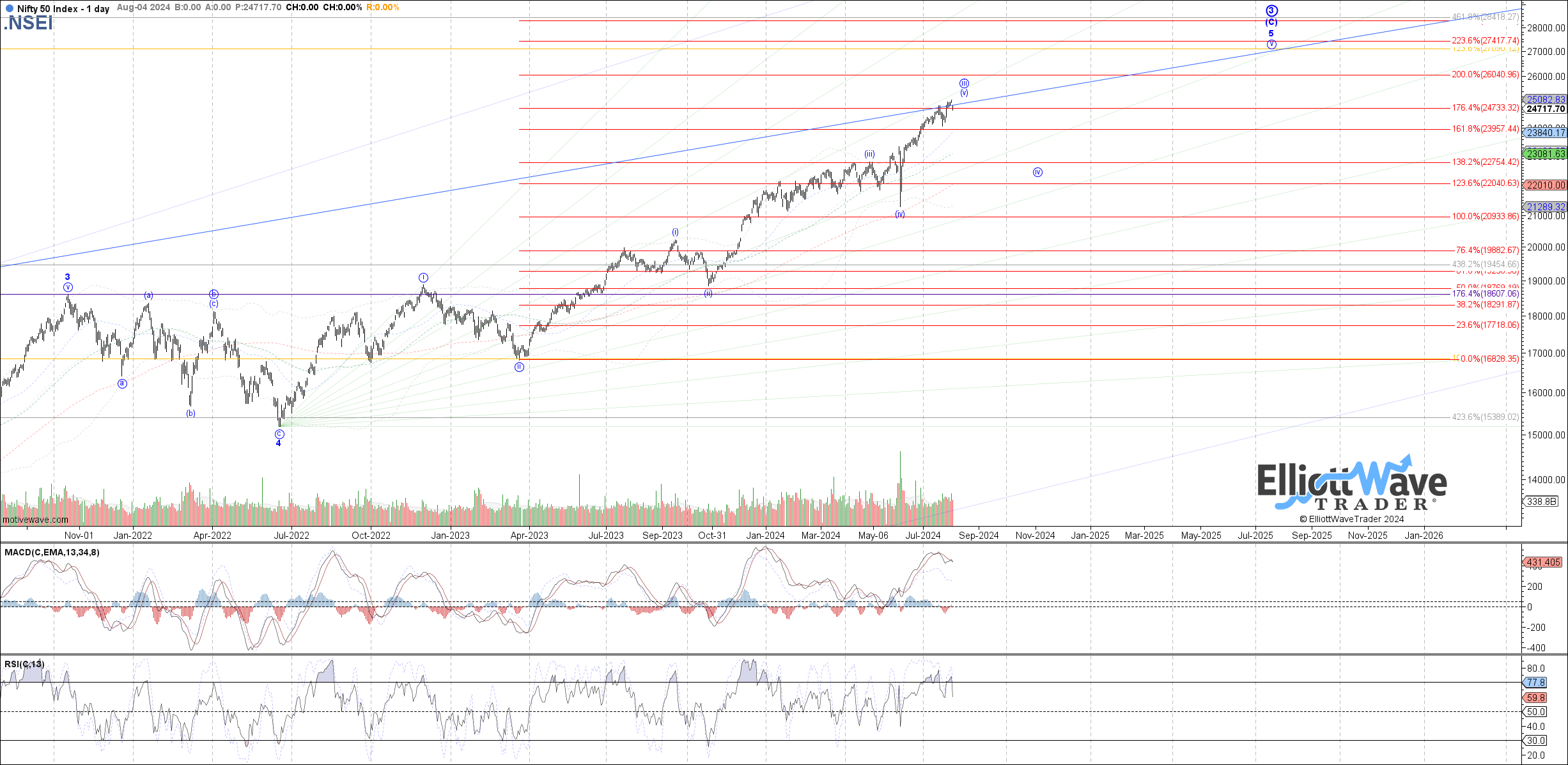

NIFTY: The Nifty continued initially higher to start last week, but curled down into Friday’s close to end the week relatively flat. Overall price still looks like it should be nearing completion if not already complete with wave (v) of iii off the June low, but we now need a break below the July lows as evidence of a top. Until then, while I do not have a clear setup for further extension, it cannot be ruled out yet.

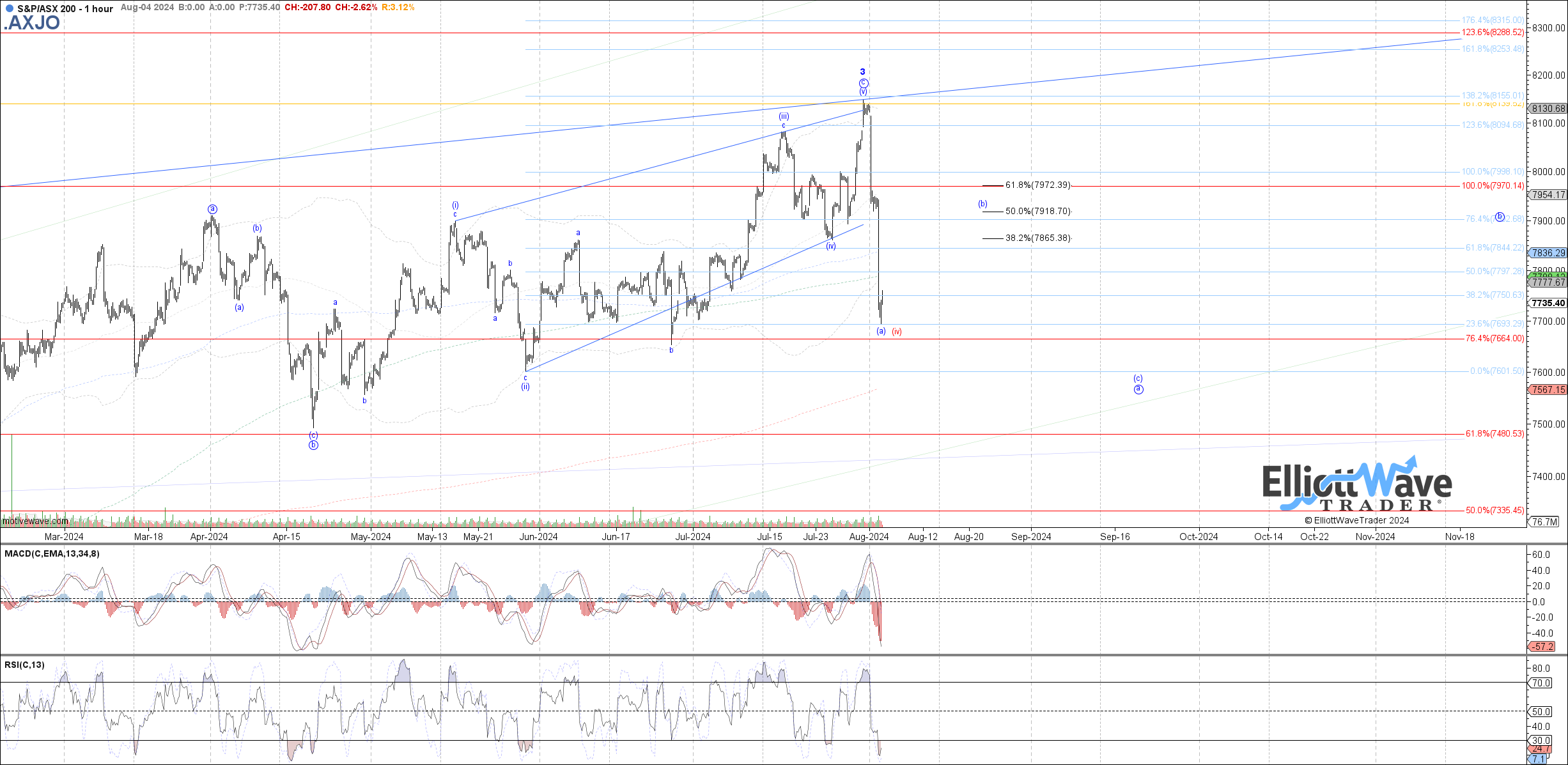

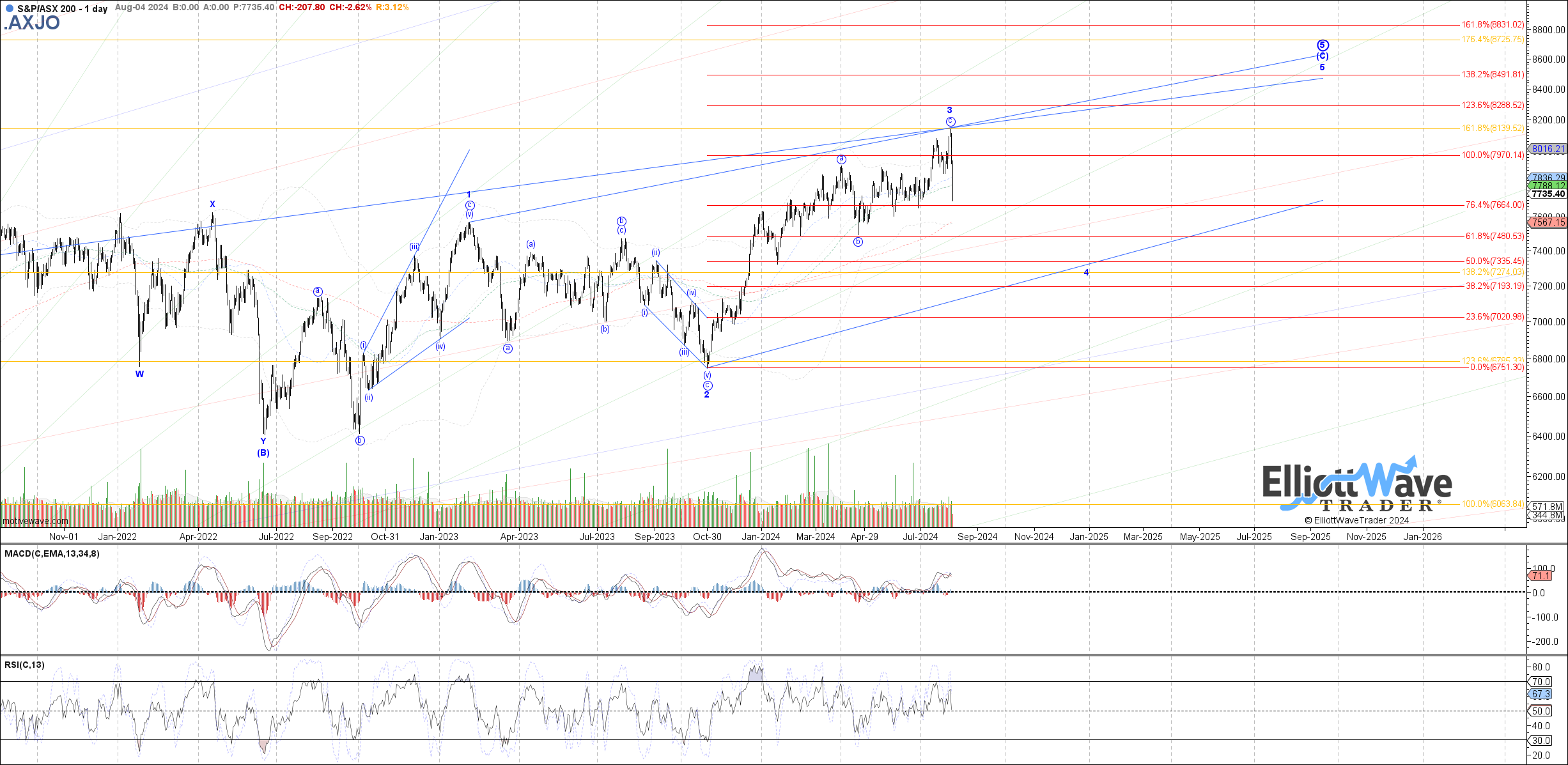

XJO: The ASX started off last week initially very strong, making another higher high compared to the prior July high. However, it was not a sustained breakout and price has since rolled over sharply from last week’s high and has even now broken back below the July lows. Therefore, the depth of this reversal has forced me to consider that all of wave c of 3 completed in a more muted fashion, and price is starting the next higher degree wave 4. Even though the wave (iv) of c in red has not officially invalidated yet, it is below reliable support so not a high probability expectation.